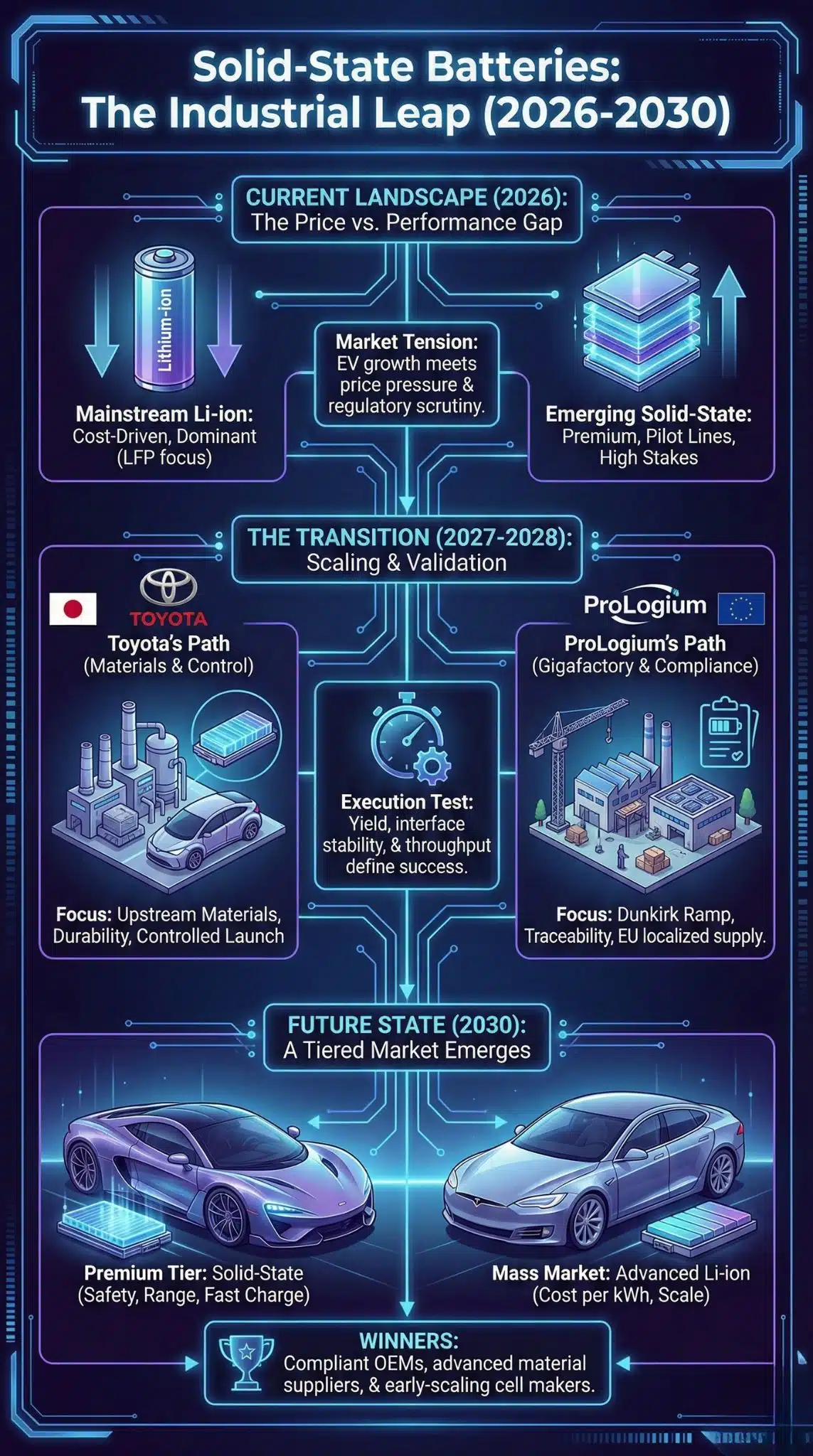

Solid-State Battery announcements are now being tied to factories, materials supply, and policy deadlines. Toyota’s 2027–28 target and ProLogium’s 2028 European ramp matter because EV growth remains strong, but price pressure is rising and regulators are tightening battery traceability. The next two years will show whether Solid-State Battery tech stays premium or reshapes mass-market EVs.

How We Got Here: Why Solid-State Took So Long To Arrive

Solid-state batteries have been “next” for so long that the phrase became a punchline. The core idea is straightforward: replace the flammable liquid electrolyte used in most lithium-ion cells with a solid material, ideally improving safety and unlocking higher energy density and faster charging.

The reason it has taken so long is also straightforward, and it is where most “breakthrough” headlines gloss over the real work. A battery is not just chemistry; it is a mechanical object that expands, contracts, and ages under heat, cold, vibration, and fast charging. Solid layers must stay in intimate contact through thousands of cycles. If they lose contact, resistance rises, heat increases, and the cell degrades. If manufacturing produces microscopic defects, the failure shows up years later as warranty claims.

That is why, even as research continued, the industry spent the last decade squeezing more performance out of conventional lithium-ion: better cathodes, silicon blends in anodes, improved separators, and smarter pack-level thermal controls. Meanwhile, EVs scaled into a global industry, and the definition of success changed from “can it work?” to “can it ship reliably, at yield, at cost?”

By the mid-2020s, EV adoption had reached a point where battery supply chains and pricing became as important as innovation. In that environment, “timeline” is no longer marketing. Timelines are capital plans, supplier contracts, compliance risk, and competitive strategy.

A Reality Check: The Market Is Big, And It Is Getting More Price-Sensitive

The EV story in 2026 is no longer “EVs are the future.” The question is what batteries dominate as the market becomes more competitive and more cost-driven.

Several trends matter at the same time:

- EV sales volumes have grown fast enough that battery manufacturing is measured in terawatt-hours, not pilot lines.

- Lithium-ion pack prices have been falling, with industry surveys showing record lows by 2025.

- The cost benchmark for mass-market EVs is increasingly defined by LFP, especially as Chinese supply expands globally.

- Commodity cycles are back in focus. Lithium price swings have reminded automakers that supply and processing capacity can tighten quickly.

That combination is why solid-state has to prove two things at once. It has to offer a clear advantage that customers will pay for, and it has to show a believable path to scalable manufacturing and cost reduction. In today’s market, “better” is not enough. It has to be “better and buildable.”

What The New Timelines Actually Indicate

The most meaningful signals from Toyota and ProLogium are not just performance claims. They are factory-linked plans and upstream materials commitments.

| Company | Most Concrete Public Signal | Timeline Marker | Why It’s A Big Deal |

| Toyota | A stated target window for all-solid-state EV deployment, reinforced by upstream materials and cathode plans | Targeting EV introduction around 2027–28, with related supply-chain milestones clustered in that period | It treats solid-state as an industrial program, not a lab project |

| ProLogium | Pilot output and a phased Europe ramp plan tied to a new factory site | Europe (Dunkirk) construction targeted to begin in 2026; mass production targeted for 2028; phased ramp after | It positions ProLogium as a supplier that intends to ship at scale under EU compliance norms |

Toyota’s timeline looks like a controlled launch that prioritizes reliability and supply security, likely starting in higher-end vehicles or limited-volume lines. ProLogium’s timeline looks like a supplier commercialization ramp: validate through pilot production, then scale into a regulated European footprint where localization and traceability increasingly matter.

Both are plausible. Both also imply that 2026–2028 will be early deployment, not an overnight conversion of the entire industry.

What A Solid-State Battery Must Deliver To Matter

Solid-state is usually pitched as three wins: safety, energy density, and charging speed. Those are real targets, but they are not the full story. In real vehicles, success is system-level.

A cell can have impressive energy density on paper and still disappoint as a pack because the pack needs structure, thermal controls, and safety systems. A cell can charge quickly for 200 cycles and still fail a warranty requirement. A cell can be safe in a puncture test and still be too expensive to adopt widely.

What makes the Toyota and ProLogium timelines interesting is that they are not simply describing a cell. They are describing pathways from cell to product.

Solid-State Battery Versus Mainstream Lithium-Ion

| Attribute | Mainstream Lithium-Ion Today | Solid-State Battery Goal | What Could Still Limit It |

| Safety | Flammable liquid electrolytes require robust mitigation | Solid electrolytes can reduce leakage and thermal runaway risk | Manufacturing defects and interface issues can still create failures |

| Energy Density | Improvements are incremental and hard-won | Higher gravimetric and volumetric density potential | Interfaces, dendrites, and cycle life can erode theoretical gains |

| Charging | Fast charging is improving but can accelerate degradation | Faster charging with less risk in principle | Heat, ion transport limits, and long-term durability still matter |

| Cold Performance | Often a weak point for many chemistries | Some solid designs may improve it | Others can be worse unless engineered carefully |

| Cost | Falling due to scale and LFP adoption | Expected to fall with yield learning and scaling | Early yields, materials, and CAPEX may keep costs high for years |

| Manufacturability | Highly mature global supply chain | Early-stage with competing designs | Yield and quality control decide viability |

The key analytical point is this: solid-state does not need to replace lithium-ion to matter. It needs to win a meaningful segment where the value of faster charging, longer range, or higher safety offsets higher early costs. If it achieves that, the learning curve can do the rest.

Manufacturing Is The Quiet Battle That Decides Everything

Most battery technology stories fail because they treat manufacturing like a footnote. It is not.

If you want a practical scoreboard for 2026–2030, watch three factory variables:

- Yield: how many cells come out meeting spec

- Interface stability: how performance holds after cycles and calendar aging

- Throughput: whether production can approach lithium-ion speeds

ProLogium has emphasized pilot output and validation narratives to signal manufacturability. Toyota has emphasized durability and supply-chain industrialization, including upstream materials and cathodes, to signal readiness and control.

Why Toyota’s Upstream Moves Matter More Than Another Prototype

For sulfide-based solid electrolytes, a key intermediate is lithium sulfide. When a supplier builds a plant for a specific intermediate, it is a sign that the company expects demand to move beyond lab scale. In February 2025 reporting, Japanese energy firm Idemitsu outlined plans to build a lithium sulfide plant with a completion target around mid-2027, and even estimated the output as enough for tens of thousands of EVs annually. That kind of number forces the conversation into the realm of supply planning, not speculation.

Toyota has also moved to strengthen cathode materials planning. In October 2025 reporting, Toyota and Sumitomo Metal Mining described progress toward cathode materials and targeted mass production timing around fiscal 2028. Cathodes are a cost driver and a performance driver. Bringing them into the “timeline” discussion is an indicator of industrial seriousness.

This matters because the hard problem in solid-state is not one miracle material. It is a stable, manufacturable stack of materials with consistent quality at speed.

The Bottlenecks That Still Apply

| Bottleneck | Why It’s Hard | What Would Count As A Breakthrough Signal |

| Solid-solid interface contact | Micro-gaps form with cycling; resistance rises; cracks develop | Third-party cycle-life data under automotive fast-charge conditions |

| Moisture sensitivity | Some solid electrolytes degrade in humidity | Demonstrated high-yield production with standard industrial controls |

| Scale-up throughput | Coating/lamination/sintering steps can be slower | GWh-scale lines with credible throughput and scrap-rate improvements |

| Quality assurance | Tiny defects can cause catastrophic failures | Warranty-grade validation and stable field performance in early fleets |

The implication for readers is clear: the 2027–28 window is not only about launch dates. It is about whether quality and yield improve fast enough for solid-state to escape “premium-only” status.

Geopolitics And Regulation: Europe Is Changing The Rules Mid-Game

Battery technology choices are increasingly shaped by industrial policy and regulation, not just engineering.

The European Union’s Battery Regulation, adopted in 2023, sets a framework that pushes the industry toward carbon-footprint reporting and a “battery passport” approach to lifecycle and supply-chain information. These requirements are staged over time and become more impactful as the decade progresses, especially for EV batteries. That matters because it changes what it means to be a viable supplier in Europe. Compliance is not optional, and traceability becomes part of the product.

Think-tank analysis around digital product passports has framed this as a broader shift toward auditable supply chains and circularity. In practice, it means automakers will increasingly prefer suppliers that can provide consistent data and compliance documentation, not just cells.

Why ProLogium’s Europe Ramp Is Strategically Timed

ProLogium’s Europe plan is not only a manufacturing decision. It is a positioning decision. It aims to place solid-state production inside a market where policy encourages localized manufacturing, traceability, and lifecycle reporting.

Earlier reporting in 2024 described ProLogium’s major investment ambition in France. More recent company statements emphasize a phased timeline: construction targeted to begin in 2026, mass production targeted for 2028, and ramping capacity through 2029–2030. Whether those milestones hold will shape how Europe views solid-state credibility.

Compliance Themes That Battery Makers Are Now Planning Around

| Policy/Compliance Theme | What It Pushes Companies To Do | Why It Matters For Solid-State |

| Carbon footprint accounting | Track emissions across materials, manufacturing, and transport | Favors producers with cleaner power and localized supply chains |

| Battery passport and data | Provide standardized lifecycle, sourcing, and performance data | Raises compliance capability as a competitive advantage |

| Due diligence scrutiny | Map supply-chain risk and auditability | Solid electrolyte and advanced cathode materials face the same scrutiny as today’s metals |

The subtle but powerful insight is this: regulation does not choose a chemistry, but it increasingly chooses which suppliers are investable and scalable in a given region.

Economics: Solid-State Must Win While Lithium-Ion Keeps Getting Cheaper

The biggest threat to solid-state may not be a rival solid-state technology. It may be the cost curve of conventional lithium-ion.

Battery industry surveys showed record-low average pack prices around 2025, reflecting scale, intense competition, and expanding LFP adoption. Reuters reporting has also highlighted how LFP cell pricing fell sharply in 2024 amid capacity expansion and competitive pressure. When mainstream batteries keep getting cheaper, the window for an expensive “next-gen” chemistry narrows.

So why do Toyota and ProLogium still press forward?

Because the value problem is not only price. Charging time, range, cold-weather performance, and safety perception still influence consumer adoption and fleet economics. Even modest gains in fast charging can change how drivers perceive EV usability. For fleets, charging time is productivity. For automakers, safety is liability risk and brand risk.

Commodity cycles also matter. In January 2026 reporting, Reuters described a surge in energy storage demand for lithium and cited forecasts pointing to a shift from surplus in 2025 toward possible deficits in 2026, depending on the scenario. That kind of market swing reminds automakers that “cheap batteries forever” is not guaranteed, especially when demand is rising across both EVs and stationary storage.

Solid-state does not eliminate lithium, but it can reshape value chains and potentially improve energy density and pack design in ways that reduce cost per mile or cost per lifetime.

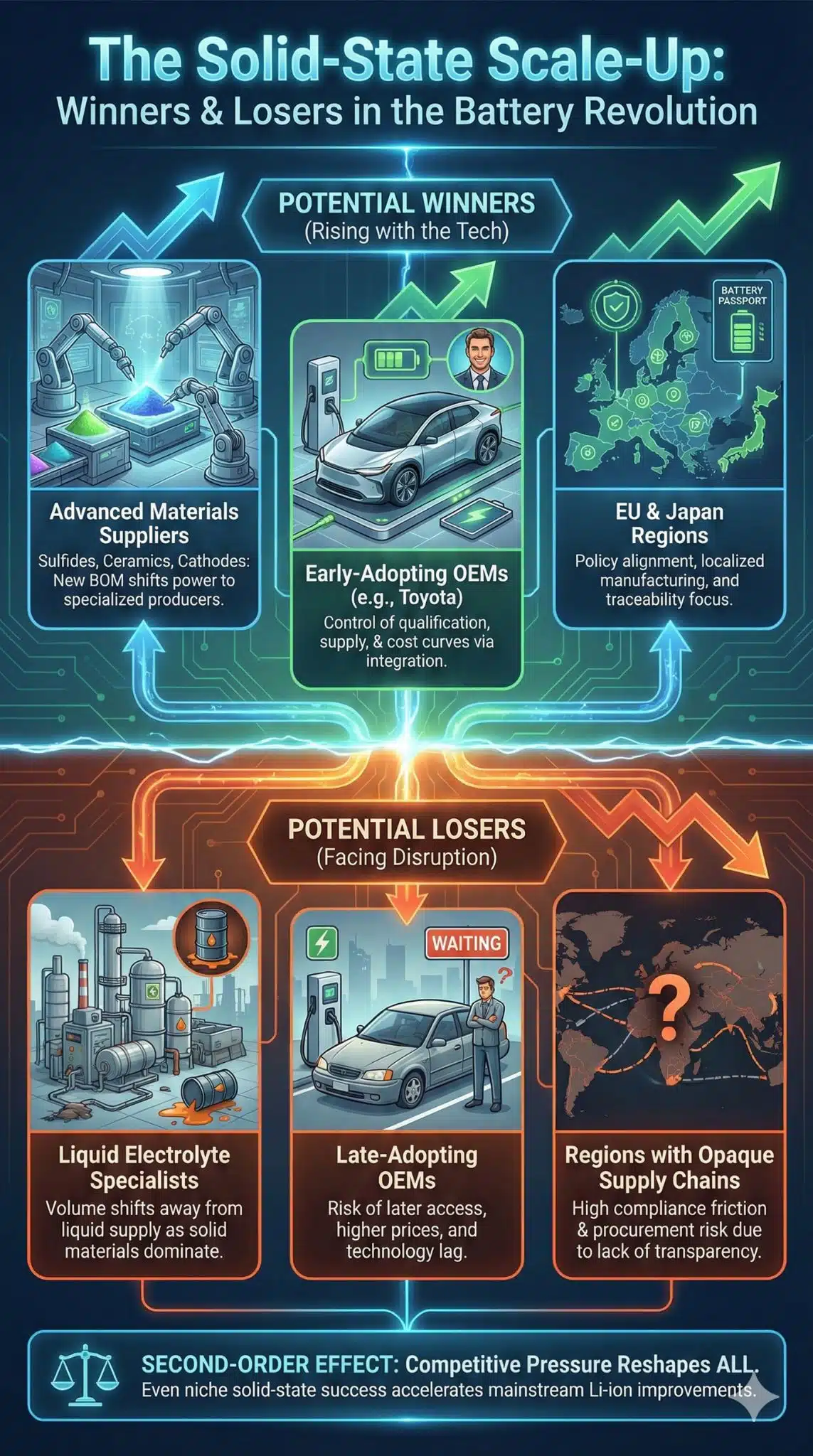

Who Wins And Who Loses If Solid-State Scales

Solid-state success would reshape parts of the battery supply chain, not just vehicle performance.

Toyota’s approach suggests the automaker wants control over critical inputs, particularly for electrolyte intermediates and cathode materials. ProLogium’s approach suggests it wants to become a high-value supplier category, building IP and manufacturing credibility while taking advantage of European localization and compliance requirements.

Winners Versus Losers In A Solid-State Expansion Scenario

| Segment | Potential Winners | Why | Potential Losers | Why |

| Materials | Suppliers of solid electrolyte precursors and advanced cathode powders | New bill of materials shifts bargaining power | Some liquid-electrolyte supply segments | Volume shifts toward solid materials over time |

| OEMs | Automakers that integrate supply early | Better control of qualification risk and cost | OEMs waiting for “off-the-shelf” solid-state | Potentially later access and higher prices |

| Cell makers | Companies with pilot-to-GWh learning curves | Faster credibility and customer adoption | Players stuck at lab demonstration | OEMs demand warranty-grade evidence |

| Regions | Europe and Japan if policy + supply chain align | Compliance and industrial support | Regions with opaque supply chains | Higher compliance friction and procurement risk |

A second-order consequence deserves attention: even if solid-state remains a smaller segment for several years, it can still influence the mainstream. If solid-state proves safer, it raises consumer expectations and regulatory scrutiny. If it proves faster-charging, it pressures lithium-ion makers to accelerate charging and durability improvements. Competitive pressure can reshape the entire market even before solid-state becomes dominant.

Expert Perspectives And The Case For Skepticism

A neutral analysis has to acknowledge why many analysts remain cautious.

The skeptical case is rooted in history. Solid-state breakthroughs have often looked impressive in controlled tests but struggled in real-world conditions. The most common failure mode is not one catastrophic flaw. It is a stack of compromises: cycle life that falls short, yields that remain too low, processes that are too slow, or costs that remain too high for more than niche segments.

The bullish case points to a maturing ecosystem: better materials science, stronger automotive demand signals, and the willingness of major industrial players to fund upstream plants and qualification programs. The most credible bullish signals are not the biggest numbers in a press release. They are third-party validation, factory timelines, and supplier investments.

The middle-ground view is increasingly the best planning assumption for 2026–2028: early deployment in premium or specialized applications, followed by a long runway of cost and yield improvement. That does not make solid-state a failure. It makes it a realistic industrial transition.

What Comes Next: The Milestones To Watch From 2026 To 2030

If you want a practical way to track who is winning without getting swept up in hype, focus on milestones that reveal execution, not aspiration.

2026: Construction And Customer Commitments

- ProLogium’s Dunkirk construction start, if it proceeds on schedule, will signal that its European plan is not just a headline.

- Watch for OEM program nominations that tie solid-state to specific vehicle launches and fleet testing plans, not generic “evaluation.”

2027: Upstream Materials Become A Bottleneck Or A Catalyst

- If lithium sulfide capacity ramps as planned, it reduces one key constraint for sulfide solid electrolytes.

- If it slips, it exposes how fragile first-wave solid-state supply chains can be.

2028: The Reality Window For Toyota And ProLogium

- Toyota’s stated 2027–28 target becomes real only if it shows reliable performance, not just introduction.

- ProLogium’s 2028 mass-production goal becomes credible only if yields, consistency, and customer acceptance align.

2029–2030: The Scale Test

- ProLogium’s phased ramp targets in the late 2020s are where the “supplier scale” story either becomes a durable business or remains a niche effort.

- For Toyota, the question becomes whether solid-state stays constrained to premium trims or begins migrating into higher volumes.

Final Thoughts

The real significance of solid-state in early 2026 is not the promise of a miracle battery. It is that the industry is finally behaving as if solid-state is a product category: upstream plants, cathode programs, phased gigafactory ramps, and compliance-aligned manufacturing strategies.

Toyota’s timeline matters because it is being reinforced by industrial moves in materials and cathodes that look like mass production planning. ProLogium’s timeline matters because it is positioning around pilot output, validation, and a European footprint at a time when the EU is raising expectations for traceability and lifecycle reporting.

Solid-state is unlikely to replace lithium-ion overnight. The more plausible future is a tiered market: lithium-ion dominates mass volumes on price, while solid-state wins where safety, charging speed, and energy density justify a premium. If solid-state then rides a learning curve and compliance advantages, it can broaden into larger segments. The story to watch is not whether solid-state exists. It is whether it ships, scales, and holds up under warranty reality.