Samsung’s 130-Inch Micro RGB TV is a signal that “ultra-premium” is no longer just about OLED. By pairing an RGB backlight with AI processing and a gallery-style frame, Samsung is trying to turn the living-room screen into both cinema and decor as 2026’s upgrade cycle heats up and rivals catch up.

How We Got Here: From The Wall To A Living-Room “Statement Screen”

Samsung’s choice of narrative matters almost as much as the hardware. Calling this 130-inch set “Micro RGB” while invoking the spirit of “The Wall” is a deliberate bridge between two eras of premium TV.

“The Wall” began life as a modular, ultra-expensive MicroLED concept that proved Samsung could scale display tech far beyond conventional panels. It was also a product that lived more comfortably in luxury installs and showrooms than in typical homes. Over time, Samsung pushed MicroLED closer to residential use cases, including all-in-one configurations, but pricing and installation complexity kept it a niche for most buyers.

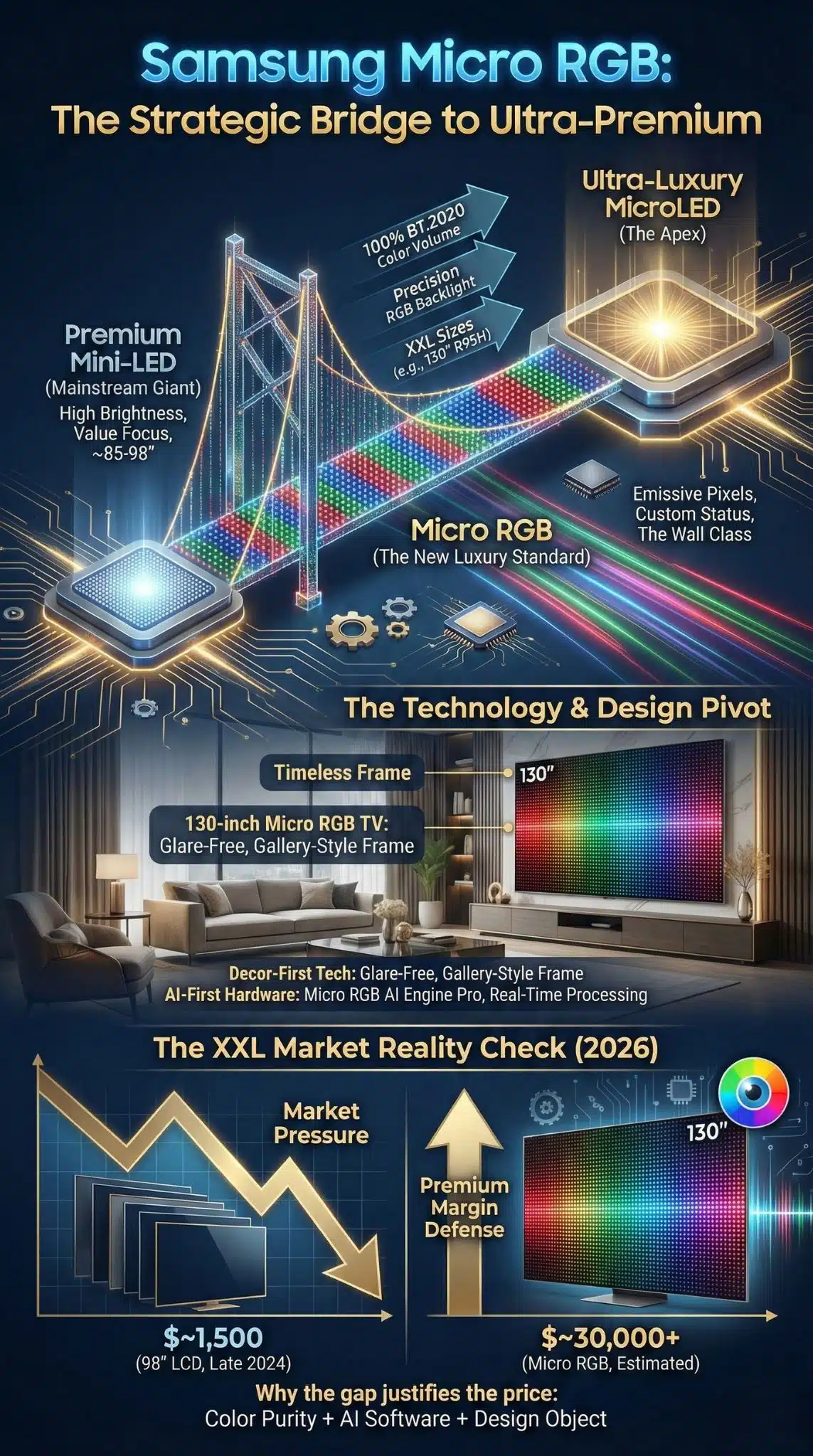

Micro RGB is Samsung’s attempt to take the aspiration of that category, the wow factor of wall-sized cinema, and attach it to a technology and cost curve that can plausibly expand faster than true MicroLED. The company launched its first Micro RGB TV commercially in 2025 at 115 inches, positioned as a new ultra-premium rung below MicroLED but above conventional Mini-LED LCD.

CES 2026 is the moment Samsung tries to make that rung feel like a platform rather than a one-off: a flagship 130-inch halo model (R95H) that looks like a design object, paired with an expanding Micro RGB lineup in smaller sizes that could eventually normalize the idea of “RGB backlit” TVs in premium retail.

| Milestone | What Changed | Why It Mattered |

| 2018: “The Wall” shown widely | Modular MicroLED at extreme sizes | Established Samsung’s “bigger than TV” identity |

| 2025: First Micro RGB TV launched (115″) | Micro-scale RGB backlight for LCD | Introduced a cheaper path to high-end color at huge sizes |

| Late 2025: 115″ pricing becomes public | Roughly $29,000 to $32,000 range reported | Anchored Micro RGB as luxury, but not MicroLED-level luxury |

| Jan 2026: 130″ Micro RGB at CES (R95H) | Bigger, bolder design, AI-heavy positioning | Reframes “ultra-large” as art plus AI, not just size |

Micro RGB Explained: A Strategic Middle Layer Between Mini-LED And True MicroLED

A lot of confusion is predictable because “Micro RGB” sounds like “MicroLED.” Samsung’s CES messaging leans into “world’s first 130-inch Micro RGB,” but the underlying idea is closer to an LCD with an unusually sophisticated backlight than to a self-emissive MicroLED wall.

Micro RGB uses microscopic red, green, and blue LEDs in the backlight architecture, instead of the more typical blue or white LED backlight used in many Mini-LED LCD designs. That can improve color precision, reduce reliance on color filters, and potentially increase efficiency, but it still behaves like an LCD system with local dimming rather than per-pixel emissive control.

Samsung is explicit about the color ambition: 100% coverage of BT.2020 is the headline claim, with additional mentions of glare reduction and AI-driven control of the RGB light system.

Here is the strategic read: Micro RGB is less about chasing OLED at its strengths, like perfect blacks and per-pixel control, and more about reshaping what “premium LCD” can do in brightness, large-size manufacturing, and color volume. It also sidesteps some OLED anxieties that still influence high-end buying, especially for bright rooms and long static-content use cases.

| Attribute | OLED | Mini-LED LCD | Micro RGB LCD | MicroLED (“The Wall” Class) |

| Blacks and contrast | Excellent (per-pixel) | Very good (zone-based) | Very good to excellent (zone-based, better color control) | Excellent (emissive) |

| Peak brightness potential | Improving fast | Very high | Very high | Very high |

| Color approach | Emissive pixels | Backlight plus filters/quantum dots | RGB micro-scale backlight, finer color control | Emissive RGB subpixels |

| Burn-in risk | Exists (varies by use) | Low | Low | Low |

| Best use case today | High-end cinema, gaming | Bright rooms, big screens value | Luxury big-screen color and brightness | Ultra-luxury installs |

| Cost curve | Falling steadily | Falling fast | Premium, early-stage | High, niche |

| Practical scaling to 100″+ | Limited, improving | Strong | Strong | Strong, but expensive |

The Economics Of Going Big: When 98 Inches Gets Cheap, Luxury Must Move Up-Market

The most important backdrop for Samsung’s 130-inch push is economic.

Ultra-large LCD TVs have gotten dramatically more affordable, fast enough to change the social meaning of “big TV.” Industry analysts have described an industry race in the 98-inch to 100-inch segment that helped push XXL TVs into mainstream retail promotions. Trade reporting has also highlighted how average selling prices for 98-inch and 100-inch LCD TVs in the U.S. hovered around $1,500 during late 2024, helping explain why 80-inch-plus demand has accelerated.

If consumers can buy a near-IMAX-sized LCD for the price of a midrange phone, then a premium brand like Samsung must re-invent the top end. Size alone no longer protects margin. That is why Micro RGB matters: it gives Samsung a story for why a screen that is not just larger, but materially better in color, glare performance, and processing, should cost multiples more than the “big and good enough” options.

Samsung’s 115-inch Micro RGB pricing anchors that strategy. Credible trade coverage reported an MSRP around $29,000, with additional reporting of pricing around KRW 44.9 million, roughly $32,000 in South Korea, depending on market and timing. Samsung’s regional retail pages have also shown premium pricing for the 115-inch Micro RGB class, reinforcing that this category is meant to sit far above mainstream XXL LCD.

| Segment Example | Typical Price Signal | What Buyers Optimize For |

| Mainstream XXL LCD (98–100″) | Around $1,500 cited for late 2024 U.S. ASP | Size-per-dollar, “good enough” HDR |

| Premium Mini-LED (85–98″) | Multi-thousand dollars, rapidly falling | Brightness, gaming, zones, value |

| Micro RGB luxury (115″) | Roughly $29,000 to $32,000 reported | Color accuracy plus huge size without MicroLED pricing |

| MicroLED wall-class | Often tens of thousands to six figures | Status, emissive performance, custom installs |

The question for 130 inches is not just “what will it cost,” because Samsung did not broadly publish consumer pricing at launch. The deeper question is: can Samsung build a ladder where Micro RGB becomes a repeatable platform, letting it keep a luxury tier even as the bottom of the XXL market collapses in price?

The Living Room As A Gallery: “Timeless Frame” And The Rise Of Decor-First Tech

Samsung is also trying to shift what buyers think they are purchasing. The R95H’s “Timeless Frame” approach and stand-based presence are meant to make the device feel like architecture or furniture, not a black rectangle. CES coverage described the set as window-like, even floating, a design stance that echoes Samsung’s broader lifestyle-TV strategy that began with The Frame and its art-first positioning.

This matters because the premium TV fight is no longer only fought in dark home theaters. It is fought in bright, multi-purpose living spaces where glare, decor coherence, and “does this dominate my room” anxiety shape the purchase as much as picture metrics.

Samsung’s glare-reduction narrative is central here. Its “Glare Free” approach on premium models has become a signature, and CES 2026 reporting reinforced that Micro RGB is part of that same push to make large screens usable in real homes, not just controlled lighting environments.

The design move also answers a threat. LG is bringing back ultra-thin “Wallpaper” style OLED concepts and pairing them with wireless or minimal-box approaches, effectively competing on “a TV that disappears into the room.” Samsung’s response is the opposite: make the screen a centerpiece, but a curated one.

AI Becomes The Feature That Sells The Panel: The New TV Stack Is Software-First

The most durable message from CES 2026 may be that display hardware is now only half the premium product. Samsung’s Micro RGB launch language leans heavily on AI processing and “companion” functionality, including Vision AI Companion and a Micro RGB AI Engine Pro framing that suggests the panel is only as good as the system that drives it.

Coverage also highlighted Samsung’s positioning around voice interaction, live translation, AI-generated wallpapers, and integrations that connect to broader assistant ecosystems, including Microsoft Copilot and Perplexity references in CES reporting.

This is not cosmetic. It is a defensive strategy against commoditization:

- If panel quality converges, brands need software experiences that feel sticky.

- If big-screen LCDs get cheap, premium brands need intelligence-driven differentiation.

- If streaming apps dominate, the OS and recommendation layer becomes an economic moat.

But AI also introduces risk. Adding always-on assistants, translation features, and deeper “companion” positioning raises privacy questions, update obligations, and long-term support expectations. Samsung’s ability to maintain performance and trust over years may become as important as initial picture quality for buyers spending luxury money.

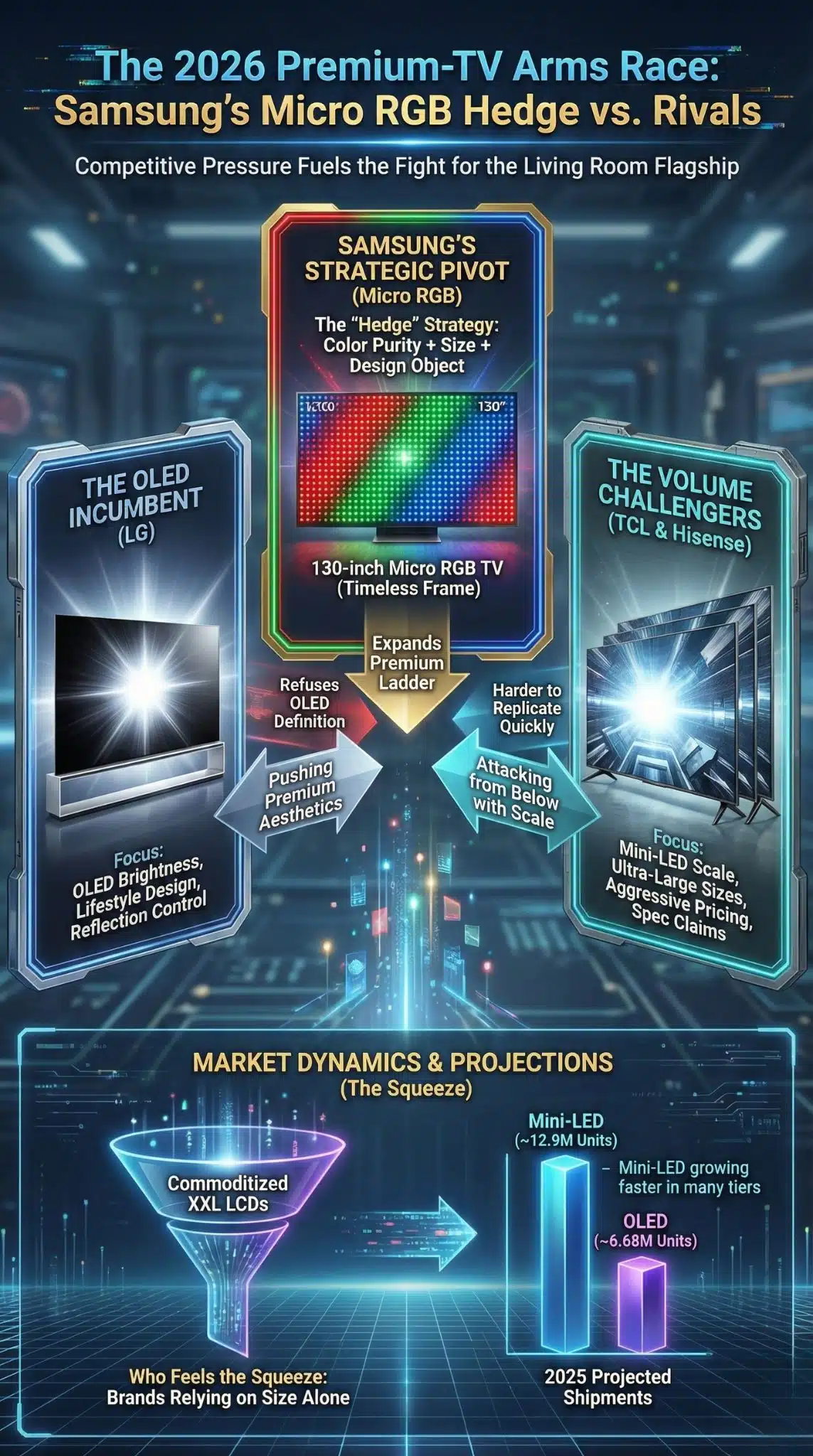

Competitive Pressure Is The Real Fuel: LG, TCL, Hisense, And The Premium-TV Arms Race

Samsung did not choose this moment randomly. The premium TV segment is getting attacked from below by Chinese brands that have become extremely competent at Mini-LED, ultra-large sizes, and aggressive pricing.

Market research has reported a sharp year-on-year surge in “Advanced TV” shipments in early 2025, with TCL and Hisense growing shipments by triple digits and gaining share via Mini-LED and ultra-large screens. Industry forecasting has also pointed to rapid Mini-LED growth, projecting global Mini-LED TV shipments rising to about 12.9 million units in 2025, with OLED shipments projected around 6.68 million units that year.

At CES 2026, that competitive heat becomes visible:

- LG pushes OLED brightness and reflection control, plus premium lifestyle design.

- TCL challenges RGB approaches with technical critiques and extreme spec claims.

- Hisense shows its own color innovation moves in the ultra-large category.

Samsung’s Micro RGB strategy reads like a hedge across all of those fronts. It does not abandon OLED, but it refuses to let OLED define “the best TV.” It expands the premium ladder and plants a flag on “color purity plus size plus design,” which is harder for value brands to replicate quickly.

| Competitive Pressure Point | Who Benefits | Who Feels The Squeeze |

| XXL screens become mainstream | TCL, Hisense, value retailers | Premium brands relying on size alone |

| Mini-LED grows faster than OLED in many tiers | Brands with aggressive Mini-LED portfolios | OLED-only narratives |

| RGB-based premium LCD emerges | Samsung (Micro RGB), challengers experimenting | Conventional LCD tiers without a story |

| OLED brightness gap narrows | OLED leaders | LCD advantage in bright rooms weakens |

Key Statistics That Explain The Moment

- Omdia projects global TV shipments rising from about 208 million (2025) to over 210 million (2026), with World Cup promotions as a driver.

- TrendForce projects Mini-LED TV shipments around 12.9 million (2025) and OLED TV shipments around 6.68 million (2025).

- Omdia has forecast MicroLED shipments reaching about 0.5 million units in 2026, while remaining niche relative to the broader display market.

- Samsung’s first commercial Micro RGB TV at 115 inches has been reported around $29,000 MSRP, with other market pricing reports around $32,000.

- Industry reporting cited around $1,500 as the late-2024 U.S. average selling price for 98–100-inch LCD TVs, illustrating how fast size is getting democratized.

Expert Perspectives: The Case For Micro RGB And The Case Against It

The bullish view: Micro RGB is a practical step toward high-end color at sizes where OLED is still constrained. Samsung frames it as a picture-quality innovation, and the BT.2020 coverage claim targets one of the clearest metrics a premium buyer can understand. If Samsung can scale Micro RGB down into 75-inch to 100-inch models over time, it could become a mass premium platform, not just a luxury curiosity.

The skeptical view: RGB backlights can introduce complexity and artifacts. TCL’s CES messaging argues that RGB systems can suffer from color crosstalk, and it promotes alternative routes to wide color coverage and high brightness. More broadly, critics point out that you do not buy BT.2020 coverage in isolation. You buy a whole system: tone mapping, content availability, HDR pipelines, viewing environment, and long-term software support. If AI features become the headline, buyers may worry about obsolescence, privacy, and “feature decay” over time.

The neutral synthesis: Micro RGB is less a replacement for OLED or MicroLED and more a new premium tool in the kit. It gives Samsung another way to win the showroom moment and protect margin in a world where big screens are getting cheap and competitors are getting better.

What Comes Next: The Milestones To Watch After CES 2026

A CES halo product only matters if it changes what ships at scale. The most realistic near-term impact is not that millions of people buy a 130-inch TV. It is that Micro RGB becomes a recognizable premium category.

Here are the next indicators that will tell you whether the strategy is working:

| Watch Item | Why It Matters | What To Look For In 2026–2028 |

| Wider Micro RGB size rollout | Proves platform intent | More sizes, more regions, retail availability |

| Pricing trajectory below 115″ | Signals mainstream premium potential | Step-down models under 100 inches with aggressive pricing |

| Content ecosystem for wide gamut | Turns BT.2020 into lived benefit | More streaming and mastering that rewards gamut coverage |

| World Cup 2026 upgrade cycle | Tests premium demand at scale | Promotions and premium mix shifts in key regions |

| Competitive response | Determines whether Micro RGB becomes a standard | Rival RGB approaches or alternative tech narratives |

| MicroLED remains niche or breaks out | Defines the ceiling of “Wall-class” dreams | Shipment updates and cost breakthroughs |

Predictions, clearly labeled: If current indicators hold, analysts will likely treat Micro RGB as a premium LCD evolution that expands downward in size and price, while true MicroLED continues to grow slowly and remain niche in the near term. Forecasts for MicroLED emphasize growth but from a small base, which suggests MicroLED’s broad consumer breakthrough is still ahead, not here.

Final Thoughts: Why The Samsung 130-Inch Micro RGB TV Matters

The Samsung 130-Inch Micro RGB TV is not important because it is the biggest thing on the CES floor. It matters because it is Samsung’s answer to three overlapping realities in 2026:

- Big screens have been democratized. Near-100-inch LCD pricing has collapsed relative to what it used to mean, so premium brands must build new ladders of value.

- Premium competition is intensifying. Chinese brands are pushing Mini-LED and ultra-large screens with speed, and the “advanced TV” category is expanding.

- The TV is becoming a software platform. AI processing, companion features, and ecosystem integration now shape differentiation almost as much as panel physics.

If Samsung succeeds, Micro RGB becomes a recognized premium tier that keeps Samsung’s brand strength intact even as the middle of the TV market becomes brutally price-competitive. If it fails, the 130-inch model will be remembered as a spectacular showroom moment that did not translate into a durable category.

Either way, “The Wall comes home” is less about a wall-sized screen and more about a wall-sized ambition: keeping the top of the TV market from becoming a commodity.