Operating a small business in Qatar offers significant opportunities for growth and profitability, but it also involves managing a number of financial responsibilities, especially when it comes to taxation.

The Qatar tax system allows small businesses to take advantage of various tax deductions to minimize their taxable income, ultimately reducing the amount they owe in taxes. However, many business owners overlook or misunderstand the full range of tax deductions available to them.

Understanding tax deductions is not only essential for improving your business’s financial health but also for ensuring compliance with Qatari tax laws. This guide explores 10 tax deductions every small business in Qatar should be aware of. By strategically applying these deductions, business owners can reduce costs and keep more profits within their business, allowing for reinvestment and growth.

In this comprehensive article, we will discuss each tax deduction, how to claim it, and provide practical examples to help you understand how these deductions work in real-world business scenarios. Whether you’re new to tax filings or an experienced entrepreneur, this guide will provide valuable insights to optimize your business’s tax strategy.

1. Business Expenses: What Can You Deduct?

Business expenses are the backbone of any small business’s ability to operate efficiently. In Qatar, most everyday operational expenses are deductible, allowing business owners to significantly lower their taxable income.

Overview of Business Expenses Deductions

You can deduct nearly all the costs associated with running your business, such as rent, utilities, office supplies, and salaries. These expenses directly impact your bottom line, so it’s essential to keep track of every expenditure. For example, if you’re leasing office space, your monthly rent payments will be deductible, as long as the space is used solely for business purposes.

Types of Business Expenses

- Operating Costs: This includes rent, utilities (electricity, water, internet), and office supplies like paper, pens, or any equipment needed for day-to-day business operations.

- Employee-Related Expenses: Salaries, wages, bonuses, health insurance, retirement plans, and other employee-related expenses are all deductible.

- Marketing and Advertising: Expenses related to promoting your business, such as digital ads, print materials, and promotions, are deductible.

How to Maximize Business Expense Deductions

- Separate Personal and Business Expenses: To avoid confusion and ensure accuracy, maintain separate accounts for business and personal expenses.

- Document Every Transaction: Keeping detailed records is essential for supporting your deductions during tax filing. Maintain invoices, receipts, contracts, and financial statements.

- Use Accounting Software: Utilize accounting software to automate the tracking of your expenses. Many modern tools offer integration with Qatar’s tax laws, helping you easily claim deductions.

Example of Business Expenses Table

| Expense Type | Description | Deductible Amount |

| Rent | Office space for business activities | Full rent paid |

| Office Supplies | Paper, printer ink, pens, etc. | Full cost paid |

| Employee Salaries | Monthly wages for staff | Full salary paid |

| Marketing Costs | Digital ads, flyers, social media marketing | Full cost paid |

2. Depreciation of Assets

Depreciation allows businesses to claim a deduction for the decrease in value of long-term assets. This deduction can significantly reduce your taxable income, especially when purchasing expensive assets like office equipment, machinery, or vehicles.

Overview of Depreciation Deductions

As assets like equipment, office furniture, or vehicles age, they lose value over time. Depreciation is a way to account for that loss in value, and businesses can deduct a portion of the asset’s cost every year. In Qatar, you can claim depreciation for assets that have a useful life of more than one year.

Types of Assets That Can Be Depreciated

- Vehicles: Cars, trucks, and other vehicles used in business operations can be depreciated over time.

- Office Equipment: Items like computers, printers, and office furniture can also be depreciated.

- Machinery and Tools: Any machinery or tools used to produce goods or provide services may qualify for depreciation.

Depreciation Methods Available

- Straight-Line Depreciation: This method divides the cost of the asset equally over its useful life. If you purchase a QAR 10,000 office desk with a lifespan of 5 years, you can deduct QAR 2,000 each year for 5 years.

- Accelerated Depreciation: With this method, larger deductions are made in the earlier years of the asset’s life. This is especially helpful for expensive equipment or machinery.

Example of Depreciation Calculation

| Asset | Initial Cost (QAR) | Depreciation per Year (QAR) | Depreciation Period (Years) |

| Office Desk | 10,000 | 2,000 | 5 |

| Business Car | 50,000 | 10,000 | 5 |

3. Home Office Deductions

If you run your small business from home, you may be eligible for home office deductions. Qatar allows you to deduct a portion of your home expenses if the space is used exclusively for business.

Overview of Home Office Deductions

Home office deductions are particularly valuable for small businesses that operate in a residential setting. If you use a part of your home exclusively for business, you can claim deductions for a portion of your rent, utilities, and other related expenses. However, the space must be used regularly and solely for business purposes, so occasional personal use will disqualify you.

How to Calculate Home Office Deduction

To calculate the deduction, you need to determine the percentage of your home that is used exclusively for business. For instance, if your home office takes up 10% of the total square footage of your home, you can claim 10% of your home-related expenses (such as rent, electricity, internet, etc.).

Examples of Deductible Home Office Costs

- Rent: A portion of your home’s rent based on the size of your office.

- Utilities: A portion of your electricity, internet, and water bills.

- Office Supplies: Items like office furniture, stationery, and electronics used in your home office.

Maximizing Home Office Deductions

- Ensure Exclusivity: The space must be used solely for business activities. If the room is also used as a guest room or for other personal purposes, it won’t qualify for deductions.

- Track Home Office Usage: Keep track of how much time is spent in your home office and make sure it aligns with your claimed deductions.

Home Office Deductions Table

| Expense Type | Description | Deductible Amount |

| Rent | Portion of rent for business use | Proportional share |

| Utilities | Portion of electricity, internet, water | Proportional share |

| Office Furniture | Desk, chair, and other office items | Full cost paid |

4. Employee Salaries and Benefits

Employee-related expenses are one of the most significant and beneficial deductions available to small businesses in Qatar. This includes the salaries and benefits you provide to your employees.

Overview of Employee Deductions

Salaries, wages, and any benefits provided to employees are deductible from your business’s taxable income. These costs are essential to running a successful business, and the government offers tax breaks to encourage businesses to take care of their staff.

Health and Welfare Deductions

- Health Insurance: Premiums paid for employee health insurance plans are deductible.

- Retirement Contributions: Contributions made to employee pension plans or other retirement funds are deductible.

- Other Benefits: Bonuses, paid leaves, and other employee perks also qualify for deductions.

How to Document Employee Deductions

- Maintain clear payroll records that show the salaries and benefits you’ve paid to employees.

- Ensure that all payments to employees are processed through official payroll systems to ensure compliance and accuracy.

Employee-Related Expenses Table

| Expense Type | Description | Deductible Amount |

| Salaries | Employee monthly salaries | Full salary paid |

| Health Insurance | Employer-paid premiums for health insurance | Full premium paid |

| Retirement Contributions | Employer contributions to retirement plans | Full amount paid |

5. Interest on Loans and Business Financing

Small businesses often rely on loans and credit to finance their operations. Fortunately, the interest payments on loans and lines of credit are tax-deductible, reducing the overall financial burden.

Overview of Loan Interest Deductions

If your business has loans or credit lines, you can deduct the interest paid on those loans. This is a valuable deduction, as it directly impacts your cash flow. Keep in mind that only the interest portion of the payment is deductible, not the principal.

Types of Loans That Qualify for Interest Deductions

- Business Loans: Loans taken out for equipment purchases, expansion, or working capital are eligible.

- Business Credit Cards: Interest paid on business credit cards is deductible if the charges are business-related.

Tracking Loan Interest Payments

- Keep detailed records of your loan payments, including interest and principal breakdowns.

- Make sure to separate personal and business loans to ensure the correct interest is deducted.

Interest Deduction Example Table

| Loan Amount (QAR) | Interest Rate (%) | Interest Payment (QAR) | Deductible Amount |

| 50,000 | 5% | 2,500 | 2,500 |

6. Marketing and Advertising Expenses

Marketing and advertising are essential for any small business looking to grow and attract new customers. Whether it’s a digital campaign or traditional marketing, the costs associated with these activities are fully deductible under Qatari tax laws.

Claiming deductions for marketing and advertising expenses can significantly reduce your taxable income and ensure that your business stays competitive in the marketplace.

Overview of Marketing and Advertising Deductions

Marketing and advertising are critical tools for expanding your customer base and increasing brand awareness. As such, the costs involved in promoting your business are fully deductible. This includes everything from online ads to promotional materials, and even event sponsorships. By utilizing these deductions, you can reinvest in your marketing efforts while reducing your tax burden.

Types of Marketing Expenses

- Digital Advertising: Expenses related to online advertising platforms such as Google Ads, Facebook Ads, and LinkedIn Ads.

- Traditional Advertising: Costs for print ads, television and radio spots, and outdoor advertisements such as billboards.

- Promotions: Expenses for running special promotions, contests, or giveaways that generate interest and increase sales.

Maximizing Marketing Deductions

- Track All Marketing Costs: Keep detailed records of every marketing-related expense, from digital ads to physical promotional materials. Using accounting software can help ensure that all costs are tracked and categorized correctly.

- Review Marketing ROI: Regularly assess the return on investment (ROI) for your marketing efforts to ensure you’re spending your budget wisely and maximizing deductions.

Marketing and Advertising Expenses Table

| Expense Type | Description | Deductible Amount |

| Digital Advertising | Ads on Google, Facebook, LinkedIn, etc. | Full ad spend |

| Traditional Advertising | TV, radio, and print ads | Full ad spend |

| Promotions | Costs for running promotions or contests | Full cost of promotion |

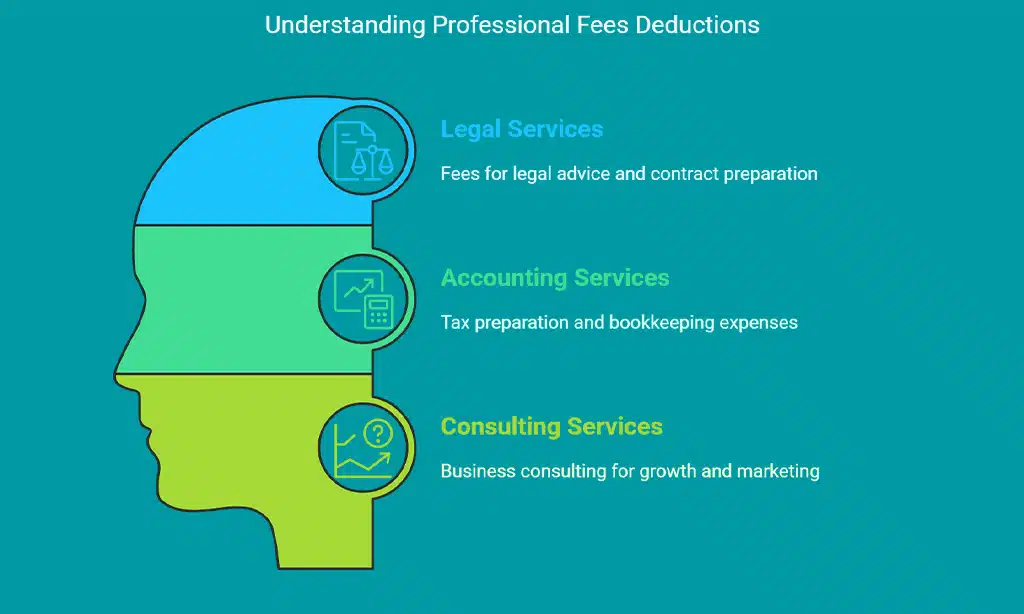

7. Professional Fees and Consultations

Small businesses often require expert advice and services to remain compliant with laws and regulations or to help them navigate business complexities. Fortunately, the fees paid to professionals for legal, accounting, or consulting services are deductible, which can offer substantial savings.

Overview of Professional Fees Deductions

Expenses related to professional services such as legal advice, accounting, and other business consultations are deductible. These services are essential for ensuring your business operates efficiently, remains compliant with local laws, and navigates complex financial matters. Whether you need a lawyer to draft a contract or an accountant to help with taxes, the cost of these services can be deducted from your taxable income.

Types of Professional Services

- Legal Services: Fees for legal advice, drafting contracts, business disputes, and other legal matters.

- Accounting Services: Expenses for bookkeeping, tax preparation, financial statements, and audits.

- Business Consulting: Fees for consultants who provide specialized advice to help your business grow, including marketing consultants or IT advisors.

How to Document Professional Service Payments

- Invoices: Keep a record of all invoices for professional services, as they should clearly list the nature of the service provided and the cost.

- Contracts: If applicable, maintain contracts or agreements that specify the scope of work and payment terms.

- Payment Proof: Ensure you have proof of payment, such as bank statements or receipts, to substantiate your claims.

Professional Services Fees Table

| Service Type | Description | Deductible Amount |

| Legal Services | Fees for legal advice, contract preparation | Full cost paid |

| Accounting Services | Tax preparation, bookkeeping, financial advice | Full cost paid |

| Consulting Services | Business consulting on growth, marketing, etc. | Full cost paid |

8. Charity Contributions

Contributing to charity not only helps your community but also offers tax savings. Small businesses in Qatar can claim deductions for charitable donations, which can reduce their taxable income while supporting a good cause.

Overview of Charity Contribution Deductions

Qatar allows businesses to deduct the costs of charitable contributions, both cash and non-cash. If your business donates to a recognized charity or public good, you can claim those donations as tax-deductible. This is a great way to reduce your tax burden while making a positive impact in the community.

Types of Deductible Charitable Contributions

- Cash Donations: Contributions made in cash to recognized charitable organizations.

- Non-Cash Donations: Donating goods or services such as office supplies, old equipment, or even providing pro bono services to charitable causes.

How to Document Charitable Contributions

- Receipts: Obtain a receipt for every donation made, whether it’s cash or goods, ensuring it is from a registered charity.

- Donation Logs: Keep a detailed log of non-cash donations, including the value of goods donated.

- Donor Acknowledgement: Ensure that the charity acknowledges the contribution and provides the necessary documentation for tax purposes.

Charitable Contributions Table

| Donation Type | Description | Deductible Amount |

| Cash Donations | Donations made to registered charities | Full donation amount |

| Non-Cash Donations | Donating goods or services to charity | Fair market value of goods |

9. Travel Expenses for Business Purposes

Traveling for business purposes is common, and Qatar’s tax laws allow you to deduct travel-related expenses. Whether you’re traveling for meetings, conferences, or business events, these costs can be claimed to reduce your tax liability.

Overview of Travel Expense Deductions

Travel expenses such as airfare, lodging, meals, and other related costs can be deducted if they are incurred for business purposes. These expenses are essential for maintaining business operations, especially for businesses that require regular client meetings or employee travel.

Types of Travel Expenses

- Airfare: Flight tickets for business trips.

- Accommodation: Hotel bills or other accommodation costs.

- Meals: Business meals during travel, subject to certain restrictions.

How to Maximize Travel Deductions

- Track Travel Expenses: Keep receipts for all travel-related expenses and maintain a log of the purpose of each trip.

- Keep Personal Travel Separate: Only business-related travel expenses are deductible. If a trip combines business and personal activities, you can only deduct the portion of expenses that is business-related.

Travel Expenses Table

| Expense Type | Description | Deductible Amount |

| Airfare | Tickets for business-related flights | Full cost of flight |

| Accommodation | Hotel or lodging during business travel | Full cost of stay |

| Meals | Meals during business trips | 50% of meal cost |

10. Insurance Premiums for Business Protection

Insurance is essential for protecting your business from unforeseen risks, and the premiums you pay are tax-deductible. Whether it’s property insurance, liability insurance, or employee health insurance, these costs can be deducted from your taxable income.

Overview of Insurance Premium Deductions

Insurance premiums are a necessary cost for businesses, as they help protect against risks such as property damage, legal liability, and employee health. Fortunately, these premiums are tax-deductible. The types of insurance that qualify for deductions include property, liability, health, and workers’ compensation insurance.

Types of Deductible Insurance Policies

- Property Insurance: For insuring your business property, including office buildings, equipment, and inventory.

- Liability Insurance: Coverage that protects your business from legal claims or lawsuits.

- Health Insurance: Premiums paid for employee health insurance plans.

Maximizing Insurance Deductions

- Track Insurance Payments: Keep records of all insurance premiums paid, and ensure they are for policies that are directly related to your business operations.

- Review Coverage Annually: Ensure your business is adequately covered and that you’re not overpaying for unnecessary insurance.

Insurance Premiums Table

| Insurance Type | Description | Deductible Amount |

| Property Insurance | Coverage for business property, equipment | Full premium paid |

| Liability Insurance | Coverage for legal claims and lawsuits | Full premium paid |

| Health Insurance | Employee health insurance premiums | Full premium paid |

Wrap Up: Maximizing Tax Deductions for Your Small Business in Qatar

Tax deductions are an invaluable tool for small business owners in Qatar, providing an opportunity to reduce taxable income and increase profitability. By utilizing these 10 key tax deductions—from business expenses to insurance premiums—small businesses can maximize their savings and reinvest those funds into their operations.

Staying organized, maintaining accurate records, and regularly reviewing tax laws are all important steps in ensuring that you’re claiming every deduction you’re entitled to. Consulting with a tax professional can help you navigate complex deductions and ensure full compliance with Qatari tax laws.

By following these strategies, you can not only reduce your tax burden but also position your business for long-term success in Qatar’s dynamic market. Take advantage of these deductions, and ensure your business stays financially healthy while growing and thriving.