In Q1 2026, the Quiet Hiring Trend is no longer a niche HR tactic. It is a strategic response to slower hiring, stubborn skill gaps, and AI-driven work redesign, as companies fill priority roles by promoting, rotating, and redeploying people they already have.

Quiet hiring sounds like a clever label for something companies have always done. In one sense, that is true. Promotions, rotations, and stretch assignments are not new. What is new in Q1 2026 is the scale, the intent, and the operating logic behind them.

The Quiet Hiring Trend describes a growing preference to meet urgent capability needs without adding traditional headcount. Instead of opening a requisition, leaders “move work to talent” by reshuffling internal teams, upgrading responsibilities, and staffing short-term projects with internal candidates. This shift matters now because it reveals where the job market is headed next: not a collapse, not a boom, but a recalibration toward skills-based deployment and higher scrutiny on payroll risk.

For job seekers, quiet hiring can feel like a locked door. For employees inside organizations, it can feel like opportunity, or like pressure. For companies, it is a bet that internal mobility and reskilling can deliver speed and resilience at a time when the external labor market is both expensive and uncertain, and when AI is changing what “ready now” even means.

Why Q1 2026 Became The Quarter Of Quiet Hiring?

Q1 is when corporate plans become real. Budgets, headcount approvals, compensation cycles, and transformation roadmaps typically reset at the start of the year. When leaders enter January with uncertainty on demand, margins, or regulation, they often avoid permanent cost commitments. The fastest alternative is internal redeployment.

That internal-first posture is reinforced by recent labor market signals. A Reuters report dated January 8, 2026 described a U.S. labor market that is stable but sluggish. Weekly jobless claims were still relatively low, yet hiring appeared hesitant, with continued claims rising and job openings falling to levels that suggested fewer options for workers trying to re-enter employment. The same report cited 2025 layoffs rising sharply year over year and hiring intentions dropping to the lowest level since 2010. Those are conditions where companies tend to freeze net new hiring while still needing to execute business priorities.

In that environment, quiet hiring is not simply about cutting costs. It is about reallocating risk. If a role is uncertain, leaders would rather re-scope an existing position than create a new one. If a project is urgent, they would rather borrow a strong internal performer for 90 days than wait months for external recruiting. And if AI is changing workflows, leaders may hesitate to hire for a job description that could be outdated within a quarter.

There is also a calendar reality. Q1 performance reviews and compensation planning frequently set the terms of internal moves. Organizations use promotions, expanded scopes, and “acting” roles to retain top performers while controlling broad salary inflation. That can be healthy if paired with transparent pay and workload adjustments. It becomes toxic when it turns into permanent expansion of responsibilities without recognition.

One reason quiet hiring accelerates specifically in Q1 is that it sits at the intersection of finance and talent strategy. Finance wants agility and predictability. Talent leaders want retention and capability building. Quiet hiring looks like a compromise, and Q1 is when compromises turn into policy.

| What Companies Need In Q1 2026 | Traditional Approach | Quiet Hiring Approach | Practical Trade-Off |

| Fill urgent roles fast | External recruiting | Internal promotions and lateral moves | Faster start, but may create backfills |

| Cover project spikes | Contractors or new hires | Internal gigs and temporary task forces | Lower cost, but can stress teams |

| Build new capabilities | Hire specialists | Upskill and redeploy existing staff | Builds loyalty, but takes time |

| Control payroll risk | Hiring freeze | Re-scope current roles | Avoids headcount growth, can create scope creep |

The bigger story is not that companies stopped hiring. It is that they changed the definition of hiring. In quiet hiring, the “offer letter” becomes the internal assignment, and the hiring pipeline becomes the internal mobility system.

The Labor Market Normal That Quiet Hiring Reveals

Quiet hiring tends to surge when the labor market enters a “low-fire, low-hire” phase. Companies avoid mass layoffs because they remember how painful it was to rehire during the post-pandemic surge. At the same time, they avoid aggressive hiring because the macro outlook looks uneven and because they are still digesting past overexpansion in certain sectors.

Indeed’s Hiring Lab outlook for 2026, published November 20, 2025, described a baseline scenario where large shifts in the broad picture are unlikely, yet meaningful changes still occur under the surface. When openings stabilize but do not expand, job switching slows. When job switching slows, internal mobility becomes more important, both as a retention lever and as a staffing mechanism.

This is why quiet hiring is best understood as an internal labor market strategy. Companies are building mini-economies inside their organizations, where people move across teams, skills are priced through compensation bands, and managers compete for internal talent. The “market” is no longer only external, it is internal too.

Compensation dynamics amplify this shift. The Conference Board’s salary budget findings for 2026 pointed to pay increase budgets holding steady around the mid-3% range on average, broadly in line with 2025. When companies plan moderate pay increases, they tend to reserve their biggest increases for promotions, critical skills, and retention exceptions. Quiet hiring becomes the mechanism to decide who gets those targeted rewards.

That targeted approach can raise productivity, but it also creates friction. When budgets are tight, managers resist losing top performers to other teams. When internal moves increase, the organization can experience a “talent tug-of-war” that distracts from execution unless the process is clearly governed.

From the employee perspective, the labor market normal changes how people interpret opportunity. During a hot market, opportunity is external, and internal moves feel optional. During a frozen market, opportunity is internal, and external exits become harder. Quiet hiring can therefore feel like the only path forward, which increases both its power and its potential for misuse.

| Labor Market Signal | What It Suggests In Practice | How It Pushes Quiet Hiring |

| Hiring slows, layoffs stay contained | Firms protect teams but avoid growth bets | Reassign people to priority work |

| Fewer openings per job seeker | External moves take longer | Employees accept internal moves more readily |

| Moderate pay budgets | Raises become selective | Promotions become key compensation events |

| AI adoption accelerates | Roles are redesigned quickly | Firms prefer to redeploy rather than hire for outdated tasks |

Quiet hiring also exposes a fairness question. Who gets the stretch assignment. Who gets visibility. Who gets promoted. In many organizations, internal opportunity still travels through informal networks. If quiet hiring becomes the dominant pathway, transparency becomes more important, not less.

AI And Skills Scarcity Are Turning Staffing Into Workforce Design

Quiet hiring in 2026 is inseparable from the AI transition. Organizations are not only filling roles. They are rethinking what roles should exist, which tasks should be automated, and which skills should define the next operating model.

The World Economic Forum’s Future of Jobs Report 2025 argued that workforce transformation through 2030 will be defined by large-scale training needs. In the report’s digest, the WEF described a scenario where, out of 100 workers, 59 would need training by 2030. Employers anticipated that 29 could be upskilled in their current roles, and 19 could be upskilled and redeployed elsewhere within their organizations. That is essentially a forecast of quiet hiring at global scale, because it assumes internal redeployment will be one of the primary ways companies adapt.

AI intensifies this logic for a simple reason. AI changes the mix of tasks inside a job faster than external hiring can keep up. If a customer support function adopts AI for first-line triage, the human role shifts toward escalations, relationship management, and judgment calls. If a marketing team uses generative AI for drafts, the human role shifts toward creative direction, brand governance, and performance analysis. The job title might stay the same, but the skill profile changes.

When skill profiles change quickly, companies face a choice. They can hire new people with the new skill mix. Or they can reskill and reposition current employees who already understand the business, the customers, and the culture. Quiet hiring is the strategic answer when leaders believe internal context plus training beats external recruitment plus onboarding.

LinkedIn Learning’s Workplace Learning Report 2025 provided another lens on why this matters. The report highlighted that only 36% of organizations qualified as “career development champions,” while 33% had no meaningful initiatives or were just getting started. It also found that career development champions were more likely to describe themselves as frontrunners in generative AI adoption, and more confident in retaining and attracting qualified talent. The implication is blunt: internal mobility and learning maturity are becoming competitive advantages, not nice-to-haves.

This is where quiet hiring becomes a fork in the road. Done well, it creates a virtuous loop:

- Internal projects reveal skill gaps.

- Training closes gaps faster than recruiting.

- Mobility pathways retain talent.

- Retained talent accelerates AI adoption.

- AI adoption creates more internal opportunity.

Done poorly, it creates a downward spiral:

- Work expands without clarity.

- People burn out.

- Trust erodes.

- Top performers leave when markets loosen.

- Capability gaps widen again.

The difference is not ideology. It is execution discipline.

| Capability Gap | External Hiring Challenge | Quiet Hiring Advantage | Hidden Risk If Mismanaged |

| AI fluency across roles | Limited supply, high competition | Train broadly, redeploy quickly | Training without time allocation fails |

| Data and analytics | Long time-to-fill | Identify adjacent skills internally | Promoting without support hurts performance |

| Cybersecurity | Chronic shortages | Build internal pipelines | Internal moves can drain other teams |

| Leadership and change | Hard to assess externally | Promote those who know culture | Bias risk if visibility is uneven |

Quiet hiring is therefore not just a staffing method. It is workforce design. It assumes the organization can map skills, create learning paths, and move people with speed. That capability is becoming as strategic as product development or supply chain optimization.

How Quiet Hiring Works At Scale: Mobility Systems, Incentives, And Guardrails?

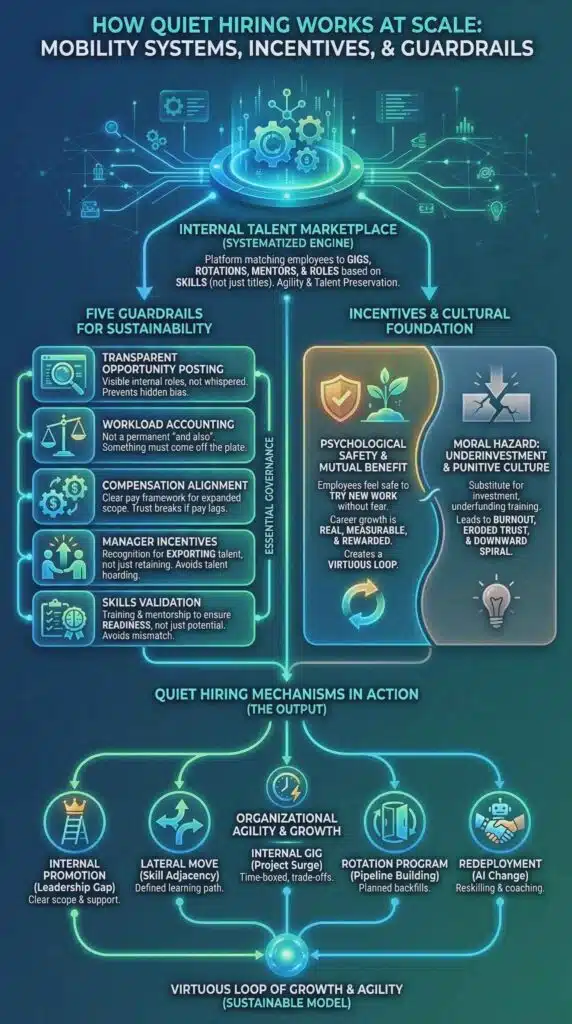

Quiet hiring becomes widespread only when it is systematized. The most visible sign of that systematization is the internal talent marketplace, a platform or process that matches employees to projects, gigs, rotations, mentors, and roles based on skills rather than job titles.

Deloitte’s analysis of internal talent marketplaces described how adoption accelerated as organizations sought agility around workforce deployment and talent preservation. Deloitte cited Unilever’s internal platform, FLEX Experiences, as an example, noting it helped redeploy more than 8,000 employees during the pandemic and unlock hundreds of thousands of hours of work. The details matter because they show quiet hiring is not theoretical. It can operate at enterprise scale when the systems exist.

But scale creates new governance challenges. Quiet hiring touches pay equity, workload fairness, manager incentives, and performance measurement. Without guardrails, it becomes messy quickly.

A practical quiet hiring model usually requires five guardrails.

First, transparent opportunity posting. Internal roles and gigs should be visible, not whispered about. If internal hiring becomes the default, hidden postings become hidden bias.

Second, workload accounting. Many quiet hiring moves fail because employees keep their old responsibilities while taking on new ones. Quiet hiring cannot work as a permanent “and also” strategy. Something must come off the plate.

Third, compensation alignment. A promotion or expanded scope should come with a clear pay framework, even if the increase is staged. When compensation lags behind responsibility, trust breaks.

Fourth, manager incentives. Managers often block internal moves because losing talent hurts their team’s output. Organizations need incentives and recognition for exporting talent, not only for retaining it.

Fifth, skills validation. Quiet hiring can lead to role mismatch if “potential” is confused with readiness. Training plans and mentorship must be part of the move.

These guardrails are not bureaucracy. They are what makes quiet hiring sustainable.

| Quiet Hiring Mechanism | Best Use Case | What Good Looks Like | What Breaks It |

| Internal promotion | Clear leadership gap | Clear scope, pay alignment, onboarding support | Title inflation, pay compression |

| Lateral move | Skill adjacency and retention | Defined learning path and success metrics | “Same pay, more work” perception |

| Internal gig | Short-term project surge | Time-boxed assignment, workload trade-offs | Shadow work and burnout |

| Rotation program | Pipeline building | Planned backfills, manager participation | Manager resistance and disruption |

| Redeployment after AI change | Job redesign and reskilling | Training, coaching, staged transition | Abrupt moves without support |

There is also a cultural dimension. Quiet hiring relies on psychological safety. Employees must feel they can try new work without fear of punishment if the first iteration is imperfect. If the culture is punitive, employees avoid stretch assignments, and the system stalls.

This is why Gartner’s framing of quiet hiring, introduced widely in early 2023, remains relevant in 2026. Gartner emphasized that quiet hiring can be mutually beneficial when it gives employees opportunities to grow and learn through stretch assignments and internal moves. In practice, that mutual benefit only materializes when the organization treats career growth as real, measurable, and rewarded.

The moral hazard of quiet hiring is that it can be used as a substitute for investment. Leaders can convince themselves that internal redeployment solves everything, and then underfund training and support. Over time, that erodes capability and morale. Quiet hiring works when it is paired with serious learning investment and clear advancement pathways.

What Happens Next In 2026: Signals To Watch And How The Trend Evolves?

Quiet hiring is likely to deepen in 2026, not because companies want to be secretive, but because the economics of uncertainty and the speed of AI-driven change favor flexibility. The next phase is less about whether companies do quiet hiring, and more about how they measure it.

Expect a shift from anecdotes to metrics. Leaders will want dashboards that answer questions like:

- What percentage of critical roles are filled internally.

- How long internal moves take from identification to start.

- Which skills are rising fastest in demand inside the company.

- Which teams export the most talent and why.

- Whether internal moves improve retention and performance.

This measurement focus is already hinted at in learning and talent research that points to internal mobility rates, promotions, and skill delivery as indicators of organizational health. The practical implication is that quiet hiring will increasingly be run like an internal marketplace with performance metrics, not like an informal set of favors.

At the same time, quiet hiring will face stress tests.

One stress test is burnout. If companies continue to do “more with the same” without redesigning workloads, the best people will become the most overloaded people. That is when quiet hiring turns from opportunity into resentment.

Another stress test is fairness. If internal moves are opaque, employees will assume favoritism, and the organization will lose trust. Transparent internal postings and skills-based matching will become non-negotiable for credibility.

A third stress test is innovation. External hiring is not only about filling seats. It imports new ideas, networks, and ways of working. If companies lean too heavily on internal mobility, they can become insular. The healthiest strategy is blended: redeploy internally for speed, hire externally for genuinely new capabilities and fresh perspective.

A fourth stress test is sector divergence. Some industries will continue to hire aggressively because demand remains strong and shortages persist. Others will rely more on internal mobility. This divergence can create an uneven experience for workers, where opportunities are abundant in some sectors and constrained in others.

| 2026 Signal To Watch | Why It Matters | If It Moves Up | If It Moves Down |

| Job openings relative to job seekers | Indicates market tightness | More external hiring leverage for workers | More internal-first staffing by firms |

| Pay budget revisions mid-year | Reveals employer confidence | Higher pay pressure and retention spend | Continued promotion-driven rewards |

| Internal mobility rate | Shows if quiet hiring is real | Faster career movement inside firms | Quiet hiring becomes mostly workload shifting |

| Training completion tied to redeployment | Measures reskilling effectiveness | Internal pipelines strengthen | Skill gaps persist, external hiring returns |

| Employee engagement and burnout indicators | Tests sustainability | Quiet hiring seen as opportunity | Quiet hiring seen as exploitation |

Predictions should be labeled carefully, and the most defensible prediction for 2026 is structural: quiet hiring will become more formal. Companies will standardize internal gig marketplaces, improve skills inventories, and link training investment to measurable redeployment outcomes. This is not guaranteed to be employee-friendly. It depends on incentives.

If companies do the hard work, quiet hiring becomes a positive-sum model. Employees gain growth without needing to leave. Companies gain agility without betting on uncertain headcount growth.

If companies cut corners, quiet hiring becomes a short-term patch that creates long-term churn. Employees will take the new skills and visibility they gained, then exit as soon as external markets reopen.

The Quiet Hiring Trend is therefore a trust test. It asks whether organizations can move faster without breaking people. In 2026, the companies that treat quiet hiring as a governed system, with workload trade-offs, transparent opportunity, and fair compensation, will likely outperform those that treat it as a convenient workaround.