Motor insurance is a critical aspect of vehicle ownership in India, providing financial protection against unforeseen events like accidents, theft, or natural disasters.

With 2025 bringing evolving customer needs and regulatory changes, selecting the right motor insurance provider has become more important than ever.

This guide explores the Top 5 Motor Insurance Providers in India for 2025, detailing their features, benefits, and why they stand out in a competitive market. Whether you’re a new vehicle owner or looking to renew your policy, this comprehensive list will help you make an informed decision.

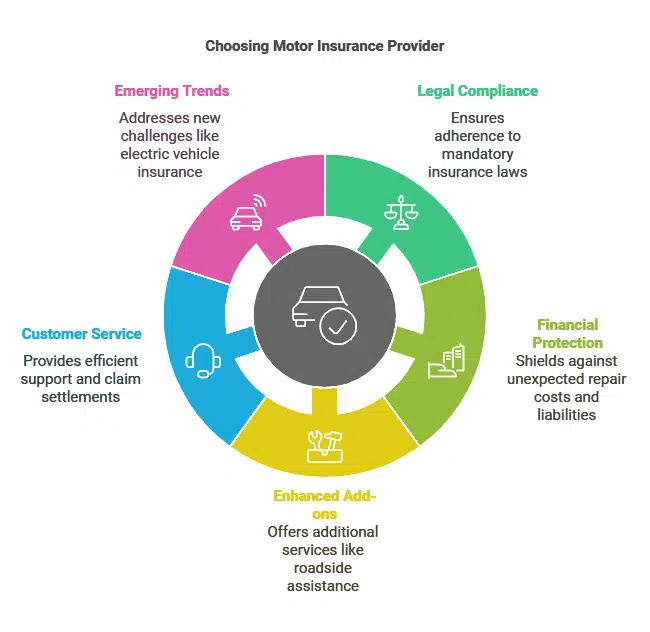

Why Choose the Right Motor Insurance Provider in 2025?

Choosing the right motor insurance provider ensures peace of mind, financial security, and compliance with legal requirements. With the rise of electric vehicles, hybrid options, and advanced telematics, the motor insurance landscape is evolving rapidly. Here’s why making an informed choice matters:

- Legal Compliance: Motor insurance is mandatory under the Motor Vehicles Act, 1988. Having comprehensive coverage ensures you meet legal requirements.

- Financial Protection: The right policy safeguards you from unexpected repair costs or liabilities.

- Enhanced Add-ons: Modern insurers offer value-added services like zero depreciation cover, engine protection, and roadside assistance.

- Customer Service: Efficient claim settlements and round-the-clock support can make a significant difference during emergencies.

- Emerging Trends: Electric vehicle insurance and telematics-based policies are transforming the market, making provider selection critical.

Factors to Consider When Selecting a Motor Insurance Provider

Before diving into the top providers, consider these factors:

- Coverage Options: Comprehensive policies that cover third-party liabilities, own damages, and add-ons are essential.

- Claim Settlement Ratio (CSR): A high CSR indicates the insurer’s reliability in settling claims promptly.

- Customer Support: Accessible and efficient support services enhance the overall experience.

- Add-on Benefits: Evaluate extras like zero depreciation, engine protection, or return-to-invoice cover.

- Premium Rates: Affordable premiums with sufficient coverage strike the perfect balance.

- Customization: Look for insurers offering flexible and tailored plans based on your driving habits and vehicle type.

Top 5 Motor Insurance Providers in India for 2025

Let’s take a closer look

1. Bajaj Allianz General Insurance

Why It Stands Out: Known for its extensive coverage options and efficient claim settlement process, Bajaj Allianz is a trusted name in the Indian motor insurance industry. The company’s focus on customer satisfaction and digital transformation ensures a seamless experience for policyholders. Its ability to handle claims swiftly makes it a favorite among vehicle owners. In 2025, Bajaj Allianz continues to lead with innovative plans and comprehensive solutions tailored to modern drivers.

Key Features & Benefits

- Comprehensive Coverage: Protects against accidents, theft, and natural disasters.

- Add-ons: Zero depreciation, engine protection, and consumables cover.

- Claim Settlement Ratio (CSR): 98% (2024 data).

- Digital Process: Quick online policy purchase and claim filing.

- Customer Support: 24/7 assistance through multiple channels.

- Telematics-Based Discounts: Encourages safe driving practices through premium reductions.

Premium Plans (Illustrative Table)

| Plan Type | Coverage Highlights | Annual Premium (INR) |

| Basic Comprehensive | Third-party + own damage | 9,000 – 11,500 |

| Comprehensive with Add-ons | Includes zero depreciation | 12,000 – 14,500 |

| Premium Plan | Comprehensive + roadside assistance | 14,500 – 16,500 |

| EV Special Plan | Coverage for electric vehicles | 10,000 – 12,500 |

Real-Life Example

Ravi, a Bangalore-based IT professional, saved INR 5,000 annually by opting for Bajaj Allianz’s EV Special Plan, which included tailored coverage for his electric car and telematics-based discounts.

Customer Ratings: 4.7/5

2. ICICI Lombard General Insurance

Why It Stands Out: ICICI Lombard is known for its customer-centric approach, offering flexible plans tailored to individual needs. Its extensive network of cashless garages and innovative digital solutions make it a leader in motor insurance. The company’s emphasis on paperless processes simplifies policy management, and in 2025, it leads in offering seamless mobile app-based solutions for claims and renewals. To further enhance digital efficiency, it also provides resources like the Invoice Template for Microsoft Word, making financial documentation and record-keeping easier for businesses and individuals.

Key Features & Benefits

- Wide Network: 6,700+ cashless garages across India.

- Innovative Add-ons: Roadside assistance, consumables cover.

- Claim approval: Paperless claims through their app.

- Premium Flexibility: Competitive pricing for all vehicle types.

- Telematics-Based Policies: Usage-based premiums for cost-effective coverage.

- DriveSmart Program: Rewards safe driving with premium reductions.

Premium Plans (Illustrative Table)

| Plan Type | Coverage Highlights | Annual Premium (INR) |

| Standard Plan | Basic coverage | 8,500 – 10,000 |

| Premium Plan | Add-ons included | 11,500 – 13,500 |

| Telematics Plan | Usage-based premiums | 7,500 – 9,500 |

| DriveSmart Plan | Includes driver behavior rewards | 9,000 – 11,000 |

Real-Life Example

Priya, a Mumbai-based doctor, benefited from ICICI Lombard’s DriveSmart Plan. She earned significant discounts for her excellent driving habits, tracked via telematics.

Customer Ratings: 4.6/5

3. HDFC ERGO General Insurance

Why It Stands Out: HDFC ERGO’s advanced digital solutions and tailored policies make it a go-to choice for tech-savvy customers. Its emphasis on user-friendly interfaces and quick claim settlements appeals to modern vehicle owners who value convenience. In 2025, HDFC ERGO strengthens its position with green initiatives and discounts for electric and hybrid vehicles.

Key Features & Benefits

- Digital First: Instant policy issuance and claims via their app.

- Unique Add-ons: Return-to-invoice cover and tyre protection.

- Claim Settlement Ratio (CSR): 96% (2024 data).

- Affordable Premiums: Competitive pricing without compromising coverage.

- Eco-Friendly Policies: Green vehicle discounts for electric cars.

- AI-Powered Assistance: Chatbots for 24/7 query resolution.

Premium Plans (Illustrative Table)

| Plan Type | Coverage Highlights | Annual Premium (INR) |

| Basic Plan | Third-party coverage | 7,000 – 8,500 |

| Premium Plan | Includes multiple add-ons | 10,000 – 12,000 |

| Green Vehicle Plan | Discounted for EVs | 6,500 – 8,000 |

| AI-Assisted Plan | Instant approvals via AI | 9,000 – 11,000 |

Real-Life Example

Vikram, an environmental enthusiast from Delhi, opted for HDFC ERGO’s Green Vehicle Plan for his electric SUV and enjoyed lower premiums alongside exceptional coverage.

Customer Ratings: 4.5/5

4. New India Assurance Company

Why It Stands Out: Backed by government trust, New India Assurance provides reliable services at competitive rates. The company’s focus on extending its reach to rural and urban areas ensures inclusivity and affordability. It is particularly well-regarded for its straightforward policies and transparent pricing. In 2025, its rural-focused initiatives cater to underrepresented demographics.

Key Features & Benefits

- Strong Reputation: Over 100 years of service.

- Wide Network: Coverage across rural and urban areas.

- Affordable Policies: Budget-friendly options for all.

- Customer-Centric Add-ons: Personal accident cover, legal liability.

- Trustworthy Claims Process: Simplified and transparent.

- Rural Policy Discounts: Special incentives for rural customers.

Premium Plans (Illustrative Table)

| Plan Type | Coverage Highlights | Annual Premium (INR) |

| Standard Plan | Basic coverage | 6,500 – 8,000 |

| Comprehensive Plan | Add-ons included | 9,500 – 11,000 |

| Rural Vehicle Plan | Designed for rural needs | 5,500 – 7,000 |

| Family Coverage Plan | Includes family accident cover | 10,000 – 12,000 |

Real-Life Example

Ramesh, a farmer from Punjab, leveraged the Rural Vehicle Plan to protect his tractor at a cost-effective premium, ensuring peace of mind during harvest season.

Customer Ratings: 4.4/5

5. Tata AIG General Insurance

Why It Stands Out: Tata AIG’s emphasis on personalized service and extensive add-on options ensures comprehensive coverage for all. The company’s innovative policies cater to modern vehicle owners, offering plans for everything from luxury cars to two-wheelers. In 2025, Tata AIG introduced exclusive coverage for high-end vehicles and luxury SUVs.

Key Features & Benefits

- Customizable Plans: Tailored policies for different vehicle types.

- Innovative Add-ons: Loss of personal belongings, key replacement cover.

- Claim Settlement Ratio (CSR): 95% (2024 data).

- Efficient Customer Service: 24/7 support.

- Special Plans: Luxury vehicle coverage and specific add-ons for high-end cars.

- Two-Wheeler Plans: Affordable coverage for bike owners.

Premium Plans (Illustrative Table)

| Plan Type | Coverage Highlights | Annual Premium (INR) |

| Basic Plan | Third-party coverage | 8,000 – 9,500 |

| Premium Plan | Includes key add-ons | 10,500 – 12,500 |

| Luxury Plan | High-end vehicle coverage | 15,000 – 18,000 |

| Two-Wheeler Plan | Affordable bike coverage | 3,500 – 5,000 |

Real-Life Example

Sunita, a luxury car owner in Hyderabad, opted for Tata AIG’s Luxury Plan for her premium sedan, enjoying tailored add-ons like loss of personal belongings and return-to-invoice coverage.

Customer Ratings: 4.6/5

How to Choose the Right Motor Insurance Plan for Your Vehicle in 2025

To make an informed decision:

- Compare Policies: Use online comparison tools.

- Assess Coverage Needs: Consider factors like vehicle age, usage, and location.

- Evaluate Add-ons: Opt for add-ons that suit your driving habits.

- Check Claim Settlement Ratio: A high CSR ensures smooth claim processes.

- Read Reviews: Customer experiences can provide valuable insights.

- Explore Discounts: Look for plans offering discounts for green vehicles or safe driving.

- Understand the Fine Print: Review terms and conditions thoroughly to avoid surprises.

Final Thoughts

The right motor insurance policy not only ensures financial security but also enhances your driving experience. Providers like Bajaj Allianz, ICICI Lombard, HDFC ERGO, New India Assurance, and Tata AIG stand out in 2025 for their customer-centric services, efficient claim settlements, and comprehensive coverage options.

Evaluate your needs, compare plans, and choose a provider that aligns with your requirements. Start your journey towards safer and smarter driving today!