Sending money across borders still feels stuck in the past. Banks charge high fees, payments take days to arrive, and tracking where your money is can be a puzzle. If you’ve ever waited for an international transfer or paid $50 just to send $500 to family abroad, you know this pain.

These old systems cost us time and money we shouldn’t have to spend.

The global payment market is set to hit $290 trillion by 2030. That’s a lot of money moving around the world! Blockchain offers a fresh way to handle these payments. It works like a digital record book that everyone can see but no one can change.

This makes payments faster, cheaper, and easier to track.

In this post, we’ll show how blockchain cuts out the middlemen in cross-border payments. You’ll learn about real-time transfers, lower fees, and why big banks are starting to take notice.

We’ll also look at the real problems blockchain still faces in the payment world. Get ready for a clear look at the future of money.

Key Takeaways

- Blockchain cuts cross-border payment times from days to minutes while saving up to 50% on fees by removing middlemen banks.

- The global payment market will reach $290 trillion by 2030, with stablecoin transactions already hitting $32 trillion in 2024.

- Smart contracts automate payment steps and run 24/7, unlike banks that close on weekends and holidays.

- Blockchain helps people sending money home to family, with fees dropping below 2% compared to traditional remittance costs.

- Companies like BVNK now process $12 billion in stablecoin payments yearly, though energy use remains a challenge for some blockchain systems.

Key Drivers of Blockchain Adoption in Cross-Border Payments

Banks and businesses want faster, cheaper ways to send money across borders. Blockchain cuts out middlemen and slashes costs that eat into profits from global trade.

Demand for faster settlement

Today’s businesses and people hate waiting days for money to move across borders. Old payment systems make us wait 3-5 days for cash to reach its target. This slow pace hurts companies that need to pay global suppliers fast or folks sending money to family abroad.

With blockchain, payments zip across the world in minutes or even seconds. The proof is in the numbers – stablecoin transactions hit $32 trillion in 2024, showing how many users want speed.

Folks pick blockchain because it works all day, every day – no banking hours or weekend delays.

Cross-border payments through banks involve too many steps and middlemen. Each stop adds time and fees. Blockchain cuts this path short. It connects payers and receivers directly through digital ledgers.

Smart contracts automate the process without human approval at each stage. This tech offers 24/7 global settlement that traditional wire transfers can’t match. For markets where currency values change quickly, faster settlement means less risk from price swings.

Need for cost efficiency

Money moves slowly across borders, and it costs a lot. Banks charge high fees for sending cash to other countries. These fees hurt both people and businesses. A small business might pay $50 just to send money abroad.

That adds up fast! Blockchain cuts these costs by removing the middlemen. Direct transfers mean fewer hands in your wallet. Companies using blockchain could save $10 billion by 2030 according to experts.

Stablecoins offer a cheaper option than credit cards for cross-border trades. While they may have some gas fees, the total cost stays lower than old methods. The SWIFT network used by banks is pricey and slow.

Blockchain systems like Stellar (XLM) and Lightning Network speed things up while keeping costs down. For people sending money to family in other countries, this means more cash reaches loved ones instead of going to banks.

Transparency and traceability

Blockchain shines a light on every step of cross-border payments. Each money move gets recorded on a shared ledger that no one can change. This means you can track your cash from start to finish without wondering where it went.

Banks and payment companies love this feature because it helps them spot odd actions that might be fraud. The clear trail also makes it easier to follow rules about money movement across borders.

With blockchain, the days of mystery fees and lost transfers are ending.

The tracking power of blockchain cuts down on paperwork too. Companies report that using this tech drops their compliance costs by 60%. This happens because the system checks and records details on its own.

No more stacks of forms or long waits for approval. Public ledgers create trust between people who don’t know each other. Even in places with weak banking systems, blockchain offers a safe way to send money with a clear path you can follow.

How Blockchain Works in Cross-Border Payments

Blockchain cuts out the middlemen in cross-border payments by storing all transaction data on a shared digital record. This shared record lets money move from one country to another in minutes instead of days, with each step tracked and verified by computers around the world.

Decentralized ledger technology

Blockchain uses a special type of record-keeping system called a decentralized ledger. Unlike banks that keep all data in one place, blockchain spreads information across many computers worldwide.

Each computer has the same copy of all payment records. This makes the system run 24 hours a day, 7 days a week without stopping. No single person controls the whole system, which cuts out middlemen and their fees.

The ledger tracks every money move in blocks of data that link together in a chain. Once a payment gets added, it can’t be changed or deleted. This setup makes cross-border payments faster and harder to hack than old banking methods.

With 90% of global central banks now looking into digital currencies, this tech is gaining ground fast.

Smart contracts for automation

Smart contracts act as digital helpers in blockchain payment systems. They run by themselves once certain rules are met. Think of them as tiny robots that follow instructions without needing a person to push buttons.

These digital agreements live on the blockchain and make cross-border payments happen faster. They check that both sides have kept their promises before money moves. This cuts out the need for banks to check each step.

The magic of smart contracts is how they make things simple. They pre-check payment data to catch mistakes before they happen. This stops fraud and makes sure money goes to the right place.

Payment execution becomes smooth with less manual work needed. No more waiting days for someone to approve your money transfer! With smart contracts, the rules are clear and the same for everyone.

Money moves when conditions are met, not when a bank worker gets to your request in their pile of papers.

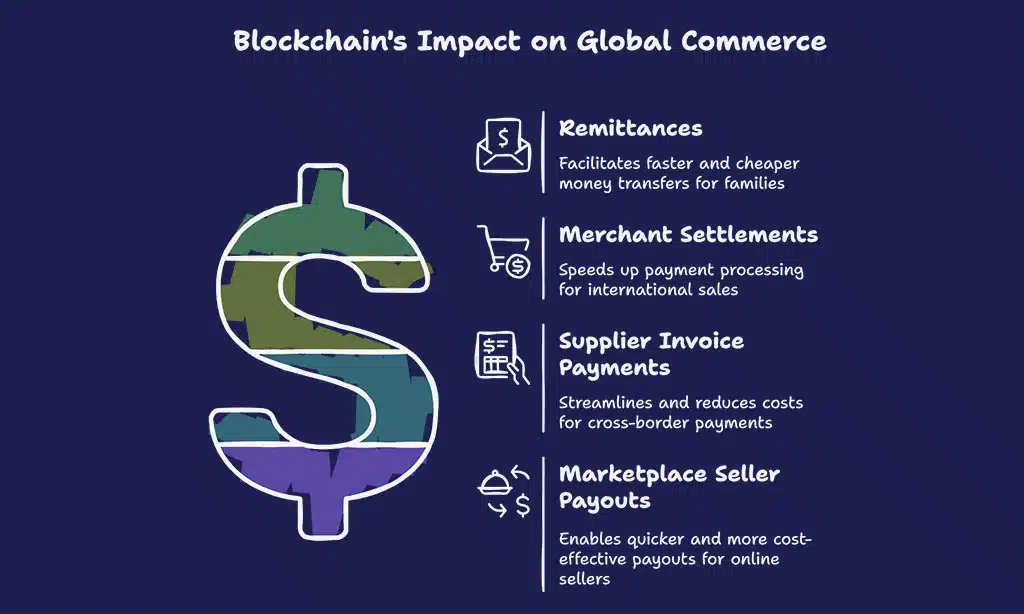

Use Cases of Blockchain in Cross-Border Payments

Blockchain now powers real-world money moves in many key areas of global commerce. Families send cash home faster, online sellers get paid quicker, and companies pay bills across borders without the old banking headaches.

Remittances

Blockchain makes sending money home much easier for people working abroad. In countries like Vietnam, Philippines, and India, many families count on money sent from relatives in other countries.

The old ways to send money can take days and cost a lot. Stablecoins now cut these costs to less than 2% of the amount sent. This means more money stays with the families who need it most.

Money transfers become faster and cheaper with blockchain networks. A worker in the US can send funds to family in the Philippines in minutes instead of days. The process skips many of the middlemen in the payment chain.

Crypto wallets allow direct transfers between people across borders. This helps fight currency inflation in places where local money loses value quickly. For millions of people, blockchain remittances offer a real solution to high fees and slow service.

Merchant settlements

Blockchain speeds up how stores get paid for sales across borders. In the past, shops waited days or weeks to get money from foreign sales. Now, blockchain cuts out the middle people.

Stores link directly to payment systems through smart contracts. This means money moves faster and costs less. Many shops love this because they get paid right away instead of waiting.

The tech also helps track every sale clearly. Merchants can see exactly where their money is and when it will arrive. This helps with planning and cash flow. Fiat-stablecoin exchanges make this even better for payment service providers.

They can swap money types quickly without the high fees banks charge. This works great for small shops that sell to people all over the world.

Supplier invoice payments

Businesses now pay their suppliers faster and cheaper with blockchain. The old way of paying bills across borders takes days and costs too much money. Now, companies like BVNK handle $12 billion in stablecoin payments each year.

This cuts out the banks that used to slow things down. For example, a Singapore business can now get paid in USDC right away instead of waiting for bank transfers.

Blockchain makes invoice tracking simple from start to finish. No more lost paperwork or payment mix-ups. Smart contracts can even pay bills on time without anyone pushing buttons.

This helps small firms get their money faster, which means they can pay their own bills on time too. The whole process stays on the digital ledger where both sides can see it clearly.

No more phone calls asking “where’s my money?

Marketplace seller payouts

Blockchain makes paying online sellers much faster and cheaper. Many marketplaces now use this tech to send money to sellers across borders without long waits. BVNK has created a system that connects regular money with blockchain for these payouts.

This cuts out the middlemen who usually slow things down and add fees.

Sellers love getting paid through blockchain because the money arrives in hours instead of days. The whole process stays on a shared record that no one can change. Stablecoins play a big role too – they work through hosted wallets at checkout.

This means sellers in different countries don’t lose money on bad exchange rates or high bank charges.

Benefits of Blockchain for Cross-Border Payments

Blockchain brings a fresh breeze to the money transfer world by cutting out the middlemen. Companies save big bucks while customers get their cash in minutes instead of days.

Real-time transactions

Blockchain slashes waiting times for cross-border money moves. Unlike old systems where funds can take days to arrive, blockchain enables payments that happen in seconds or minutes.

The Swift network has improved, with 89% of payments reaching banks within one hour, but blockchain takes this speed to a new level. Money flows 24/7 without stopping for weekends or holidays.

This matters a lot for businesses that need cash flow and people sending money to family abroad.

The speed comes from cutting out middlemen banks that add steps to the process. With distributed ledger technology, transactions get verified right away by network computers. Smart contracts automate the steps that used to need human approval.

This means a worker in the US can send money home to the Philippines during lunch break, and their family can use those funds before dinner. No more waiting for banks to open or payments to clear through multiple time zones.

Secure and predictable processes

Blockchain makes cross-border payments safer through its built-in security features. Each payment gets locked in a chain that no one can change or tamper with. This stops fraud before it starts.

The SOC 2 Type II certification earned by BVNK in May 2025 shows how the tech keeps getting more secure. Users can track their money at every step, unlike old bank transfers that seem to vanish for days.

No more guessing where your cash is or when it will arrive!

The process also follows clear rules that don’t change. Smart contracts run the same way every time, cutting out human errors. You send money today, it moves the same way it did yesterday.

No surprise fees pop up halfway through. No payments get stuck without explanation. This makes planning easier for businesses sending money across borders. They know exactly what will happen, when it will happen, and how much it will cost.

This level of trust helps companies budget better and avoid payment headaches.

Reduced reliance on intermediaries

Blockchain cuts out the middlemen in cross-border payments. Traditional money transfers need banks, payment processors, and other third parties that each take a fee. This adds up fast! With blockchain, people send money directly to each other through the distributed ledger.

No more waiting for each bank to check and approve the transfer. This direct path saves businesses big money – up to 30-50% on cross-border fees. The math is simple: fewer hands touching your money means more cash stays in your pocket.

The impact goes beyond just saving cash. Banks and payment firms often take 3-5 days to move money across borders. Blockchain shrinks this to minutes or even seconds. The smart contracts on blockchain networks handle the rules and checks that humans used to do.

This cuts out human error too. By 2030, experts say blockchain could save global businesses $10 billion in transfer costs. For people sending money to family in other countries, this means more of their hard-earned dollars reach loved ones instead of paying for middlemen.

Challenges in Implementing Blockchain Solutions

Blockchain faces real hurdles in the payment world despite its promise. Rules differ across borders while old systems don’t always play nice with new tech.

Regulatory compliance

Regulatory rules for blockchain payments vary across the globe. The EU’s MiCA rules focus on keeping customers safe and markets fair. Companies must follow these rules or face big fines.

Banks and payment firms need to check who sends money and why, which can slow down blockchain systems. This creates a tough balance between speed and safety in cross-border payments.

Money laundering checks add more steps to blockchain payment systems. Firms must track all money moves and share data in safe ways. This means extra work for payment providers who use blockchain.

They must build systems that can spot odd money moves while still keeping payments fast. Many firms now use special tools that check payments against rules without slowing things down too much.

Interoperability concerns

Blockchain systems often struggle to talk to each other and to old banking systems. This creates a major roadblock for cross-border payments. Different blockchains use their own rules and codes, making it hard for them to share data.

Think of it like trying to connect puzzle pieces from different sets – they just don’t fit together easily. Banks use one type of system while blockchain networks use another, creating a gap that slows down money transfers.

Financial groups must work together to fix these connection problems. Banks, payment providers, and crypto companies need to build bridges between systems. Some firms are making special tools that help different blockchains work together.

Others focus on making blockchain systems that can talk to bank networks. Without these fixes, blockchain payments will stay in their own world, apart from the main banking system.

This team effort is key to making blockchain truly useful for global money transfers.

Energy consumption issues

Proof-of-work blockchains like Bitcoin use tons of power. A single Bitcoin transaction can eat up as much electricity as a U.S. home does in a week. This massive energy use creates a big problem for companies that want to be green.

Many firms now face tough choices between using fast blockchain systems and meeting climate goals. The carbon footprint of these networks has sparked debate about whether the benefits are worth the environmental cost.

Companies must now look at climate impact benchmarks before picking a blockchain for payments. Some newer systems use less power by switching to proof-of-stake models. These cut energy use by more than 99% compared to older methods.

Ripple, Stellar, and other payment-focused chains have made this switch to address the problem. Businesses that ignore these concerns risk bad press and may lose customers who care about the planet.

Takeaways

Blockchain is changing how money moves across borders right now. This tech cuts costs, speeds up transfers, and adds new levels of trust to global payments. Big banks and small startups alike jump on this trend as the market heads toward $290 trillion by 2030.

Yes, challenges exist with rules and systems working together. Still, the shift to blockchain marks the biggest upgrade in payment systems in decades. The future of cross-border payments will be faster, cheaper, and more open thanks to this game-changing technology.

FAQs

1. What is blockchain technology and how does it change cross-border payments?

Blockchain technology is a secure, decentralized ledger that records transactions across many computers. It cuts high costs and speeds up settlement times for international payments. The distributed ledger makes payments faster than old systems like SWIFT network or wire transfers.

2. How do cryptocurrencies fit into the cross-border payment picture?

Cryptos like Stellar (XLM) offer real-time settlement for global finance. They work through blockchain networks to move money without the usual banking delays. Payment providers are starting to use crypto assets because they’re fast and can lower transaction fees.

3. What benefits do smart contracts bring to international payments?

Smart contracts automatically execute payment terms when conditions are met. They help with clearing, reduce human error, and speed up the whole process. Plus, they can handle anti-money laundering checks without slowing things down.

4. Are banks and fintechs really adopting blockchain for payments?

Yes! Many banks now use permissioned blockchains for faster payments systems. Fintechs and startups are building payment platforms on blockchain. The technology is growing fast, though not everyone has jumped on board yet.

5. What about security and regulatory compliance?

Blockchain security comes from its immutable ledger design and encrypted data. For regulatory compliance, systems must follow know your customer rules and combat the financing of terrorism. The Financial Action Task Force (FATF) has created guidelines for blockchain in payments.