Aging can bring many rewards: retirement, more free time, and the ability to focus on what truly matters. But with those rewards come hidden costs that can catch many seniors off guard. While many expect their lifestyle to change as they grow older, they may not realize how these changes can affect their financial situation. In this article, we’ll explore some of the hidden costs of aging, focusing on healthcare expenses, housing, and the impact of Medicare and Medigap policies.

Healthcare Expenses: The Growing Burden

One of the most significant hidden costs of aging is healthcare. As we age, we often face an increase in medical needs. Chronic conditions like diabetes, heart disease, and arthritis become more common, and many seniors also experience mobility issues, cognitive decline, or sensory impairments. These health challenges can lead to more frequent doctor visits, medical tests, medications, and treatments, all of which can add up quickly.

For many seniors, the cost of healthcare is a serious concern. Medicare, the federal health insurance program for people 65 and older, covers a significant portion of healthcare costs but doesn’t cover everything. Seniors still face out-of-pocket costs for premiums, deductibles, copayments, and coinsurance. The complexity of Medicare can lead to confusion, especially for those who don’t fully understand what is covered and what isn’t. This lack of understanding can result in unexpected bills for necessary treatments or services.

Medicare and the Need for Medigap Coverage

While Medicare provides essential coverage, it often leaves gaps that can be expensive for seniors to cover. Original Medicare (Parts A and B) typically covers hospital and outpatient services but doesn’t cover prescription drugs, dental, vision, hearing care, or long-term care. This is where Medigap policies come into play.

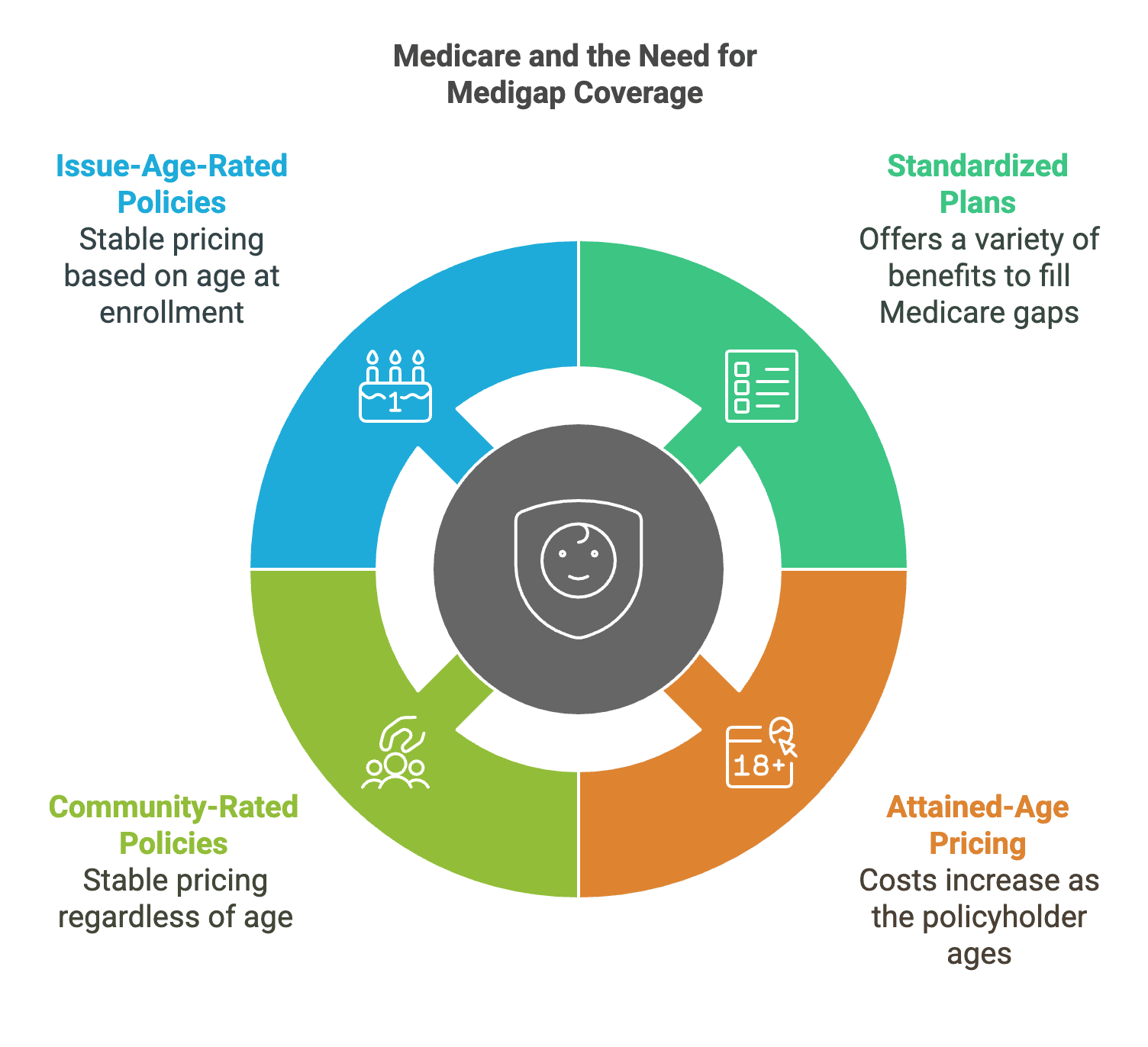

Medigap is a private insurance policy that helps cover some out-of-pocket costs not paid by Medicare. Medigap policies help fill the gaps, such as co-pays, deductibles, and coinsurance. There are ten standardized Medigap plans, and each offers a different combination of benefits. It’s important to note that while Medigap can provide valuable assistance, it can come with added premiums that can increase over time. Seniors should assess their needs carefully and choose a Medigap plan that balances coverage and cost.

A common topic with Medigap policies is the concept of “attained-age” pricing. So what is an attained-age policy? Attained-age policies increase in cost as the policyholder ages, meaning that a Medigap plan could be affordable when you first sign up but become more expensive as you age. This can be a significant financial burden, especially for seniors on fixed incomes. Seniors should consider the long-term implications of an attained-age policy and compare it to other options, like community-rated or issue-age-rated policies, which might offer more stability in pricing.

Housing and Living Arrangements

As people age, their housing needs often change. Some seniors decide to downsize or move into a retirement community, while others may need to consider assisted living or nursing homes. These transitions can be costly, with the price of assisted living or long-term care facilities often outpacing inflation.

Retirement communities, while providing social opportunities and amenities, can come with hefty entrance fees, monthly charges, and additional costs for services like meals, housekeeping, and transportation. Assisted living facilities offer a higher level of care, but they come at a premium. Nursing homes, which provide round-the-clock medical care, are even more expensive and may require personal savings or other assets to cover costs. Many seniors mistakenly believe that Medicare will cover long-term care, but it generally does not. Medicare only covers short-term care in a skilled nursing facility following a hospitalization, and even then, the coverage is limited.

In addition to the costs of moving or transitioning to a facility, seniors may also face the challenge of maintaining their existing homes. Home upkeep, property taxes, utilities, and insurance can become burdensome on a fixed income. The cost of home modifications, such as installing ramps or grab bars, may be necessary to make a home safer for aging individuals, further adding to the expenses.

Transportation Costs

Driving may become more difficult as people age due to physical limitations, vision problems, or cognitive decline. While some seniors can rely on family or friends for transportation, others may need to hire a private driver or use ridesharing services, which can quickly add up. Public transportation may be an option in some areas but may not always be convenient or accessible.

For seniors who can no longer drive, the cost of alternative transportation services can be a significant hidden cost. Many retirees find that they need to budget for taxis, ridesharing apps, or shuttle services, all of which can eat into their savings over time. Seniors need to factor in these transportation costs when planning their retirement budget.

Social and Emotional Wellbeing

Aging can also bring social and emotional challenges. Loneliness and isolation are common among seniors, especially those who no longer drive or have difficulty leaving their homes. This can lead to emotional distress and even mental health issues, such as depression or anxiety. For some, the cost of maintaining social connections—whether through activities, memberships, or support groups—can be an additional financial burden.

The emotional cost of aging may not always be obvious, but it’s essential to consider. Many seniors may need therapy or counseling, which Medicare doesn’t always cover, and maintaining a social network, even in a digital age, can be expensive in terms of time and money. Assisted living facilities and retirement communities often offer social activities, but these services can come at an extra cost.

Conclusion

Aging comes with its own joys, but it also brings hidden costs that can sneak up on seniors who aren’t fully prepared. Healthcare expenses, including the costs of Medicare and Medigap policies, housing changes, and transportation needs are just a few examples of the financial burdens that can accompany aging. The emotional and social costs of aging are often overlooked but can also be significant.

By understanding these potential costs and planning ahead, seniors can better prepare themselves for a comfortable and financially secure future. Medicare and Medigap policies can help with some healthcare expenses, but seniors should carefully evaluate their coverage options. Being proactive and informed can make all the difference in navigating the complexities of aging.