In 2025, home insurance continues to serve as a vital safeguard for homeowners. It ensures financial protection against a wide range of risks, from natural disasters to theft, providing peace of mind during times of uncertainty.

While homeowners insurance policies vary, they typically cover common perils that could damage your property or belongings and even your financial standing due to liability claims. With evolving risks and emerging trends, it’s crucial to understand what risks are covered by home insurance policies in 2025 to ensure your home is adequately protected.

Understanding the risks covered by home insurance policies is not only beneficial but necessary to maximize the value of your policy.

In this article, we will discuss the top 7 risks covered by home insurance policies in 2025, breaking them down in detail, offering practical tips, and ensuring that you make informed decisions when choosing a policy.

Risk #1: Fire and Smoke Damage

Fires are one of the most destructive events a homeowner can face. Aside from the emotional toll, the financial burden of fire-related repairs or rebuilding can be overwhelming. Thankfully, home insurance policies commonly cover fire and smoke damage, ensuring that homeowners are protected in case of such an emergency.

How Fire and Smoke Damage Are Covered

When a fire causes damage, a standard home insurance policy typically covers both the repair of the physical structure [roof, walls, flooring, etc.] and the replacement of personal property [furniture, electronics, clothing]. The cost of temporary housing while your home is being repaired is also included under Loss of Use coverage, which helps alleviate the burden of finding alternative accommodations.

Common Causes of Fire in Homes

Understanding the most common causes of fire can help prevent them and, in some cases, ensure you receive coverage. Here are some leading causes of home fires:

- Electrical Fires: Faulty wiring, overloaded circuits, or malfunctioning appliances.

- Cooking Fires: Leaving the stove or oven unattended.

- Heating Equipment: Space heaters or chimneys in poor condition.

- Flammable Materials: Improper storage of chemicals or combustible materials.

- Candles: A leading cause of accidental fires when left unattended.

Practical Tips for Minimizing Fire Risk

To reduce your risk of fire, follow these safety measures:

- Install smoke detectors in every room and test them monthly.

- Ensure electrical appliances are properly maintained and avoid overloading circuits.

- Have your heating system professionally serviced at least once a year.

- Store flammable items in safe, designated areas away from heat sources.

| Fire Hazard | Prevention Tip |

| Faulty wiring | Hire a licensed electrician to inspect your home’s wiring. |

| Unattended cooking | Never leave food cooking unattended; keep a fire extinguisher nearby. |

| Space heaters | Keep heaters away from combustible materials and turn them off when not in use. |

| Candles | Always extinguish candles when leaving a room, and keep them on a stable surface. |

Risk #2: Water Damage and Leaks

Water damage is one of the most frequent and costly risks homeowners face. Whether from a burst pipe, a faulty roof, or an appliance malfunction, water damage can significantly impact your home and belongings. Thankfully, home insurance policies cover certain types of water damage, though not all forms are included.

What Water Damage is Covered by Home Insurance?

In 2025, home insurance generally covers water damage from sudden and accidental events. Examples include:

- Burst pipes or frozen pipes that crack and leak water into the home.

- Roof leaks from storms or falling debris.

- Overflowing appliances, such as washing machines or dishwashers.

Types of Water Damage Covered

While many forms of water damage are covered, flood damage is not typically included under standard home insurance policies. For flood coverage, homeowners must purchase additional flood insurance, which can be obtained through the National Flood Insurance Program [NFIP] or private insurers.

Preventing Water Damage in Your Home

Water damage prevention is key to avoiding costly repairs. Here are some proactive measures:

- Regularly inspect plumbing for leaks or wear and tear.

- Maintain your roof, replacing shingles as needed to avoid leaks during storms.

- Install sump pumps in basements prone to flooding.

- Clean gutters regularly to ensure proper water drainage.

| Water Damage Type | Prevention Tip |

| Burst pipes | Insulate pipes in colder climates and check for leaks regularly. |

| Roof leaks | Inspect and repair your roof after every major storm. |

| Overflowing appliances | Check hoses and connections regularly for wear. |

| Flooding | Consider purchasing flood insurance if you live in a high-risk area. |

Risk #3: Theft and Vandalism

Theft and vandalism are unfortunate risks that can leave homeowners vulnerable to significant financial loss. Most home insurance policies provide coverage for property stolen during a burglary, as well as damage caused by vandalism.

Coverage for Stolen Property

If an intruder steals personal property such as electronics, jewelry, or furniture, home insurance policies typically cover the replacement costs up to the policy’s limits. However, some high-value items like jewelry, art, or collectibles may require special coverage through endorsements or riders to ensure full protection.

Vandalism Protection Under Home Insurance

Vandalism is the intentional destruction of property, often caused during a break-in. Standard home insurance policies usually cover repairs or replacements for damage caused by vandalism, such as broken windows or spray-painted walls.

Securing Your Home Against Break-ins

To minimize the likelihood of theft or vandalism, homeowners can take several proactive steps:

- Install security systems with cameras, motion sensors, and alarms.

- Use deadbolt locks on all doors and secure windows with locks or bars.

- Keep your property well-lit at night to deter intruders.

- Consider using a smart home security system to monitor activity remotely.

| Risk | Prevention Tip |

| Burglary | Install a security system with cameras and motion detectors. |

| Vandalism | Ensure the exterior is well-lit and keep valuable items out of sight. |

| Broken windows | Use laminated glass or install window security bars for added protection. |

Risk #4: Natural Disasters [Earthquakes, Floods, and Storms]

Natural disasters like earthquakes, floods, and storms are unpredictable events that can cause devastating damage to homes. Homeowners need to be aware of what is covered under their policies and what isn’t.

Is Natural Disaster Coverage Part of Standard Home Insurance?

Standard home insurance policies often cover certain natural disasters such as windstorms, hail, and tornadoes, but earthquake and flood coverage are typically excluded. Homeowners need to purchase separate policies to cover these risks.

How Home Insurance Covers Earthquakes and Floods

- Earthquake Insurance: Earthquakes can cause significant structural damage to a home. A separate earthquake insurance policy is needed to cover repairs or rebuilding costs.

- Flood Insurance: If your home is in a flood-prone area, separate flood insurance is required. It covers damage to both the structure and your personal property due to flooding.

Steps to Prepare for Natural Disasters

Homeowners in disaster-prone areas should:

- Retrofit their homes to be more earthquake-resistant.

- Install sump pumps and backflow valves to prevent flooding.

- Maintain an emergency kit and establish an evacuation plan.

| Disaster | Standard Insurance Coverage | Additional Insurance Needed |

| Earthquakes | Not covered | Earthquake insurance |

| Floods | Not covered | Flood insurance |

| Windstorms/Hail | Covered | None |

| Tornadoes | Covered | None |

Risk #5: Liability Protection [Accidents and Injuries]

Liability protection is one of the most valuable components of home insurance, covering you against legal and medical costs if someone is injured on your property. Accidents happen, and when they do, you need to be prepared to cover any associated expenses.

What Does Liability Coverage Include?

Liability coverage typically helps pay for:

- Medical expenses for someone injured on your property.

- Legal costs if you’re sued for damages.

- Settlements or court-ordered damages if you’re found liable.

Examples of Accidents and Injuries Covered by Home Insurance

Common incidents include:

- Slip-and-fall accidents on a wet floor or icy sidewalk.

- Dog bites if your dog injures a guest.

- Trampoline accidents if a guest is hurt while using a backyard trampoline.

Tips for Minimizing Liability Risks at Home

To reduce liability risks:

- Ensure walkways are free from hazards like snow, ice, or debris.

- Install proper fencing around pools and trampolines.

- Keep pets secured, especially if they have a history of aggression.

| Liability Risk | Prevention Tip |

| Slip-and-fall accidents | Clear walkways of ice or debris and use non-slip mats. |

| Dog bites | Keep pets in a secured area, especially if aggressive. |

| Trampoline accidents | Fence off trampolines and supervise use. |

Risk #6: Damage to Personal Property

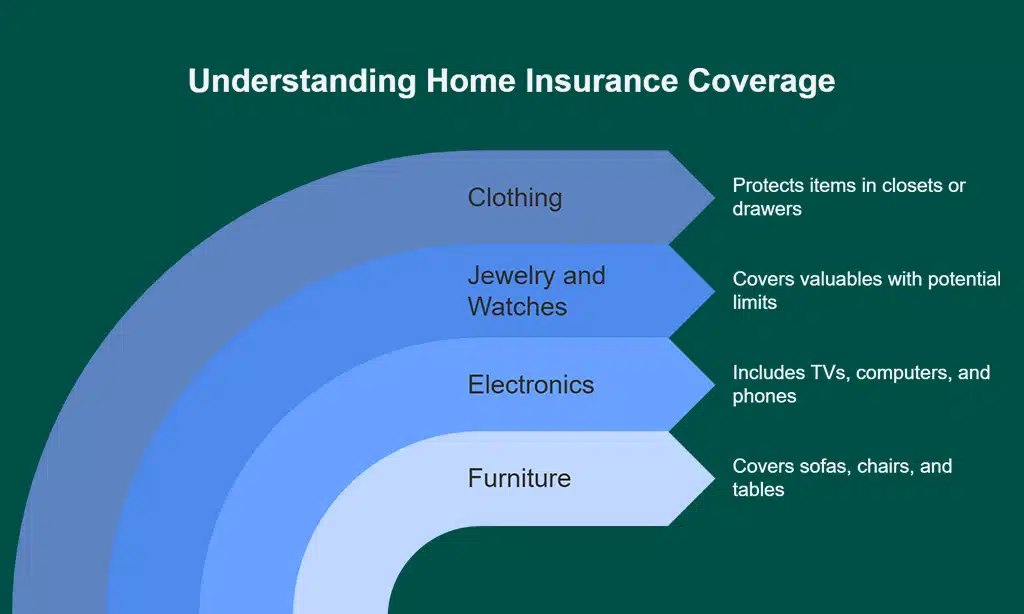

Personal property, including furniture, electronics, clothing, and valuables, is often at risk during accidents like fires, water damage, or theft. Home insurance policies typically cover the damage or theft of these items.

What Personal Property is Covered?

Home insurance policies usually cover:

- Furniture, including sofas, chairs, and tables.

- Electronics, such as TVs, computers, and phones.

- Jewelry and watches, though limits may apply.

- Clothing, including items in closets or drawers.

Understanding Full Replacement vs. Actual Cash Value Coverage

Most policies offer two types of coverage for personal property:

- Actual Cash Value [ACV]: This covers the current value of the item after depreciation.

- Replacement Cost: This reimburses you for the cost of replacing the item with a new one.

How to Protect Valuable Items with Home Insurance

To ensure protection for valuable items:

- Consider adding riders or endorsements for jewelry, art, or collectibles.

- Keep an up-to-date inventory of your possessions to streamline the claims process.

| Item | Coverage Type | Additional Consideration |

| Electronics | Replacement cost or ACV | Ensure adequate policy limits |

| Jewelry and Watches | ACV or Replacement cost | Consider adding a rider for high-value items |

| Furniture | Replacement cost or ACV | Verify limits for high-cost items |

| Clothing | Replacement cost or ACV | Document valuable clothing items |

Risk #7: Temporary Living Expenses During Repairs

After a disaster such as a fire, storm damage, or other covered events, your home may become temporarily uninhabitable. Home insurance policies often cover the cost of living elsewhere until repairs are completed.

How Temporary Living Expenses Are Covered

Loss of Use coverage includes:

- Hotel stays or rent for a temporary home.

- Meals and incidental expenses incurred while living away from home.

What Happens if You Can’t Live in Your Home?

In the event your home is damaged, this coverage helps alleviate the stress of finding temporary housing. However, it’s important to check the policy limits for Loss of Use coverage to understand how long you can be reimbursed for these expenses.

How to Claim Temporary Living Expenses Under Your Policy

- Keep records of all receipts for lodging and meals.

- File a claim promptly and provide documentation to your insurance provider.

| Expense | Covered Under Loss of Use |

| Hotel Accommodations | Yes, up to policy limits |

| Rent for Temporary Housing | Yes, up to policy limits |

| Meals | Yes, usually up to a daily per-person limit |

Wrap Up: Protect Your Home with the Right Coverage in 2025

The risks covered by home insurance policies in 2025 are more varied and crucial than ever. From fire and water damage to liability protection and temporary living expenses, having a solid home insurance policy can provide you with much-needed security and peace of mind.

It’s essential to understand the risks covered, assess your specific needs, and regularly review your coverage to ensure it matches the risks you face.

By being proactive, protecting your home and personal property, and addressing potential risks before they become problems, you can ensure that you are fully prepared for the unexpected. Stay informed, stay protected, and enjoy your home with confidence in 2025.