US-China relations are entering 2026 with a paradox: trade is thawing in soybeans and metals, while the tech war over AI chips and the military balance around Taiwan is hardening. The next moves will shape supply chains, markets, and crisis risk. New “great power competition” reports explain why.

How We Got Here: From “Engagement” To Managed Rivalry

For three decades after China’s WTO entry, Washington largely treated economic integration as a stabilizer: deeper trade and investment would make strategic conflict less likely. That bet began fraying well before COVID, but the last eight years turned doubt into doctrine. The U.S. moved from targeted sanctions to system-level constraints on advanced technology, capital, and supply chains. China, in turn, pivoted from “integration on Western terms” to “resilience on Chinese terms,” leaning harder on state direction, industrial policy, and selective market openings.

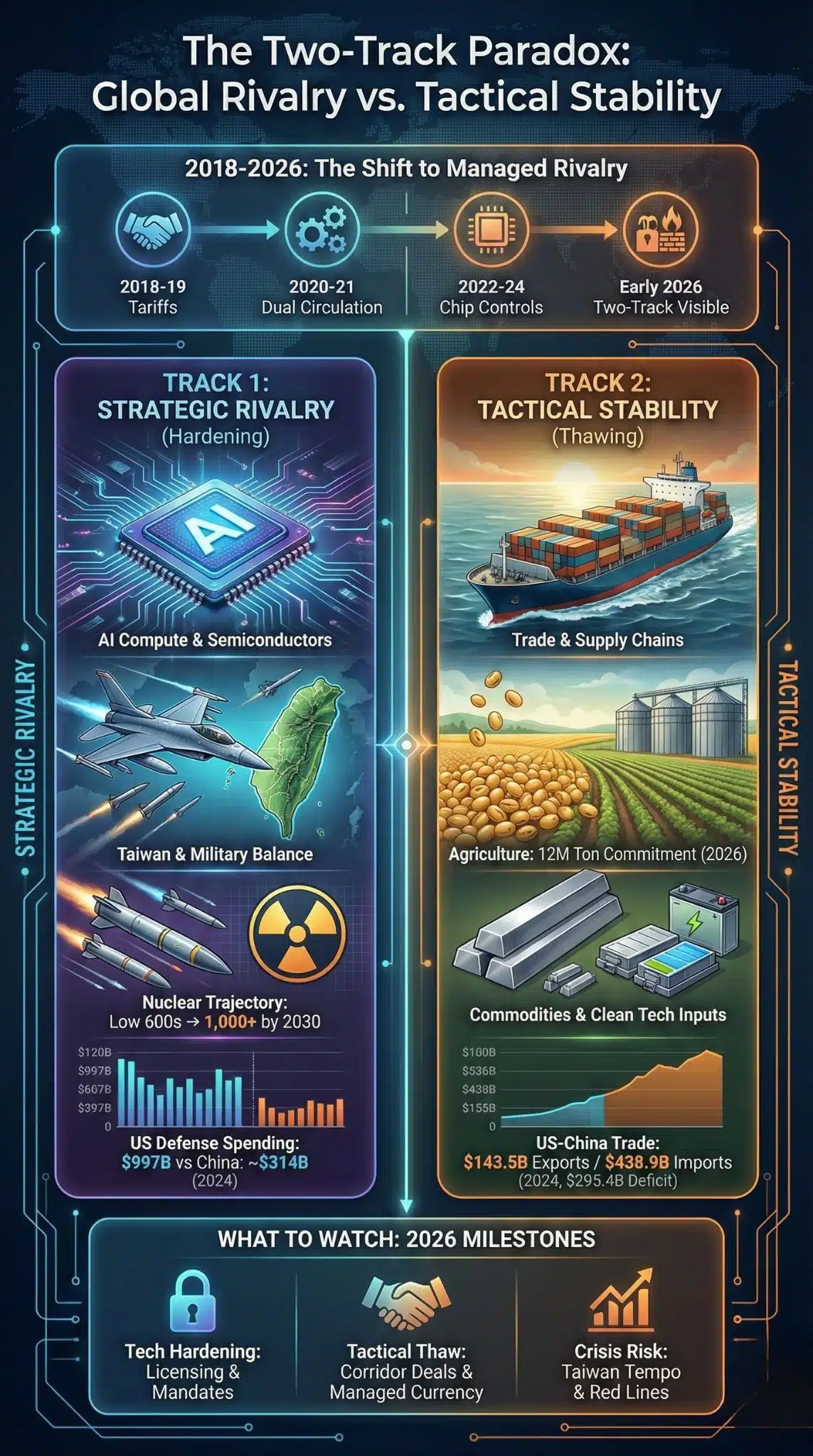

What is different about 2026 is not that rivalry exists. It is that both sides are now testing a more explicit two-track model:

- Track 1: Compete in domains that generate military advantage and long-run productivity, especially AI compute, semiconductors, space, and defense-industrial capacity.

- Track 2: Contain the blast radius in areas where decoupling would impose immediate economic pain, such as agriculture, energy transition inputs, and some commodity flows.

That duality is visible in the early-2026 news flow: Beijing reportedly asked some firms to pause Nvidia H200 orders even as Washington reopens a licensing channel, while Chinese state buyers step up U.S. soybean purchases that were previously weaponized by tariffs.

Key Statistics That Frame The 2026 Moment

- U.S.-China goods trade remains enormous: In 2024, U.S. exports to China were $143.5B and imports were $438.9B, a $295.4B deficit.

- 2025 stayed large even amid “de-risking”: Jan–Sep 2025 U.S. exports were $109.9B, imports $332.3B, deficit $222.4B.

- Defense spending gap is still decisive: SIPRI estimates 2024 U.S. military spending at $997B and China at $314B (estimated).

- China’s nuclear trajectory is accelerating: the U.S. Defense Department assesses China’s stockpile in the low 600s through 2024, projecting over 1,000 warheads by 2030.

- Taiwan-area operational tempo is rising: the same report cites 3,067 PLA aircraft ADIZ entries in 2024 vs 1,641 in 2023.

- China’s trade surplus politics are intensifying: analysts debate the meaning and sustainability of a $1T-plus surplus narrative and its impact on global backlash.

The Baseline Reality: Competition Inside Interdependence

Before getting lost in headlines, it helps to see the structure. The “great power competition” frame increasingly treats economics and technology as part of national security, not separate from it. The policy problem is less “how to cooperate better” and more “how to compete effectively without triggering catastrophe.”

That shift explains why 2026 developments can look contradictory. They are not contradictions so much as selective pressure applied to different parts of the relationship.

A Short Timeline Of The Shift To 2026

| Year | Inflection Point | Why It Still Matters In 2026 |

| 2018–2019 | Tariffs and tech restrictions begin scaling | Trade becomes a lever, not a byproduct |

| 2020–2021 | Pandemic shocks + “dual circulation” | Resilience and self-reliance become central goals |

| 2022–2024 | Export controls on advanced chips tighten in waves | Semiconductors become the core strategic bottleneck |

| 2025 | Rules expand: tighter foundry due diligence and entity listings | Enforcement shifts from “what” to “how it might be diverted” |

| Early 2026 | Nvidia licensing drama + commodity and agriculture thaw | Two-track rivalry becomes visible in real time |

The Meat: Six Forces Reshaping US-China Relations 2026

US-China Relations 2026 Is A Semiconductor War With Macroeconomic Side Effects

Semiconductors are no longer just a “tech sector story.” They sit at the intersection of AI leadership, productivity growth, intelligence capabilities, and advanced weapons systems. U.S. policy has tightened around a clear objective: strengthen controls, close loopholes, increase due diligence obligations, and expand restrictions to prevent diversion.

Two strategic dynamics make 2026 feel sharper:

- The control surface expanded. The debate is no longer only “ban the top chips.” It is about policing packaging, foundry verification, and who counts as “trusted” in the supply chain.

- Beijing is now counter-optimizing. The reported request to pause Nvidia H200 orders suggests China wants to avoid both stockpiling risk and political vulnerability, while weighing whether to mandate domestic chips more aggressively.

Meanwhile, Nvidia’s CEO signaling that purchase orders will reveal the real approval mechanism underscores how licensing has become de facto diplomacy.

What The Export-Control “Stack” Looks Like Now

| Policy Layer | What It Targets | Strategic Intent | Likely 2026 Trade-Off |

| Advanced chip export licensing | High-end AI compute | Slow military-relevant AI capability | Pushes China to substitute faster |

| Foundry/packaging due diligence | Diversion and laundering routes | Make enforcement “supply-chain aware” | Raises compliance costs for allies |

| Entity listings | Specific firms and facilitators | Increase friction, signal red lines | Encourages shadow supply networks |

| Investment restrictions | Capital + know-how | Prevent acceleration via funding | Shifts VC routes and structures |

The deeper risk is that the chip war becomes a macro story through second-order effects: slower diffusion of AI tools across sectors, duplicated capex across rival ecosystems, and more volatile equity narratives around “China exposure.”

Trade Is Thawing In Select Lanes, Not “Resetting”

If the 2020s taught policymakers anything, it is that trade volumes alone do not equal trust. The U.S.-China trade relationship remains massive, but its political meaning has changed. The U.S. goods deficit with China is still measured in the hundreds of billions, and the 2025 year-to-date figures show continued reliance even after years of tariff and supply-chain shock.

Yet 2026 begins with a notable sign of pragmatism: China’s state buyer Sinograin reportedly purchased about 600,000 metric tons of U.S. soybeans in a week, bringing total purchases close to 10 million tons and nearing a stated 12 million ton commitment by late February.

This is not a “return to normal.” It is closer to transactional stabilization:

- Beijing secures food supply flexibility and price management.

- Washington gets a politically salient export channel and a signal that talks are not frozen.

What The Trade Numbers Say About Interdependence

| Metric | 2024 | Jan–Sep 2025 | What It Signals |

| U.S. exports to China | $143.5B | $109.9B | China still matters for U.S. exporters |

| U.S. imports from China | $438.9B | $332.3B | “De-risking” has not removed dependence |

| U.S. trade deficit | -$295.4B | -$222.4B | Politically durable grievance, not a short-term cycle |

The forward-looking implication: expect more narrow “corridor deals” (agriculture, select commodities, specific tariffs) that help both sides domestically, while the strategic sectors remain locked down.

Taiwan And The Military Balance Are Driving The Risk Premium

The most dangerous part of U.S.-China relations is not tariffs. It is miscalculation under pressure, especially around Taiwan. The Pentagon’s latest annual assessment highlights a sharp rise in operational tempo and signaling behavior, including the jump in ADIZ entries noted above.

Two details matter for 2026 risk assessment:

- Carrier ambition and power projection: the report discusses carrier development and longer-term goals, including an aspiration to expand carrier capability over time.

- Nuclear modernization as strategic backdrop: moving toward 1,000+ warheads by 2030 changes how both sides think about escalation ladders, even if conventional scenarios remain more likely.

Military Competition: A Snapshot That Shapes 2026 Calculus

| Indicator | United States | China | Why It Matters |

| 2024 military spending (SIPRI) | $997B | $314B (est.) | Scale, R&D depth, alliance capacity |

| Nuclear trajectory | Mature triad | “Low 600s” through 2024, 1,000+ by 2030 | Raises crisis stability stakes |

| Taiwan pressure indicators | Deterrence posture | ADIZ activity rising sharply | Normalization of coercive tempo |

The key analytical point: crisis risk is increasingly “managed” by operational habits. More aircraft, more patrols, more interceptions create a dense contact environment where small errors can have outsized consequences.

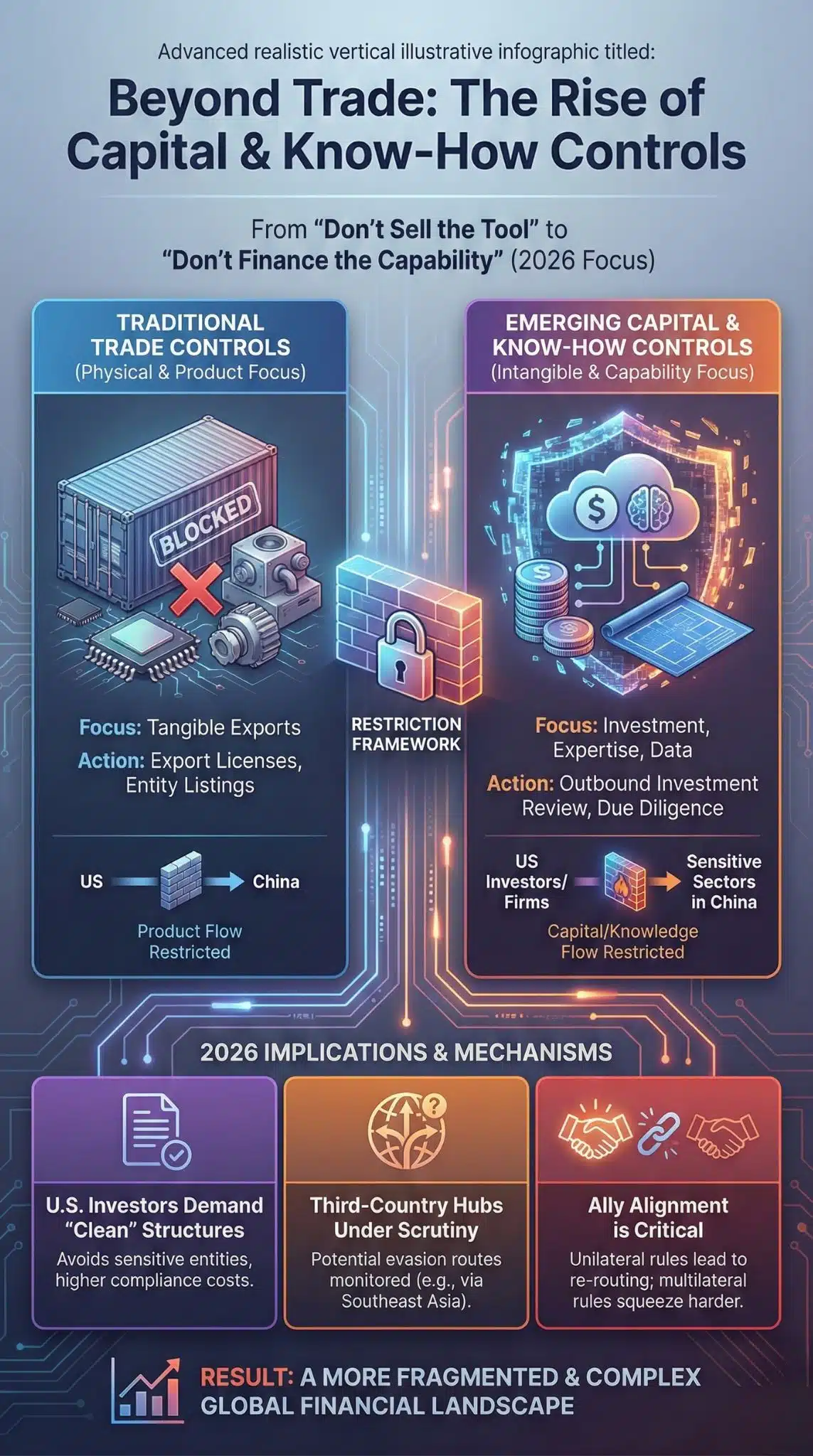

Capital And Know-How Controls Are Becoming As Important As Trade Controls

Washington’s logic is evolving from “don’t sell them the tool” to “don’t finance the capability.” The U.S. outbound investment framework signals an intent to restrict flows of U.S. capital and managerial expertise into sensitive sectors in “countries of concern,” with implementation beginning in 2025.

For 2026, this matters less for immediate totals and more for behavior:

- U.S. investors increasingly demand “clean” structures.

- Chinese firms face higher cost of capital and more complex offshore engineering.

- Third-country hubs become more politically sensitive, because they can look like evasion.

This is also where allies matter. If the U.S. builds restrictions that partners do not match, firms will route activity through jurisdictions with looser rules. If partners align, China accelerates indigenous substitutes and alternative funding channels.

Global Markets Are Being Pulled Into The Rivalry Via Commodities And Clean Tech

Technology rivalry is easy to see. Commodity rivalry is easier to miss until prices move.

Reporting on copper flows illustrates how tariff threats can rewire trade routes. Separately, the energy storage boom has been strengthening lithium demand, linking geopolitics to the energy transition supply chain (materials, storage, grid gear).

The 2026 implication is subtle but powerful: even when Washington and Beijing “de-risk” in tech, they may still be tightly coupled through energy transition supply chains. That coupling can reduce conflict (mutual dependence) or increase leverage (weaponization risk), depending on the sector and the shock.

The Macro Backdrop: China’s Surplus Politics And The Currency Debate

As China leans on manufacturing and exports to stabilize growth, trade balances become political lightning rods. A strong surplus narrative tends to amplify pressure for tariffs, industrial policy, and anti-dumping actions across the U.S. and Europe.

For U.S.-China relations in 2026, that means macro policy is not neutral terrain. Currency debates, surpluses, and industrial overcapacity are becoming part of the competition narrative, not just economic commentary.

Expert Perspectives: Where Credible Views Diverge

A useful way to keep this analysis neutral is to separate disagreements about goals from disagreements about tools.

Where many experts broadly agree

- Semiconductors and AI compute are central to long-run power and military advantage.

- Risk of miscalculation around Taiwan is rising with operational tempo.

- Partial decoupling is real, but full separation is costly and unlikely in the near term, given trade volumes.

Where the debate is sharp

- Do export controls “work” or just accelerate substitution? Some think tanks argue controls have limits and can produce unintended outcomes, including incentivizing faster domestic innovation and creating enforcement whack-a-mole problems.

- Is selective trade thaw stabilizing or enabling? Optimists see corridor deals (like soybeans) as guardrails. Skeptics see them as tactical pauses that leave the core rivalry untouched.

- Does a larger Chinese surplus imply vulnerability or strength? Some read it as evidence of industrial dominance. Others see weak domestic demand and deflationary pressure, which can be destabilizing internally and provocative externally.

What Comes Next: A Practical 2026 Watch List

Predictions should be labeled, so here are conditional outlooks grounded in observable milestones.

If the tech rivalry hardens further, watch for

- Licensing regime tightening or politicization around AI accelerators and cloud access, indicated by delays, new due diligence layers, or expanding entity actions.

- Beijing shifting from “support domestic chips” to “mandate domestic chips” in specific procurement domains, which would be a step change in forced substitution logic.

If the relationship stabilizes tactically, watch for

- More commodity and agriculture corridor agreements that reduce inflation risk and smooth domestic politics, even while strategic sectors remain constrained.

- Managed currency adjustments that attempt to reduce external pressure without triggering domestic slowdown.

If crisis risk rises, watch for

- Spikes in Taiwan-area operational tempo and more frequent, higher-risk encounters as coercive habits normalize.

- Narrative shifts that redefine “red lines,” especially if domestic political cycles intensify rhetoric and reduce diplomatic room to maneuver.

Final Thoughts

US-China Relations 2026 is not simply a bilateral story. It is a blueprint for how the world’s two most consequential powers will try to compete in a way that is “cold” enough to avoid direct war, but “hot” enough to reshape supply chains, technology diffusion, commodity pricing, and alliance behavior.

The paradox at the heart of 2026 is that stabilization in trade lanes can coexist with escalation in strategic lanes. Soybeans can rebound even as AI chips become a bargaining chip. Copper and lithium flows can be distorted by tariff threats even as both sides talk about “guardrails.”

The most realistic forecast is not a clean break, nor a reset. It is a longer era of managed confrontation, where each side tries to deny the other decisive advantage in frontier tech and security, while selectively preserving economic channels that prevent immediate self-harm.