In today’s unpredictable economy, property owners and investors face constant challenges. From interest rate hikes to economic slowdowns, market volatility can significantly affect the value of real estate. Whether you own a family home, a rental unit, or a commercial property, your investment is vulnerable to sudden market shifts.

Understanding how to protect your property from market volatility is more than a smart move—it’s essential for long-term success. Let’s explore ten proven steps to reduce your risks and keep your real estate investment stable even during tough times.

Step-by-Step Guide to Safeguarding Your Property Investment

Protecting your property from market volatility requires a clear plan. This guide outlines the most effective actions you can take to reduce risk and maintain stable returns. By following these steps, you’ll be better prepared to navigate economic downturns, tenant issues, and fluctuating property values with confidence. Each step builds a stronger foundation for long-term property success.

1. Conduct a Comprehensive Risk Assessment

Before you take action, it’s crucial to understand the risks. A risk assessment helps you spot potential threats that could hurt your property’s value. Start by evaluating the location of your property. Is it prone to natural disasters like floods or earthquakes?

Are crime rates high in the neighborhood? These factors can impact both the safety and the value of your property. Then, consider market-related risks. For example, oversupply in your area might reduce demand and rental income. Tenant risk is another concern—unreliable renters can lead to payment delays or property damage. Being aware of these issues lets you prepare better and take preventive actions before problems escalate.

What to Consider:

- Location risk (e.g., flood zones, economic decline)

- Market risk (e.g., oversupply, decreasing demand)

- Tenant risk (e.g., unreliable renters)

Tools You Can Use:

- Online property risk calculators

- Local council hazard maps

- Insurance risk evaluation reports

| Factor | Description | Action Required |

| Location Risk | Natural disasters, crime rates | Research before purchasing |

| Market Risk | Price fluctuations, market crashes | Diversify and monitor trends |

| Tenant Risk | Missed rent, property damage | Use background checks |

2. Diversify Your Property Portfolio

Don’t rely on one type of property or location. Diversification helps spread your risk. If the market for one property type dips, another may remain strong. For instance, commercial properties may struggle during economic slowdowns, but residential rentals often remain in demand.

Diversification isn’t just about property types. You should also consider geographic diversity. Owning properties in different cities or even countries can cushion you from regional economic fluctuations. In addition, mix your rental strategies. Include long-term leases, short-term rentals, and even corporate lets for stability and flexibility.

How to Diversify:

- Own both residential and commercial properties

- Invest in multiple cities or regions

- Mix long-term rentals with short-term vacation rentals

Example Diversification Table:

| Property Type | Location | Rental Strategy |

| Single-family home | Suburban area | Long-term lease |

| Apartment unit | City center | Airbnb short-term |

| Office space | Business district | Corporate lease |

3. Secure Adequate Property Insurance

Having the right insurance coverage can save you from huge financial loss. Start by ensuring you have basic homeowner or landlord insurance. This should cover building and contents as a minimum. But in today’s market, that’s not enough.

Additional insurance for natural disasters, legal fees, and loss of rent can offer peace of mind. Consider the risks in your area—for example, flood insurance is essential in flood-prone regions. Review your insurance coverage annually to make sure it’s aligned with your property’s current value and usage.

Types of Insurance to Consider:

- Landlord insurance

- Flood or earthquake coverage

- Rent loss protection

What to Do:

- Review your policies yearly

- Compare insurance providers

- Adjust coverage as property value increases

| Insurance Type | Coverage Scope | Why It Matters |

| Landlord Insurance | Property & liability | Covers tenant-related risks |

| Natural Disaster Cover | Floods, earthquakes, fires | Protects against major damage |

| Rent Guarantee | Loss of rental income | Ensures cash flow during vacancies |

4. Build a Financial Buffer or Emergency Fund

A financial cushion helps you handle unexpected expenses without panic. This buffer acts as your safety net. In times of vacancy, you’ll still be able to meet your mortgage and operating costs. Likewise, unexpected repairs or legal costs won’t throw your finances into chaos.

To determine how much you need, calculate your property’s monthly expenses and aim to save at least 3 to 6 months’ worth. Keep these funds in a separate, easily accessible account dedicated to property emergencies.

How Much to Save:

- At least 3 to 6 months of expenses

- Include mortgage, maintenance, taxes

Use Cases:

- Cover a mortgage during vacancies

- Pay for emergency repairs

| Scenario | Estimated Cost | Fund Coverage Needed |

| Vacancy (3 months) | $4,500 | Yes |

| Major Roof Repair | $8,000 | Yes |

| Legal Tenant Dispute | $3,000 | Yes |

5. Keep Up with Property Maintenance

Regular upkeep keeps your property attractive and functional. Deferred maintenance can lead to much larger expenses down the road. A leaking roof or broken pipe, if ignored, can cause structural damage. Staying on top of repairs also keeps tenants happy, which helps reduce turnover and vacancy rates. Set a maintenance schedule and use trusted service providers to ensure your property remains in top shape.

Why It Matters:

- Reduces the risk of expensive repairs

- Improves tenant satisfaction and retention

Checklist for Routine Maintenance:

- HVAC servicing

- Plumbing inspections

- Roof checks

- Lawn care

| Maintenance Task | Frequency | Benefit |

| Roof Inspection | Every 6 months | Prevents water damage |

| HVAC Servicing | Annually | Energy efficiency |

| Plumbing Checks | Quarterly | Avoids major leaks |

6. Lock in Long-Term Financing

When interest rates are unstable, a fixed-rate mortgage is your best friend. It offers financial predictability by keeping monthly payments steady. This is particularly important when rents may fluctuate or expenses increase. If you already have a mortgage, evaluate if refinancing could help you secure a lower fixed rate. Avoid variable-rate loans unless you have a high tolerance for financial risk and are experienced in managing market shifts.

Benefits of Long-Term Loans:

- Predictable monthly payments

- Shield from rising interest rates

Tips:

- Refinance when rates are low

- Avoid variable-rate loans in uncertain times

| Loan Type | Interest Rate | Suitable For |

| Fixed-Rate Mortgage | 5% (example) | Long-term property holders |

| Variable Rate Loan | Starts at 4% | Risk-tolerant investors |

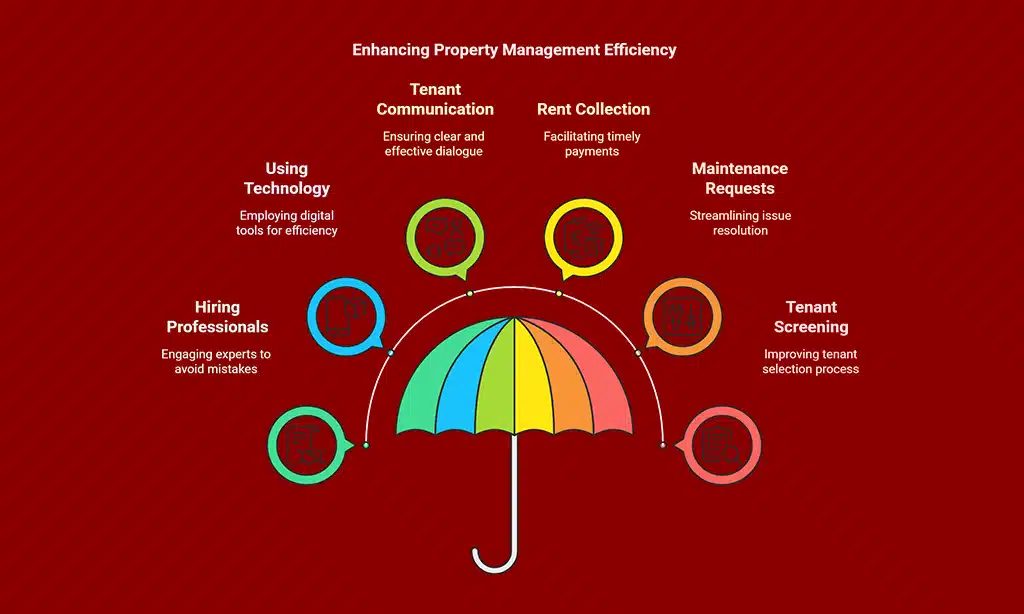

7. Optimize Property Management Practices

Good property management improves profitability and reduces risk. From tenant screening to timely maintenance, management practices affect your property’s income and reputation. Hiring a professional manager can help you avoid costly mistakes, especially if you own multiple properties or don’t live nearby. Automation tools like rent collection apps and maintenance request systems also help streamline operations.

Key Actions:

- Hire professional managers or agencies

- Use tech tools like property management software

- Maintain good communication with tenants

| Task | Tool/Resource Used | Benefit |

| Rent Collection | Online platforms | Timely payments |

| Maintenance Requests | Management apps | Fast resolution |

| Tenant Screening | Credit check tools | Better tenant selection |

8. Stay Informed on Market Trends and Regulations

Knowledge is power, especially in real estate. Staying current with laws and trends allows you to make better decisions and avoid fines or losses. Pay attention to local zoning changes, property tax updates, and broader economic indicators. Join real estate forums or investor networks to learn from others and stay ahead of market shifts.

How to Stay Updated:

- Subscribe to industry newsletters

- Follow local zoning law changes

- Attend real estate webinars or workshops

Useful Sources:

- National Association of Realtors (NAR)

- Local property boards and municipalities

| Source | Type | Info Provided |

| Realtor.org | Industry updates | Market stats, policy changes |

| Local Housing Authority | Regulation updates | Zoning laws, tax updates |

9. Increase Rental Property Value Strategically

Boosting your property’s value doesn’t have to cost a fortune. Even small improvements can make a big difference in tenant satisfaction and resale value. Focus on upgrades that provide a good return on investment. Modern finishes, energy-saving appliances, and curb appeal enhancements are good places to start. Keep track of improvement costs and compare them with the potential increase in rent or value to ensure profitability.

Simple Upgrades with Big Impact:

- Energy-efficient lighting and appliances

- Modern kitchen and bathroom finishes

- Fresh paint and landscaping

Focus on:

- High ROI improvements

- Appealing to your target tenants

| Upgrade | Cost Estimate | Added Value |

| Smart Thermostat | $150 | Energy savings |

| New Paint (Interior) | $1,200 | Fresh look |

| LED Light Fixtures | $300 | Modern appeal |

10. Have an Exit Strategy Ready

Always plan for the worst, even during the best times. An exit strategy gives you control over your investment, whether the market is booming or declining. It helps prevent rash decisions during stressful periods. Evaluate different options like selling, refinancing, or converting to another use. A 1031 exchange can allow you to reinvest without paying immediate taxes. Know your financial goals, and align your exit plan accordingly to maximize returns.

Why You Need It:

- Market dips can force quick sales

- Planning prevents panic decisions

Options to Consider:

- 1031 Exchange (defer capital gains)

- Selling during peak seasons

- Holding for rental income

| Exit Option | Benefit | When to Use |

| 1031 Exchange | Tax deferral | Swapping investments |

| Strategic Sale | Maximize profit | During market highs |

| Long-Term Hold | Consistent cash flow | In stable or recovering markets |

Common Mistakes Property Owners Make During Market Downturns

Being aware of common pitfalls helps you avoid them.

Top Mistakes:

- Panic selling during downturns

- Delaying repairs to cut costs

- Ignoring changes in rental laws

- Over-leveraging with high-interest loans

Avoid by:

- Keeping a cool head

- Having a long-term plan

- Staying educated

Pro Tips for Real Estate Investors in Uncertain Times

Use these advanced strategies to stay ahead:

- Work with Financial Advisors: Get personalized planning

- Invest in Landlord Insurance: Additional protection

- Use Data Analytics: Make smart decisions based on trends

- Prioritize Location: Some areas are recession-resistant

Visual Breakdown – Key Steps at a Glance

| Step | Action | Benefit |

| 1 | Risk Assessment | Reduce unexpected exposure |

| 2 | Portfolio Diversification | Spread risk |

| 3 | Proper Insurance | Financial protection |

| 4 | Emergency Fund | Handle cash flow issues |

| 5 | Ongoing Maintenance | Maintain value and attract tenants |

| 6 | Fixed Financing | Payment stability |

| 7 | Smart Property Management | Fewer problems, more income |

| 8 | Stay Updated | Make informed decisions |

| 9 | Upgrade Property | Increase rent and resale value |

| 10 | Exit Strategy | Better control over outcomes |

FAQs About Market Volatility and Real Estate Protection

How does market volatility affect real estate values?

Market fluctuations can cause property prices to rise or fall suddenly, impacting your investment’s worth and rental income potential.

Can rental properties be safer investments during a recession?

Yes, especially if they’re in high-demand areas with stable employment and population growth.

What types of properties are most resilient to economic downturns?

Affordable rental units and multi-family homes tend to perform well, even during recessions.

Should I refinance during market instability?

Only if you can lock in a better rate. Always consult with a financial advisor first.

Takeaways

Market volatility is unavoidable, but with the right strategies, you can reduce the impact on your real estate investments. By following these ten steps—from risk assessments to building an exit plan—you ensure your property remains a stable, income-generating asset.

Start today to protect your property from market volatility and secure your financial future.