The landscape of premium credit cards has shifted aggressively. With annual fees for top-tier cards now routinely breaching the $700–$900 mark and “coupon book” perk structures becoming more complex, the days of easy value are gone.

For the savvy consumer, the question is no longer just “can I afford the fee?” but “is the math actually working in my favor?” This analysis cuts through the marketing hype to determine if premium plastic still deserves a slot in your wallet this year.

Key Takeaways

- The “New Normal” Price Tag: Annual fees for flagship premium cards have jumped to the $695–$895 range, driven by inflation and higher service costs.

- Perks Have Become “Coupon Books”: To justify high fees, issuers have fragmented benefits into monthly “lifestyle credits” (e.g., Uber, streaming, dining) that require active management, banking on users forgetting to use them (the “breakage” model).

- Mid-Tier is the New Sweet Spot: Cards in the $95–$250 range now offer the best value for most consumers, providing about 80% of the utility (solid earning rates, decent insurance) for 20% of the cost.

- Lounge Access is Devalued: While still a core perk, “luxury” lounge access is often compromised by overcrowding and waitlists, making it a less reliable benefit for casual travelers.

- ROI Depends on Profile: Premium cards are only mathematically worth it for three specific groups: frequent flyers (15+ trips/year), business owners with high ad/travel spend, or users who already subscribe to the card’s bundled partners.

- Downgrade > Cancel: If a premium card no longer offers value, product changing (downgrading) to a no-fee version is the smartest move to preserve credit history and limits.

What Defines a Premium Credit Card in 2026?

A premium card in 2026 is defined less by its metal weight and more by its ecosystem of specialized access. It is no longer just a payment tool; it is a subscription service for travel and lifestyle management.

Typical Annual Fee Range

The baseline has moved. While $550 was the standard in the early 2020s, $695 to $895 is the new normal for flagship cards (e.g., updated pricing for Amex Platinum or Chase Sapphire Reserve tiers). Ultra-premium invite-only tiers are seeing fees upwards of $5,000, but for the mass-affluent market, expect to pay roughly $750/year to sit at the table.

Core Perks That Justify the Price

To demand these fees, issuers have doubled down on “experiential” benefits:

- Lounge Access 2.0: Access to exclusive issuer-branded lounges (Centurion, Sapphire, Capital One) is now the primary driver, as generic Priority Pass memberships have been devalued by restaurant exclusions and guest caps.

- Travel Credits: Flexible $300+ travel stipends remain the easiest way to recoup costs.

- Elite Status: Automatic mid-tier status with Marriott, Hilton, or Hertz remains standard, offering room upgrades and late checkouts.

What’s New in 2026

The 2026 refresh cycles have introduced features distinct to this era:

- AI Concierge: Cards now integrate with banking apps to offer “predictive spending analysis” and automated deal activation—no more manually adding offers.

- Subscription Bundling: Credits are now heavily weighted toward digital subscriptions (streaming, wellness apps, and even AI tool subscriptions).

- ESG & Carbon Offsetting: New dashboards allow users to track the carbon footprint of their flights and use points to purchase certified offsets instantly.

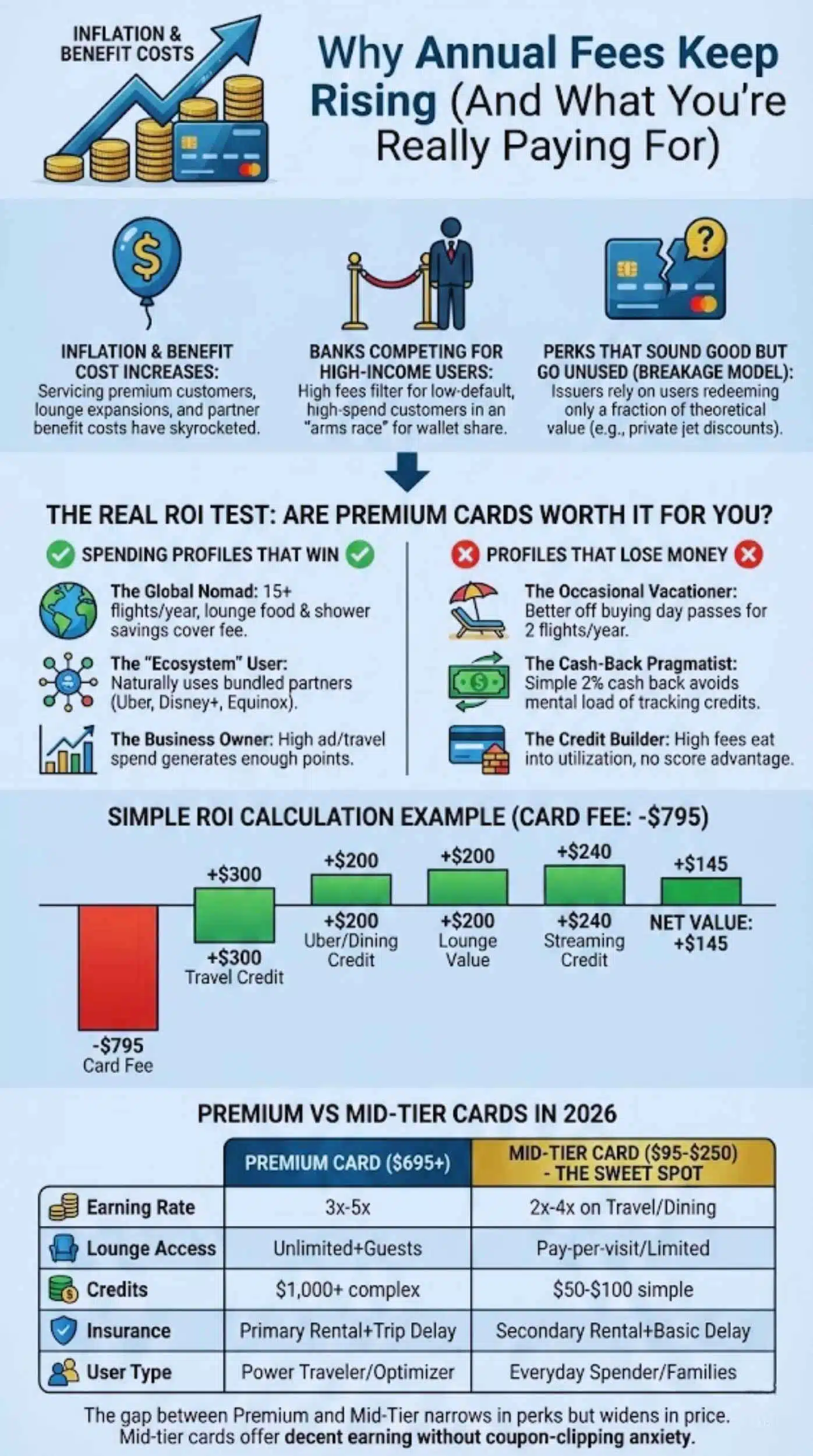

Why Annual Fees Keep Rising (And What You’re Really Paying For)

Inflation and Benefit Cost Increases

The cost of servicing a premium customer has skyrocketed. Lounge overcrowding led to expensive expansions and renovations in 2024–2025. Furthermore, the cost of partner benefits (like free hotel nights or ride-share credits) has risen with broader inflation, forcing issuers to pass these costs to the consumer.

Banks Competing for High-Income Users

Banks are in an arms race for “share of wallet.” By charging $895, they filter for high-spend customers who are less likely to default and more likely to use the card for everything. The high fee is, effectively, a velvet rope.

Perks That Sound Good but Go Unused

This is the “breakage” model. Issuers know that while a card might offer $1,500 in theoretical value, the average user only redeems about $400 worth. You pay for the option to use a private jet charter discount or a luxury SoulCycle credit, even if you never do.

The Real ROI Test: Are Premium Cards Worth It for You?

Spending Profiles That Win

- The Global Nomad: If you fly 15+ times a year, the lounge food and shower savings alone cover the fee.

- The “Ecosystem” User: Someone who naturally uses the bundled partners (e.g., you already pay for Uber, Disney+, or Equinox) breaks even before swiping.

- The Business Owner: High ad-spend or travel expenses can generate enough points to make the annual fee a rounding error.

Profiles That Lose Money

- The Occasional Vacationer: If you fly twice a year, paying $700+ for lounge access is bad math. You are better off buying a day pass ($50–$75).

- The Cash-Back Pragmatist: If you prefer simple 2% cash back, the mental load of tracking premium credits results in a net loss of time and money.

- The Credit Builder: High fees eat into your available credit utilization and offer no credit score advantage over a no-fee card.

Simple ROI Calculation Example

- Card Fee: -$795

- Travel Credit: +$300 (Easy to use)

- Uber/Dining Credit: +$200 (If used monthly)

- Lounge Value: +$200 (10 visits @ $20 value)

- Streaming Credit: +$240 (If you already subscribe)

- Net Value: +$145

Premium vs Mid-Tier Cards in 2026

The gap between “Premium” and “Mid-Tier” is narrowing in perks but widening in price.

Perks You Actually Lose When Downgrading

- Unlimited lounge access (often capped or removed on mid-tier).

- Top-tier travel insurance (evacuation and interruption coverage limits drop).

- Concierge service (though AI tools are making this less relevant).

Perks You Don’t Miss at All

- Niche retail credits (e.g., $50 at a specific luxury department store).

- Obscure status upgrades that don’t guarantee room availability.

The Sweet Spot Cards ($95–$250 Range)

Mid-tier cards in 2026 have become the “Goldilocks” solution. They offer decent earning rates and basic travel protections without the coupon-clipping anxiety.

| Feature | Premium Card ($695+) | Mid-Tier Card ($95-$250) |

| Earning Rate | 3x-5x on Travel/Dining | 2x-4x on Travel/Dining |

| Lounge Access | Unlimited + Guests (usually) | Pay-per-visit or Limited (2-4 passes) |

| Credits | $1,000+ (complex fragmentation) | $50-$100 (simple hotel/flight credits) |

| Insurance | Primary Rental + Trip Delay | Secondary Rental + Basic Delay |

| User Type | Power Traveler / Optimizer | Everyday Spender / Families |

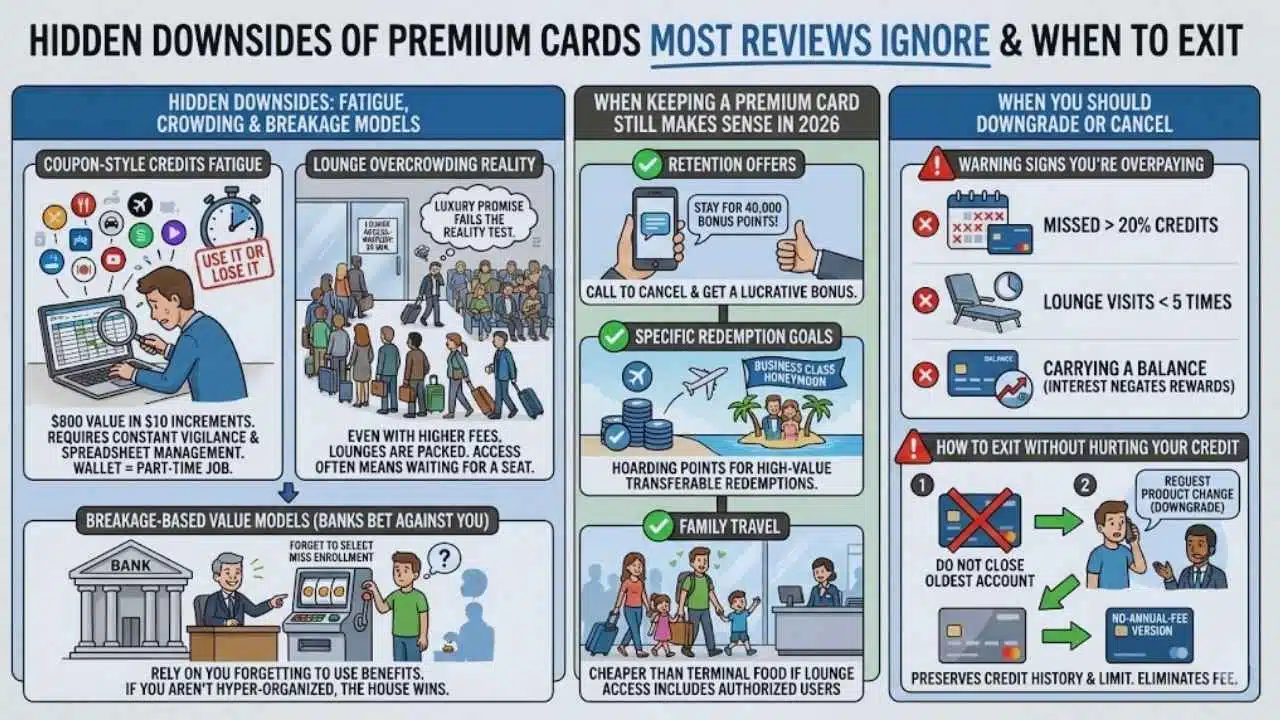

Hidden Downsides of Premium Cards Most Reviews Ignore

Coupon-Style Credits Fatigue

To justify a $795 fee, banks give you $800 in value—split into $10 monthly increments across 12 different merchants. Managing these “use it or lose it” credits requires a spreadsheet and constant vigilance, turning your wallet into a part-time job.

Lounge Overcrowding Reality

Even with higher fees, lounges remain crowded. In 2026, “access” often means waiting on a digital waitlist for 45 minutes to enter a club where you can’t find a seat. The “luxury” promise often fails the reality test.

Breakage-Based Value Models

Banks are betting against you. They rely on you forgetting to select your “preferred airline” for the fee credit or missing the monthly enrollment window for the dining perk. If you aren’t hyper-organized, the house wins.

When Keeping a Premium Card Still Makes Sense in 2026

Despite the costs, retention is logical if:

- Retention Offers: You call to cancel and the bank offers a 40,000-point bonus to stay.

- Specific Redemption Goals: You are hoarding points for a specific high-value redemption (like a honeymoon in business class) where transferable points yield 4–5 cents per dollar.

- Family Travel: If the card grants lounge access to authorized users (even with new 2026 fees), it can still be cheaper than feeding a family of four at the terminal gate.

When You Should Downgrade or Cancel

Warning Signs You’re Overpaying

- You missed using more than 20% of the monthly credits last year.

- You visited a lounge fewer than 5 times.

- You are carrying a balance (interest charges instantly negate all rewards).

How to Exit Without Hurting Your Credit

Never just close a premium card if it’s one of your oldest accounts. Instead, request a product change (downgrade) to a no-annual-fee version within the same bank family. This preserves your credit history and credit limit while eliminating the fee.

Final Words

For the top 10% of travelers and spenders, yes—premium cards remain an essential tool for maximizing value and comfort. The math still works if you naturally engage with the card’s ecosystem.

However, for the majority of consumers in 2026, the value proposition has inverted. The “Sweet Spot” mid-tier cards now offer 80% of the utility for 20% of the price. If you find yourself stressing over a $10 dining credit on the 30th of the month, it’s time to downgrade.