In a significant development for the global semiconductor industry, Elon Musk has confirmed that Tesla has signed a $16.5 billion chip manufacturing deal with Samsung Electronics, one of the world’s largest technology conglomerates.

The deal, which had been previously announced by Samsung without naming the client, is now known to be with Tesla and is expected to reshape both companies’ positions in the rapidly evolving artificial intelligence (AI) chip market.

Tesla and Samsung Join Forces to Boost Advanced AI Chip Production

On Monday, Elon Musk announced via social media platform X (formerly Twitter) that Samsung will manufacture Tesla’s next-generation AI6 chip at its new semiconductor plant located in Taylor, Texas. This facility, which has faced delays due to lack of clientele and operational challenges, is expected to become a vital part of Tesla’s AI hardware ecosystem.

Musk emphasized Tesla’s hands-on role in the partnership, saying:

“Samsung agreed to allow Tesla to assist in maximizing manufacturing efficiency. This is a critical point, as I will walk the line personally to accelerate the pace of progress.”

He also highlighted the proximity of the Texas chip plant to his residence, which suggests that he will personally oversee the project’s development to ensure it stays on track. Musk further added that the $16.5 billion figure is only the baseline, stating:

“The $16.5B number is just the bare minimum. Actual output is likely to be several times higher.”

Samsung’s Taylor Facility Finally Secures a Key Client After Months of Uncertainty

Samsung’s Taylor, Texas chip fabrication plant, initially unveiled in 2021 with great fanfare, had encountered significant operational hurdles. In October 2024, Reuters reported that the tech giant had postponed deliveries of chipmaking equipment from Dutch supplier ASML due to the lack of major orders. At that time, no major customer had committed to the facility.

Industry analysts had described the plant as a “white elephant” project without major contracts. But the Tesla deal transforms the trajectory of the plant, turning it into a central hub for future AI hardware development in the United States.

According to Ryu Young-ho, a senior analyst at NH Investment & Securities:

“Samsung’s Taylor fab so far had virtually no customers, so this order is quite meaningful.”

The contract is especially important given the enormous capital investment Samsung made in building and maintaining the facility. It also validates the South Korean firm’s long-term strategic goal to expand its foundry business beyond memory chips.

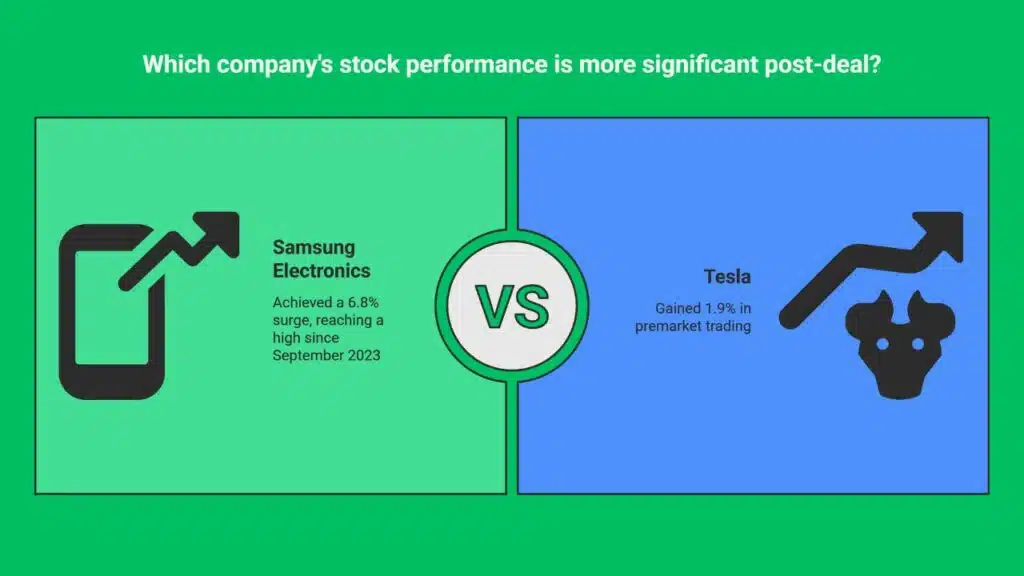

Market Reactions: Samsung Soars, Tesla Rises in Premarket Trading

The confirmation of the Tesla-Samsung deal had immediate effects on the stock market. Samsung Electronics saw its shares surge by as much as 6.8%, marking their highest level since September 2023. Meanwhile, Tesla’s stock gained 1.9% in U.S. premarket trading, indicating investor confidence in the company’s chip strategy.

Market watchers say that this is not just good news for both companies, but also signals a potential reshaping of the global chip manufacturing landscape, which has been increasingly dominated by Taiwan’s TSMC.

Inside the Deal: What the $16.5 Billion Contract Entails

Samsung previously disclosed a $16.5 billion chip manufacturing agreement with an unnamed client, with confidentiality requested by the customer. Now that Musk has confirmed Tesla’s involvement, more details are becoming clear.

The contract is set to run through the end of 2033, spanning nearly a decade. It is expected to include multiple phases of chip production, starting with support for Tesla’s AI6 chip and possibly evolving into more advanced chip iterations based on future Tesla innovations.

While Samsung has already been producing AI4 chips for Tesla, used in its Full Self-Driving (FSD) system, this new deal involves next-generation chips. Tesla’s AI5 chip is scheduled for production at TSMC, initially in Taiwan and eventually at its new Arizona facility. The AI6 chip, to be produced by Samsung, is likely an even more advanced architecture, though technical specifications have not been disclosed.

When Will AI6 Chips Be Ready? Experts Predict Delays

Despite the excitement, no precise timeline was shared for the rollout of AI6 chips. Elon Musk had earlier indicated that Tesla’s AI5 chips will begin production by the end of 2026. Based on that schedule, AI6 chips may not enter full production until late 2027 or even 2028.

Lee Dong-ju, an analyst at SK Securities, suggested that production of AI6 may start in 2027 or later, but emphasized Tesla’s repeated history of missing chip and vehicle production targets, so delays are still possible.

This timeframe means that Samsung will have ample time to refine its fabrication processes, a critical factor given its recent struggles in competing with foundry leader TSMC.

Samsung’s Foundry Business Faces Growing Pressure

Samsung is the world’s largest memory chip maker, but its foundry division—which manufactures logic chips designed by external clients—has been under intense pressure. According to TrendForce, Samsung’s foundry business holds only 8% of the global market, compared to TSMC’s dominant 67%.

This lag has hurt Samsung’s profitability and investor confidence, especially in the AI era when demand for high-performance computing chips is soaring.

Earlier this month, Samsung projected a 56% drop in its second-quarter operating profit, citing deepening losses in its foundry division. Analysts estimate that Samsung’s foundry unit may have lost over 5 trillion won ($3.6 billion) in the first half of 2025 alone.

Pak Yuak, an analyst at Kiwoom Securities, said:

“This deal with Tesla will significantly reduce losses in Samsung’s foundry division.”

Samsung’s struggle to retain and attract premium clients—many of whom have switched to TSMC—has been a critical concern. For example, TSMC counts Apple, Nvidia, and Qualcomm among its top customers, a group that Samsung has failed to secure or retain.

Geopolitical Factors: Could U.S.–South Korea Trade Talks Have Influenced the Deal?

The timing of the Tesla-Samsung deal has sparked speculation about its connection to ongoing trade negotiations between South Korea and the United States. While the companies have not publicly linked the deal to diplomacy, the broader context suggests potential alignment with Seoul’s goals.

South Korea is currently in urgent talks with Washington to eliminate or reduce potential 25% tariffs on key exports, including chips and shipbuilding materials. As part of its strategy, South Korea has been promoting technology cooperation with U.S. companies.

This partnership with Tesla could help South Korea position itself as a key player in the U.S. tech ecosystem, especially as Washington aims to de-risk supply chains by moving production away from China and toward more friendly allies.

Strategic Significance for Both Companies

This deal is strategically valuable for both Tesla and Samsung:

For Tesla:

- It localizes chip production near Tesla’s Gigafactory and headquarters in Texas.

- It offers greater control over chip manufacturing timelines and costs.

- It helps meet the growing demand for autonomous driving chips, which require enormous computing power.

For Samsung:

- It revives a struggling foundry division.

- It gives Samsung a high-profile customer in the AI chip race.

- It could pave the way for more U.S. contracts, helping it compete more directly with TSMC.

A Milestone Deal with Global Implications

The $16.5 billion Tesla-Samsung chip deal is not just a transaction—it’s a bold move that underscores how critical semiconductor partnerships have become in the AI era. For Tesla, the collaboration ensures continued development of cutting-edge autonomous technologies. For Samsung, it marks a much-needed win in its battle to remain relevant in the fiercely competitive chipmaking market.

As Musk pushes forward with his vision for full autonomy and AI-driven transport, this partnership will likely serve as a cornerstone for future innovations, while reshaping the balance of power in the global chip industry.

The Information is Collected from CNN and CNBC.