The biggest entertainment trends in the coming years will be driven by one simple shift: people don’t just “watch” anymore—they scroll, sample, subscribe, share, and pay across multiple screens, often in the same day.

Social platforms are competing head-to-head with streaming services, AI is speeding up how content is made and personalized, and audiences are pushing the entire industry toward better value (bundles, ad-supported tiers, and flexible plans).

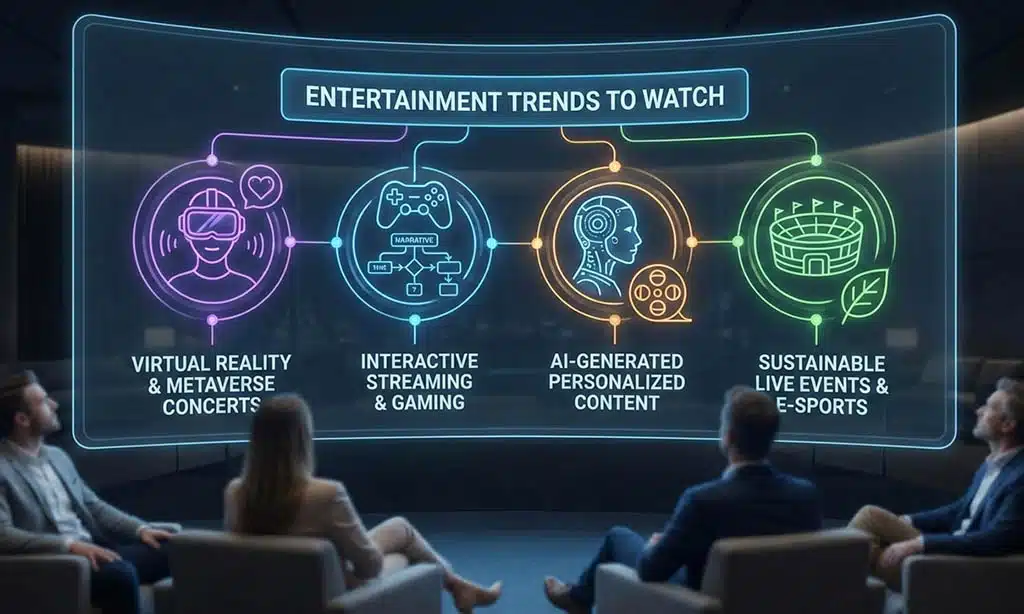

Before we dive in, here’s the whole landscape at a glance:

| Trend | What it means (in plain English) | Who does it impact most |

|---|---|---|

| 1) Social video becomes the main “TV.” | Short-form + creator content takes more daily attention | Creators, studios, advertisers |

| 2) Generative AI changes production & discovery | Faster creation, dubbing, and personalization—plus new IP rules | Studios, creators, legal/rights |

| 3) Streaming shifts to ad-supported + bundling | Less “subscription stacking,” more bundles and ad tiers | Streamers, telcos, viewers |

| 4) Live events get bigger (and more media-integrated) | Tours, sports, and events fuel content + community | Music, sports, venues, brands |

| 5) Gaming grows into a mega-entertainment pillar | Games rival movies/music in time + spending | Publishers, streamers, brands |

| 6) Podcasts become video-first and platform-native | “Watchable” podcasts expand reach and ad value | Podcasters, YouTube/Spotify |

| 7) Direct-to-fan monetization becomes standard | Memberships, paid communities, merch, micro-products | Creators, indie media |

Key takeaways

-

Social video is the new front door for discovery, fandom, and breakout hits.

-

Streaming is maturing into ad-supported tiers, bundles, and simpler “choose-your-plan” options.

-

AI will speed up production and localization, but rights, trust, and authenticity rules will matter more.

-

Live events remain a premium growth engine, and they increasingly feed content across platforms.

-

Gaming keeps expanding as a core entertainment category with massive global revenue and audiences.

-

Podcasts are becoming video-first, especially on YouTube, changing how shows are produced and monetized.

-

Direct-to-fan monetization is becoming standard, helping creators reduce reliance on algorithms and ads.

How We Chose These Entertainment Trends & Why They Matter

Not every “hot topic” becomes a real shift, so this list focuses on entertainment trends that show clear momentum across platforms, consumer behavior, and business models—not just one viral moment.

Each trend below meets at least one of these criteria: it’s changing how people discover and consume entertainment (like social video and “watchable” podcasts), it’s reshaping the economics of media (like ad-supported streaming and bundling), or it’s transforming production and distribution at scale (like generative AI and global localization).

Quick framework showing what we looked for:

| What we looked for | Why it matters | What it signals |

|---|---|---|

| Audience behavior shifts | Where attention goes, money follows | Social video dominance, multi-format consumption |

| Platform strategy changes | Platforms shape discovery + distribution | Bundling, genre plans, and ad-tier growth |

| Technology adoption | Tech changes speed, cost, and scale | AI-enabled creation, localization, and personalization |

| New monetization patterns | Revenue models determine what gets made | Direct-to-fan growth, creator diversification |

In short, the next era of entertainment won’t be defined by a single platform or format. It will be defined by how fast content can be created, how efficiently it can be distributed, and how strongly it can build community—and that’s exactly what the seven trends ahead reveal.

1) Social video becomes the default entertainment format

Social video isn’t just a marketing channel anymore—it’s where a huge portion of entertainment happens end-to-end: discovery, consumption, fandom, and monetization. Deloitte’s Digital Media Trends highlights how hyperscale social video platforms are reshaping media habits and pressuring traditional players.

What’s changing:

-

Attention is moving to “infinite feeds.” People increasingly prefer bite-sized content they can sample instantly.

-

Creators are becoming studios. The best creators run writer rooms, editors, design, community, and sponsorship pipelines.

-

Platforms are turning into TV. YouTube, in particular, has pushed deep into living-room viewing and premium content ecosystems.

What to watch next:

-

More creator-led “series” formats (recurring casts, story arcs, cliffhangers).

-

Stronger in-app monetization (subscriptions, gifting, brand marketplaces).

-

Short-form video is becoming the primary launchpad for new talent and new IP.

2) Generative AI reshapes how entertainment is made, localized, and discovered

AI will be one of the most disruptive entertainment trends because it hits every step of the pipeline: ideation, production, editing, localization, and marketing. At the industry level, PwC expects generative AI and AI-powered advertising to be major forces in how entertainment companies grow revenue and change business models.

Where AI is already moving fast:

-

Pre-production: concept art, storyboards, previs, scripts (as drafts).

-

Post-production: clean-up, VFX assists, subtitles, trailer variants.

-

Localization at scale: dubbing/translation workflows that reduce time-to-market.

-

Discovery + ads: more personalized recommendations and targeting.

The big tension: speed vs. trust

As AI content rises, audiences and platforms will care more about provenance (what’s real, what’s synthetic, what’s licensed).

Expect more:

-

Likeness protections

-

IP licensing frameworks

-

“AI-made / AI-assisted” labeling debates

Practical takeaway: If you’re a creator or publisher, AI is less about replacing creativity and more about increasing output without destroying quality—but only if you build guardrails (brand voice, editorial checks, rights-safe assets).

3) Streaming evolves into ad-supported viewing, smarter bundles, and flexible plans

The streaming era is maturing. Viewers want value, simplicity, and fewer subscriptions. Nielsen’s Q3 2025 Ad Supported Gauge shows that streaming made up the largest share of ad-supported TV during that period (46.4%), ahead of cable and broadcast.

At the same time, bundling is accelerating:

-

Omdia forecasts bundling could generate 540 million online video streaming subscriptions by 2029 (about 25% of the global market).

-

YouTube TV announced genre-based plans (starting early 2026 in the U.S.), signaling a move toward “choose-your-bundle” TV packages again.

What this trend looks like:

-

More ad-supported tiers (cheaper or free)

-

More FAST channels and “lean-back” programming

-

More bundles (telco bundles, partner bundles, super-aggregators)

-

More genre packs (sports, kids, news, lifestyle)

What to watch next:

-

Streamers investing in ad tech and measurement (CTV becomes the center of gravity).

-

Wider adoption of “single bill / single login” ecosystems (aggregation wins).

What wins in the bundling era:

| If you’re | Best move in 2026+ |

|---|---|

| A streaming platform | Build partnerships + stronger ad products |

| A media publisher | Package content into bundles + FAST distribution |

| A creator | Negotiate rights + distribution across multiple “hubs.” |

| An advertiser | Prioritize CTV + cross-platform reach planning |

4) Live events keep booming—and become even more “contentized”

One of the most overlooked entertainment trends is how live experiences now power the entire ecosystem: highlights, documentaries, livestreams, behind-the-scenes shorts, merch drops, and community growth.

PwC’s E&M outlook expects growth driven in part by live events (alongside advertising and games), with the industry forecast to reach US$3.5 trillion by 2029. Meanwhile, the scale of touring has exploded—Pollstar data summarized by AP notes the rise of billion-dollar tours as a modern benchmark.

What to watch next:

-

More “tour-to-screen” pipelines (concert films, docuseries, live streams).

-

Dynamic ticketing + premium fan tiers (VIP experiences, meet-and-greets).

-

Partnerships between tours and platforms for exclusive content windows.

Why it matters: Live events are one of the few places where audiences happily pay premium prices and create massive social content for free.

5) Gaming becomes an even bigger entertainment pillar (and a growth engine)

Gaming is no longer a separate category—it’s central to modern entertainment. Newzoo’s 2025 Global Games Market Report (free edition) projects $188.8B in global games revenue in 2025 and a player base of around 3.6B.

PwC also forecasts global video games revenue growth through 2029 (often outpacing other segments).

What’s driving this:

-

Always-on, social, multiplayer experiences

-

Live-service models and post-launch content

-

Creator ecosystems around games (streaming, UGC, mods)

-

Crossovers: games ↔ film/TV ↔ music ↔ merch

What to watch next:

-

More “watchable” game experiences (events, tournaments, spectator modes).

-

Better integration of commerce (skins, digital items, collectibles).

-

IP expansion where games are the start of a franchise, not the adaptation.

6) Podcasts go video-first and platform-native

Podcasting is evolving into watchable entertainment, especially on YouTube and Spotify.

Edison Research’s Infinite Dial 2025 reports:

-

48% of Americans age 12+ have both listened to and watched a podcast

-

YouTube is the most-used service among U.S. weekly podcast listeners (33%)

Spotify also reported strong momentum in video podcast adoption, with active monthly video podcasts up 28% since its Partner Program launched (as of their April 2025 update).

What this changes:

-

Set design, editing, and thumbnails become essential.

-

Clips become the growth engine (short-form distribution).

-

Platforms compete on creator payouts, discovery, and monetization tools.

Practical takeaway: If you’re writing about entertainment trends, treat podcasts as a visual format now—closer to talk shows than radio.

7) Direct-to-fan monetization becomes a default strategy (not a niche)

Creators are diversifying because ad revenue can be volatile. Direct-to-fan models—memberships, subscriptions, paid communities, merch, digital products—are becoming a core business layer. Epidemic Sound’s 2025 creator economy report highlights that 95% of creators are leaning into direct-to-fan models.

What’s growing fastest:

-

Membership perks (exclusive episodes, early access, behind-the-scenes)

-

Paid communities (Discord/Telegram/community platforms)

-

Micro-products (templates, mini-courses, presets, ebooks)

-

Limited drops (merch, collectibles, event access)

Why it matters: This trend reduces dependence on algorithms and gives creators predictable revenue—while giving fans a sense of belonging.

What this means for creators, brands, and viewers

Entertainment is no longer a one-way experience where studios publish, and audiences simply watch. These shifts are changing how content gets discovered, how it gets funded, and where communities form—often across multiple platforms at once.

For creators

-

Build for multi-format discovery: turn one idea into a short clip → long video/podcast → newsletter/community → paid product.

-

Diversify revenue early: memberships, paid communities, and digital products reduce volatility.

-

Use AI as a workflow accelerator, not a shortcut: speed up drafts, captions, localization—keep human review for voice and accuracy.

For brands and marketers

-

Plan for ad-supported streaming + CTV: ad-supported viewing is growing, and measurement matters.

-

Creator partnerships should be long-term: recurring series and community-driven content beat one-off posts.

-

Leverage “event moments”: tours, sports, and big drops create highly shareable content windows.

For viewers

-

Expect cheaper options (with ads) and more bundled plans instead of many separate subscriptions.

-

More global hits: international content will keep breaking through due to better distribution and localization.

-

More personalization: recommendations, dubbing/subtitles, and content variations will feel more tailored.

Frequently Asked Questions About Entertainment Trends

What are the biggest entertainment trends right now?

The biggest shifts include social video’s dominance in daily attention, streaming’s move toward ad-supported tiers and bundles, AI-assisted production/localization, growth in live experiences, and gaming’s continued expansion as a mainstream entertainment pillar.

How is AI changing the entertainment industry?

AI is accelerating creation and distribution—helping with ideation, editing workflows, subtitles/dubbing, and personalization—while also raising new questions around rights, authenticity, and trust.

Are ad-supported streaming services growing?

Yes. Nielsen’s Q3 2025 ad-supported TV analysis shows streaming held the largest share of ad-supported TV, ahead of cable and broadcast in that period.

Will streaming bundles become more common?

Most signs point to yes. Research forecasts bundling growth through 2029, and services are actively testing more flexible packaging (like genre-based plans).

Why are video podcasts becoming more popular?

Podcasting is expanding beyond audio into a “watchable” format. Edison Research reports that many people now both listen to and watch podcasts, and YouTube is a leading platform for weekly podcast users in the U.S.

Is gaming really bigger than movies and music?

Gaming is one of the largest entertainment categories globally. Newzoo projects $188.8B in games revenue in 2025 with billions of players, and broader outlooks forecast continued growth.

How are creators making money beyond ads?

Many creators are leaning into direct-to-fan monetization—memberships, paid communities, and digital products—reducing reliance on platform algorithms and ad rates.

Bottom Line: What these entertainment trends mean for the next era

The biggest entertainment trends over the next few years all point in the same direction: entertainment is becoming more platform-native, more interactive, and more relationship-driven. Social video will keep shaping what breaks into the mainstream, streaming will keep simplifying through ad tiers and bundles, and gaming will continue to blur the line between “watching” and “participating.”

At the same time, AI will accelerate production and localization while pushing the industry to tighten rules around rights and authenticity. The creators and brands that win won’t just chase views—they’ll build community, diversify revenue (especially direct-to-fan), and design content for discovery across multiple formats, from short clips to live experiences.