CES 2026 put the LG CLOiD Home Robot onstage to sell a “zero-labor home”—a promise that could reshape appliances, care work, and home data. It matters now because generative AI is finally giving robots a usable brain, and households are ready for help. But the slow, stage-managed laundry handoff shows the gap.

LG’s CLOiD is not just another “robot butler” concept. It’s a strategic bet that the next smart-home platform will be measured less by how well it connects devices and more by how well it can act in the real world. LG is explicitly framing CLOiD as a system that coordinates chores across connected appliances, tied to its ThinQ ecosystem and “Physical AI” stack (vision-language models that perceive, interpret, and then execute actions).

If that framing is right, CLOiD is a signal that the smart-home era is entering its second act: from dashboards and voice commands to embodied automation. The stakes are bigger than convenience. “Zero-labor” is a claim about time, household economics, gendered unpaid work, and the future of home data. And it arrives while robotics is moving from isolated single-purpose devices (robot vacuums) toward more general-purpose systems that can learn tasks, navigate messiness, and interact naturally.

How We Got Here: From Single-Task Bots To “Physical AI” Helpers

The home-robot story has always been a tug-of-war between ambition and reality. The early winners did one job well, repeatedly, at a price that felt reasonable. The Roomba became an icon by narrowing the problem to floor cleaning.

The “general household robot,” by contrast, has struggled because homes are adversarial environments: cluttered, variable lighting, fragile objects, stairs, pets, children, and countless edge cases. What changed in the last two years is not that motors and sensors suddenly became magical. It’s that AI perception and language interfaces improved enough to make robots feel more teachable, more adaptable, and less like pre-programmed toys.

LG’s CLOiD pitch rests on that shift. LG describes CLOiD’s “Physical AI” as combining a vision-language model layer that turns visual input into structured understanding, and a vision-language-action layer that translates that understanding into physical actions, trained on extensive household task data.

That “data claim” is a quiet tell: the limiting factor is increasingly not just hardware, but training pipelines, simulation, and the ability to update models safely over time.

A Short Timeline Of The Road To “Zero-Labor”

| Year | Milestone | Why It Mattered |

| 2002 | Roomba launches | Proved consumers will pay for a single reliable home robot task. |

| 2022 | Matter 1.0 launches | Began standardizing interoperability across smart-home ecosystems. |

| 2024–2025 | Matter expands (energy, large appliances, easier onboarding) | Smart homes start integrating “big chores” like laundry, cooking, energy management into automations. |

| 2025 | Service-robot sales rise; RaaS grows | Shows automation demand is broadening and business models are shifting to subscriptions/rentals. |

| CES 2026 | LG demos CLOiD + “Zero Labor Home” | A major appliance giant reframes the smart home around embodied action and platform control. |

| 2026–2028 | AI rules tighten + industrial humanoids push commercialization | Regulation and industrial scale will shape what “safe, trustworthy robots” means in homes. |

Key Statistics That Explain Why This Moment Feels Different

- Unpaid domestic and care work totals over 16 billion hours per day globally, with a disproportionate share borne by women.

- The global share of people aged 65+ rose from 5.5% (1974) to 10.3% (2024) and is projected to keep rising, increasing demand for assistance and care infrastructure.

- Consumer service robots sold about 20 million units in 2024 (+11%), dominated by domestic tasks like floor cleaning and lawn mowing.

- Professional service robots sold about 200,000 units in 2024 (+9%), with strong growth in logistics and cleaning.

- Smart home device shipments reached about 892.3 million units in 2024 (near-flat), with forecasts pointing to a rebound led by emerging markets.

These figures don’t prove CLOiD will succeed. They do explain why “zero-labor” is a compelling narrative now: labor scarcity (paid and unpaid), aging demographics, and a maturing smart-home installed base that robots can potentially orchestrate.

Why The LG CLOiD Home Robot Is More Than A CES Stunt

LG’s CES 2026 reveal is unusually specific about how CLOiD fits into an appliance-first worldview. CLOiD isn’t being marketed as a standalone gadget. It’s framed as an orchestrator that performs and coordinates household tasks across connected appliances, built on ThinQ and positioned as a mobile “AI home hub.”

This matters because the smart home still has a usability problem: lots of devices, fragmented apps, and automations that break. Standards like Matter aim to reduce fragmentation by standardizing interoperability, improving onboarding, and making it easier to use devices across ecosystems. But interoperability alone does not do the dishes. It doesn’t fold laundry. It doesn’t pick up toys.

CLOiD is LG’s attempt to add the missing layer: a physical agent that can turn “smart appliances” into a coordinated household workflow. The showcased scenarios are telling: retrieving milk, placing food in an oven, initiating laundry, folding and stacking garments. These are chores that span multiple devices and spaces.

The strategic subtext: if CLOiD becomes the interface that controls the home, LG gains leverage over (1) appliance choice, (2) service subscriptions, and (3) the highest-value dataset in consumer tech: what people do at home, when, and why.

The Economics Of A “Zero-Labor” Home: Time, Cost, And Who Captures The Value

“Zero labor” is marketing. The real question is whose labor is reduced, whose labor is shifted, and who gets paid. A home robot can reduce hands-on time, but it can also create new labor categories: setup, maintenance, training, troubleshooting, and supervision.

Household chores aren’t just tasks. They’re routines with social meaning, risk tolerance, and quality standards. A robot that loads a washer slowly can be acceptable if it’s unattended and reliable. It’s not acceptable if it needs constant babysitting. That’s why the CES demo’s “slow handoff” detail, while minor, is analytically important. It hints at throughput and friction—two variables that determine whether the robot becomes a household utility or stays a novelty.

A Market Snapshot: The Installed Base Is Huge, But “Generalist” Robots Are Still Rare

The data suggests the world is already buying robots, but mostly the narrow kind. Meanwhile, smart-home devices are everywhere, but growth has slowed in mature markets, pushing vendors toward premium experiences and services.

| Metric | Latest Reported Figure | What It Suggests For “Zero-Labor” |

| Smart home device shipments (2024) | 892.3M units (near-flat) | The platform is widespread; differentiation must come from outcomes, not more gadgets. |

| Smart home device shipments (2025 forecast) | ~931.1M units (+4.4%) | Growth shifts toward emerging markets; value capture may move to software/services. |

| Consumer service robots sold (2024) | ~20M units (+11%) | Consumers want automation, but mostly for bounded tasks (vacuuming, mowing). |

| Professional service robots sold (2024) | ~200K units (+9%) | Robots win when ROI is measurable and environments are semi-controlled. |

| Robot-as-a-service (RaaS) growth | +31% (fleet growth) | Subscription models may be the bridge for expensive household robots. |

The likely economic path: early “zero-labor” robots are more plausible as premium services (subscription, leasing, maintenance included) than as one-time purchases. The hardware will be expensive, and the AI will require ongoing updates, safety patches, and model improvements.

The Tech Stack Behind CLOiD: Why This Is A Data Problem Disguised As A Hardware Problem

LG describes CLOiD as having two articulated arms with seven degrees of freedom each, five individually actuated fingers per hand, sensors and cameras in the head, and a wheeled base chosen for stability and cost. That is a sensible engineering compromise: wheels beat legs for home safety, battery life, and price, even if they limit stair navigation.

But the bigger constraint is not whether CLOiD can grasp a towel. It’s whether it can robustly execute long-horizon tasks across messy real homes without constant human correction. That’s what “Physical AI” is trying to solve.

What A “Zero-Labor” Robot Must Do Well (And Why It’s Hard)

| Capability | Why It’s Required | The Real Bottleneck | Practical Near-Term Workaround |

| Perception in clutter | Homes aren’t standardized; objects move | Lighting variation, occlusion, long-tail objects | Constrain tasks to “prepared” zones |

| Safe manipulation | Humans, pets, fragile items everywhere | Force control, error recovery, reliable grasping | Start with low-risk items (towels, packaged goods) |

| Long-horizon planning | Chores are sequences, not single actions | Planning under uncertainty + interruptions | Break into micro-tasks with checkpoints |

| Natural interaction | Users must trust and correct the robot | Ambiguity, personalization, edge-case intent | “Confirm before action” modes, user profiles |

| Cross-device orchestration | “Zero-labor” requires appliances to cooperate | Ecosystem fragmentation and permissions | Deep vertical integration (ThinQ-first) |

| Continuous learning | Homes differ; robot must adapt | Privacy constraints + update safety | On-device learning + opt-in cloud improvements |

The pattern is consistent: “zero-labor” is less about replacing human effort and more about lowering coordination costs across devices, spaces, and decisions.

Trust, Safety, And Privacy: The Home Is Not A Factory Floor

A home robot is not a robot vacuum with arms. It’s closer to a mobile sensing system that sees inside your living space, learns routines, and potentially records audio/video. That is a different trust relationship than “my vacuum occasionally gets stuck.”

LG emphasizes “Affectionate Intelligence” and personalization. Personalization is valuable, but it can collide with privacy expectations, especially across jurisdictions.

Regulation is also tightening around AI systems that can meaningfully affect safety. The EU’s AI rule timeline, for example, points to major obligations for certain high-risk systems beginning in August 2026, shaping how robotics firms document risk management, testing, and post-market monitoring—especially in Europe.

For “zero-labor” robots, the trust questions are predictable:

- What data is processed locally vs in the cloud?

- Are cameras always on?

- Who can access logs?

- What happens after resale, repair, or bankruptcy?

- How do software updates change behavior over time?

Continuity and support matter more than most consumers realize. The consumer robotics market has already shown that even prominent companies can face financial stress and strategic pivots. If a generalist home robot becomes a home “operating system,” these risks become existential concerns.

Platform Wars In The Living Room: ThinQ, Matter, And The Battle For Home Data

CLOiD’s real competitive arena is platform control.

Matter exists because consumers and device makers were tired of fragmented ecosystems. It has steadily expanded since 2022, emphasizing broader device types and easier setup. In theory, this reduces lock-in and makes it easier for households to mix brands.

But robots add a twist: the controller becomes more powerful than any single device. If CLOiD can autonomously decide when to run laundry, preheat an oven, or manage energy loads, it becomes the household’s “policy engine.”

That makes the robot a gatekeeper for:

- which appliances get preferred workflows,

- which services get surfaced,

- and which data streams get collected and monetized.

CES itself signaled how central robotics is becoming to consumer tech, with robotics increasingly framed as a mainstream category across home automation, healthcare, and hospitality, plus national initiatives showcasing humanoids and service robots.

Interpretation: the smart-home battle is shifting from “who has the best voice assistant” to “who owns the most useful agent that can act.” That will likely reward companies that already have appliance footprints, service networks, and end-to-end ecosystems.

Competition Reality Check: Why LG Is Racing, And Why It Still Might Be Early

It’s tempting to treat CLOiD as a category-creating moment. A more grounded read is that LG is trying to win the “middle layer” before competitors do.

On one end, you have cheap, single-purpose robotics that are brutally competitive. The robot vacuum market has become crowded, and category leaders have faced pressure from rivals offering similar features at lower prices.

On the other end, you have industrial humanoid robotics and “embodied AI” investment accelerating, with major moves, acquisitions, and stated timelines for scaled deployments in industrial environments.

LG sits between those extremes, trying to:

- defend appliance margins against commoditization,

- create a premium automation experience,

- and claim an early lead in “home Physical AI.”

Why Homes Punish Generalists

Industrial automation works because environments are constrained and ROI is calculable. Homes are not. The biggest reason generalist household robots have historically disappointed is not engineering laziness. It’s that “do everything” means solving a combinatorial explosion of scenarios.

This is where CLOiD’s wheeled design and appliance-integration emphasis look pragmatic. LG is implicitly saying: don’t start with stairs and chaotic kitchens as independent problems. Start with tasks that are partially structured by appliances that provide known coordinates, predictable interfaces, and machine-to-machine commands.

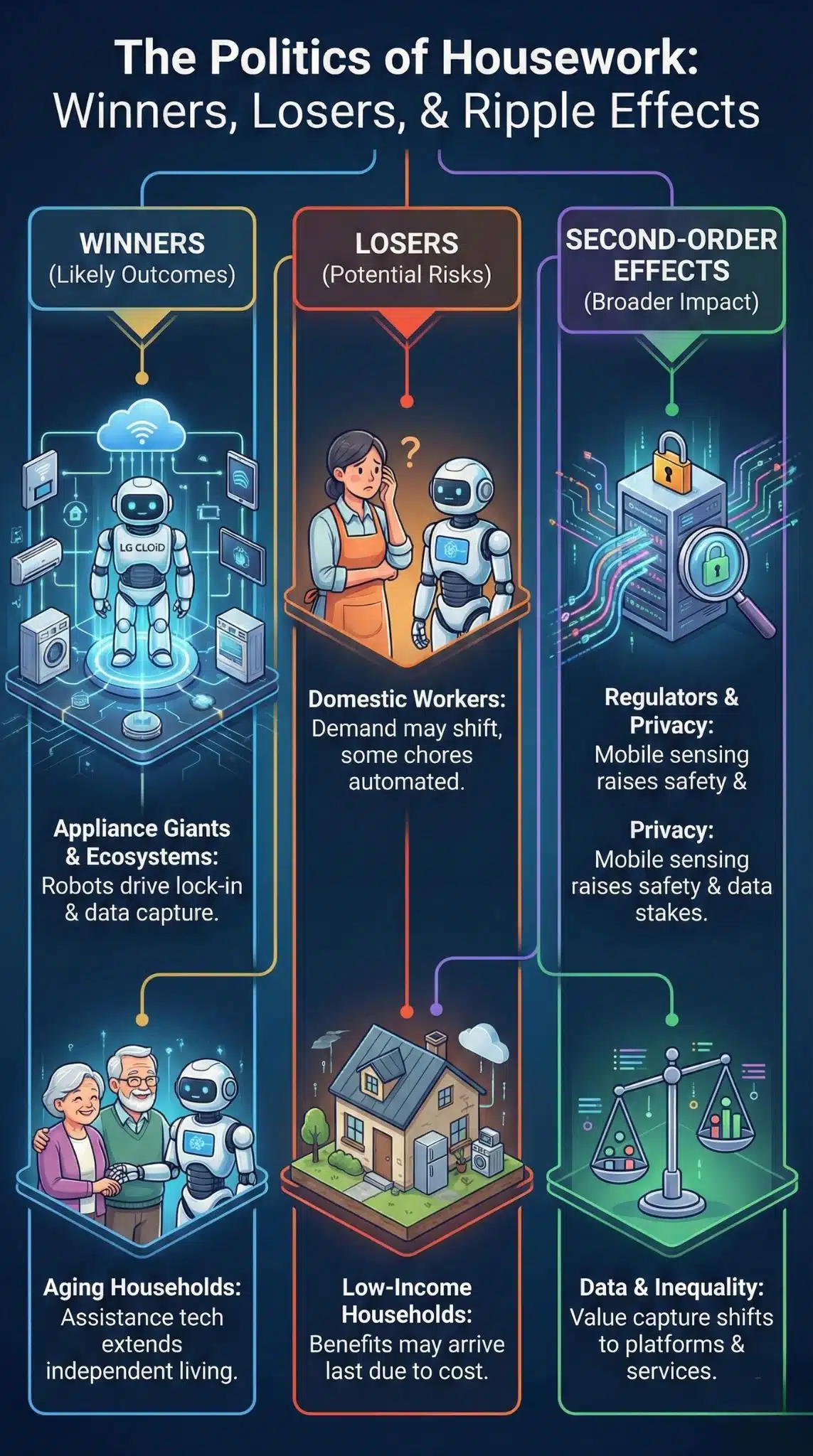

Winners, Losers, And Second-Order Effects: The Politics Of Housework

“Zero labor” language is powerful because it touches a sensitive reality: households run on a vast amount of unpaid work, and it is not evenly distributed.

A home robot that meaningfully reduces chore time could be socially beneficial. But it could also reinforce inequalities if only high-income households can afford it, or if it shifts labor burdens in less visible ways.

| Group | Likely Outcome If Home Robots Scale | Why |

| Appliance giants with ecosystems | Win | Robots become the interface layer that drives appliance + service lock-in. |

| Single-task robotics firms | Mixed | Could be commoditized, or become modules inside larger platforms. |

| Aging households | Potential win | Assistance tech could help extend independent living. |

| Domestic workers | Risk | Some chores may be automated; demand may shift toward care roles. |

| Low-income households | Risk | Benefits may arrive last due to cost and service requirements. |

| Regulators and privacy advocates | Pressure increases | Mobile sensing inside homes raises safety, privacy, and accountability stakes. |

A neutral but important point: if “zero-labor” becomes real, the social impact will depend less on the robot’s existence and more on pricing models, data governance, and distribution.

Expert Perspectives: The Two Competing Stories About Home Robots

“We’re Crossing The Threshold” (Optimists)

- The AI leap is enabling more robust perception, planning, and interaction.

- The market pull is real: labor constraints, aging populations, and consumer appetite for automation.

- CES 2026 increasingly frames robotics as a mainstream category, not a sideshow.

- LG’s approach looks pragmatic: start with appliance-integrated workflows in controlled home zones.

“Homes Are A Graveyard For Generalist Robotics” (Skeptics)

- Stage demos often hide reliability issues, edge-case failures, and maintenance costs.

- Home robotics history shows even category leaders can be squeezed by commoditization and competition.

- Privacy and liability risks are higher for mobile, sensor-rich assistants than for single-task bots.

- The “do everything” promise can collapse under real-world variability.

Both narratives can be true at once: AI is enabling new capabilities, and the home remains one of the hardest environments to productize.

What Comes Next: The Milestones That Will Decide Whether “Zero-Labor” Is Real

If you want to assess CLOiD’s significance beyond CES headlines, watch for proof in the next 12–24 months. The key is not another demo. It’s evidence of a viable product pathway.

Milestones To Watch (2026–2028)

- Commercial clarity: pricing, availability, and whether CLOiD is sold, leased, or offered as a service.

- Reliability metrics: time-to-complete chores, failure rates, and recovery behavior in uncontrolled homes.

- Interoperability stance: whether CLOiD stays ThinQ-first or supports multi-ecosystem workflows as standards mature.

- Privacy posture: on-device processing commitments, camera/audio controls, and auditability of AI behavior changes.

- Ecosystem flywheel: partnerships and whether “Physical AI” becomes a broader platform strategy.

- Regulatory readiness: documentation, safety alignment, and market strategy as 2026 compliance obligations approach.

A Measured Prediction

Market indicators suggest more robots will enter more homes, but mostly as specialists (cleaning, lawn care, security) before generalists become common. CLOiD’s best near-term path is not “replacing housework.” It’s reducing coordination costs—moving items between appliances, initiating routines, and acting as a mobile interface for a more complex home.

If LG can make CLOiD reliably orchestrate just a handful of high-value workflows (laundry, kitchen prep, basic home monitoring, energy routines), “zero-labor” won’t be literal. But it could become real enough to reset consumer expectations and force rivals to respond.