The Pentagon’s insistence that there are no U.S. troops on the ground in Venezuela is not a minor clarification. It is a signal about Washington’s risk tolerance after Maduro’s capture, a hedge against mission creep, and a message to allies, markets, and rivals watching for whether “pressure” turns into occupation.

How We Got Here

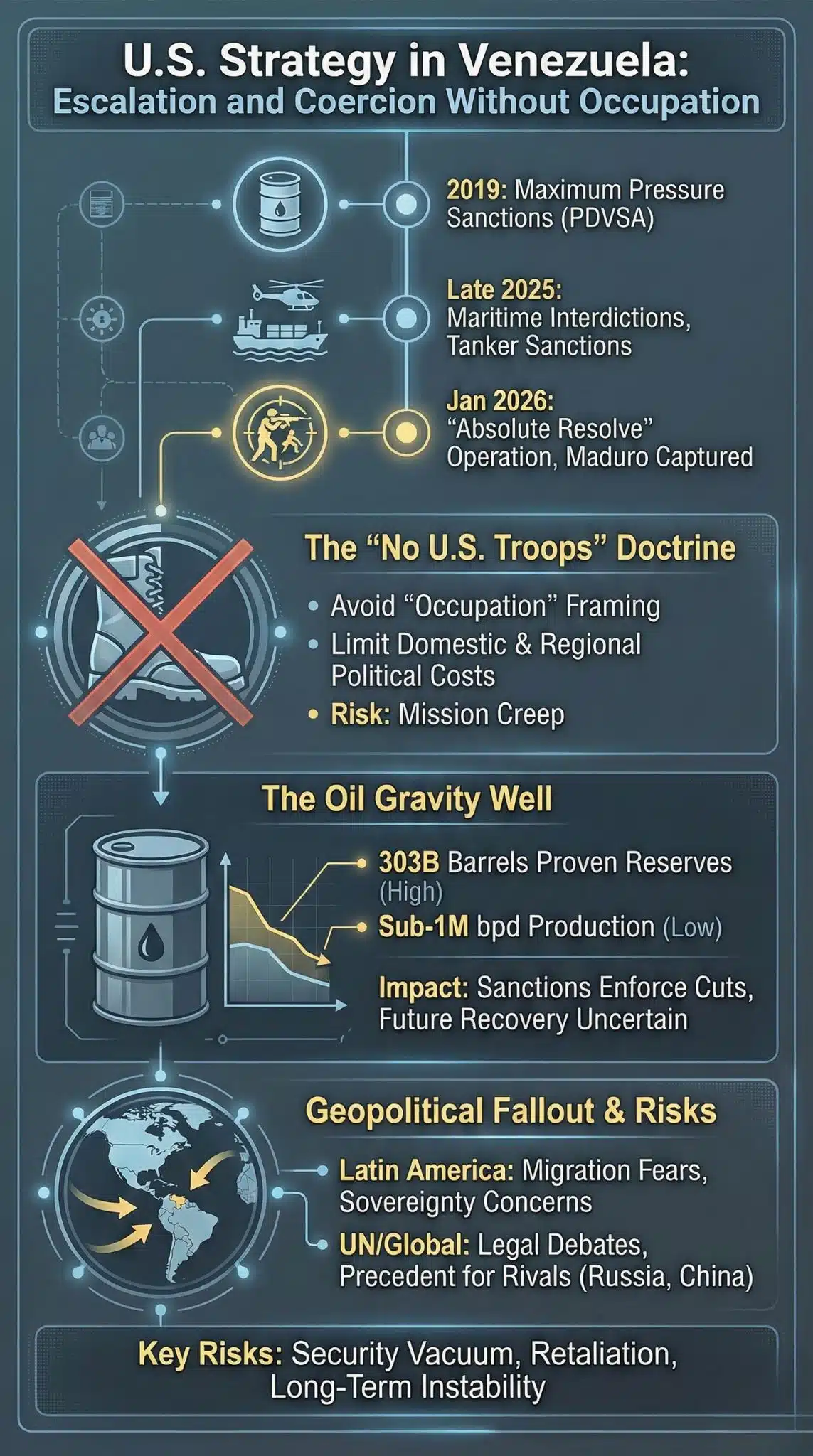

For years, U.S. policy toward Nicolás Maduro has oscillated between isolation, sanctions, limited diplomatic probes, and episodic pressure tied to elections and human rights. The sanctions architecture hardened in 2019 when the United States designated Venezuela’s state oil company PDVSA and expanded sectoral tools designed to constrain regime revenue. Congressional research has repeatedly described U.S. sanctions as both an instrument of leverage and a source of second-order effects, including humanitarian strain and incentives for sanctions evasion.

By late 2025, the pressure campaign shifted from primarily financial coercion to visible enforcement at sea. Treasury actions targeting oil traders, shipping firms, and tankers framed Venezuela’s oil trade as a sanctions-evasion ecosystem, explicitly calling out “shadow fleet” dynamics that resemble other sanction theaters.

Then came the rupture. Multiple reports described U.S. strikes around Caracas and a special-operations raid that captured Maduro and his wife, transporting them to U.S. custody to face drug-related criminal charges.

That is the context in which the “no U.S. troops” line matters: it lands amid a maximal shock to Venezuelan sovereignty, a highly contested legal rationale, and open-ended rhetoric about “running” Venezuela, while senior officials signal a narrower posture.

| Key Milestones In The U.S.–Venezuela Escalation | Why It Mattered |

| 2019: Broad “maximum pressure” sanctions, including PDVSA designation | Reduced official oil revenue channels, expanded sanctions-evasion incentives |

| Oct 2023–2024: Conditional sanctions easing tied to elections | Demonstrated “relief for concessions” model, fragile and reversible |

| Feb 2025: Policy shift affecting Chevron’s license (per U.S. congressional research) | Signaled re-hardening of energy leverage |

| Sep–Dec 2025: Maritime interdictions and expanded tanker sanctions | Pressure shifts from banking chokepoints to physical enforcement |

| Dec 31, 2025: Treasury sanctions oil traders and vessels | Formalized “shadow fleet” framing in Venezuela context |

| Jan 3–4, 2026: “Absolute Resolve,” Maduro captured, UN legality debate | Redefined the crisis from sanctions to direct kinetic action |

Why “No U.S. Troops” Is The Most Important Sentence In The Story

In crises, governments fight two battles at once: the operational one and the narrative one. “No U.S. troops on the ground” is narrative armor.

It attempts to draw a bright line between a raid and an occupation. That line is meant for multiple audiences:

- Domestic U.S. politics: limiting the perception of an open-ended war helps the White House contain War Powers and authorization debates that follow sustained deployments. Reporting indicates congressional frustration over notice and oversight around the operation.

- Regional governments: Latin America’s default suspicion of U.S. intervention is historically conditioned. A “troops-free” posture tries to soften the occupation optics without conceding the reality of coercion.

- International law and legitimacy: if Washington can frame action as a targeted “law enforcement” operation rather than a use of force for territorial control, it may hope to reduce diplomatic costs, even if legal experts still reject the underlying rationale.

But the line is also revealing. It implies the administration believes the biggest strategic risk is not the raid itself, but what follows: security vacuums, retaliation, and a slide into governance responsibility.

Reporting summarized the tighter version of this posture: senior officials suggested the U.S. would not govern Venezuela day-to-day and emphasized there were no U.S. forces on the ground, even as a significant naval footprint remained in the region.

| What Leaders Suggested | What “No Troops” Tries To Achieve | The Strategic Risk It Can’t Remove |

| “We’ll run Venezuela” rhetoric | Deterrence and leverage over Caracas | Creates expectations Washington may not want to meet |

| “No forces on the ground” signaling | Avoid “occupation” framing | Still looks like regime change by force to many states |

| Large naval presence persists | Coercion without holding territory | Sustained maritime pressure can become a de facto blockade with escalation dynamics |

A Doctrine Shift: Coercion Without Occupation

If the Iraq and Afghanistan era was defined by mass deployments and nation-building ambitions, the current Venezuela playbook appears closer to “coercion without occupation,” combining:

- Special operations raids

- Maritime enforcement and interdictions

- Sanctions, including energy choke points

- Information operations and signaling

This resembles the logic of “over-the-horizon” power projection: hit high-value nodes, deny revenue flows, and avoid the political and human costs of holding territory. The problem is that even if Washington avoids a ground footprint, it can still inherit responsibility for outcomes.

Analysts have warned that Venezuela is not a “low-cost” environment even if its conventional defenses are degraded. Resistance risks are asymmetric: urban environments, militias, and internal security networks can outlast a quick strike narrative. One prominent defense-analysis argument is that Venezuela could be “weak in battle” yet dangerous in resistance, especially if conflict mutates into urban coercion and insurgent tactics.

The “no troops” line, in other words, is less about what happened in the raid and more about what Washington is trying to prevent next.

The Legal And Normative Fallout: A Precedent Bigger Than Venezuela

Here the Pentagon’s phrasing intersects with a harsher reality: international law debates rarely hinge on whether troops stayed overnight. They hinge on sovereignty, consent, and justification.

Reporting from the UN debate captured the core objection: legal experts widely regard the operation as unlawful absent UN authorization, Venezuelan consent, or a valid self-defense claim. The UN Secretary-General warned the episode could set a dangerous precedent.

This matters beyond Venezuela because it invites mirror-image arguments by other powers. If a state can seize a sitting head of state on criminal allegations, the norm against cross-border abduction by force weakens. Even if one believes Maduro’s alleged crimes are severe, the rule being tested is whether criminality dissolves sovereign protections.

Domestic politics compounds the legal ambiguity. If the executive branch can conduct major strikes and a decapitation-style raid without clear congressional authorization, U.S. war powers debates intensify, especially if retaliatory cycles begin. The Pentagon’s “no troops” framing functions as a domestic pressure valve, but it cannot fully address the underlying constitutional question.

Oil Is Not A Side Plot: It Is The Gravity Well

Even before the raid, Venezuela’s energy sector was the center of the sanctions chessboard. After the raid, it became the central variable in global market expectations.

Venezuela sits on the world’s largest proven oil reserves—around 303 billion barrels by commonly cited estimates—yet production has collapsed from historical highs to under 1 million barrels per day in recent years. Analysts disagree on how fast output could recover under a political transition.

Two things can be true at once:

- In the near term, coercion can reduce supply. Reports indicated PDVSA began cutting output as export constraints tightened and storage limits grew, with millions of barrels reportedly waiting offshore as floating storage.

- In the medium term, a transition could add supply. Major-bank analysts cited in market reporting suggested production could rise meaningfully within two years under a transition, with longer-run potential higher—but only with major investment and infrastructure stabilization.

That tension is why “no troops” matters for markets: investors and oil traders are trying to infer whether Washington intends to create conditions for investment, or whether instability and legal uncertainty will delay any recovery for years.

| Venezuela Oil Snapshot (Early Jan 2026) | What It Signals |

| ~303B barrels in proven reserves | Resource scale is enormous, but not the same as usable capacity |

| Sub-1M bpd production baseline | Long-running operational constraints persist |

| Output cuts reported amid export disruption | Enforcement can be supply-negative quickly |

| Large volumes waiting offshore | Logistics bottlenecks become economic pressure multipliers |

| Long-run “price downside” scenario under recovery | A successful transition could reshape global supply expectations |

A second-order effect is OPEC+ politics. Market reporting highlighted that OPEC+ has been cautious amid member turmoil, underscoring how geopolitical shocks now compete with fundamentals in driving sentiment.

Latin America’s Political Aftershocks: The Region Will Not Treat This As “Limited”

Washington may describe the episode as a raid without occupation. Much of Latin America will still read it through historical memory: sovereignty violations, regime-change fears, and the risk of spillover instability.

One immediate accelerator is migration. UN agencies estimate that millions of Venezuelans live abroad, mostly in Latin America and the Caribbean. Any renewed instability and economic collapse can push that number higher, adding political strain to Colombia, Brazil, Peru, Ecuador, and beyond.

Another accelerator is the Cuba factor. Reporting indicated that Cuban personnel were killed during the U.S. operation, underscoring that Venezuela’s alliances were not merely diplomatic but embedded in security structures.

Finally, the “next targets” rhetoric changes regional threat perception. Reporting indicated U.S. leaders floated the possibility of further strikes if cooperation was not forthcoming. Even if those threats are bargaining posture, they can reorder defense planning and alliance behavior across the hemisphere.

| Regional Stakeholders And Likely Incentives | Near-Term Behavior To Watch |

| Colombia, Brazil, Mexico | Mediation offers, border security tightening, condemnation balanced against U.S. leverage |

| Caribbean states | Concern over maritime enforcement, shipping disruption, and energy volatility |

| Cuba | Hard rhetorical opposition and security recalibration after reported casualties |

| Venezuelan interim leadership | Legitimacy contest, security consolidation, bargaining over oil and sanctions |

| Venezuelan diaspora hubs | Political mobilization, humanitarian advocacy, lobbying campaigns |

Great Power Competition: Venezuela As A Stress Test For China, Russia, And The Sanctions Era

Venezuela is also a proxy arena for how rival powers respond when the United States uses force in a contested legal frame.

UN reporting highlighted predictable bloc lines: Russia and China condemning the operation as a breach of international law, while U.S. partners responded more cautiously. The underlying strategic question is whether Beijing and Moscow can translate condemnation into material costs for Washington.

This matters because sanctions policy is no longer just about denial. It is about building global enforcement capacity in a world where “shadow fleets” and alternative financial channels are increasingly sophisticated. U.S. Treasury language on Venezuela’s oil trade suggests Washington views the trade as a transnational network problem rather than a purely Venezuelan one.

If the U.S. can enforce constraints without broad troop deployments, it will treat that as a template. If rivals can help Caracas evade enforcement, they will treat that as a template.

Expert Perspectives: Competing Narratives, Competing Risks

A credible analysis has to hold conflicting interpretations at once.

The administration’s implicit case is that the U.S. can remove a destabilizing actor and choke off illicit flows without repeating the occupations of the 2000s. The “no troops” posture is designed to keep costs bounded, reduce U.S. casualties, and preserve domestic support.

The critics’ case is that legality and precedent matter more than troop counts. Even a “troops-light” model can be destabilizing if it collapses institutions, triggers retaliation, or normalizes cross-border abduction of leaders.

The market’s case is conditional: oil supply outcomes will depend on whether sanctions shift, whether PDVSA’s operations stabilize, and whether investment barriers clear. Near-term supply disruption can coexist with long-term supply optimism if traders price in a transition and eventual investment inflows.

The humanitarian lens warns that political shocks in Venezuela translate quickly into regional migration and service strain, and baseline displacement numbers are already historically large.

What Comes Next

Predictions should be labeled carefully. Based on public signals and structural incentives, three forward-looking dynamics are most plausible.

Mission Creep Will Be The Central Risk

Even if there are no U.S. troops on the ground today, “no troops” can become “advisers,” then “security detachments,” then “stabilization support.” The pathway is familiar: once you take responsibility for a political outcome, you inherit responsibility for security conditions that enable it.

Milestones to watch: War Powers and oversight fights in Congress; any shift from “no troops” to “temporary security assistance.”

Oil Pressure Will Determine Whether Venezuela Craters Or Transitions

Near-term operational stress—output cuts, storage constraints, and joint-venture disruptions—can accelerate economic deterioration, undermining any interim authority and raising migration pressures.

Milestones to watch: Treasury licensing/enforcement decisions; PDVSA export patterns; OPEC+ messaging as markets reassess long-run supply.

Legitimacy Will Be Fought At The UN And Across The Hemisphere

The UN debate is not just theater. It is where states define the narrative about permissible force. Even cautious allies tend to emphasize international law, and regional blocs will shape whether Washington is isolated or tacitly tolerated.

Milestones to watch: Regional summit communiqués; any negotiation framework tying sanctions relief to elections, governance reforms, or security arrangements.

A Measured Forecast

Many analysts expect Washington to try to preserve the “no troops” posture as long as maritime enforcement and economic tools deliver leverage. Market indicators point to continued volatility: near-term supply disruption can coexist with long-term supply optimism if a transition becomes credible. But the most enduring impact may be normative—if the world accepts leader seizure by force as “law enforcement,” the precedent won’t stay confined to Venezuela.