Hey there, are you feeling swamped trying to juggle your real estate portfolio? It’s a common headache for many investors, watching rental properties sit empty or struggling to keep up with market shifts.

Here’s a neat tidbit: real estate investing isn’t just about buying and selling; it covers cool stuff like flipping homes, managing rental income, and even dipping into real estate investment trusts, or REITs.

So, how can you tackle these challenges and build a winning portfolio? My list of 15 tips will guide you through simple steps to boost your cash flow, manage risks, and grow your investment properties with ease.

Stick around for the ride!

Key Takeaways

- Set clear goals to guide your real estate investing, focusing on rental income or flipping for quick gains.

- Diversify with options like crowdfunding on Ark7, Lofty, or Arrived, starting at just $20, or syndications with 15 to 50 percent returns.

- Research your market by tracking trends like mortgage rates and chatting with real estate agents for hot tips.

- Keep a reserve fund for emergencies to cover sudden costs in property management.

- Monitor market trends and adjust strategies, using seller financing if mortgage rates rise.

Set Clear Goals for Your Portfolio

Setting clear goals is the first step to winning in real estate investing. Think of it as plotting your map before a big road trip. You gotta know where you’re headed! Decide if you want steady rental income or quick gains from property flipping.

For beginners, start small, save for a down payment, and build from there. Goals keep you focused, even when the real estate market trends get bumpy.

Dig into what matters to you as a real estate investor. Are you chasing financial independence or just some extra passive income? Pin down your risk tolerance too, because not every investment property fits every plan.

Lay out a solid investment strategy, whether it’s rental properties or commercial real estate. Stick to your targets, and watch your portfolio grow step by step.

Diversify Your Investments

Hey there, let’s chat about spreading out your real estate investments. Diversifying means not putting all your eggs in one basket. It lowers your risk and helps keep your returns steady.

Think about mixing things up with different types of properties, like rental properties, commercial real estate, and even land investments. You can also try strategies like house hacking, property flipping, or short-term rentals.

This way, if one area struggles, others can hold you up.

Have a look at options like real estate crowdfunding too. Platforms such as Ark7, Lofty, and Arrived let you start with just $20. Plus, some even allow you to sell shares whenever you want.

Then there’s syndications, which can offer 15 to 50 percent returns, though they often need a bigger upfront amount, usually between $50,000 and $100,000. So, explore fractional ownership or real estate investment trusts (REITs) to build a varied portfolio without breaking the bank.

Research and Understand Your Market

Dig into the real estate market with a sharp eye, folks. Knowing your area, like the geography and local vibes, is a game-changer for real estate investors. Study the trends, from mortgage rates to new developments popping up.

Get a grip on what drives prices in your spot, whether it’s a hot neighborhood or a quiet suburb. This ain’t just guessing; it’s about hard facts shaping your next move.

Grasp the big picture by tracking market conditions and location perks. Economic shifts and demographic changes can flip the script on rental properties or commercial real estate fast.

Chat with a real estate agent to get the scoop on what’s hot. Look at how folks are moving in or out, and spot opportunities before they slip away. Stay ahead by keeping tabs on real estate market trends, no shortcuts here!

Analyze Cash Flow and Profit Margins

Hey there, let’s chat about cash flow and profit margins for your real estate investing journey. These are the lifeblood of your rental properties. Check if your income from rent beats your expenses like mortgage interest and repairs.

Look at positive cash flow, which means more money comes in than goes out. Use concepts like capitalization rates to see your property’s value against its income. Don’t skip cash-on-cash return either; it shows what you earn on the actual cash you put down.

Now, grab a tool like a house hacking calculator to estimate how much of your housing costs get covered by rental income. Study price-to-rent ratios to spot good deals in the real estate market trends.

Profit margins matter too, so weigh your return on investment, or ROI, against tax implications. Keep this simple focus, and you’ll steer your portfolio toward financial independence with ease.

Focus on Long-Term Value Appreciation

Start thinking about the big picture for your real estate investments. Long-term value appreciation means picking properties that grow in worth over time. It’s like planting a tiny seed and watching it turn into a huge tree.

Focus on spots where prices are likely to climb, maybe due to new schools or businesses popping up nearby. This approach can boost your return on investment (ROI) down the road.

Dig into options like live-in flips to cut down on capital gains tax. If you hold a place for over a year and live there as your main home for two of the last five years, you save big on taxes.

That’s a sweet deal for any real estate investor. Keep your eyes on residential real estate or even commercial properties that show promise. With smart planning, your portfolio management will shine, paving the way for solid rental income or passive income streams.

Leverage Technology for Portfolio Management

Hey there, let’s talk about using tech to elevate your real estate investing approach. Tools today can streamline property management and help you monitor your cash flow with just a few clicks.

Envision having all your rental income data in one place, no more cluttered spreadsheets. Harnessing technology for analysis, management, and optimization isn’t just wise, it’s a total game-changer.

Got a large real estate portfolio? Use software to identify trends and track performance metrics like return on investment (ROI). These digital tools can reveal which rental properties excel and which require attention.

So, embrace tech, my friends, and see your investment strategy strengthen every day.

Conduct Regular Property Inspections

Let’s talk about keeping your properties in top shape. Regular checks can save you big headaches down the road.

- First, know that property inspections are vital for maintaining condition and boosting long-term value in real estate investing. By walking through your rental properties often, you show a dedication to upkeep, which can lead to better tenant retention. It’s like keeping your car tuned up; it just runs better.

- Second, spot maintenance issues early to avoid costly fixes later. Catching a small leak in residential real estate before it floods a unit can save thousands in repairs. Think of it as nipping a problem in the bud.

- Third, keep tenants happy with a safe, well-maintained space. A clean, secure environment in your rental housing builds trust and satisfaction, making folks want to stay longer. Happy tenants are gold in this game.

- Fourth, document every visit for future planning and smart decision-making. Write down what you see during property valuation walks; these notes give insights for upgrades or repairs. It’s like having a roadmap for success.

- Fifth, show your commitment to property care with consistent check-ins. Tenants notice when landlords prioritize upkeep in commercial properties or homes, and it builds loyalty. You’re not just a name; you’re a caretaker.

- Sixth, stay ahead by spotting trends or potential risks during inspections. Proactive management in property management lets you fix small stuff before it grows into a monster. It’s like playing defense in a tight game.

- Seventh, contribute to sustainability and profit by keeping properties in good shape. Regular checks ensure long-term profitability in real estate strategies, as well-maintained spaces attract better rental income. You’re building a legacy, brick by brick.

Build a Strong Professional Network

Crafting a solid network is a game-changer for real estate investing. Think of it as building a team of superheroes, each with a special skill. You need agents to snag the best deals, contractors to fix up properties, lenders to fund your dreams, and investors to share ideas.

Strong communication skills tie this crew together. Without chatting often, you miss out on hot tips or quick fixes for your rental properties.

Having these connections can save your bacon when issues pop up. Imagine a sudden repair need; your go-to contractor jumps in fast. Or, picture a market shift; your agent clues you in before others catch on.

Networking isn’t just shaking hands, it’s about real bonds with property managers and residents too. Keep those lines open, and watch your real estate investor journey soar with better cash flow and smarter moves.

Stay Updated on Real Estate Laws and Regulations

Keeping up with real estate laws is a must for any investor. You don’t want to trip over rules like Rent Control or the Fair Housing Act. These laws shape how you manage rental properties and treat tenants.

Slip up, and you could face fines or legal headaches. So, stay sharp on landlord-tenant laws and eviction rules. They’re your roadmap to staying on the right side of the law.

Dig into regulatory shifts that impact real estate investing too. New policies can change mortgage rates or even property taxes overnight. Chat with pros or join local investor groups to get the latest scoop.

It’s like having a cheat sheet for risk management. Stay ahead, and your portfolio will thank you.

Develop a Strategy for Risk Management

Crafting a solid plan to handle risks is key for any real estate investor. Think of it like wearing a seatbelt; you hope you won’t need it, but it’s there to save you. Risks in real estate investing can hit hard, from sudden market drops to unexpected repairs.

So, start by setting clear investment goals and figuring out your risk tolerance. How much loss can you stomach? Answer that, and you’re already ahead.

Dig into diversification to spread out those risks. Don’t put all your cash into one rental property or area. Mix it up with residential and commercial properties, or even look at real estate investment trusts (REITs).

This approach stabilizes your returns and cushions the blow if one part of the real estate market trends south. Keep your cash flow safe by planning for the unexpected. That’s how you stay in the game for the long haul.

Prioritize Tenant Relationships and Retention

Hey there, let’s chat about keeping your tenants happy in rental properties. Good tenant relationships are the backbone of a solid real estate investing plan. Treat them right, and they’ll stick around, saving you the hassle of finding new folks.

Focus on their needs, like fixing issues fast or just listening to their concerns. A happy tenant means steady rental income for you.

Think of it as planting a garden; nurture it, and it grows. Know what your tenants value, such as a safe location or cool amenities. Keep crime rates in mind when picking a spot, since safety matters big time.

Also, be patient with real estate deals, as they often take time to settle. Stay in touch, maybe even send a quick note to check in. Building trust turns tenants into long-term partners for your investment strategy.

Use Leverage and Financing Strategically

Smart use of leverage can boost your real estate investing game. Think of it like using a lever to lift a heavy load, making your money work harder. You don’t always need to pay cash for properties.

Instead, tap into financing options like conventional loans, seller financing, or even hard money loans. These tools let you buy more rental properties with less of your own cash upfront.

Using Other People’s Money, often called OPM, is a neat trick too. It means you borrow funds from private lenders or banks to grow your portfolio. This way, you can spread your capital across multiple investments, ramping up your cash flow and return on investment.

Just be cautious, though; balance is key to avoid overextending yourself in the real estate market.

Keep a Reserve Fund for Emergencies

Hey there, folks, let’s chat about keeping a reserve fund for emergencies in your real estate investing journey. Think of this fund as your safety net, catching you when unexpected expenses pop up.

It’s vital for handling sudden property maintenance or tenant issues without breaking a sweat. Successful investors treat real estate like a business, always watching their finances and stashing away cash for those rainy days.

Having this backup money helps lessen risks and keeps your rental properties running smooth. It also plays a big part in building long-term wealth by giving you liquidity during tough financial times.

Make sure to review your plans often, adjusting the size of this fund to match your goals and market shifts. Trust me, a solid reserve fund is your best pal in the wild ride of property management.

Monitor Market Trends and Adjust Your Strategy

Keeping an eye on real estate market trends is essential, everyone. You’ve got to stay alert and observe how things change in the sphere of rental properties and commercial real estate.

Markets can turn quickly, and overlooking a prime opportunity could be costly. By tracking these shifts, you seize chances to increase your return on investment (ROI) before others catch on.

It’s all about staying ahead of the curve.

Now, real estate is flexible, so adjust your investment approach as trends develop. If mortgage rates rise, you might consider seller financing to avoid steep expenses. Or, if a new location shows potential, explore up-and-coming markets for new profits.

Staying informed keeps you competitive, my friends. So, stay updated, connect with fellow real estate investors, and adapt your strategies to align with the latest market movements.

Invest in Property Upgrades to Increase Value

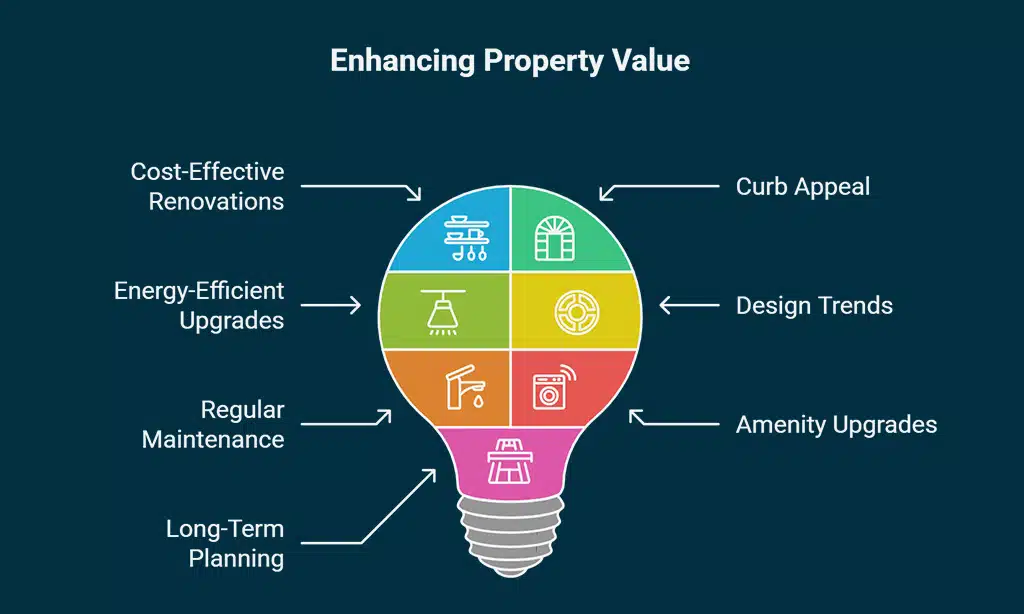

Hey there, let’s talk about making your real estate shine. Upgrading your properties can seriously boost their worth, and I’ve got some tips to help.

- Start with cost-effective renovations like kitchen and bathroom remodels, since these often bring a high return on investment (ROI) for your rental properties. A fresh sink or new countertops can make a space feel brand new, and trust me, tenants notice. This kind of fix-up can push your property value up without breaking the bank.

- Focus on curb appeal to draw in potential buyers or renters for your residential real estate. Simple stuff, like painting the front door or planting flowers, can create a welcoming vibe. First impressions stick, so make that outside pop.

- Add energy-efficient upgrades to save on utility costs and increase property value in your real estate investing journey. Think about installing LED lights or better insulation. Tenants love lower bills, and it’s a win for your cash flow too.

- Stay on top of design trends to keep your rental income flowing strong in the real estate market. A modern backsplash or trendy paint color can set your place apart. It’s like dressing your property to impress, and it works.

- Make regular maintenance a habit to sustain value and avoid big headaches down the road. Fix leaky faucets or patch up walls before they turn into pricey repairs. Staying ahead keeps your investment safe and sound.

- Boost rental income potential by upgrading amenities in your commercial properties or homes. Adding a washer-dryer combo or a small gym space can justify higher rent. Tenants will pay more for comfort, no doubt.

- Think long-term by choosing upgrades that enhance both appeal and functionality for your real estate portfolio. A well-planned deck or extra storage can add serious charm. It’s all about making your space a hot pick for anyone looking.

Track Performance Metrics for Your Portfolio

Tracking your real estate portfolio is a must. It helps you spot patterns and make smart moves.

- First, examine the cash flow numbers for your rental properties. Review how much money comes in from rent each month, then subtract your costs like mortgage rates and upkeep. This reveals whether your investment is profitable or costing you money. Pay close attention to these figures to stay prepared.

- Next, assess your return on investment, or ROI, for each property. Calculate how much profit you generate compared to your initial investment. A strong ROI indicates your real estate strategy is effective. If it’s low, it’s time to reassess your approach.

- Also, keep track of vacancy rates in your residential real estate holdings. High vacancies in rental properties can disrupt your income stream. Monitor how often units remain empty, and investigate why tenants depart. This allows you to improve tenant retention and maintain steady cash flow.

- Don’t overlook monitoring market trends for your area. Real estate market conditions can change quickly, affecting property values and rental income. Use data analytics to determine if prices are rising or falling. Staying informed enables you to adapt before issues arise.

- Keep track of property appreciation over time. Long-term value growth is essential for achieving financial independence through real estate. Compare current values to your purchase price, using analytical tools to identify trends. This highlights which investments perform best.

- Lastly, leverage tech tools for portfolio management and optimization. Apps and software can consolidate all these metrics in one place, saving you time. They assist with everything from cash flow to tenant data. Get familiar with these tools, as they’re invaluable allies in this endeavor.

Delegate Tasks to Trusted Property Managers

Hey there, owning a real estate portfolio can feel like juggling a dozen balls at once. Don’t drop any by trying to do it all yourself. Hand over the daily grind to experienced property managers.

These pros handle tenant issues, collect rental income, and keep your properties in top shape. I’m confident it’s like having a dependable partner who takes care of the tough tasks.

Now, envision the peace of mind that comes with delegation. Build a strong professional network with lawyers, inspectors, and management companies. They’ve got the skills to manage property tasks while you focus on expanding your investment strategy.

Think of this as creating your own ideal team for real estate investing. Let them handle the minor details, and watch your stress fade away.

Embrace Tax Planning and Optimization

Tax planning can save you big bucks in real estate investing. I’m not kidding, folks, it’s like finding hidden treasure in your rental properties. Real estate offers sweet tax advantages, such as deductions for mortgage interest, maintenance costs, and even management fees.

So, dig into these perks and cut down on what you owe Uncle Sam.

Sit down with a tax pro to map out a solid investment strategy. They’ll help you spot every deduction tied to your residential real estate or commercial properties. Think of it as a cheat code for boosting your cash flow.

Keep more of your hard-earned passive income by staying sharp on these breaks.

Explore Opportunities in Emerging Markets

Hey there, let’s chat about finding gold in new places with your real estate investing. Emerging markets are like hidden treasure maps in the real estate world, often packed with chances for high returns on investment (ROI) if you play your cards right.

Dig into areas where growth is just starting, and you might snag properties at lower costs. Think of up-and-coming neighborhoods or regions with new businesses popping up. These spots can boost your rental income or property value over time.

So, keep your eyes peeled for real estate market trends in these fresh zones, and don’t shy away from a little adventure in your investment strategy!

Plan Exit Strategies for Each Property

Crafting exit plans for each property is a smart move in real estate investing. Think of it as mapping out different roads to take when it’s time to move on. You might go for flipping, where you sell fast for a profit after fixing up a place.

Or, consider renting it out with a solid buy-and-hold strategy for steady rental income over the years. Another path could be seller financing, letting the buyer pay you over time while you earn interest.

Having these options keeps you ready for any twist in the real estate market trends.

Let’s chat about why this matters so much. Planning multiple exit strategies, like flipping, long-term leasing, or seller financing, gives you power over your investment strategy.

If mortgage rates spike, renting might be the best bet for cash flow. If the market’s hot, flipping could bring a quick return on investment. Stay flexible, and you’ll handle whatever comes your way with your rental properties or commercial properties.

Keep these ideas in your toolbox, and watch your portfolio grow strong.

Stay Committed to Continuous Learning

Staying sharp in real estate investing means never stopping your education. Immerse yourself in books, listen to podcasts, and join meetups to build your skills. This field, like a river, keeps moving with fresh ideas and trends.

You’ve got to stay current to remain competitive as a real estate investor.

Seize every opportunity to learn about the real estate market shifts. Talk with others, gain insights from their experiences, and offer your own advice. Lifelong learning isn’t just an advantage; it’s your key to thriving in this constantly changing landscape of rental properties and cash flow.

Avoid Emotional Decision-Making

Hey there, let’s chat about keeping your cool in real estate investing. Emotions can sneak up on you, pushing you to make hasty choices that hurt your portfolio. Stick to strict investment criteria, and set non-negotiables to guide you.

This helps you stay disciplined, keeping impulsive decisions at bay.

Think of your properties like a business, not a personal treasure. Emotional attachments can cloud your judgment, so focus on hard facts instead. Track financial metrics often to spot trends early.

Also, prep multiple exit strategies for each property to adapt fast to market shifts and cut losses. That’s how you build resilience as a real estate investor!

Takeaways

Wrapping up, managing a real estate portfolio can feel like taming a wild beast, but you’ve got this! Stick to these 15 tips, and watch your investments grow like a well-watered garden.

Got a question or a funny story about a property deal? Drop it below, I’d love to chat. Keep learning, stay sharp, and build that dream portfolio one brick at a time!

FAQs

1. How can I start building a real estate portfolio with little cash?

Hey, jumping into real estate investing doesn’t need a fat wallet, my friend. Look into real estate crowdfunding or wholesaling real estate to get your foot in the door with minimal upfront dough. You can also explore seller financing to dodge those hefty down payments and still snag rental properties.

2. What’s a smart way to boost cash flow in my portfolio?

Listen up, focusing on rental income is your golden ticket. Pick residential real estate or turnkey properties that pull in steady tenants, and watch that passive income roll in like clockwork.

3. Should I mix commercial properties into my real estate game plan?

Oh, absolutely, tossing in some commercial real estate can spice up your investment strategy. It often brings higher returns on investment (ROI) compared to just sticking with houses. Just be ready for trickier property management and shifting real estate market trends, okay?

4. How do mortgage rates mess with my real estate plans?

Well, pal, mortgage rates can bite into your profits faster than a dog on a bone. Higher rates mean bigger payments on financed properties or hard money loans, so keep an eye on them before locking in deals with mortgage lenders.

5. Can house hacking really help me as a real estate investor?

You bet it can! House hacking, where you live in part of your property and rent out the rest, slashes your own housing costs while building passive real estate investing income.

6. What’s the deal with real estate investment trusts for my portfolio?

Hey there, if you’re itching to diversify without the hassle of direct property flipping, real estate investment trusts (REITs) are your jam. They’re like stocks or exchange-traded funds (ETFs) in the stock market, letting accredited investors grab dividends from properties without managing a single lease agreement. Think of it as dipping your toes into the real estate pool without diving headfirst into home owners association drama or energy management headaches.