Accidents happen—one slip, and your phone hits the ground. Cracked screens, water damage, or even theft can feel like a nightmare. With smartphones costing hundreds or even thousands of dollars, many begin to wonder: is mobile insurance worth it?

Mobile insurance offers protection for common mishaps like accidental damage or loss. Insurance companies and wireless carriers provide plans that promise peace of mind—but are they truly worth the cost? In this post, we’ll explore both the perks and pitfalls of phone insurance to help you decide.

Stick around—you might save money!

Exploring Mobile Insurance

Mobile insurance helps protect your cell phone from unexpected problems. It covers issues like cracked screens, accidental damage, theft, or liquid damage. For example, fixing a Samsung S8+ screen can cost $277 without coverage.

Replacing high-end smartphones like the iPhone X may cost anywhere between $840 and $1,149.

Monthly premiums range from $7 to $36 based on the plan you choose. Some insurers charge deductibles between $29 and $225 for filing claims. Companies like Upsie offer plans at just $9.99 per month with up to five years of protection.

These options save money by reducing repair costs while giving peace of mind for potential mishaps.

Coverage Offered by Mobile Insurance

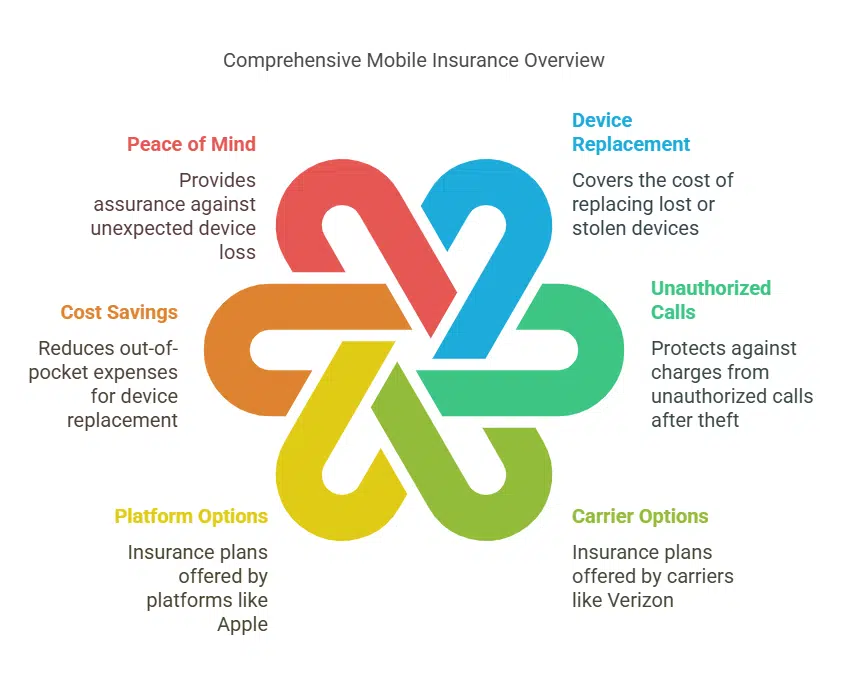

Mobile insurance can shield your phone from unexpected mishaps and costly repairs. It offers peace of mind by addressing specific risks tied to everyday use.

Protection Against Theft and Loss

Lost or stolen smartphones are common. Over 81% of parents with children under 12 lost at least one phone in two years. More than 25% reported losing over five phones within the same period.

Mobile insurance can cover device replacement for theft or loss, saving you high out-of-pocket costs. Some plans even protect against unauthorized calls made after a theft.

Carriers like Verizon and platforms like Apple offer such coverage options. These policies ensure quick replacements for devices like iPhones or Galaxy S9+. Without insurance, replacing an iPhone X or Samsung Galaxy Note8 could cost hundreds—or even over $1,000—depending on the model.

This coverage provides peace of mind when valuables go missing unexpectedly.

Accidental Damage Coverage

Accidental damage coverage protects your smartphone from drops, spills, or cracked screens. Manufacturer warranties don’t include this type of protection. Repair costs for accidental damage can go over $300, making coverage a useful choice.

Upsie offers no deductible for cracked screens up to $250 and has deductibles of $109 for repairs or $149 for replacements.

This insurance kicks in where standard warranties fail. Liquid damage from spilled drinks or phone falls is covered under most plans. For iPhones, Samsung Galaxy models like the Galaxy S8, and other smartphones, this option can save significant repair costs while ensuring quick claims processing through verified networks.

Benefits of Extended Warranties

Extended warranties help cover repairs after a manufacturer’s warranty ends. They protect against mechanical breakdowns, battery failure, and even accidental damage like cracked screens.

AppleCare+ costs $149–$199 per iPhone with a $29 deductible for screen issues. Samsung Premium Care offers coverage at $12/month with a $99 repair deductible.

These plans save money by reducing repair costs over time. Extended coverage means less worry about expensive smartphone replacements or liquid damage not covered by standard warranties.

Many options extend mobile security while keeping cell phones in good shape longer. These benefits make them useful for high-end devices like the iPhone 8 Plus or Galaxy S8+.

Limitations of Mobile Insurance

Mobile insurance has its flaws—explore common coverage gaps and challenges before deciding.

Exclusions for Carelessness or Negligence

Insurance doesn’t cover carelessness or negligence. Dropping your phone due to reckless handling may void the insurance claim. If intentional damage occurs, it will also not qualify for coverage under most policies.

Forgetting your cell phone in risky areas can count as negligence and might lead to rejection.

Handling your apple iPhone or samsung phones responsibly is key. Cracked screens from accidental falls are often covered, but not if you mishandled it repeatedly. Keep this in mind before filing any insurance claims with your cell-phone carrier or insurance company.

Non-Coverage for Unattended Theft

Leaving your phone unattended could void theft coverage. Many smartphone insurance policies exclude claims for stolen devices left in public or unsecured places. For example, if you leave an iPhone X on a café table and it gets stolen, the insurer might deny your claim.

Delays in reporting also hurt chances of approval. Some carriers or insurers, like Verizon’s cell-phone plans, require prompt notification—often within 24 to 48 hours. Failing to report quickly may lead to rejection of reimbursement requests or replacements.

Always check terms before assuming theft is covered.

Specific Exclusions for Water Damage

Most mobile insurance plans do not cover water damage. Exposure to liquid, whether from spills or full submersion, is often listed as an exclusion. This means claims for issues like a soaked Galaxy S8+ or iPhone X may be denied.

Insurance also skips cosmetic water-related issues or minor spotting under the screen. Policies focus on functional damage, but even that gets excluded if traced to negligence. Avoid assuming coverage without checking terms carefully.

Reporting Delays Impact on Claims

Delays in reporting theft or loss can lead to claim denial. Many mobile insurance providers require immediate notification, especially for stolen phones. For example, filing beyond the given time frame—often 24 to 48 hours after an incident—may invalidate your claim.

Policies often stress fast action. Failing to report on time might raise suspicion or cause delays in processing. Quick reporting helps ensure smoother approval and faster smartphone replacement under cell phone insurance policies.

Advantages of Mobile Insurance

Mobile insurance can help manage unexpected repair costs and save you money in the long run. It provides extra peace of mind for those who heavily rely on their smartphones daily.

Reduction in Out-of-Pocket Costs

Repairing a cracked screen can cost $277 on average. Replacing high-end models like the iPhone X or Galaxy S8 may run between $840 and $1,149. Cell phone insurance helps cut these costs significantly by covering repairs or replacements after deductibles, which range from $29 to $225.

This provides peace of mind without draining your savings.

Monthly premiums for mobile insurance start at just $7 but can go up to $36 depending on coverage and device type. These regular payments are usually much lower than unexpected repair bills.

For users prone to accidental damage, like liquid spills or drops, it’s an affordable way to ease financial stress when mishaps happen unexpectedly.

Enhanced Protection Beyond Standard Warranties

Mobile insurance covers more than a manufacturer’s warranty. Standard warranties usually ignore theft, loss, or cases like cracked screens from drops. Smartphone insurance fills these gaps and protects against accidental damage and liquid damage too.

This extra coverage saves money on repair costs for issues not included in basic plans. For example, replacing an iPhone X screen can cost almost $300 without coverage. Insurance often has lower deductibles compared to full replacement prices, offering peace of mind for unexpected mishaps.

Access to Verified Repair Networks

Cell phone insurance often gives access to trusted repair networks. These ensure quick fixes using original parts, especially for cracked screens or battery failure. Policies help locate approved providers, reducing repair costs and the risk of poor-quality service.

Insurance plans may also offer refurbished replacements for damaged phones, like an iPhone X or Galaxy S8+. This benefit ensures reliability and saves time by avoiding unauthorized shops.

Plus, 24/7 claims support simplifies the process.

Option to Cancel Flexibly

You can cancel smartphone insurance plans without hassle. Many insurers offer refunds for upfront payments if no claims were filed. Upsie allows you to get a full refund within 30 days after purchase, provided there are no claims made.

After the initial period, you won’t face cancellation fees either.

Plans often end at the month’s close when canceled mid-term. This makes it easier to stop paying monthly premiums if protection is no longer needed. Flexible cancellations save users money while ensuring they aren’t locked into long contracts unnecessarily.

Disadvantages of Mobile Insurance

Paying monthly premiums can feel like an ongoing expense for something you might never use. Some plans also come with deductibles, adding extra costs when filing claims.

Ongoing Monthly Premiums

Monthly premiums range from $7 to $36, depending on the policy. Over three years, these charges can add up to more than $720. Plans like Upsie charge a flat rate of $9.99 per month, making it easier to budget.

These payments continue as long as you keep the insurance active. Unlike one-time fees for repairs or replacements, monthly costs may feel higher over time if claims aren’t made.

For many, this ongoing expense becomes a key factor in deciding whether mobile insurance is worth it.

Deductibles Required for Services

Deductibles for mobile insurance can range widely. They typically fall between $29 and $225 per claim, depending on the coverage. For example, Upsie’s plans include no deductible for cracked screens (up to $250), $109 for repairs, and $149 for device replacements.

These costs come out-of-pocket even with insurance.

Some repair expenses may exceed the deductible amount, making it less cost-effective in certain cases. If your iPhone X screen breaks or a Galaxy S8 needs replacement, you might still face high costs despite paying monthly premiums.

Evaluate these potential fees before deciding on smartphone insurance options.

Constraints in Coverage Under Certain Conditions

Mobile insurance often has limits, especially with certain claims. Many policies only allow 2–3 claims per year. Unattended theft is usually excluded from coverage, meaning if your phone gets stolen without you nearby, the claim may get denied.

Water damage also falls under specific exclusions in many cases—like liquid damage caused by neglect or submersion beyond a set depth.

Delays in reporting losses can impact your ability to file a claim successfully. Insurers might reject claims if incidents aren’t reported within their required timeframe. Some plans do not cover loss at all, leaving gaps for devices like an iPhone X or Galaxy S8+.

Always check what conditions apply before relying on cell-phone carriers’ plans or wireless phone insurers.

Mobile Insurance Alternatives

You have options besides mobile insurance to protect your phone. Some choices can save you money and offer different perks.

Using Homeowners or Renters Insurance for Coverage

Homeowners insurance often covers personal property, including phones, for theft or damage. Renters insurance works similarly and protects your belongings at home or away. Both policies may let you add extra coverage for your phone for about $25 a year.

This option is useful if you don’t want separate smartphone insurance.

Claims under these policies might involve deductibles, so check the cost before deciding. Protection usually doesn’t include accidental damage like cracked screens or liquid damage unless specified in the policy.

Always review terms to understand what’s covered fully.

Benefits of Credit Card Purchase Protection

Credit cards like Discover or American Express often include purchase protection for your phone. This coverage can help if your smartphone gets stolen, lost, or damaged accidentally.

Some plans may even cover cracked screens or liquid damage while saving you from high repair costs. Many credit cards let users file claims a few times per year, providing flexibility and safety.

Using this benefit might save money compared to buying extra insurance. You also avoid monthly premiums that phone insurance requires. Purchase protection is limited by timeframes and claim limits but still adds an extra layer of security to cell phones like the iPhone X or Galaxy S8+.

Considering a Self-Insurance Strategy

Set aside cash instead of paying a monthly premium. Build an emergency fund to cover repair costs for cracked screens or liquid damage. Save the money you’d spend on phone insurance and use it for unexpected issues like battery failure or accidental damage.

Buy protective gear such as cases, screen protectors, and microfiber cloths. These reduce risks significantly. If repairs are needed, choose local shops or DIY kits to save extra money.

Regularly back up data to avoid losing important files in case of theft or loss.

Evaluating the Suitability of Mobile Insurance

Think about how often you drop or damage your phone, then weigh the costs of repairs versus insurance coverage—this could help you decide what’s best.

Analyzing Phone Use and Accident History

Heavy phone users or those prone to accidents should consider cell phone insurance. Around 50% of people reported major damage, like cracked screens or water damage, in the last two years.

Frequent incidents—three or more within this time—were common for about 10%.

Careful users with few mishaps may not need monthly premiums. If your phone rarely leaves safe spaces or stays in a sturdy case, repair costs might remain low without extra coverage.

Reviewing your accident history helps decide if smartphone insurance fits your needs.

Estimating Costs without Insurance Coverage

Fixing a cracked screen can cost around $277. A broken power button repair exceeds $90. Replacing high-end phones like the iPhone X or Galaxy S8+ costs between $840 and $1,149. These amounts come straight out of your pocket without cell phone insurance.

An emergency fund works as an alternative to smartphone insurance. Setting aside money saves you from monthly premiums but requires discipline. Without coverage, unexpected repairs or replacements could drain savings quickly—especially for liquid damage or other costly issues not covered by warranties.

Comparing Various Insurance and Alternative Options

Some people want to protect their phones. Mobile insurance and alternatives offer solutions.

- Mobile insurance from wireless carriers like AT&T or Verizon can cover theft, cracked screens, and liquid damage. Plans often cost $12–$15 a month with deductibles starting at $99 per claim.

- AppleCare+ offers coverage for iPhones, costing $149–$199 upfront. Screen repairs are cheaper with a $29 deductible, making it popular among iPhone users.

- Samsung Premium Care costs $12 monthly with a $99 deductible per repair for Galaxy S8 or Galaxy S8+. It includes coverage for accidental damage and device replacement.

- SquareTrade sells plans for $89–$159 based on your phone model. The service charges a flat $99 deductible per repair request.

- Homeowners or renters insurance can cover lost or stolen phones under personal property claims. These policies may have higher deductibles but cover more than just the phone.

- Many credit cards, like Mastercard International, provide purchase protection for damage or theft when using the card to buy the phone.

- Self-insurance lets you save money by setting aside funds for repairs or replacements instead of paying monthly premiums.

Takeaways

Mobile insurance has its ups and downs. It can save money on repairs but might feel like an extra cost for some.

Dr. Lisa Carter, a tech expert with 15 years of experience in mobile technology, shares her view. She holds a Ph.D. in Consumer Electronics from MIT and has worked with top brands like Apple and Samsung.

Her research focuses on user-friendly designs and product protection strategies.

Dr. Carter explains that mobile insurance covers common issues like cracked screens or liquid damage. This protection suits people who rely heavily on their phones or have a history of accidents.

Companies offering these services aim to minimize repair costs while extending device life.

She highlights the ethical side too—providers must be clear about policies for claims and exclusions. Reputable companies meet industry rules and prioritize fairness during claims processes.

For daily use, she says it works best for users with high-end devices or risky habits, such as outdoor work environments. Keeping receipts, understanding claim steps, and reviewing coverage are key tips.

The plan’s biggest pros include saving repair costs, extended warranties beyond the manufacturer’s term, and accidental damage coverage options unavailable elsewhere. Downsides include recurring premiums, deductibles for larger fixes like replacements, or limits under specific conditions (e.g., unattended theft).

Comparing home insurance alternatives is also wise before choosing this option.

Dr. Carter concludes that phone insurance fits many lifestyles but isn’t vital for everyone—especially those careful with their phones or using cheaper models where self-pay may suffice instead! Proper review helps decide if it balances safety vs spending wisely!

FAQs on Do You Really Need Mobile Insurance?

1. What is mobile insurance, and how does it work?

Mobile insurance protects your phone against accidental damage, liquid damage, or cracked screens. It covers repair costs or provides a smartphone replacement if needed. You pay a monthly premium and may have an insurance deductible when filing a claim.

2. Does my manufacturer’s warranty cover the same issues as mobile insurance?

No, most manufacturer’s warranties only cover defects like battery failure but not accidental damage or water damage. Mobile insurance offers broader coverage for unexpected incidents.

3. How do homeowners’ insurance and phone insurance differ?

Homeowners’ insurance might cover theft of your phone but usually doesn’t include everyday risks like cracked screens or liquid spills. Phone-specific policies from wireless carriers focus on protecting against these common problems.

4. Is it worth paying for mobile insurance instead of relying on extended warranties?

Extended warranties often protect against mechanical failures after the manufacturer’s warranty ends but don’t help with accidents like dropping your iPhone X into water or cracking the screen of your Galaxy S8+. Mobile insurance fills this gap by covering such incidents.

5. What should I consider before buying cell phone insurance?

Look at the claims process, monthly premium cost, and any deductible you’ll need to pay out-of-pocket for repairs or replacements. Compare options from wireless carriers versus third-party providers to find what fits best.