Elon Musk’s rocket and satellite company, SpaceX, has grown into one of the most valuable private firms in the world. It has received billions of dollars in contracts and investments from the U.S. government. Yet, a detailed investigation has revealed that the company may not be paying federal income taxes despite its rising profits.

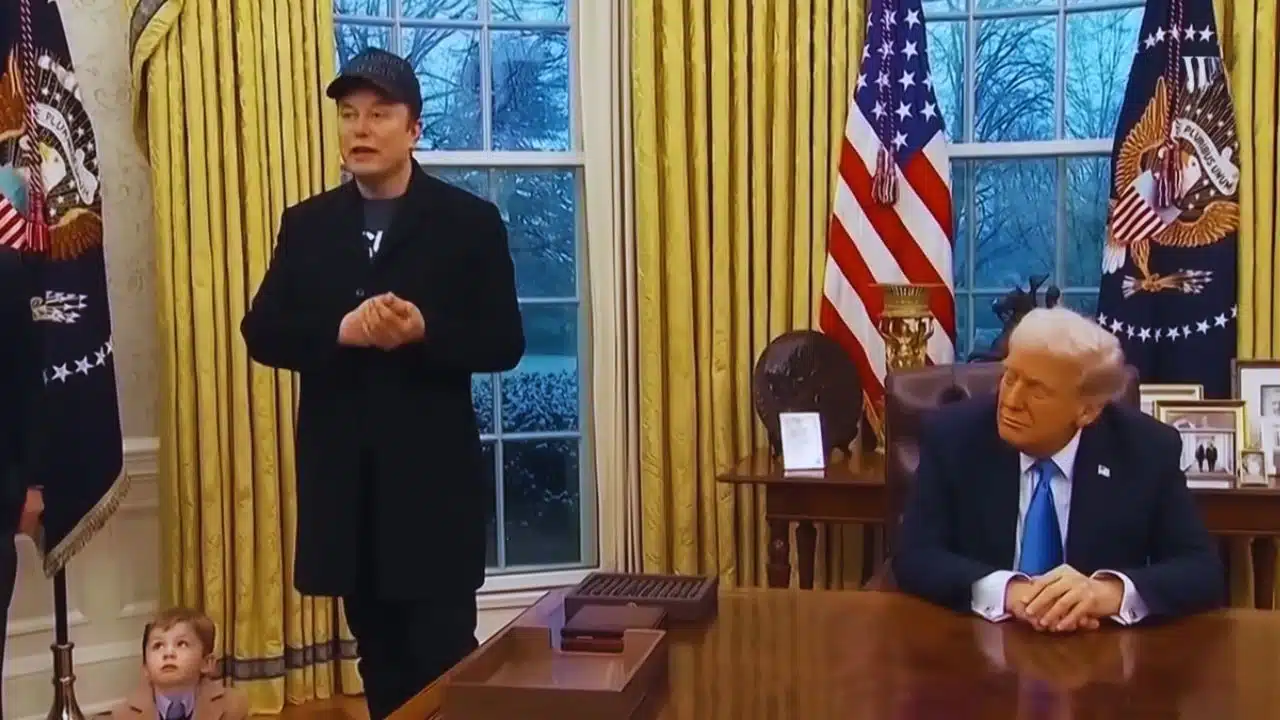

According to a report by The New York Times, SpaceX has legally positioned itself to avoid federal taxes for years—possibly indefinitely—by taking advantage of a change in U.S. tax law made during former President Donald Trump’s administration in 2017.

Trump’s 2017 Tax Law and SpaceX’s Advantage

In December 2017, Donald Trump signed the Tax Cuts and Jobs Act (TCJA), the largest overhaul of the U.S. tax code in decades. Among many provisions, the law removed the expiration date for a tax benefit known as the Net Operating Loss (NOL) carryforward.

Previously, companies could only use losses from past years to offset taxable profits for up to 20 years. Trump’s reform, however, made these losses usable indefinitely—though capped at offsetting 80% of taxable income each year. This meant that companies that had piled up billions in losses over the years could continue deducting them from their future profits without time limits.

For SpaceX, which had struggled financially for nearly two decades, this law became a game-changer.

SpaceX’s Early Struggles and Huge Losses

Since its founding in 2002, SpaceX endured long periods of losses while trying to develop reusable rockets and launch services. Like other ambitious startups—such as Uber and Tesla—it spent years “bleeding cash” as it invested heavily in technology, infrastructure, and staff.

By the end of 2021, SpaceX had accumulated about $5.4 billion in losses. These losses created a massive tax shield under the NOL rule. According to the documents reviewed by The New York Times, roughly $3 billion of these losses remain available to be applied against taxable income in the future.

From Losses to Profits—but Still No Taxes?

While SpaceX lost billions in its first two decades, its financial picture shifted after 2022. Thanks largely to the success of Starlink (its satellite internet business) and major NASA and Pentagon contracts, the company finally began generating significant profits.

Elon Musk recently told investors that SpaceX could record more than $15.5 billion in profits this year. Despite this turnaround, the company may pay little or no federal income tax because of the tax credits generated from its earlier losses.

In simple terms: every time SpaceX makes a profit, it can subtract its old losses from that amount, reducing or eliminating the tax it owes.

Federal Contracts, But No Federal Taxes

The report highlights a controversial issue: SpaceX relies heavily on U.S. government contracts—yet may contribute little back in federal taxes. Over the past decade, SpaceX has received tens of billions of dollars in federal funding, including contracts for NASA’s Commercial Crew Program, national security satellite launches, and even projects supporting Ukraine through Starlink.

Experts told the NYT that it is highly unusual for a company with such deep ties to the federal government to pay virtually no federal taxes. Critics argue that taxpayers are essentially financing SpaceX while the company avoids contributing tax revenue in return.

Has SpaceX Paid Any Taxes?

According to the report, SpaceX has paid some taxes—but likely not federal income taxes. These payments may include state-level taxes, payroll taxes, and taxes paid to foreign governments for operations abroad.

The New York Times reviewed 23 years of financial documents, including balance sheets and income statements. These showed that while SpaceX made tax payments here and there, there was little evidence that these were federal income tax payments.

How the Net Operating Loss (NOL) Carryforward Works

To understand why SpaceX’s situation is legal, it’s important to look at the Net Operating Loss carryforward rule:

- When a company’s deductible expenses exceed its income, it creates a “net operating loss.”

- Under pre-2017 rules, those losses could offset profits for up to 20 years.

- Under the Trump-era law, companies can now use those losses forever against future profits.

- The only restriction: losses can offset only up to 80% of taxable income each year.

For SpaceX, this means the $3 billion in losses it still carries forward can keep reducing its taxable income for many years—even while it makes billions in profit.

Expert Reactions and Criticism

Not everyone agrees with how this system is being used. Experts argue that the intent of the NOL rule was to help struggling companies recover, not to allow already-profitable giants to avoid taxes for decades.

Danielle Brian, executive director of the Project on Government Oversight, said the situation raises fairness questions. “It’s clearly not what lawmakers had in mind when they created these provisions,” she explained, noting the tension between taxpayer-funded contracts and near-zero tax contributions.

Others point out that while SpaceX may be following the law, the system highlights broader flaws in the U.S. corporate tax code.

Musk’s Bold Statement on Revenue

Elon Musk has not directly addressed the tax issue, but in June he highlighted SpaceX’s growing dominance. He stated that SpaceX’s commercial revenue from space operations will exceed NASA’s entire annual budget next year. NASA’s budget for 2025 is estimated at around $25 billion, meaning Musk expects his private company to surpass the very agency that helped fund its growth.

This underscores just how profitable SpaceX has become—and why the tax revelations are drawing attention.

The case of SpaceX illustrates the complicated relationship between government support, corporate profits, and tax law. On one hand, the company has revolutionized space exploration, reduced launch costs, and created critical technologies like Starlink. On the other, it appears to be using legal loopholes to avoid paying federal income taxes—despite relying heavily on taxpayer-funded contracts.

As SpaceX moves toward record profits, the debate over whether such companies should contribute more in taxes is likely to intensify. The issue may also become a political flashpoint, especially as Trump seeks another presidential term and critics highlight the long-lasting consequences of his 2017 tax law.

The Information is Collected from NYTimes and CBS News.