Teachers play a vital role in shaping the future, but they often face significant financial challenges. Fortunately, the Canadian tax system offers several deductions and credits that can help educators reduce their taxable income and maximize their refunds.

Whether you’re a full-time teacher, substitute, or an early childhood educator, understanding these tax benefits can put more money back in your pocket.

In this comprehensive guide, we will explore essential tax-saving tips for teachers in Canada, covering everything from educator deductions to retirement savings strategies. Let’s dive into how you can legally lower your tax burden while continuing to inspire the next generation.

Understanding Tax Benefits for Canadian Teachers

Effective tax planning can help teachers keep more of their hard-earned money. With rising living costs, strategic tax-saving techniques ensure educators can offset expenses and improve their financial stability. By leveraging available deductions, teachers can significantly reduce taxable income and increase their tax refunds.

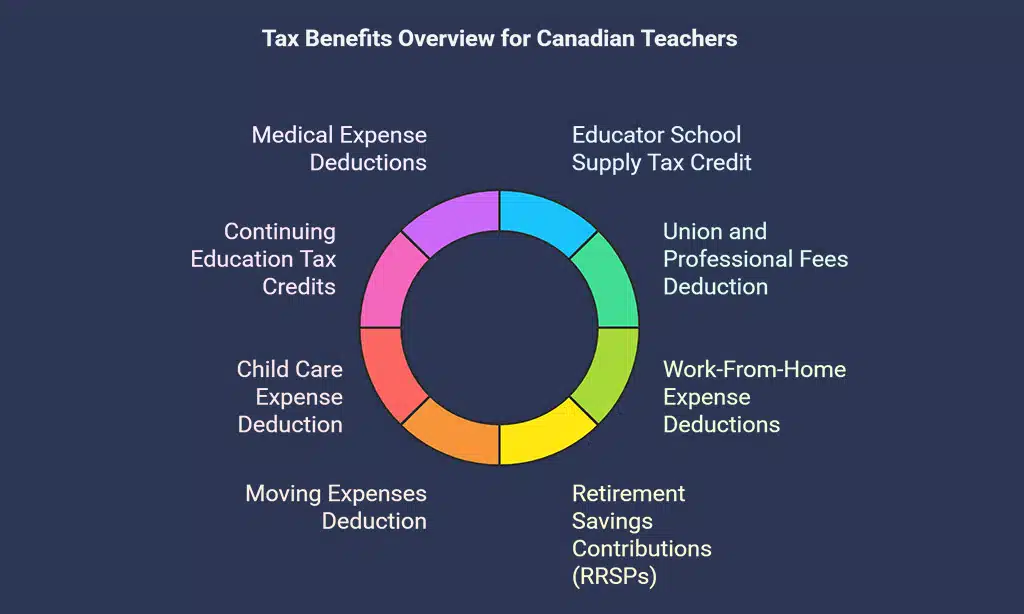

Common Tax Deductions Available for Teachers in Canada

Before filing your taxes, it’s essential to know which deductions apply to you. The most common tax benefits for Canadian teachers include:

- Educator School Supply Tax Credit

- Union and Professional Fees Deduction

- Work-From-Home Expense Deductions

- Retirement Savings Contributions (RRSPs)

- Moving Expenses Deduction

- Child Care Expense Deduction

- Continuing Education Tax Credits

- Medical Expense Deductions

By utilizing these deductions, you can significantly reduce the amount you owe in taxes.

Top 8 Tax-Saving Tips for Teachers in Canada

Maximizing tax savings is essential for teachers looking to make the most of their hard-earned income. By utilizing the right deductions and credits, educators can significantly reduce their tax burden. Below, we outline the top tax-saving tips for teachers in Canada to help you keep more money in your pocket while continuing to invest in your professional growth.

1. Claim Eligible Educator School Supply Tax Credit

Teachers often purchase classroom supplies out-of-pocket, which can add up over time. The Educator School Supply Tax Credit is designed to help offset these costs by allowing eligible teachers to claim up to $1,000 worth of expenses for essential teaching materials. This provides a 15% refundable tax credit, meaning that even if you have little taxable income, you can still receive a refund.

This tax credit covers a wide range of materials used directly for instruction, including technology, books, and other classroom necessities, helping teachers manage their expenses more effectively while ensuring a well-equipped learning environment for their students.

What Expenses Qualify for the Credit?

Eligible expenses include:

- Educational books

- Stationery supplies

- Arts and crafts materials

- Technology like USB drives and software for teaching purposes

How to Properly Document Your Purchases?

To claim this credit, keep the following:

- Receipts of all purchases

- Proof that the materials were used for teaching

- Certification from the employer confirming the supplies were not reimburse.

Eligible Expenses for the Credit

| Expense Type | Examples |

| Educational Books | Textbooks, reference materials |

| Stationery Supplies | Pens, notebooks, paper |

| Arts and Crafts | Paints, markers, craft paper |

| Technology | USB drives, software, tablets |

How to Properly Document Your Purchases?

To claim this credit, keep the following:

| Documentation Type | Description |

| Receipts | Proof of purchase for all materials |

| Employer Certification | Confirmation that supplies were not reimbursed |

| Usage Proof | Evidence that materials were used for teaching |

2. Deduct Union and Professional Fees

Many teachers pay annual membership fees to unions or professional organizations, which can represent a significant portion of their yearly expenses. Fortunately, these fees are fully tax-deductible, meaning they directly reduce taxable income. This deduction applies to various professional associations, including teacher unions, regulatory bodies, and subject-specific organizations that support educators’ professional growth.

By ensuring proper documentation of these payments, teachers can effectively lower their tax liability and reinvest their savings into further professional development or personal financial goals.

What Membership Fees Can Be Claimed?

- Provincial teacher union fees

- Professional development association dues

- Certification renewal costs

Keeping records of annual payments and including them in your tax return ensures you maximize this deduction.

What Membership Fees Can Be Claimed?

| Membership Type | Examples |

| Provincial Teacher Unions | Local and national teacher unions |

| Professional Associations | Subject-specific organizations |

| Certification Renewal Fees | Teaching license renewals |

3. Leverage Work-From-Home Expense Deductions

With online and hybrid learning becoming more common, many teachers work from home, leading to increased personal expenses for maintaining a functional workspace. The Work-From-Home Tax Deduction helps educators claim home office expenses, providing a way to offset costs such as rent, electricity, internet, and office supplies.

Understanding how to leverage this deduction can make a significant financial difference for teachers adapting to remote or hybrid work models.

Eligibility Criteria for Home Office Deductions

To qualify, you must:

- Work from home more than 50% of the time

- Have a designated workspace used primarily for work purposes

Calculating and Claiming the Deduction

You can choose between:

- Flat rate method: Claim $2 per day (up to $500 for 250 days of remote work)

- Detailed method: Claim a portion of home expenses like rent, utilities, and internet

Eligibility Criteria for Home Office Deductions

| Criteria | Requirement |

| Work Percentage | More than 50% of the time |

| Workspace Usage | Primarily for work purposes |

Claiming the Deduction

| Method | Details |

| Flat Rate Method | Claim $2 per day (up to $500 for 250 days) |

| Detailed Method | Claim a portion of home expenses like rent, utilities, and internet |

4. Take Advantage of RRSP Contributions

The Registered Retirement Savings Plan (RRSP) is an excellent way for teachers to save for retirement while lowering taxable income. By contributing to an RRSP, teachers can defer taxes on their investments, allowing their savings to grow tax-free until withdrawal.

The flexibility of RRSPs also enables educators to choose from a wide range of investment options, including stocks, bonds, mutual funds, and GICs, making it a powerful tool for long-term financial security. Additionally, teachers who anticipate a lower tax rate in retirement can benefit from significant tax savings when they begin making withdrawals.

How RRSP Contributions Reduce Taxes

- Contributions reduce taxable income dollar-for-dollar

- Investment growth is tax-deferred until withdrawal

Best Strategies for Maximizing RRSP Benefits

- Max out your annual RRSP limit

- Contribute during high-income years to save more on taxes

- Consider spousal RRSP contributions to split income tax efficiently

How RRSP Contributions Reduce Taxes?

| Benefit | Description |

| Tax Deferral | Investment growth is tax-free until withdrawal |

| Contribution Deduction | Reduces taxable income dollar-for-dollar |

Best Strategies for Maximizing RRSP Benefits

| Strategy | Description |

| Maximize Contribution | Contribute up to your RRSP limit |

| Use Spousal RRSP | Split income tax efficiently |

| Contribute in High-Income Years | Save more on taxes when earning more |

5. Claim Moving Expenses If You Relocate for Work

Teachers relocating for a new teaching job can deduct eligible moving expenses, including transportation, accommodation, and real estate fees. This deduction covers costs associated with hiring professional movers, temporary housing during the transition, and even storage fees for belongings.

Additionally, teachers who drive to their new location can claim vehicle-related expenses such as fuel and maintenance. Proper documentation, such as receipts and mileage logs, is crucial to ensure compliance with the Canada Revenue Agency’s requirements.

Who Qualifies for the Moving Expense Deduction?

- Teachers who move at least 40km closer to their new place of work

Key Expenses You Can Include in Your Claim

- Moving company fees

- Travel costs

- Temporary lodging expenses

Key Deductible Moving Expenses

| Expense Type | Examples |

| Transportation | Airfare, train tickets, gas costs for driving |

| Accommodation | Hotel stays during transition |

| Real Estate Fees | Legal fees, realtor commissions |

| Storage Costs | Temporary storage for belongings |

6. Use Child Care Expense Deductions

Teachers who have children can claim child care expenses for services like daycare, babysitting, and summer camps, helping to ease the financial burden of balancing work and family responsibilities. The Canada Revenue Agency (CRA) allows eligible parents to deduct a portion of their child care costs from their taxable income, making it an essential tax-saving opportunity for educators.

To maximize this benefit, teachers should ensure they keep detailed receipts and records of payments made to licensed daycares, nannies, and after-school programs. This deduction can be particularly beneficial for single parents or households where both partners are working, reducing overall tax liability and freeing up resources for other essential expenses.

What Child Care Costs Can Be Claimed?

- Licensed daycare services

- Babysitters and nannies

- Educational programs for young children

By keeping receipts and records, parents can reduce taxable income significantly.

Eligible Child Care Expenses

| Child Care Type | Examples |

| Daycare Services | Licensed daycare facilities |

| Babysitting | Private nannies, babysitters |

| After-School Care | Educational programs, supervised activities |

| Summer Camps | Recreational and academic summer camps |

7. Apply for Continuing Education Tax Credits

Many teachers invest in further education to enhance their skills and stay competitive in the field. The Tuition Tax Credit allows educators to deduct eligible tuition and examination fees, making it a valuable financial relief for those pursuing additional qualifications, diplomas, or certifications.

This credit applies to various post-secondary programs and professional development courses, helping teachers offset the costs of continuous learning. Educators should ensure they obtain official tax receipts and verify the eligibility of their courses under the CRA guidelines to maximize their tax benefits.

How to Claim the Tuition Tax Credit

- Obtain official tax receipts from the institution

- Ensure the course is eligible under CRA guidelines

Eligible Educational Expenses

| Expense Type | Examples |

| Tuition Fees | Accredited university and college programs |

| Exam Fees | Certification and licensing exams |

| Course Materials | Textbooks, lab fees |

8. Benefit from Medical Expense Tax Deductions

Teachers can claim medical expenses for themselves and their dependents, reducing taxable income and making healthcare more affordable. This includes costs for prescription medications, dental care, vision expenses, and even therapy or mental health services.

In addition, travel costs for medical appointments and certain medical equipment may also qualify for deductions. Keeping detailed receipts and ensuring expenses meet the eligibility criteria set by the Canada Revenue Agency (CRA) will help maximize the tax benefits available.

What Medical Expenses Can Be Deducted?

- Prescription medications

- Dental procedures

- Therapy and mental health treatments

Keeping an organized record of medical expenses ensures you claim the highest possible deduction.

Eligible Medical Expenses

| Medical Expense Type | Examples |

| Prescription Drugs | Medications prescribed by a doctor |

| Dental Care | Cleanings, braces, surgeries |

| Vision Care | Glasses, contact lenses, eye exams |

| Therapy Services | Physical therapy, mental health counseling |

Additional Strategies to Save on Taxes

While the primary tax-saving tips for teachers in Canada help reduce taxable income, there are additional strategies that can further optimize financial benefits. Teachers should be proactive in exploring every possible avenue to lower their tax liabilities and retain more earnings for personal and professional growth.

Filing Taxes on Time to Avoid Penalties

Late tax filings can result in penalties. Mark tax deadlines and ensure timely submissions to avoid unnecessary fees.

Keeping Detailed Records for Easy Tax Filing

Organize all tax-related receipts and documents throughout the year to streamline tax season.

Using Tax Software or Hiring a Professional Accountant

For complex tax situations, hiring a professional or using tax software ensures maximum deductions.

Final Thoughts on Maximizing Tax Savings for Teachers

By implementing these tax-saving tips for teachers in Canada, educators can significantly reduce taxable income and maximize refunds. Whether claiming classroom expenses, contributing to RRSPs, or deducting professional fees, proactive tax planning helps teachers retain more of their earnings.

For additional guidance, consider consulting a tax professional or using trusted tax software. Happy saving!