People want financial privacy now more than ever. Banks and governments often track every transaction, leaving little room for anonymity. This is where privacy coins step in.

Privacy-focused cryptocurrencies like Monero hide your transaction details from prying eyes. They’re gaining traction as tools for financial freedom, especially in places with strict money laundering rules or excessive surveillance.

Wondering why these coins are booming? Here are five reasons why privacy coins are gaining popularity. Read on to see if they fit your needs.

Key Takeaways

- Privacy coins like Monero hide transaction details using stealth addresses and ring signatures, making them hard to trace—Monero processed over 32 million transactions since 2014.

- Governments and banks track regular payments, but privacy-focused cryptocurrencies protect users from financial surveillance and unfair targeting.

- DeFi growth boosts demand for privacy coins as users seek anonymous, decentralized transactions without middlemen or exposed wallet risks.

- Some exchanges like Bittrex and Kraken dropped privacy coins due to regulatory pressure, but users still choose them for financial freedom.

- Monero saw 8.8 million transactions in 2021 alone, proving their use in bypassing capital controls, high fees, and oppressive policies.

Protection Against Financial Surveillance

Governments and corporations keep a close eye on financial transactions. Every bank transfer, credit card swipe, or even small payment can be tracked. Privacy coins like Monero (XMR) give control back to users by hiding transaction details.

Unlike Bitcoin, which leaves a public trail, privacy-focused cryptocurrencies use stealth addresses and ring signatures to protect identities.

This matters because financial surveillance affects personal freedom. Some people don’t want banks or officials knowing how they spend money. Others fear their data could be misused for unfair targeting by advertisers or authorities.

With anti-money laundering (AML) laws tightening globally, privacy-enhancing cryptocurrencies offer an alternative for those who value discretion without breaking rules. They let users transact securely away from prying eyes while staying inside the crypto ecosystem.

Enhanced Transaction Privacy and Anonymity

Privacy coins like Monero, Zcash, and Dash hide transaction details better than regular cryptocurrencies. They use tools like stealth addresses and ring signatures to keep things private.

A stealth address creates a one-time code for each payment, so no one can trace it back to you. Ring signatures mix your transaction with others, making it hard to tell who sent what.

These coins also use zero-knowledge proofs, which confirm a payment happened without showing who was involved. Unlike Bitcoin, where transactions are public, privacy coins keep your business off the radar.

This appeals to folks who want financial privacy without banks or governments watching. Some worry about illegal uses, but many just want control over their own money. No middlemen, no snooping, just simple, secure spending.

Increased Demand Due to Decentralized Finance (DeFi) Growth

DeFi is changing finance, and privacy coins fit right in. Many users want anonymous transactions without banks watching their moves. That’s where Monero (XMR) and others shine, hiding details with ring signatures and stealth addresses.

Hackers target exposed crypto wallets, but privacy-focused cryptocurrencies cut that risk. As DeFi grows, so does demand for financial freedom without middlemen or prying eyes. People flock to these coins to avoid trackable blockchain trails tied to Bitcoin or Ethereum.

They don’t just want decentralization—they need it silent too.

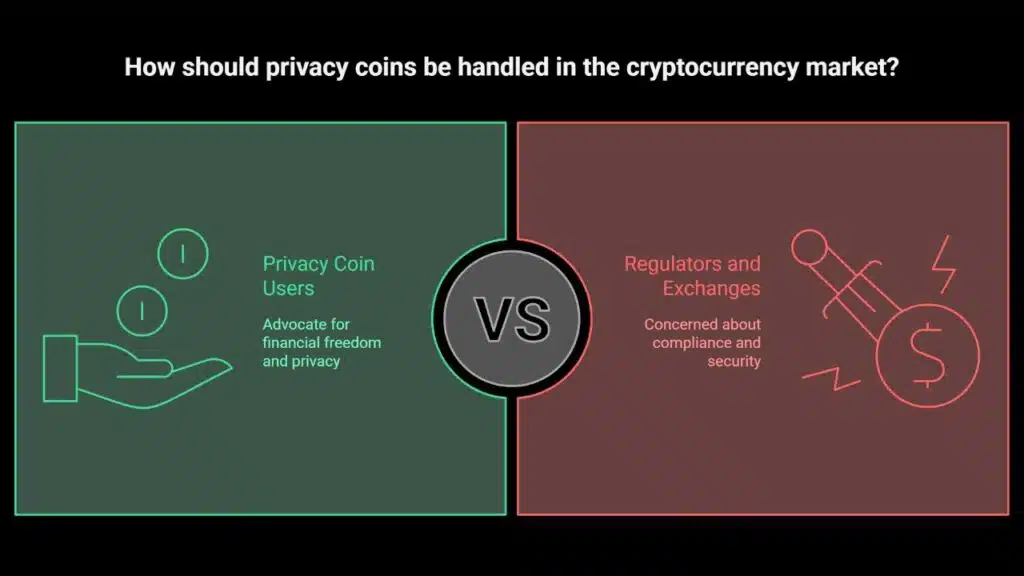

Resistance to Regulatory Oversight and Censorship

Privacy coins like Monero fight against tight control. Governments track regular crypto, but hidden addresses and ring signatures make privacy coins hard to trace. This scares regulators worried about tax evasion or money laundering.

Exchanges like Bittrex and Kraken have cut ties with these coins. In 2021, Bittrex dropped them entirely. UK users on Kraken lost access to Monero too. Still, many choose privacy-focused cryptocurrencies for financial freedom, despite crackdowns from crypto-asset service providers and laws like AML.

The tug-of-war continues.

Borderless and Unrestricted Financial Freedom

Privacy coins break down financial barriers. People in restrictive countries use them to move money freely, without government interference. Monero, for example, has handled over 32 million transactions since 2014, proving their demand.

These cryptocurrencies bypass capital controls and banking limits. Users avoid high fees, slow transfers, and invasive checks common with traditional systems. Privacy-focused coins like Monero empower anyone to trade globally, even under oppressive policies.

The rise of decentralized finance (DeFi) amplifies this freedom further. No middlemen means no borders.

Darknet markets once dominated crypto privacy use, but now ordinary people benefit too. Whether evading unfair taxes or escaping surveillance, these tools offer real financial independence.

Just check the numbers—Monero hit 8.8 million transactions in 2021 alone. That spike wasn’t just hype; it was necessity in action.

Takeaways

Privacy coins are on the rise, and for good reason. They shield users from prying eyes, whether it’s hackers or overbearing governments. With DeFi booming, more people want transactions that stay private.

Some use them to bypass unfair rules, others just value their freedom. Love them or hate them, these coins are carving a big space in crypto’s future.

FAQs

1. What are privacy coins?

Privacy coins, like Monero (XMR), are cryptocurrencies that focus on financial privacy. They use ring signatures and stealth addresses to hide transaction details.

2. Why do people use privacy coins?

People want financial freedom. Privacy coins help them avoid prying eyes, whether from governments, banks, or nosy third parties. Some also worry about traceability in regular crypto.

3. Aren’t privacy coins used for illegal activities?

Yes, some bad actors exploit them for money laundering or tax evasion. But most users just want enhanced security in the DeFi space. Not everyone using cash is a criminal, right?

4. How do privacy coins stay ahead of regulations?

Crypto-asset service providers face strict AML and KYC rules. Privacy coins adapt with better blockchain tech, making them harder to track without breaking laws.

5. Will privacy coins survive if CBDCs take over?

Central bank digital currencies won’t kill privacy coins. Demand for financial privacy won’t disappear. As long as people value secrecy, these altcoins will stick around.