As car insurance premiums continue to rise, finding ways to save money without compromising coverage has become a priority for many drivers. Whether you’re a seasoned driver or someone renewing their policy for the first time, there are numerous strategies you can use to reduce your costs effectively.

This article presents 12 actionable tips to lower your car insurance costs in 2025, ensuring you get the best value for your money.

By following these tips, you can save hundreds of dollars annually while maintaining comprehensive coverage.

Why Car Insurance Costs Are Increasing in 2025

The cost of car insurance has been steadily increasing due to several factors:

- Advanced Vehicle Technology: Modern cars are equipped with high-tech features that are expensive to repair or replace, such as sensors, cameras, and onboard computers.

- Inflation and Rising Accident Rates: Increased claims due to more frequent accidents, coupled with inflation, have led to higher payouts by insurers, which in turn drive up premiums for consumers.

- Natural Disasters: Events like floods, wildfires, and hurricanes cause extensive damage to vehicles, leading to higher claim volumes and increased premiums across the board.

These trends highlight the importance of implementing strategies to manage and lower your car insurance costs.

12 Actionable Tips to Lower Your Car Insurance Costs

1. Compare Insurance Providers Regularly

Why It Matters

Insurance companies vary widely in their pricing and discounts. Shopping around ensures you’re not overpaying for the same level of coverage. Staying with the same provider for years without reviewing your policy could mean missing out on significant savings.

How to Do It

- Use online comparison tools like Insurify, The Zebra, and Policygenius to find the best rates.

- Contact multiple providers directly to ask about discounts, loyalty programs, and customized policies.

| Top Comparison Platforms for Car Insurance in 2025 | Features | Average Savings (%) |

| Insurify | Real-time quotes | 25% |

| The Zebra | Multi-provider comparisons | 20% |

| Policygenius | Personalized recommendations | 15% |

Example

A recent study showed that drivers who compared rates annually saved an average of $500 per year on car insurance. Switching providers after finding a better deal ensures that you’re maximizing your savings.

2. Opt for a Higher Deductible

Why It Saves Money

Choosing a higher deductible lowers your monthly premium because it reduces the insurer’s financial risk. However, this approach works best if you have the financial cushion to pay the deductible in case of an accident.

Things to Consider

- Pros: Immediate monthly savings, often ranging between 10-20% depending on the increase in deductible amount.

- Cons: Higher out-of-pocket costs if you file a claim.

| Deductible Amount | Monthly Premium Savings (%) | Risk Level |

| $250 | Low savings | Low risk |

| $500 | Moderate savings | Moderate risk |

| $1,000 | High savings | Higher risk |

Example

Switching from a $250 deductible to a $1,000 deductible can save you up to 15% annually on your premium, translating to hundreds of dollars in savings for low-risk drivers.

3. Bundle Your Policies

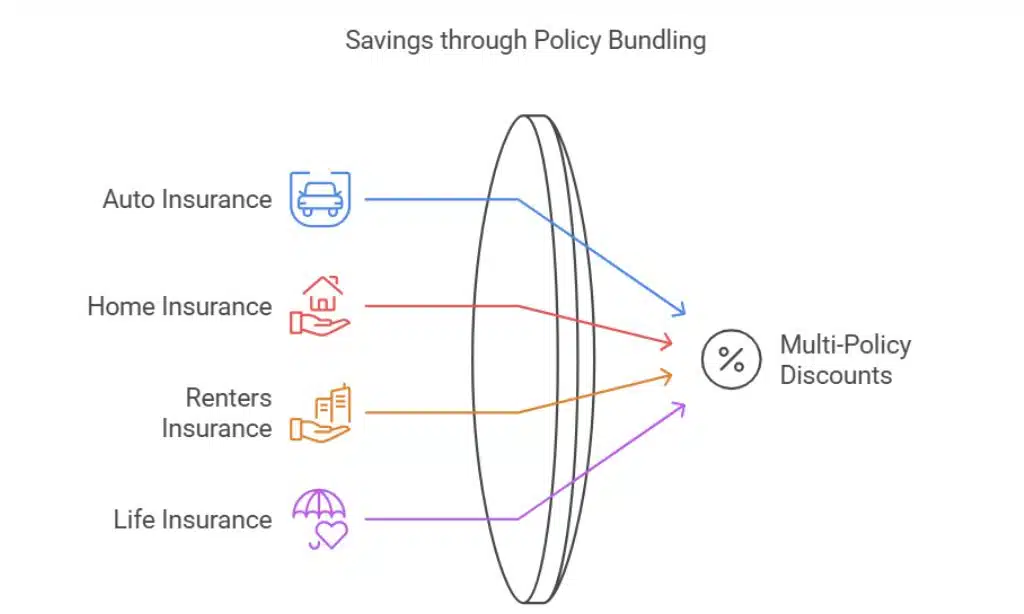

Why Bundling Works

Combining your auto insurance with home, renters, or even life insurance can lead to significant discounts. Many insurers reward policyholders with multi-policy discounts because it increases customer retention.

Example Savings

- Home + Auto: Save up to 15%.

- Renters + Auto: Save up to 10%.

- Auto + Life: Additional savings depending on the insurer.

| Type of Bundle | Average Savings (%) |

| Home + Auto | 15% |

| Renters + Auto | 10% |

| Auto + Life | 5-10% |

4. Maintain a Clean Driving Record

Why It Matters

Safe driving demonstrates responsibility and reduces the likelihood of accidents, which keeps your premiums low. Insurance providers offer significant discounts to drivers with no history of traffic violations or claims over the past three to five years.

Tips for a Clean Record

- Follow Traffic Laws: Avoid speeding, running red lights, or engaging in distracted driving.

- Defensive Driving Courses: Taking a certified course can improve your skills and make you eligible for discounts.

- Telematics Devices: Some insurers provide devices that monitor your driving habits, rewarding safe behavior with lower premiums.

Example

A driver with a spotless record for five years saved up to 20% annually compared to someone with multiple violations, translating to $400 in yearly savings on a $2,000 premium.

5. Take Advantage of Discounts

Popular Discounts in 2025

Many insurers offer discounts tailored to specific customer profiles. Staying informed about these opportunities ensures you’re not missing out on potential savings.

| Discount Type | Eligibility Criteria | Average Savings (%) |

| Good Driver | No violations for 3 years | 20% |

| Low Mileage | <7,500 miles annually | 10-15% |

| Student | Maintain a GPA of 3.0 or higher | 10% |

| Military | Active duty or veterans | 15% |

Example

A college student maintaining a GPA above 3.5 could save up to $200 annually through good student discounts offered by major insurers.

6. Drive a Car with Lower Insurance Rates

Why Car Choice Matters

Insurers assess vehicle repair costs, safety ratings, and theft risks when determining premiums. Driving a car with lower repair costs and strong safety features can significantly reduce your rates.

Top Cars with Low Insurance Costs

| Car Model | Average Annual Premium ($) | Safety Rating |

| Toyota Corolla | $1,200 | 5/5 |

| Honda Accord | $1,150 | 5/5 |

| Subaru Outback | $1,100 | 5/5 |

Example

Switching from a luxury SUV to a Honda Accord could save you over $500 annually due to the lower risk profile of the sedan.

7. Install Safety and Anti-Theft Devices

How It Helps

Installing safety and anti-theft devices reduces the likelihood of claims, leading to lower premiums. Some insurers offer discounts for having devices like alarm systems, GPS trackers, or dash cams.

| Device Type | Premium Discount (%) | Additional Benefits |

| GPS Tracker | 5-10% | Easier vehicle recovery |

| Anti-Theft Alarm | 5% | Deters theft |

| Dash Cam | 3-5% | Provides evidence |

Example

A driver who installed a GPS tracker and dash cam saved $150 annually on a $2,500 premium while improving vehicle security.

8. Limit Your Annual Mileage

Why It Saves Money

Drivers who spend less time on the road are less likely to be involved in accidents, making them eligible for reduced rates. Low-mileage discounts reward these drivers.

How to Achieve Low Mileage

- Use public transportation or carpool when possible.

- Combine errands to reduce unnecessary trips.

- Consider remote work opportunities to reduce commuting.

9. Improve Your Credit Score

The Connection

A higher credit score often leads to lower insurance rates as it reflects financial responsibility. Insurers view individuals with better credit scores as lower risk. It’s important to understand how car insurance is affected by credit scores and how they vary by state and provider.

Steps to Improve

- Pay bills on time.

- Keep credit utilization below 30%.

- Dispute any inaccuracies on your credit report.

| Credit Score Range | Impact on Premiums |

| 750+ | Lowest rates |

| 650-749 | Moderate rates |

| Below 650 | Higher rates |

10. Review Your Coverage Regularly

Why It’s Important

As your car ages, its value depreciates. Adjusting your coverage ensures you’re not overpaying for features like collision and comprehensive insurance if the car’s market value is low.

Recommendations

- Drop collision coverage for cars older than 10 years.

- Evaluate whether comprehensive coverage is still necessary based on vehicle usage and value.

11. Enroll in Usage-Based Insurance Programs

What They Are

Usage-based insurance (UBI) programs track your driving habits through telematics devices or mobile apps. These programs reward drivers who maintain safe speeds, avoid hard braking, and drive less frequently.

| Telematics Program | Provider | Potential Savings (%) |

| Snapshot | Progressive | Up to 25% |

| Drivewise | Allstate | 15-25% |

12. Switch to a Low-Risk Job or Lifestyle

Why It Matters

Insurance companies consider your occupation when determining rates. Professions like teachers, engineers, and healthcare workers often qualify for lower premiums due to perceived lower risk.

How to Benefit

- Inquire about occupational discounts when applying for or renewing your policy.

- Update your provider about lifestyle changes such as reduced commute distances.

Takeaways

By implementing these 12 tips to lower your car insurance costs in 2025, you can reduce your premiums significantly while maintaining the coverage you need. Regularly reviewing your policy, taking advantage of discounts, and making strategic lifestyle adjustments can save you hundreds of dollars annually.

For more expert insights, visit Editorialge for comprehensive guides on financial planning, insurance, and more.

Start saving today and make 2025 the year you take control of your car insurance expenses!