In a major political development on Tuesday, the Republican-led U.S. Senate passed President Donald Trump’s sweeping legislative proposal known as the One Big Beautiful Bill. This critical victory represents a significant step toward the president’s ambitious goal of signing the legislation into law before the July 4 deadline.

The bill passed the Senate by a narrow margin of 51 to 50, with Vice President J.D. Vance stepping in to cast the tie-breaking vote. This rare intervention by the Vice President underscored just how tightly contested the legislation was. Among Republicans, three senators — Susan Collins of Maine, Thom Tillis of North Carolina, and Rand Paul of Kentucky — broke ranks and voted against the bill, citing various policy and fiscal concerns.

What the Bill Includes: Taxes, Defense, and Border Spending

The One Big Beautiful Bill, also informally referred to as the “Trump 2.0 Agenda,” is a sweeping piece of legislation that combines tax reform, national security investment, and cuts to federal welfare programs.

One of its core features is the extension of the 2017 Tax Cuts and Jobs Act, which was originally set to expire in late 2025. The bill makes these tax reductions permanent, including those for individuals, small businesses, and corporate entities. In a move aimed at gaining support from working-class Americans, the bill includes tax breaks on tips and overtime pay, a first-of-its-kind federal policy shift targeting service and gig economy workers.

Additionally, the bill allocates increased funding for the U.S. military and expanded resources for border security infrastructure, including physical barriers, surveillance technologies, and personnel expansion. Proponents argue that this military and border spending will enhance national safety, deter illegal immigration, and create defense sector jobs across several states.

Strategic Significance Ahead of the 2026 Midterm Elections

The timing of this bill is particularly critical. With the 2026 midterm elections on the horizon, the GOP is attempting to solidify its legislative track record. Currently holding only a slim majority in the House of Representatives, Republicans hope this bill will serve as a showcase of their ability to legislate and deliver results. Party strategists believe the bill’s provisions — especially those offering direct tax benefits and visible border enforcement — could play well with the Republican base and undecided voters.

The bill is being described within GOP circles as their biggest legislative victory in recent years, giving them a flagship success to campaign on during what is expected to be a contentious and highly polarized midterm cycle.

The Road Ahead: House Vote Remains Crucial

While the Senate approval is a critical milestone, the bill must still pass in the House of Representatives, where Republicans also hold a fragile majority. House Speaker Mike Johnson has announced plans to bring the bill to the floor as early as Wednesday, July 2, aiming to meet President Trump’s target for signing it into law by Independence Day.

Although the House is generally seen as more favorable to the bill’s provisions, especially on taxes and border funding, several moderate Republicans and nearly all Democrats are expected to raise objections, particularly to the bill’s cuts in social welfare programs and its implications for the national debt.

Sharp Criticism from Democrats: Tax Relief for the Wealthy, Cuts for the Poor

Democratic lawmakers have come out strongly against the One Big Beautiful Bill, calling it a massive giveaway to the wealthy at the expense of the most vulnerable. They argue that the bill’s permanent tax cuts overwhelmingly benefit corporations and high-income earners, further widening the gap between rich and poor.

In contrast, key social programs like Medicaid, which provides healthcare for low-income Americans, and the Supplemental Nutrition Assistance Program (SNAP), commonly known as food stamps, face significant reductions in funding under the new bill. Democrats warn that millions of Americans will lose access to essential health and food security services.

They are particularly concerned about how these reductions will affect children, the elderly, and people with disabilities. Several Democratic governors and nonprofit organizations have echoed these warnings, predicting a rise in homelessness, food insecurity, and emergency room visits due to a lack of access to preventive healthcare.

Fiscal Impact: Trillions Added to the National Debt

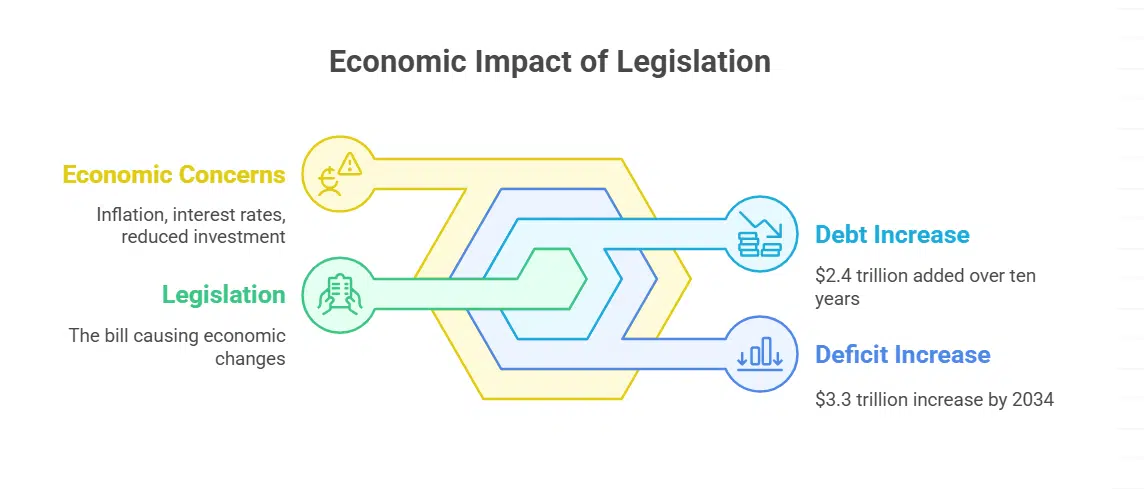

An in-depth analysis by the Congressional Budget Office (CBO) has raised serious alarms about the bill’s long-term economic impact. According to the nonpartisan agency, the legislation will add $2.4 trillion to the national debt over the next ten years. Additionally, it is projected to increase the federal deficit by approximately $3.3 trillion between 2025 and 2034.

This substantial increase in government borrowing comes at a time when the national debt is already at a historic high. Fiscal conservatives within and outside the Republican Party are voicing concern that such spending is unsustainable and could trigger inflation, higher interest rates, and reduced public investment in infrastructure, education, and science.

Millions Could Lose Health Coverage

Beyond the fiscal outlook, the social implications of the bill are also deeply concerning to many experts. The CBO projects that the healthcare-related changes in the bill will result in 11.8 million more Americans becoming uninsured by 2034. This includes individuals who would lose Medicaid eligibility and others affected by the repeal of Affordable Care Act (ACA) subsidies.

Public health experts have warned that these losses in coverage could lead to poorer health outcomes, rising medical debt, and overburdened emergency services, especially in rural and underserved areas. Hospitals that rely on Medicaid reimbursements are also expected to feel the financial strain, potentially leading to service cutbacks or closures.

Broader Criticism from Economists, Advocates, and International Observers

Economists, advocacy groups, and even international financial institutions are watching this bill closely. Some analysts have likened it to a short-term political win with long-term economic risks. They argue that while tax breaks may boost consumer spending in the short term, the long-term debt accumulation and social safety net reductions could outweigh those benefits.

Environmental groups are also expressing concern. The bill reportedly cuts funding for several renewable energy tax credits introduced under the Biden administration, potentially reversing progress on clean energy transitions and climate goals.

What’s Next: High-Stakes Vote in the House

As the House prepares to vote, the stakes could not be higher. If passed, the One Big Beautiful Bill will become one of the most consequential pieces of legislation in modern American history. It would reshape the nation’s tax code, alter the structure of social welfare programs, and redefine the role of government in areas like health care, national defense, and border enforcement.

For President Trump, securing this bill would be a defining moment of his second term. For the country, it may mark the beginning of a new economic and political era — one marked by lower taxes, greater military spending, and a leaner, less expansive federal government.