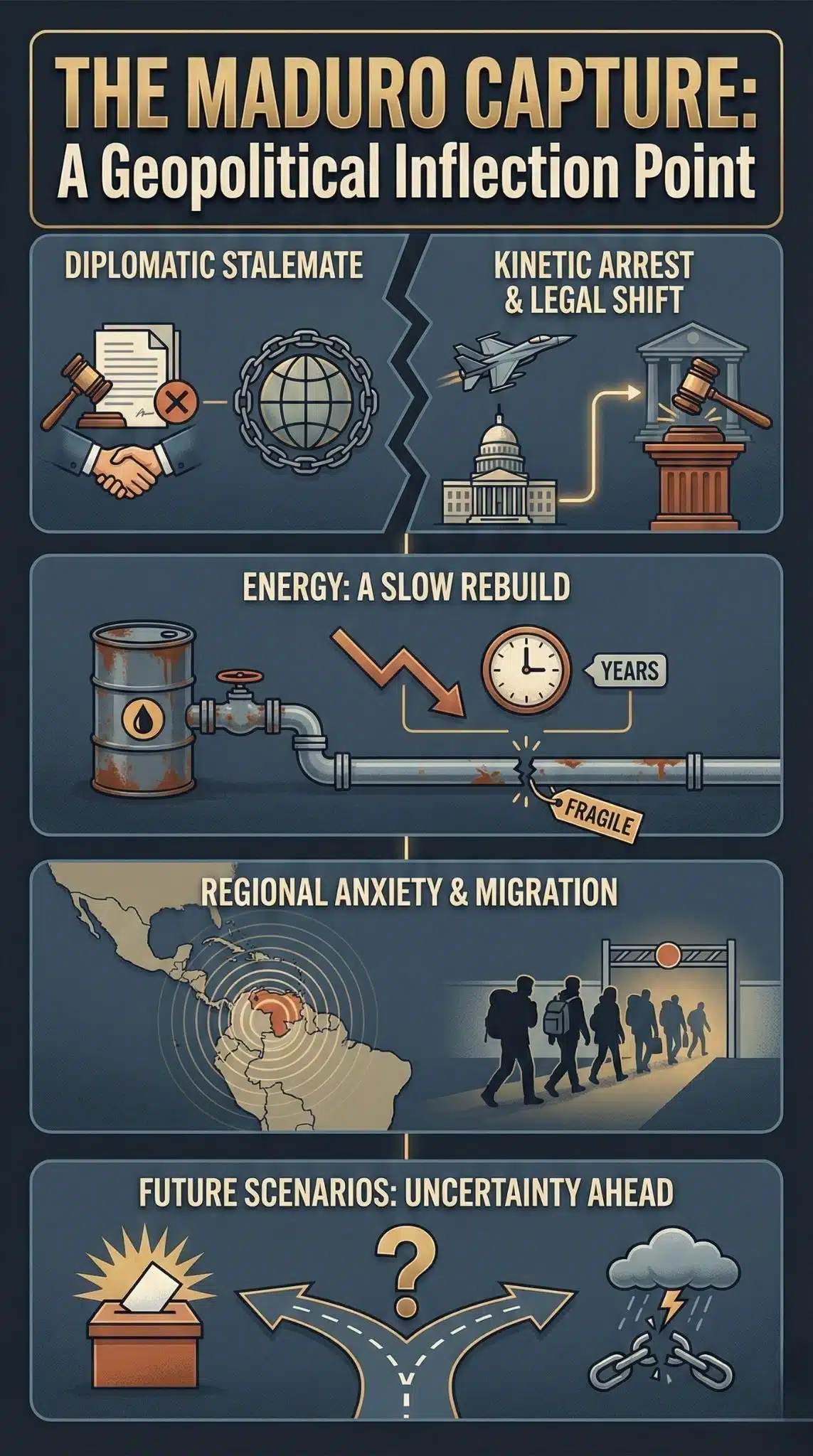

The U.S. Intervention In Venezuela is a geopolitical inflection point because it turns a long sanctions-and-diplomacy standoff into direct force, with Nicolás Maduro now in U.S. custody. It immediately pressures energy markets, jolts Latin American security politics, and challenges the global norm that sovereignty cannot be overridden by “law enforcement” claims.

How We Got Here: From Sanctions Pressure To A Kinetic “Arrest”

The overnight U.S. operation that captured Maduro did not emerge from a vacuum. It sits at the intersection of three long-running arcs.

First, Venezuela’s political crisis hardened into a durable stalemate. For years, outside pressure tried to force concessions without triggering a regional war. Washington leaned on sanctions, financial isolation, and targeted licenses that selectively allowed energy activity while retaining leverage. The Chevron-style license architecture became a policy dial: tighten to punish Caracas, loosen to incentivize talks, tighten again when talks fail.

Second, the U.S. legal case against Maduro created a ready-made justification for escalation. In 2020, U.S. prosecutors announced narco-terrorism charges against Maduro and other Venezuelan officials. Whatever one thinks of the merits, those charges created a persistent U.S. domestic-law narrative: Maduro was not only a foreign head of state but also an indicted defendant.

Third, energy and security pressures converged. Venezuela holds the world’s largest proven oil reserves, yet produces a fraction of its historical levels because of underinvestment, technical complexity, and sanctions constraints. Analysts have long argued that meaningful recovery would take years and major capital, even in a best-case political environment.

By early January 2026, these threads snapped into a single high-risk move: U.S. strikes and a raid that removed the sitting Venezuelan leader and flew him to the United States, followed by a courtroom appearance where Maduro pleaded not guilty and said he had been “kidnapped.”

A Timeline That Explains The Escalation Logic

| Date | Event | Why It Mattered |

| Mar 26, 2020 | U.S. prosecutors announce narco-terrorism charges against Maduro | Created a durable “law enforcement” framing for a head-of-state target. |

| 2022–2025 | Sanctions calibrated via general licenses and wind-down periods | Showed Washington preferred leverage through energy permissions, not occupation. |

| Jan 3, 2026 | U.S. strikes and raid capture Maduro and Cilia Flores | Crossed from coercion to force, changing regional risk calculations overnight. |

| Jan 5, 2026 | Maduro appears in Manhattan federal court; interim leadership installed in Caracas | Turned a foreign-policy crisis into a U.S. judicial process with global implications. |

| Jan 6, 2026 | UN Human Rights Office criticizes U.S. intervention as violating international law | Elevated the episode into a direct test of UN Charter norms. |

The Legality Fight Is The Real Battlefield

The U.S. justification is unusually ambitious: a “surgical” operation framed as law enforcement against an indicted narco-terrorism figure, rather than war against a state. This is not just a messaging choice. It is an attempt to rewrite the legal category of cross-border force.

The UN Human Rights Office response is blunt: using force against a country’s territorial integrity or political independence violates a core international principle, and the precedent is dangerous precisely because it implies powerful nations can act unilaterally.

Inside the United States, the legality question splits into two tracks:

- Domestic constitutional authority: Critics are raising War Powers and congressional authorization concerns, while the administration argues inherent authority for a limited mission tied to national security and criminal indictments.

- International law and sovereign immunity: Maduro’s defense is expected to push sovereign-immunity arguments, while opponents of the intervention argue that indictments do not override the UN Charter’s prohibition on the use of force.

Why this matters: if the “law enforcement raid” concept is normalized, the global system shifts toward a world where states with power treat international borders as conditional when they can narrate a security rationale. That is a structural shock to the post-1945 order, not a Venezuela-only dispute.

Oil Markets Reacted—But Not Like A Classic Supply Shock

The first market signal is counterintuitive: oil moved, but not explosively. Early reporting showed crude prices rising modestly after the raid, with U.S. crude around $58 per barrel and Brent around $61–$62 in the immediate reaction window. Then oil fell as traders focused on oversupply expectations and speculation that Venezuelan output could eventually rise if constraints loosen, with Brent around $61.48 and WTI around $58.00 on Jan 6.

That “muted” response tells a deeper story: traders are weighing two opposite forces.

- Short-term risk premium: instability, sabotage, PDVSA disruption, and regional escalation can reduce supply.

- Medium-term supply optionality: if Washington tries to unlock Venezuelan capacity, the market anticipates additional barrels later, which is bearish in an oversupplied environment.

Energy Snapshot: The Day After The Raid

| Indicator | What Moved | What It Suggests |

| Brent crude | ~1–2% swing around $61–$62 | Market sees risk, but also expects global supply cushions. |

| WTI crude | ~1–2% swing around $58 | Same signal: event matters, but fundamentals still dominate. |

| U.S. refining angle | Some refineries can run ~100,000 bpd of Venezuelan crude | U.S. downstream winners exist if heavy crude access expands. |

A second-order implication is refining politics. Venezuelan crude is typically heavy and sour. Certain Gulf Coast refineries are configured for that slate, and reporting noted that Phillips 66 highlighted capacity to process up to 100,000 barrels per day of Venezuelan crude at two refineries. That does not mean a quick flood of Venezuelan barrels, but it does mean a clear corporate constituency will lobby for policies that convert geopolitical control into stable supply contracts.

Venezuela’s Oil Reality Is A Decades-Long Rebuild, Not A Quick Prize

Political speeches often treat Venezuela’s reserves like a tap that can be turned on. The technical and institutional record says otherwise.

Venezuela’s production has collapsed from late-20th-century highs to levels that struggle to consistently reach 1 million bpd. Structural reasons recur across credible analyses: extra-heavy crude complexity, PDVSA talent flight, infrastructure decay, and sanctions constraints. Energy reporting put output at ~838,000 bpd (Jan–May 2025) after partial easing, still far below historic levels. And even the domestic system is constrained: U.S. EIA’s country brief lists Venezuela’s refineries at ~1.46 million bpd nameplate capacity (as of 2022), but nameplate does not equal operable capacity after years of outages and maintenance deficits.

What The Oil Numbers Actually Say

| Metric | Best Available Recent Data | Why It Matters |

| Proven reserves | ~303 billion barrels (largest globally) | Strategic lure is real, but reserves are not flow. |

| Output | ~838,000 bpd (Jan–May 2025) | Recovery is slow and fragile even before the intervention shock. |

| Refining system | ~1.46 million bpd nameplate (2022) | Domestic fuel stability depends on operational capacity, not slogans. |

| Rebuild horizon | “Years” to “a decade” scale in many analyses | The timeline mismatch drives policy disappointment and overreach risk. |

The strategic takeaway: the intervention may have been motivated partly by energy, but energy payoffs are slow. That creates a temptation for policymakers to pursue coercive shortcuts (control, trusteeship rhetoric, forced contracts) that increase resistance and sabotage risk, delaying the very production gains they seek.

Venezuela’s Power Vacuum Will Decide Outcomes

Removing a leader is not the same as stabilizing a state. Reporting said Venezuela’s vice president stepped in as interim president, and that the operation was extraordinary, with immediate questions about what “running” the country could mean in practice.

Key internal variables now dominate:

- Security services and military cohesion: If top commanders perceive the intervention as a precedent for targeting them next, loyalty may harden into resistance. If they perceive it as the end of a regime era, bargaining and defections become more likely.

- Opposition fragmentation: Venezuela’s opposition has long been divided between maximalists and negotiators. A foreign military capture can unify them briefly, or split them further over legitimacy and sovereignty.

- State capacity under stress: Even if a transitional authority emerges, it inherits a degraded oil sector, fragile institutions, and humanitarian strain. Those pressures can rapidly delegitimize any successor if living conditions worsen.

Think tanks have warned that tactical success does not guarantee strategic success. The strategic payoff depends on whether it leads to durable democratic restoration rather than prolonged instability.

Latin America Sees A Precedent, Not A One-Off

International reaction has been intense because the region reads this through the long memory of intervention history. Coverage described broad condemnation at the UN, including from countries that are not reflexively aligned with Caracas, because the method matters as much as the target.

Regional anxiety is understandable: even states that do not resemble Venezuela politically worry about a future where Washington applies unilateral force under a cartel or terrorism rationale.

This anxiety lands in a region already stressed by transnational organized crime, migration pressures, political polarization, and weak trust in institutions. So the intervention may catalyze a new security posture: more hedging, more defense cooperation among neighbors, and more incentives to invite outside partners as political counterweights.

Humanitarian Fallout And Migration Could Re-Accelerate

Venezuela’s migration crisis is already one of the largest displacement events in the world. UNHCR materials for 2026 put Venezuelans living abroad at nearly 7.89 million, mostly in Latin America and the Caribbean. IOM’s regional appeal tied to the 2025–2026 response framework underscores ongoing needs across 17 countries and the strain on services, integration, and protection capacity.

A destabilizing intervention can push migration in two ways:

- Immediate displacement: fear, violence, and uncertainty trigger flight.

- Delayed displacement: economic dislocation and state dysfunction push people out over months.

Migration Stress Points To Watch

| Indicator | What We Know Now | Why It Matters Next |

| Venezuelans abroad | ~7.89 million | Even a small re-acceleration stresses host-country politics and budgets. |

| Regional response | 17-country coordination framework | The capacity exists, but funding and political will are fragile. |

| Risk trigger | Security crackdown, shortages, border bottlenecks | These convert political events into human flows rapidly. |

For policymakers, this is where “shockwaves” become measurable. Migration is a political accelerant in Colombia, Peru, Ecuador, Chile, Brazil, and beyond, and it feeds directly into election cycles, social cohesion debates, and crime narratives.

Key Statistics Readers Should Anchor On

- Operation scale described in briefings and reporting includes 150+ aircraft and drones, reflecting planning far beyond a symbolic raid.

- Maduro’s first U.S. court appearance: January 5, 2026, with next proceedings expected later in 2026 (some coverage cited March 17).

- Oil market reaction (Jan 6): Brent around $61.48, WTI around $58.00.

- Venezuelans abroad: ~7.89 million (UNHCR 2026 overview).

- IMF “at a glance” projections (latest displayed): 2026 real GDP change ~0.5% and consumer prices ~269.9% for Venezuela.

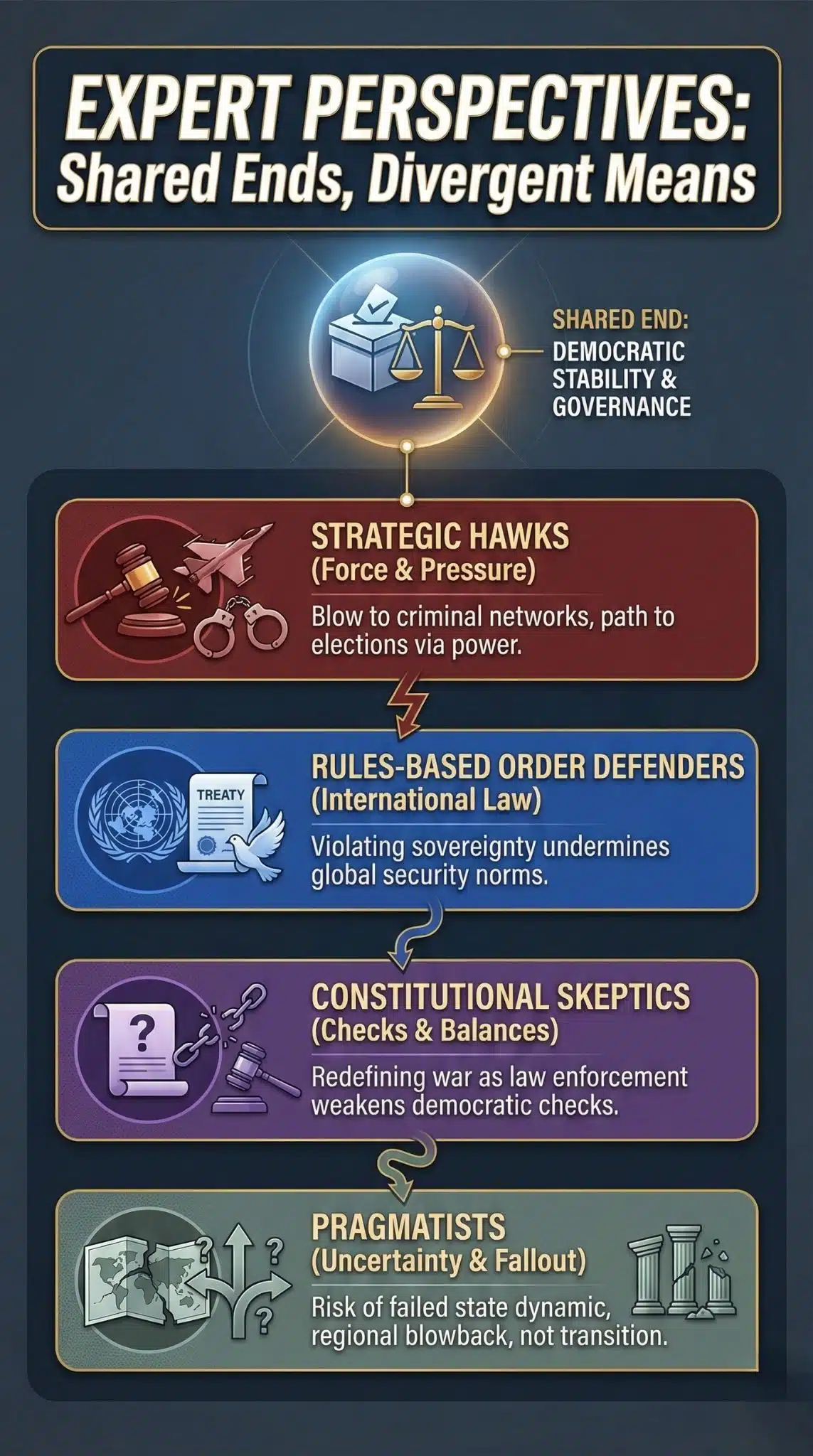

Expert Perspectives: The Central Disagreement Is Over Means, Not Ends

A striking feature of the debate is that many actors share a diagnosis (Venezuela’s governance failures, corruption, and criminal networks) but diverge sharply on the remedy.

- Strategic hawks: Some analysts emphasize the blow to criminalized authoritarianism and argue it could open a path to elections if followed by disciplined diplomacy and humanitarian support.

- Rules-based order defenders: UN officials and many governments focus on the method, warning that violating sovereignty undermines global security even if the target is unpopular.

- Constitutional skeptics: U.S.-focused critics argue that redefining war as “law enforcement” weakens democratic checks and makes future interventions easier to launch.

- Pragmatists: Some think tanks emphasize uncertainty and second-order effects: fragmented security forces, regional blowback, and the risk that the operation creates a failed-state dynamic rather than a transition.

Neutrality requires acknowledging a hard truth: even if the objective is democratization, the intervention’s legitimacy deficit may poison the very political settlement needed to stabilize Venezuela.

What Comes Next: The Scenarios That Matter More Than The Headlines

The next phase is not defined by whether Maduro is in a U.S. courtroom. It is defined by what fills the gap inside Venezuela and how the international system responds to the precedent.

A Forward-Looking Scenario Map

| Scenario | What It Looks Like | Early Signals | Likely Winners | Likely Losers |

| Managed Transition | Interim authority schedules credible elections with external monitoring | Military neutrality, opposition unity, negotiated guarantees | Venezuelan civilians, regional stability, long-term investors | Hardliners, criminal networks |

| Coercive “Stability” | Crackdowns, selective reforms, prolonged emergency politics | Rising detentions, restricted media, patchy aid access | Security elites, some short-term oil players | Civil society, migrants, legitimacy |

| Fragmentation | Competing armed factions, sabotage of oil infrastructure, regional spillover | Breaks in chain of command, localized violence, pipeline attacks | Illicit economies | Everyone else, especially neighbors |

| Negotiated Settlement Under Pressure | Deal tying sanctions relief, elections, and security guarantees | Backchannel diplomacy, UN/OAS roles debated | Diplomats, humanitarian actors | Maximalists on all sides |

Milestones To Watch In 2026

- The U.S. court process: sovereign-immunity fights, evidence disclosure, and whether proceedings become a global legitimacy battleground.

- UN system responses: Security Council paralysis versus broader diplomatic isolation costs for Washington.

- Oil policy signals: any shift from sanctions and licenses toward direct management or rapid contract restructuring, which could deter investment rather than attract it.

- Humanitarian and migration metrics: if outflows rise above the baseline implied by UNHCR and IOM planning documents, regional politics will harden quickly.

Final Thoughts

The U.S. Intervention In Venezuela is not only about Maduro. It is about whether the Western Hemisphere is entering a new era where force is normalized under the banner of counter-narcotics and counter-terrorism. UN officials argue the world becomes less safe when territorial integrity is breached, precisely because it invites imitation and escalation.

Energy markets reveal a second lesson: even a dramatic raid does not automatically create oil supply. The market’s restrained reaction reflects realism that Venezuela’s oil sector is a long rebuild, and that instability can destroy capacity faster than any foreign investment can restore it.

What comes next will be decided by governance, not bravado: whether Venezuela moves toward elections and institutional repair, or slides into fragmentation with humanitarian spillovers. The headline moment has passed. The consequences are just beginning.