Many want to buy crypto but feel lost. They worry about scams and weird blockchain words. They fear they will lose money.

People talk about Bitcoin and Ethereum every day. This guide will teach you blockchain technology. It will show you how to set up a crypto wallet, pick a trading platform, and start dollar-cost averaging.

You will also learn about hot wallets, cold wallets, and ways to diversify your portfolio. Read on.

Key Takeaways

- Blockchain links digital money in chained blocks. Bitcoin and Ethereum run on it. Ethereum moved to proof of stake in 2022 and cut gas fees by 60%.

- Compare exchange fees: Coinbase charges 0.5% spread, $0.99–$2.99 per trade, and $5–$25 withdrawals. Gemini offers 1.49% instant buys and free withdrawals. Robinhood has 0% trading fees and a 0.1–0.5% spread markup.

- Use a hot wallet like MetaMask or Trust Wallet for quick trades. Store long-term funds in a cold wallet such as Ledger Nano S Plus ($79) or Trezor Model One ($69). Enable Google Authenticator 2FA and keep your 12–24-word seed phrase offline.

- Start small with dollar-cost averaging: buy a set dollar amount each week to smooth 20–50% swings. Diversify across Bitcoin, Ethereum, and altcoins like Solana, Chainlink, and Polkadot. Include stablecoins to steady your portfolio.

- Track taxes and rules: export CSVs to CoinTracker or TaxBit. Follow IRS, SEC, and MiCA guidelines on capital gains. Plan exits with take-profit triggers (sell 25% at 2×) and stop-loss orders (limit losses at 20%).

Learn the Basics of Cryptocurrency

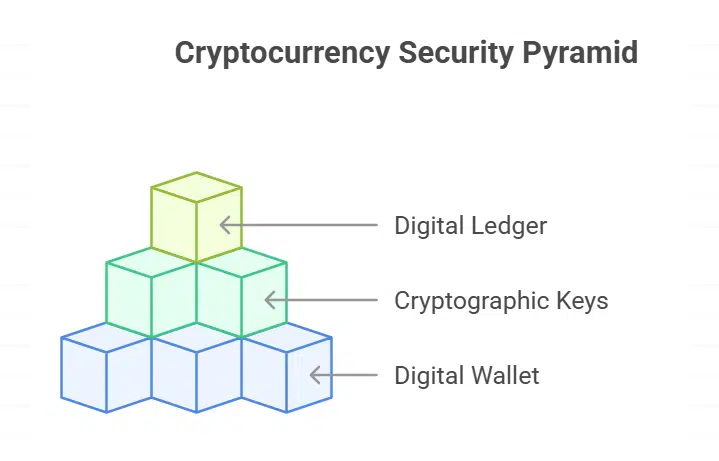

Use a basic digital wallet to house your tokens, and watch how cryptographic keys keep them safe. Then grab a short guide on the digital ledger, to see how each block links in the chain.

What is blockchain technology and how does it work?

A blockchain holds digital currency moves in blocks. Blocks stack like train cars on rails, so you know which one comes next. The ledger lives on decentralized networks, not on a single server.

Anyone can view transactions with a public key, but they need a private key to spend coins. Bitcoin and Ethereum run on this system. It cuts out banks, so digital money moves peer to peer.

Two main consensus mechanisms power blockchains. Proof of work makes miners sweat over math puzzles. Proof of stake picks validators based on coins they lock up. Ethereum switched to proof of stake in 2022.

That move cut gas fees by 60 percent. All transactions remain transparent and auditable. A cold wallet or a hardware wallet can store seed phrases and keep your crypto assets safe.

What are the key cryptocurrency terms I should know?

Blockchain technology powers digital money. It works like an open ledger you cannot erase. Bitcoin feels like digital gold for investors. Ethereum lets code run on that ledger. Altcoins, all tokens beyond Bitcoin and Ethereum, offer new features.

Stablecoins tie to the US dollar to cut wild swings.

Crypto wallets hold your coins and tokens. A hot wallet sits online and feels like your checking account. A cold wallet stays offline like a lockbox at home. Hardware wallets add a chip to boost crypto security.

Two-factor authentication or 2FA adds a second lock on your account. You use a 12–24 word seed phrase to recover access. You need it if you lose the device.

Choose a Trusted Crypto Exchange

Pick a cryptocurrency exchange that shows clear fee charts and runs bug bounty hunts, so white hats can spot weak spots. Lock down your account with an authenticator app, and scan user chat to catch red flags before you buy your first coin.

How do fees and features compare across crypto platforms?

Fee and tool stacks shift by platform.

| Platform | Trading Fee Structure | Withdrawal Fee | Deposit Options | Feature Note |

|---|---|---|---|---|

| Coinbase | 0.5% spread $0.99–$2.99 per trade |

$5–$25 per transfer | Bank transfer (up to 15 days) Card, PayPal (3–4% fee) |

Supports 240+ coins |

| Gemini | Instant buys 1.49% Active traders 0.35% |

Free withdrawals | Bank transfer, card | No withdrawal charges |

| Robinhood | 0% trading fee 0.1–0.5% spread markup |

$5–$25 per transfer | Bank transfer, card | Simple mobile interface |

How can I verify security and read user reviews?

Check each trading site for two-factor authentication (2FA) and cold storage of at least 95 percent of funds. Scan SEC regulations or MiCA filings to confirm legal compliance. Seek out deposit insurance to shield your assets during platform failures.

Test the support team with a simple query to see how fast they reply. Watch for a bug bounty program to spot security gaps before criminals find them. Link a hardware wallet to keep private keys offline for strong crypto security.

Browse crypto communities and review sites for real user reports on withdrawal delays or security breaches. Spot stories about crypto scams or stolen credentials. Shun platforms with frequent hacking news or user funds gone missing.

Verify active licenses and past regulatory filings in the platform’s public records. Check mobile app comments if you plan day trading or swing trading on the go.

Set Up a Secure Digital Wallet

Pick a mobile app wallet, jot your seed phrase on paper, tuck it away like a secret map. Then plug in a USB key vault, flip on two-factor authentication, it feels like a guard dog watching your stash.

What are the differences between hot wallets and cold wallets?

Hot wallets live online. Software wallets like MetaMask or Trust Wallet run as apps. Traders use them for fast crypto trades, balance checks, coin transfers. They cost nothing and offer little crypto security.

These wallets save your seed phrase on your phone or PC. Hackers target them with phishing sites or malware. Many people use hot wallets for day trading.

Cold wallets keep keys offline. Device wallets such as Ledger Nano S Plus ($79) or Trezor Model One ($69) sit in your safe. You connect them by USB only when you move funds. They block remote hacks and phishing scams.

They make solid gear for long-term crypto storage on blockchain networks. Manual steps slow frequent moves but boost peace of mind.

Which wallet options are best for beginners?

Coinbase Wallet works free with the Coinbase exchange. MetaMask runs on Chrome and links to many dapps. Trust Wallet stays on your phone and holds a wide range of cryptocurrencies.

Software wallets act as hot wallets and let you shift to hardware cold wallets as your portfolio grows.

Hardware wallets boost security for long-term holding. Ledger Nano S Plus costs $79 and stores over 5,500 coins offline. Trezor Model One sells for $69 and locks keys in a secure chip.

Material DIY offers fireproof, waterproof boxes for seed phrase backups. Always keep recovery phrases offline and in multiple secure spots for strong crypto security.

Start Small with Dollar-Cost Averaging

You can ease in with dollar-cost averaging, by adding a small amount to your Coinbase wallet every week. This habit tames wild price swings, and it trains your risk tolerance over time.

Why should I avoid investing large sums at once?

Crypto values can swing 20 to 50 percent in a single day. A single $1,000 lump sum can drop fast, slicing your balance by half. Hype can drive prices sky high, causing regret after the dust settles.

Newcomers to crypto investing place big bets and watch wallets shrink.

Dollar-cost averaging cuts timing stress and builds position over weeks. It places small, regular buys to smooth out wild moves. This strategy fits sound risk management and aids portfolio diversification.

Store coins in a hardware wallet or cold wallet for extra crypto security. Only invest money you can afford to lose.

What are the benefits of consistent, small investments?

Dollar-cost averaging means small buys over time, no matter the price swings. This style of crypto investing cuts timing risk and builds discipline. You can set up buys on a cryptocurrency exchange or use a crypto wallet’s recurring feature.

It kills the urge to panic sell when markets dip.

Over months, you might see a better average entry price. Small stakes guard your rainy day cash and boost confidence with blockchain tools. You learn risk management and diversify your portfolio without stress.

This habit helps you hold longer, and skip the wild swings of day trading.

Diversify Your Portfolio

Don’t crowd all your crypto into one basket. Mix big coins with sprinkles of altcoins, and track them with market trackers and block explorers.

Why should I invest in a mix of cryptocurrencies?

Mixing cryptocurrencies spreads risk across assets, so a crash in one token can’t wipe out your whole balance. Bitcoin and Ethereum rank as the safest entry points, backed by strong institutional moves like BlackRock’s IBIT ETF in 2023.

Altcoins expose you to growth areas, such as DeFi and NFTs, that big coins might miss. Stablecoins peg to the U.S. dollar, which smooths out portfolio swings.

Blockchain technology and its decentralized networks power coins in different ways, and that can help cushion sudden drops. A diverse mix fits both day trading and long-term holding, and it matches various risk tolerance levels.

This strategy highlights core crypto investing tactics, like portfolio diversification, for smarter swings in volatile markets.

How do I research altcoins beyond Bitcoin and Ethereum?

Start by checking a coin’s use case, team, and adoption. Look at Solana, Chainlink, Polkadot, Avalanche, Cosmos. Solana drives NFT growth and holds a $52.05 billion market cap. Chainlink feeds real data to smart contracts.

Polkadot and Cosmos build blockchain interoperability. Avalanche wins on fast finality. Check each coin’s trading volume and market cap to gauge liquidity and stability. Read its history, count active developers on public code repos.

Watch community size and chatter in crypto communities on Reddit or Discord. Skip coins that hype loud on forums. They often peak too soon.

Use CoinDesk or The Block for news, and scan Binance Academy for tutorials. Explore defi projects on decentralized networks for real mind share. Chat with investors on Discord to gauge risk tolerance and market mood.

Track price moves for swing trading and long-term holding. Open a block explorer to watch big trades flow. Lean on portfolio diversification and risk management for any move. Treat many new tokens as risky.

They often lack long-term potential.

Prioritize Security Measures

Lock down your crypto stash with a hardware wallet and two-factor authentication (2FA) via Google Authenticator, and slam the door on phishing scams. Guard your seed phrase like a secret diary, tuck it offline, and set up a strong password before you fire up more trades.

How do I enable two-factor authentication (2FA)?

Pick Google Authenticator or Authy to add 2FA to your crypto wallet or exchange. Open crypto security settings in your Coinbase or Gemini account. Coinbase and Gemini require 2FA for withdrawals.

Tap the 2FA option. Scan the QR code with your app. Write down backup codes on paper and hide them offline. Skip text message codes since scammers can use SIM swap attacks. Link your app code with a strong, unique password.

This double shield blocks most phishing scams and protects your crypto trading funds.

Why use hardware wallets for long-term storage?

Cold wallets lock private keys offline, shielding them from hackers and malware. A USB dongle like Ledger Nano S Plus ($79) or Trezor Model One ($69) acts like a vault for crypto investing.

Each transaction needs a tap on the gadget. This step cuts phishing and malware risk.

Dongles act as a cold crypto wallet and support thousands of coins for portfolio diversification. You must store your seed phrase offline, maybe in a MATERIAL DIY kit or a MATERIAL BITCOIN pouch.

Losing that phrase means permanent loss of funds. Serious investors and institutions pick cold storage for large, long-term holding.

Understand Tax and Legal Implications

Use a crypto tax calculator or a simple spreadsheet to log every trade as a taxable event. Check IRS guidelines on capital gains and losses to file correctly and avoid fines.

How do I track crypto transactions for taxes?

Export your transaction history from exchanges like Binance, or from your crypto wallet. Feed CSV files into CoinTracker or TaxBit. Track every crypto trading event, including swaps from BTC to ETH.

Mark dates, amounts, and prices for each trade. Rely on those tools to calculate gains and losses for your crypto tax forms.

Missing a sale or swap can spark errors and penalties. Many platforms let you download monthly reports in your account settings. Back up those files in a secure folder or on a cloud drive.

Employ tax software to automate cost basis calculations and form generation. Report only realized gains from trading or purchases, since holding crypto stays tax free until sold.

How can I stay updated with local crypto regulations?

Follow the SEC site in the U.S. for rules on mandatory registration of centralized platforms and the MiCA portal for standard requirements across EU countries. Visit Canada revenue and UK tax authority pages to see how they treat crypto as property under standard capital gains rules.

Scan those sites each tax year for new reporting rules. Subscribe to Bloomberg Crypto, CoinDesk, CNBC for regulatory news.

Join local crypto communities on Discord or Telegram for live rule talks. Discuss new policies on crypto trading and crypto tax with fellow investors. Save official policy links in your note files for quick reference.

Hear how changes affect decentralized networks and blockchain technology.

Stay Informed with Reliable Resources

Stay sharp by scanning news feeds from top trading hubs and chain ledger blogs. Join a Discord or Reddit group, grab your cold vault key, and share hot takes with fellow stargazers.

Where can I find trustworthy cryptocurrency news and trends?

CoinDesk and The Block offer fresh crypto trading news each day. Bloomberg Crypto reports price swings, regulation changes. CNBC covers major market events and legal shifts for crypto investors.

Official project blogs list protocol updates and coin roadmaps.

Binance Academy posts free tutorials on blockchain basics and wallet safety. MATERIAL BITCOIN BLOG shares clear, beginner guides on decentralized networks and crypto wallet security.

Coin Bureau on YouTube shows unbiased coin reviews and strategy tips for swing trading. Finematics and BK Crypto Trader break down smart contract code and market signals. Most of these sources explain two-factor authentication steps.

Reddit and Telegram groups connect traders, spark chat on scams, and share token alerts.

How do I join reputable crypto communities?

Find r/CryptoCurrency and r/BitcoinBeginners on Reddit to ask questions and study market moves, you can learn crypto trading tips. Check out Discord groups for major projects, you get direct chat with developers and other crypto investors.

Always verify community authenticity before sharing your seed phrase to avoid phishing scams and fake coupon drops. Do not join chats that promise guaranteed returns or urgent deals.

Join forums with clear rules and strict moderation to boost your crypto security. Engage in Q and A threads to learn from experienced investors, and pick up portfolio diversification ideas.

Attend educational webinars and AMA sessions for new insights on blockchain technology. Use Telegram cautiously, many chat groups lure newcomers with scam pitches.

Develop a Clear Exit Strategy

Set clear profit and loss levels, like a sell-stop order on Coinbase or a sell-limit order on Binance, to lock in gains and curb losses. Then, track your wins and setbacks in a simple spreadsheet as you surf the crypto waves.

How do I define profit and loss thresholds?

Risk management starts with clear profit goals. Sell about 25 percent when your portfolio doubles. Use take-profit triggers on your crypto trading platform to lock in gains at set price points.

Write your price targets before you fund any position. Adjust those targets to match your risk tolerance and market conditions in your investment strategy.

Pick a loss limit around twenty percent to stop big dips. Place a stop-loss trigger to sell coins if prices tumble. Create a time-based exit, such as a five-year hold on long-term assets.

Record every exit rule in your plan to curb emotion. This approach keeps your crypto investing on track.

How can I plan for market volatility?

Plan for swings by setting clear profit and loss limits on your crypto trading platform. Use stop-loss orders to cap losses. Price swings can reach 20 to 50 percent in a single day and spike anxiety fast.

Use dollar-cost averaging to invest small amounts over weeks and cushion entry price. Use portfolio diversification across cryptos to spread risk.

Track token news, regulatory changes, and market updates that can trigger sudden drops. Adjust holdings with a portfolio tracker or mobile app and rebalance as needed. Stick to your exit strategy while avoiding panic trades during volatile swings.

Limit any stake to funds you can afford to lose and ease stress.

Takeaways

Ten simple steps now stand between you and your first crypto trade. You know how blockchain works and key terms like hash and token. You picked a trading venue like Coinbase or a niche exchange.

Digital vaults and hardware devices keep your coins safe. Buying small with dollar-cost averaging tames wild price swings. You spread bets across Bitcoin, Ethereum, and some altcoins.

You lock accounts with two-step codes and store most coins offline. You track each move for tax time and join a crypto chat group for fresh tips. You set clear gain and loss limits to curb panic selling.

Now you can step into 2025 with more excitement than doubt.

FAQs on Simple Steps to Start Your Crypto Journey

1. How do I pick a safe crypto wallet?

Pick a hot wallet for quick moves. Or choose a cold wallet for tough security. You can also use a hardware wallet, it stays offline in a safe. Turn on two-factor authentication, or 2fa. Write your seed phrase on paper, lock it up. Think of the seed phrase as a treasure map to your coins.

2. How can I start small and build my crypto portfolio?

Use dollar-cost averaging. Buy a bit each month with a credit card or through your banking app. Match each buy to your risk tolerance. This stops big price swings from spooking you. Spread funds across coins for solid portfolio diversification.

3. Should I chase short-term gains or go for long-term investing?

Do you like thrills? Try day trading or swing trading for short-term gains. If you want calm, lean on long-term investing or long-term holding. Mix both to form a strong investment strategy. That way, your financial future lines up with your risk-taking style.

4. How do I spot and avoid crypto scams?

Beware of crypto scams and phishing scams on the web. Do not click odd links in your inbox. Never share your keys. Say no to ponzi scheme pitches. Join real crypto communities. Keep apps updated to block malware attack and keystroke logging. Watch alerts from the financial regulator.

5. Do I need to worry about crypto tax?

Yes, crypto tax means you pay on gains from each trade on a cryptocurrency exchange. Track every buy and sell. Save your receipts in cloud storage. You can also seek financial advice for loans or a home equity line of credit.

6. Why does blockchain technology matter in crypto?

Blockchain technology stores each deal in a block, it stops any double-spend. It runs on decentralized networks and fuels defi, or decentralized finance. This setup keeps your coins safe and makes the whole system fair.