The digital landscape is rapidly evolving, and at its forefront is Web3—a decentralized internet that empowers users through blockchain technology. Unlike traditional systems, Web3 shifts control from centralized entities to individuals, offering transparency, privacy, and innovation.

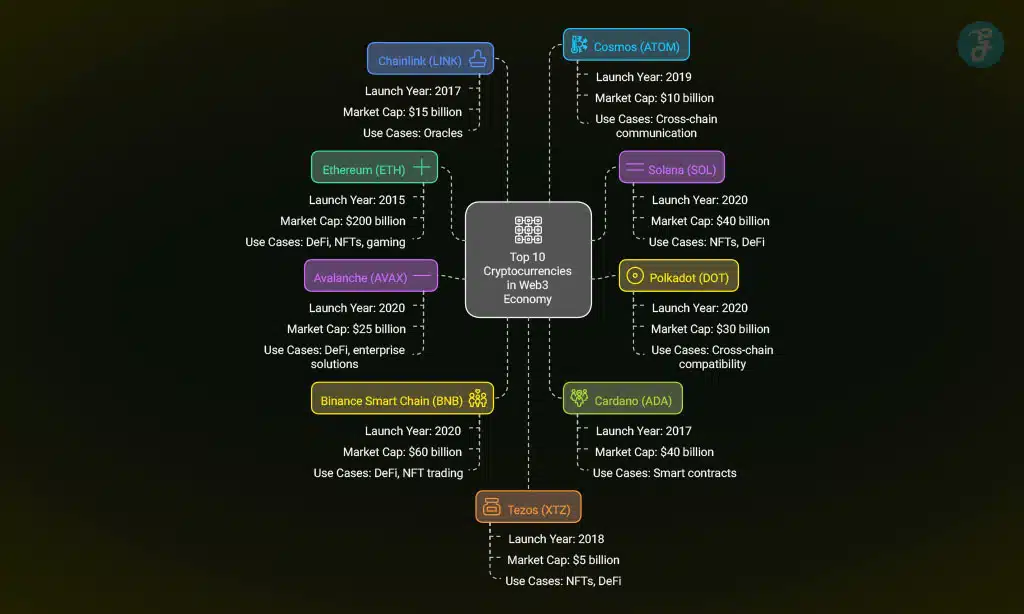

Top cryptocurrencies in Web3 economy are the backbone of this movement, facilitating transactions, smart contracts, and decentralized applications (dApps).

In this article, we’ll explore the top cryptocurrencies powering in Web3 economy, their unique features, and how they’re shaping the future of decentralized finance (DeFi), non-fungible tokens (NFTs), and beyond.

What is the Web3 Economy?

Web3 represents the next generation of the internet, built on blockchain technology. Unlike Web2, which relies on centralized platforms, Web3 fosters a decentralized ecosystem where users control their data and digital assets.

Key Features of Web3:

| Feature | Description |

| Decentralization | Eliminates intermediaries, giving control back to users. |

| Smart Contracts | Self-executing agreements on the blockchain. |

| Ownership | Users own digital assets such as NFTs and cryptocurrencies. |

| Interoperability | Blockchains can interact seamlessly for improved user experience. |

By integrating top cryptocurrencies in web3 economy, Web3 unlocks countless possibilities, from secure financial transactions to innovative dApps.

Criteria for Selecting the Top Cryptocurrencies

The top cryptocurrencies in web3 economy bring real value. We selected the top cryptocurrencies in web3 economy based on the following criteria:

- Utility: How the cryptocurrency supports Web3 services like DeFi, NFTs, or DAOs.

- Adoption: Popularity among developers, businesses, and users.

- Market Cap: Reflects stability and community trust.

- Innovation: Unique features that set it apart from competitors.

These factors ensure the listed cryptocurrencies truly empower the Web3 ecosystem.

Top Cryptocurrencies in Web3 Economy for 2025

1. Ethereum (ETH)

Ethereum is the undisputed leader of Web3, thanks to its pioneering role in smart contracts and dApps.

| Feature | Details |

| Launch Year | 2015 |

| Market Cap | Over $200 billion (as of 2025) |

| Use Cases | DeFi, NFTs, gaming, DAOs |

| Unique Feature | Smart contract functionality enabling decentralized applications. |

Good Side:

- Highly versatile platform for dApps and DeFi.

- A massive developer community ensures ongoing innovation.

Bad Side:

- High gas fees during network congestion.

- Scalability issues before Ethereum 2.0.

2. Solana (SOL)

Solana is celebrated for its speed and low transaction costs, making it ideal for DeFi and NFT platforms.

| Feature | Details |

| Launch Year | 2020 |

| Market Cap | Over $40 billion |

| Use Cases | NFTs, decentralized finance, Web3 gaming |

| Unique Feature | High throughput with 65,000 transactions per second (TPS). |

Good Side:

- Extremely fast transaction speeds.

- Low fees make it accessible for small-scale users.

Bad Side:

- Occasional network outages due to high demand.

- Relatively centralized validator network.

3. Polkadot (DOT)

Polkadot focuses on interoperability, allowing multiple blockchains to communicate seamlessly.

| Feature | Details |

| Launch Year | 2020 |

| Market Cap | Around $30 billion |

| Use Cases | Cross-chain compatibility, dApps |

| Unique Feature | Parachains enabling scalable and customizable blockchain networks. |

Good Side:

- Robust interoperability between blockchains.

- Scalability through parachains.

Bad Side:

- Complex architecture may deter new developers.

- Relatively slow adoption compared to competitors.

4. Avalanche (AVAX)

Avalanche is known for its high speed and low fees, rivaling Ethereum in DeFi and NFT applications.

| Feature | Details |

| Launch Year | 2020 |

| Market Cap | Around $25 billion |

| Use Cases | Decentralized finance, enterprise blockchain solutions |

| Unique Feature | Subnets that allow developers to create custom blockchains. |

Good Side:

- Highly efficient consensus mechanism.

- Flexible architecture for custom solutions.

Bad Side:

- Smaller ecosystem compared to Ethereum.

- Subnet creation can be complex for new developers.

5. Binance Smart Chain (BNB)

Binance Smart Chain (BSC) is a highly scalable platform ideal for DeFi projects and NFT marketplaces.

| Feature | Details |

| Launch Year | 2020 |

| Market Cap | Over $60 billion |

| Use Cases | DeFi, NFT trading, token creation |

| Unique Feature | Dual-chain architecture for flexibility and scalability. |

Good Side:

- Low transaction fees and high throughput.

- Strong backing by Binance, ensuring liquidity.

Bad Side:

- Concerns over centralization due to Binance’s control.

- Vulnerability to security issues in some dApps.

6. Cardano (ADA)

Cardano emphasizes sustainability, scalability, and scientific research.

| Feature | Details |

| Launch Year | 2017 |

| Market Cap | Over $40 billion |

| Use Cases | Smart contracts, decentralized apps |

| Unique Feature | Peer-reviewed development process ensuring robust technology. |

Good Side:

- Energy-efficient proof-of-stake consensus.

- Emphasis on security and scalability.

Bad Side:

- Slower development process due to peer review.

- Limited ecosystem compared to Ethereum and Binance Smart Chain.

7. Chainlink (LINK)

Chainlink connects smart contracts to off-chain data, enabling real-world applications.

| Feature | Details |

| Launch Year | 2017 |

| Market Cap | Around $15 billion |

| Use Cases | Decentralized oracles, data feeds |

| Unique Feature | Decentralized oracle network ensuring tamper-proof data. |

Good Side:

- Essential for connecting blockchain to real-world data.

- Broad adoption across multiple blockchain networks.

Bad Side:

- Dependency on external data sources introduces vulnerabilities.

- High competition from emerging Oracle solutions.

8. Cosmos (ATOM)

Cosmos aims to solve blockchain interoperability through its innovative architecture.

| Feature | Details |

| Launch Year | 2019 |

| Market Cap | Around $10 billion |

| Use Cases | Cross-chain communication, custom blockchain development |

| Unique Feature | Tendermint consensus for enhanced scalability and security. |

Good Side:

- Seamless cross-chain communication.

- Scalable and secure through Tendermint.

Bad Side:

- Complicated setup for new users.

- Slower adoption in the broader market.

9. Tezos (XTZ)

Tezos is designed for upgrades without hard forks, ensuring seamless evolution.

| Feature | Details |

| Launch Year | 2018 |

| Market Cap | Around $5 billion |

| Use Cases | NFTs, DeFi, digital identity |

| Unique Feature | On-chain governance enabling community-driven upgrades. |

Good Side:

- Smooth upgrade process without disruptions.

- Active community engagement through governance.

Bad Side:

- Smaller market share compared to top competitors.

- Slow growth in DeFi applications.

10. Filecoin (FIL)

Filecoin revolutionizes data storage by offering decentralized solutions.

| Feature | Details |

| Launch Year | 2020 |

| Market Cap | Around $8 billion |

| Use Cases | Decentralized data storage, content delivery |

| Unique Feature | Incentivized storage network using blockchain technology. |

Good Side:

- Innovative solution for decentralized storage.

- Strong incentives for storage providers.

Bad Side:

- High competition from traditional cloud storage solutions.

- Requires technical expertise for effective use.

How Cryptocurrencies Drive the Web3 Revolution

Top cryptocurrencies in web3 economy play a critical role by:

- Enabling Smart Contracts: Automating agreements without intermediaries.

- Supporting DeFi: Allowing borderless financial services.

- Powering NFTs: Facilitating ownership of digital art and collectibles.

- Driving DAOs: Empowering communities with decentralized governance.

Challenges and Future Outlook

Despite their promise, cryptocurrencies face challenges:

- Scalability Issues: High network congestion and transaction costs.

- Regulatory Uncertainty: Governments are still defining their stance.

- Environmental Impact: Mining remains energy-intensive.

Future Trends:

| Trend | Description |

| Layer 2 Solutions | Enhancing scalability with off-chain transactions. |

| Interoperability | Seamless communication between blockchains. |

| Eco-friendly Protocols | Transitioning to energy-efficient mechanisms like Proof-of-Stake. |

Takeaways

The Web3 economy is a transformative force, and cryptocurrencies in the Web3 economy are at its core. From Ethereum’s smart contracts to Filecoin’s decentralized storage, each cryptocurrency contributes uniquely to this decentralized revolution.

By understanding these top cryptocurrencies in web3 economy, you can better navigate the evolving digital landscape.