Picking a bank in Romania can feel like a maze. You worry about hidden fees, slow wire transfers, and poor mobile banking applications. This can hurt your business if you deal in lei or euros.

Banca Transilvania leads the pack in asset size in Romania. In this post we rate six banks side by side. We cover credit cards, current accounts, online banking features, and export financing options.

We even mention cashback deals and Google Pay support. Keep reading.

Key Takeaways

- Banca Transilvania leads Romania with the highest assets. It serves over 3 million clients, funds exports, mortgages, and savings, and lets users tap Apple Pay and Google Pay via BT Pay in city and small-town branches.

- Banca Comercială Română ranks second by assets and joins Erste Group. It runs hundreds of branches, offers savings, export financing, private banking, and smooth desktop/mobile banking with Apple Pay and Google Pay. One client joked, “My bank fits in my pocket and never sleeps.”

- BRD – Groupe Société Générale holds fourth place by assets. It excels in corporate banking and export financing and powers payments through the YOU app, MyBRD Net, and MyBRD Mobile for fast approvals.

- Raiffeisen Bank boasts strong capital and fraud protection. Its Raiffeisen Online portal and mobile apps send instant alerts, guide every step, and link debit cards to Apple Pay and Google Pay for quick, safe payments.

- ING wows businesses with sleek digital platforms, IBAN transfers, and contactless wallet support for local and cross-border trade.

Banca Transilvania (BT)

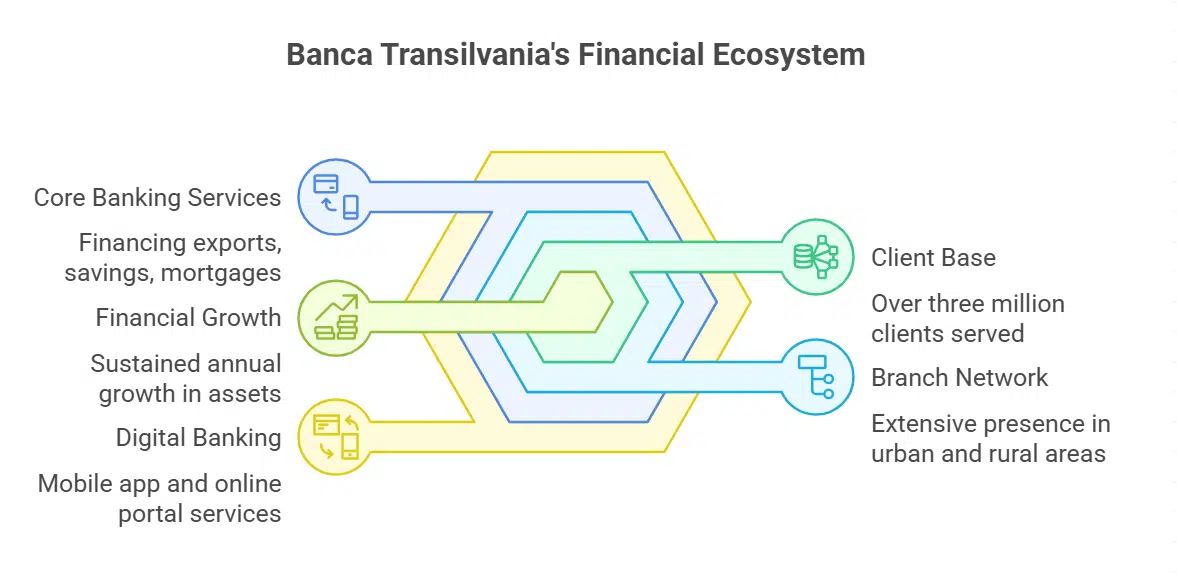

Banca Transilvania ranks as Romania’s largest bank by assets. This lender shows strong financial growth each year. More than three million clients use its services. A vast branch network spans urban centers and small towns.

They finance exports, savings accounts, and mortgage loans for local and international firms.

Digital banking shines in its mobile app and internet portal. BT Pay lets users tap Apple Pay and Google Pay on smartphones. Business customers connect to capital markets and money transfers with ease.

Private banking gives custom support for wealthy entrepreneurs.

Banca Comercială Română (BCR)

This lender ranks second in Romania by total assets. It stands as part of Erste Group, a major European banking firm. Clients find an extensive branch network across hundreds of locations.

They pick from savings accounts, export financing, and private banking. The team also provides business loans and currency exchange services.

The internet banking platform runs smoothly on desktop and mobile devices. Customers tap into Apple Pay and Google Pay on iPhone and Android devices. You can check balances, send transfers, and manage your debit card.

Regulators at the National Bank of Romania monitor its sound performance, and its work boosts the romanian banking sector. One customer once joked, “My bank fits in my pocket and never sleeps.

BRD – Groupe Société Générale

BRD – Groupe Société Générale ranks fourth among banks in Romania by assets. Local firms praise its strong corporate banking. Businesses tap its export financing and specialized solutions.

The bank covers daily banking, loans and savings accounts.

Solid digital offerings power the YOU app, MyBRD Net and MyBRD Mobile. Users pay with Apple Pay, Google Pay, or a debit card. They check balances, send money, clear bills in seconds.

Clients smile at fast approvals and easy money moves.

Raiffeisen Bank

Raiffeisen Bank ranks high in the Romanian banking sector. It sports strong financial health and solid capital. Clients enjoy top-notch service at every branch. Staff answer calls with a smile, then solve problems quick.

The secure Raiffeisen Online platform speeds up moves. Mobile banking apps feel like a helpful buddy, with instant alerts and easy menus.

This bank guards accounts with strong fraud protection. It links Apple Pay and Google Pay to debit cards for swift, safe pay. It grew its digital offerings, with customer-focused apps that guide each step.

Firms and families trust its online banking for daily money work.

ING Bank Romania

ING Bank Romania, a subsidiary of the Netherlands-based ING Group, has positioned itself as one of the most forward-thinking digital banks in the country. As of 2025, ING holds a top-five position in terms of market share and is widely regarded as a leader in user experience, automation, and paperless banking.

Its client base has grown steadily due to its minimalist interface, transparent fees, and mobile-first mindset—qualities that make it a favorite for startups, freelancers, and international businesses looking to operate efficiently in Romania.

Exim Bank Romania

Exim Bank Romania stands apart from traditional commercial banks. Backed by the Romanian government, Exim Bank is a strategic financial institution that plays a critical role in export promotion, foreign trade financing, and state-guaranteed credit programs.

As of 2025, Exim Bank is undergoing significant digital transformation and expanding its services to bridge Romanian businesses with international markets. It operates under dual capacity—as a commercial bank and a development bank—making it a rare hybrid in the country’s financial system.

Takeaways

Your choice depends on needs, size and growth goals. Banca Transilvania leads with strong assets and BT Pay for quick payments. BCR and BRD offer SEPA transfers and export financing to boost trade.

ING wows with sleek digital platforms, IBAN transfers and contactless wallet support. Excellent service drives Raiffeisen ahead in ratings. Pick the bank that fuels local deals or powers cross-border trade.

FAQs on Top Banks in Romania

1. What banks lead the local market in romania?

Banca Transilvania, Banca Comercială Română (BCR), CEC Bank, First Bank and Salt Bank shine in local lending. They hold the biggest total assets and back small shops. They guide you through the romanian banking sector with friendly staff.

2. Which banks have strong pay apps?

Alpha Bank, BT Pay, Vista Bank, TBI Bank and OTP Bank let you swipe or tap your phone. They link to Apple Pay and Google Pay, so you can pay like a pro on the go.

3. Who helps with export financing and cross border trade?

Exim Bank, Erste Group, Societe Generale, Intesa Sanpaolo and UniCredit Bank Romania drive export financing. They know the ropes of the international market and the romanian lei, so you sail smooth overseas.

4. Where do I get private banking and savings accounts?

ING Bank, Raiffeisen Bank, BNP Paribas and ProCredit Bank hold top spots for private banking. They build solid savings accounts and let you track your cash with clear online tools.

5. Who keeps an eye on banks in romania?

The National Bank of Romania guides the romanian economy, sets rules for financial institutions in romania, and watches the financial market. It checks each bank’s financial performance, so you can sleep soundly.

6. What are the top banks in romania for local and international business?

Our top 6 list names Banca Transilvania, Raiffeisen Bank, ING Bank, BCR, OTP Bank and Exim Bank. These lenders mix strong financial performance with smart automation to suit both home and abroad.