You open your trading platform, but you feel lost in a sea of data. You place market orders without a plan, you overtrade, you watch your win rate slip. Many beginners in the stock market and forex trading face that trap.

Nial Fuller has used a part-time routine, based on daily chart review, price zones, and strict risk management, for over ten years.

This step-by-step guide will help you build a clear trading plan, set stop-loss orders, size your positions, and scan weekly charts with trend lines and price action. It will show you how to keep your emotions in check, track market trends, and boost your trading performance with strong trading discipline.

You can cut stress and master your routine. Keep reading.

Key Takeaways

- Set clear goals before you trade. State profit targets, stop-loss orders, and timelines. Risk no more than 1% per trade and only money you can afford to lose. Remember, over 80% of day traders quit in two years without a plan. Nial Fuller has used his part-time routine for 10 years.

- Use a 9-step pre-trading checklist. Verify your watchlist, scan news, review your written plan, confirm risk rules, score trade ideas, open charts, test orders, log trades, and apply Fuller’s “Routine + Discipline = Habit” law.

- Conduct daily market analysis on weekly and daily charts. In TradingView and MetaTrader 5, mark support and resistance zones, track 20- and 50-period EMAs, spot price action signals, and update your watchlist. Record each trade’s date, symbol, entry, exit, risk, and result.

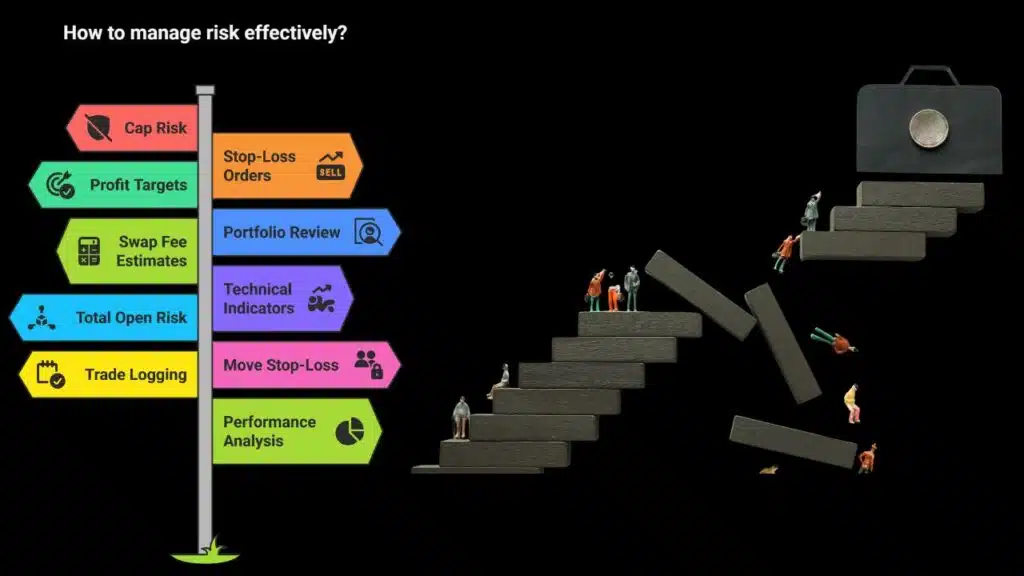

- Follow strict risk management rules. Cap risk at 1% per trade and 5% total open risk. Place stop-loss orders just beyond key levels. Aim for 2R to 3R profit targets. Move your stop to breakeven at 1R. Include swap fees for multi-day holds and review allocations weekly.

- Maintain emotional discipline. Before each session, clear your mind of baggage, assess market conditions, and pause before you act. Rely on your plan and stop-loss orders to curb rash trades. Apply Cory Mitchell’s four-step process to protect your focus and cut stress.

Define Your Trading Goals

Set clear goals to shape your trading plan. State profit targets, stop-loss orders, and timelines. Gauge your risk tolerance with a questionnaire or talk to a financial advisor. Only risk money you can afford to lose.

Past performance does not predict future results, so trade responsibly.

Factor in market conditions like support and resistance levels or a simple moving average. Pick a timeline for your trades, whether you swing trade over days or hold positions for weeks.

Stick to your risk management rules for consistent trading discipline.

Choose Your Trading Style

Picking a style helps you focus. Fuller favors a part time routine based on end of day data. Seyyed tracks a single forex pair for higher win rate. Salabius limits his watchlist to five pairs and studies their fundamentals.

Adeleye scans weekly, daily and four hour charts for support and resistance. Janis journals each setup to build trading discipline and trades only near key levels. Keith cut his MT4 watchlist from 28 to avoid screen clutter.

Swing trading fits market conditions that show clear trends or defined ranges. Day trading links rapid trade execution to tight profit targets. Position trading suits traders with high risk tolerance and a long outlook in the financial markets.

You match style to your trading plan and risk management rules. Charting platform choice and economic data shape trading strategies. Monitor moving averages or head and shoulders as technical indicators.

Use stop loss orders and market orders to lower risks.

Develop a Clear Trading Strategy

Fuller builds his trading strategy around technical indicators and fundamentals. He scans weekly charts, marks support and resistance zones, and spots major trends. He flips to daily charts and studies price action near those zones.

He uses moving averages to gauge short swings. He writes entry and exit rules with clear risk management steps. Banet once asked about trendlines. Fuller said they break in real time and dropped them.

Traders test a bearish tailed bar plus a pin bar inside a downtrend for a 2R profit over three to four weeks. They enter near a 50 percent retracement zone so they can use tighter stops and chase up to 6R.

Fuller sends market commentary after the Forex close each day, a habit he has kept for ten years. Matt reported better results after he switched to support lines on higher timeframes.

Set Realistic Expectations

Set profit targets and exit limits before you place a trade. Assign risk levels and trade only with funds you can afford to lose. Over 80% of day traders quit in two years without a clear trading plan.

Use metrics like total return, win ratio, risk-adjusted return measure and average gain or loss. Apply support and resistance, price action cues and chart tools to refine entries.

Adopt exit limits on each swing and day trade. Measure drawdown depth, recovery rate and profit ratio to monitor trading performance. Treat trading like a small business, and use a routine Cory Mitchell calls more vital than any single strategy.

Choose a broker regulated by ASIC or holding an Australian financial services license. Maintain discipline and curb emotional moves on market swings.

Create a Pre-Trading Checklist

A solid routine makes trading painless. A pre-trading list stops mistakes.

- Verify your pre-market watchlist: check each ticker’s trend, support and resistance levels, and note price action signals.

- Scan for news events: open an economic calendar and a newsfeed to gauge market conditions and assess risk ahead of trade execution.

- Review one written plan: confirm your trading plan stays stable in sessions and adapts during off-hours; note your favorite swing trading or day trading strategy.

- Confirm risk rules: set stop-loss orders, profit targets, and position sizing that suit your risk tolerance and money management style.

- Score each trade idea: use a personal system to rank setups by trading discipline and win rate potential, just like elite performers do.

- Open your chart graphs: look at key technical indicators and monitor support zones, so you spot fresh entry signals fast.

- Activate your order platform: test market orders and limit entries to confirm your trading system’s ease of use and accuracy.

- Enter logs in your trade journal: note your rationale, emotion, forex trading or cfd insights, and track performance stats.

- Apply Fuller’s RDH law: Routine plus Discipline equals Habit; love this structured process and build a ritual that Lode Loyens says fuels focus and commitment.

Conduct Daily Market Analysis

Daily analysis helps you catch shifts early. It anchors your trading discipline in real market conditions.

- Consult weekly charts on TradingView to spot major support and resistance zones and trend direction, following Fuller’s analysis routine that traders have used for over 10 years.

- Shift to daily charts in MetaTrader 5, highlight recent price action signals like engulfing bars and doji near key levels.

- Track 20 and 50 EMAs to gauge short-term momentum shifts and align them with overall trend phases.

- Gauge market conditions for stocks, forex pairs, and options, spotting trending moves or defined ranges, and ignore choppy consolidations.

- Update your watchlist on Excel or your trading platform, flag high-volume names to maintain familiarity with market behavior.

- Check RSI and MACD for divergences or overbought signals to refine entry timing and trade execution.

- Set market orders or limit orders, define stop-loss orders, profit targets, and position sizing based on risk tolerance in your trading plan.

Establish Risk Management Rules

Traders need clear rules to protect capital. Solid risk management cuts losses and locks gains.

- Cap risk per trade at 1% of portfolio value to match your risk tolerance with proper position sizing.

- Place stop-loss orders just beyond key support or resistance, for example above a pin bar high on a 4-hour chart.

- Aim for profit targets of 2R to 3R over a couple of weeks in swing trading to balance reward and time.

- Review portfolio allocation weekly to stay in line with market conditions and your trading strategies.

- Include swap fee estimates for holds over days after Don raised concerns about extra carry costs.

- Use technical indicators like a volatility gauge or momentum gauge to set position size and stop distance.

- Limit total open risk across all positions to 5% of account equity to maintain strict trading discipline.

- Move stop-loss orders to breakeven once a trade reaches 1R to secure gains and reduce stress.

- Log each trade execution with date, instrument, entry, exit, risk taken, and profit or loss for honest review.

- Analyze win rate and trading performance monthly, then tweak your rules based on real data.

Plan and Execute Your Trades

You need a solid plan before you risk real cash. A clear entry, exit and risk rule keeps you sharp.

- Recognize patterns like a bearish tailed bar and an inside bar signal in a downtrend that yielded a $400 profit in March 2023.

- Plan your trade entry at a breakout of support and resistance or at a bounce off the 8-day or 21-day moving average lines.

- Set stop-loss orders just beyond recent swing highs or lows to match your risk tolerance and risk management rules.

- Define profit targets at twice your risk for a 2:1 reward ratio or tweak them to suit current market conditions.

- Calculate position sizing using a 1% account risk per trade, guided by drawdown limits and trading discipline.

- Place market or limit orders on your broker’s platform, such as Stonex Group Inc. or firms overseen by the Australian Securities & Investments Commission, to execute your trading plan in live financial markets.

- Log each trade in a journal, track win rate, average wins and losses, plus any drawdowns, to gauge trading performance.

- Compare your results to Cory Mitchell’s four-step trading process, noting that trade planning and placing stands as the third step.

- Use a demo account, as Anthony King suggests for complete beginners, to practice your strategy without risking real funds.

Monitor and Evaluate Your Trades

Traders track each trade in a journal. They check performance metrics on the spot.

- Record date, ticker symbol, position size, entry and exit prices, and profit or loss. Use a trading journal or spreadsheet to keep detailed trade records.

- Rate each deal on a personal scale from one to five to spot high-quality setups and poor triggers.

- Log technical indicators like moving averages and a momentum indicator, chart patterns, and candlestick signals to spot market trends.

- Note support and resistance touches, price action shifts, breakouts, and false signals in your journal for context.

- Calculate weekly win rate, average drawdown, and recovery rate to track risk management and performance.

- Review all trades every Friday, marking both successes and failures to match the fourth step in Cory Mitchell’s plan: evaluation after implementation.

- Cross-check your entries against your trading plan, to confirm discipline, entry rules, and trade execution quality.

- Adjust stop-loss orders and profit targets if drawdown tops three percent of capital per week.

- Compare alerts from your trading platform with your manual actions to refine trade execution and boost discipline.

- Learn from webinars, books, and blogs to stay updated on trading psychology, new strategies, and continuing education.

Adjust Your Routine Based on Performance

Feedback guides a trader, like a seed needs water. Routine needs tweaks if it shows cracks.

- Check your trading journal each evening, log trades, record entry notes and exit notes.

- Drop entries into a spreadsheet to track win rate and average profit against profit targets.

- Watch market trends with a graph tool, spot shifts in support and resistance levels.

- Note how you felt mid-trade to tame bad habits in trading psychology and keep trading discipline strong.

- Adjust position sizing and stop-loss orders to match your risk tolerance and risk management plan.

- Shift between day trading and swing trading strategies when fresh data or market conditions demand a new plan.

- Use an economic calendar for coming reports, tweak your off-hours routine to prep for big news.

- Keep patience on daily charts, wait for clear price action signals before you hit market orders.

Maintain Emotional Discipline

Traders must clear their minds before each session. Cory Mitchell teaches a four-step process. Step one asks to let go of emotional baggage. Step two tells traders to assess market conditions.

This pause fuels better trade execution. It cuts off random moves and protects trading discipline.

Patience saves a lot of mistakes. Buyers often stare at daily charts around the clock. That habit leads to rash calls and ruined trading plan. Over-monitoring throws off risk management and profit targets.

A strong plan, backed by stop-loss orders, beats shaky trading psychology. That simple shift topples a trader’s biggest foe, their own mind.

Takeaways

A steady routine builds strong habits. Candlestick graphs show clear price action. RSI and MACD flag good entry points. Stop-loss orders guard your capital. Profit targets match your big plans.

A logbook records each trade, it lifts your win rate. Market swings become less scary, stress drops. Follow each step, learn fast, and watch your trading blueprint take shape.

FAQs

1. What is a trading plan and why do I need one?

A trading plan is your map for trading for beginners and pros, it lists trading strategies, trade planning steps, risk tolerance. It guides trade execution in financial markets and serves for informational purposes, adapts to market conditions for better trading success.

2. How do I set stop-loss orders, profit targets, and manage risk?

Pick support and resistance zones or use technical indicators. Set stop-loss orders and profit targets that match your trading strategy. Plan trade execution carefully and use position sizing for proper risk management.

3. How do I build trading discipline and improve my win rate?

Treat it like brushing your teeth, do it daily and without fail. Trading discipline shapes your trading psychology, lifts win rate, and curbs bad trades. Log each trade, check trading performance, and keep your inbox for notes.

4. How do price action and fundamental analysis work in the stock market or forex trading?

Price action shows real moves on charts, fundamental analysis digs into earnings or economic news. Use both to spot market trends, decide on position trading or swing trading, and boost trading success.

5. What is the difference between day trading, swing trading, and position trading?

A day trader ends all trades by market close, a swing trader holds for a few days, position trading spans weeks or months. Pick one that fits your time, preferences, and risk tolerance.

6. Can I add options trading or asset management to my trading business?

Yes, add options trading to hedge or boost gains, or mix in asset management to spread risk. Use market orders or limit orders, stick to risk management, and keep close tabs on stop-loss orders for smooth trading.