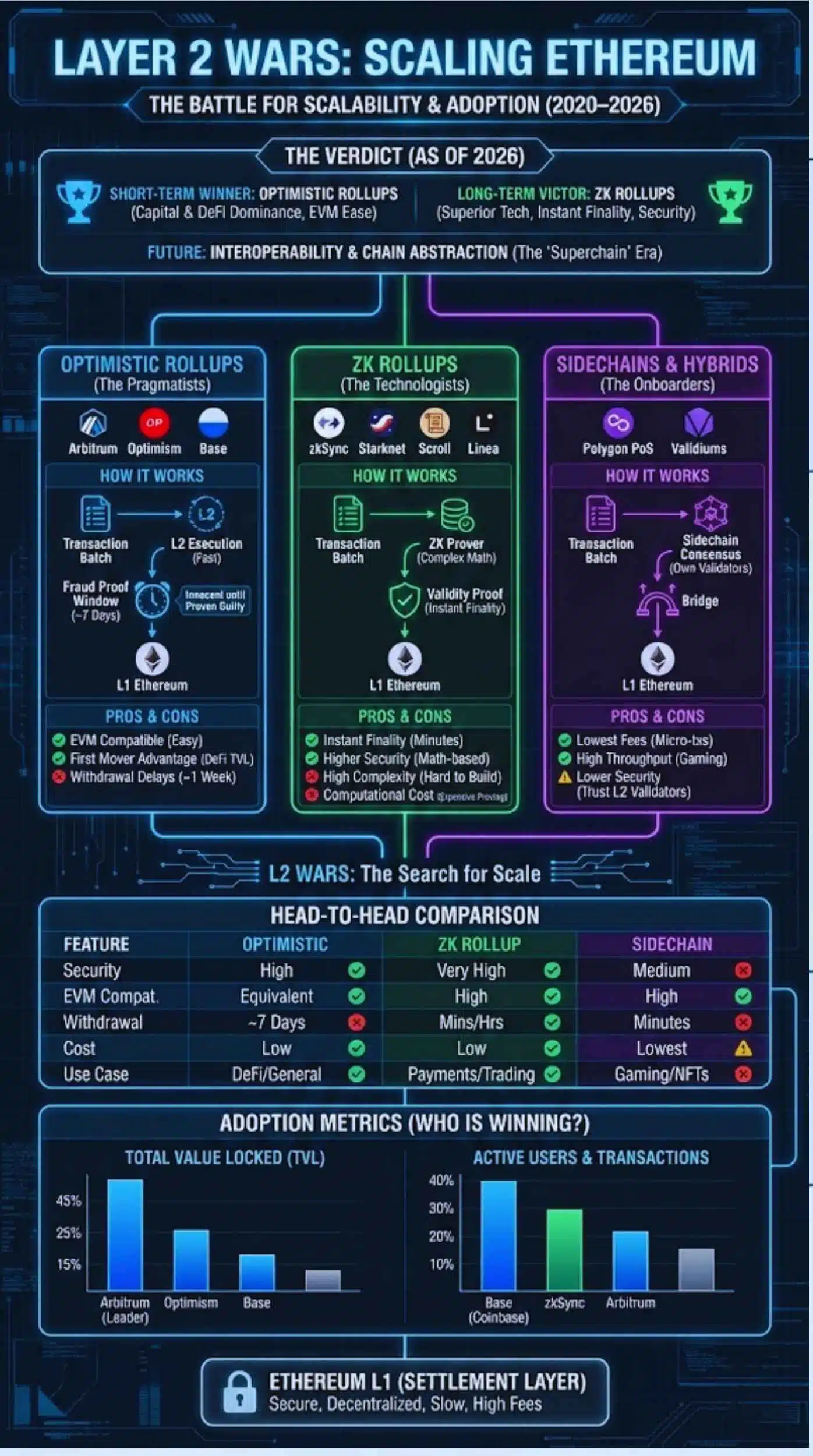

For years, the Ethereum network faced an existential crisis. As DeFi summers and NFT crazes drove adoption, the network became a victim of its own success. Gas fees skyrocketed, effectively pricing out everyday users and forcing the industry to ask a critical question: How do we scale without sacrificing security?

This question ignited the “Layer 2 Wars”—a fierce competition between different technological approaches, each vying to become the standard for Ethereum scalability. From optimistic rollups to zero-knowledge (ZK) proofs, billions of dollars in venture capital and developer hours were poured into finding a victor.

Now, as the dust settles, we can finally answer: Which scaling solution won? The answer is nuanced, involving a dominant short-term winner, a technically superior long-term successor, and a completely new paradigm for how we view blockchains.

Key Takeaways

- Pragmatism Beat Perfection: Optimistic Rollups didn’t win because they were the perfect technology; they won because they were “good enough” right now. They prioritized developer ease (EVM equivalence) over theoretical purity, teaching us that in tech adoption, friction is the ultimate enemy.

- The “Invisible” Blockchain: The next phase isn’t about which L2 you are using; it’s about not knowing which L2 you are using. With concepts like Chain Abstraction, the “Wars” will become irrelevant to the end-user. You will simply use an app, and the wallet will route your transaction to Base, Arbitrum, or zkSync in the background.

- Cooperation over Conquest: We are entering an era of interoperability. The “Superchain” (Optimism) and the “AggLayer” (Polygon) demonstrate that the biggest players are now focused on connecting their liquidity rather than siloing it.

What Are Layer 2 Scaling Solutions?

At its core, a Layer 2 (L2) is a secondary framework or protocol built on top of an existing blockchain system (Layer 1, like Ethereum). The goal is to solve the transaction speed and scaling difficulties of the main chain.

Why Ethereum Needed Layer 2s

The need for L2s arose from the “Blockchain Trilemma”: the difficulty of achieving Decentralization, Security, and Scalability simultaneously.

- Gas Fees: At peak congestion, a single swap on Uniswap could cost upwards of $50-$100.

- Network Congestion: Ethereum’s mainnet can only handle roughly 15-30 transactions per second (TPS).

- User Experience: Slow confirmations and high costs made consumer applications (like gaming or social media) impossible to build on Layer 1.

How Layer 2 Solutions Work

L2s operate by handling heavy computation off-chain while utilizing the security of the main chain.

- Off-chain Execution: Transactions are processed on the L2 (fast and cheap).

- Batching: These transactions are bundled together into a single piece of data.

- On-chain Settlement: The bundled data is posted to Ethereum (Layer 1), inheriting its robust security.

The Origins of the Layer 2 Wars

The path to scalability wasn’t a straight line; it was a graveyard of deprecated technologies.

Early Scaling Attempts and Their Limits

Before rollups dominated the conversation, developers experimented with other methods:

- Plasma: An early framework proposed by Vitalik Buterin and Joseph Poon. It struggled with “data availability” issues and complex user exits (taking weeks to withdraw funds).

- State Channels: Similar to Bitcoin’s Lightning Network, effective for payments between two parties but poor for general-purpose smart contracts (DeFi).

- Sidechains: Independent blockchains (like the early iterations of Polygon) that ran parallel to Ethereum. While fast, they relied on their own consensus mechanisms, meaning they didn’t inherit Ethereum’s security—a major trade-off.

Ethereum’s Shift to a Rollup-Centric Roadmap

The turning point came when the Ethereum Foundation officially pivoted to a “Rollup-Centric Roadmap.” They acknowledged that the mainnet would eventually serve primarily as a “Settlement Layer” and “Data Availability Layer,” while almost all user activity would move to Rollups. This signaled the start of the true Layer 2 Wars.

Major Contenders in the Layer 2 Wars

As the wars heated up, two primary camps emerged: Optimistic Rollups and Zero-Knowledge (ZK) Rollups.

Optimistic Rollups

- Leaders: Arbitrum, Optimism (OP Mainnet), Base.

- How they work: They operate on an “innocent until proven guilty” model. They assume all transactions are valid and post them to Ethereum. If a transaction is invalid, anyone can submit a “fraud proof” within a challenge window (usually 7 days) to revert it.

- Pros:

- EVM Compatibility: Developers could copy-paste their Ethereum code directly to Arbitrum or Optimism without changes.

- First Mover Advantage: They launched earlier, capturing the majority of DeFi liquidity.

- Cons:

- Withdrawal Delays: Users must wait ~7 days to bridge funds back to L1 due to the fraud-proof window.

Zero-Knowledge (ZK) Rollups

- Leaders: zkSync, Starknet, Scroll, Linea.

- How they work: They use complex cryptography to generate a “validity proof” for every batch of transactions. This proof mathematically guarantees the transactions are correct before they are ever posted to Ethereum.

- Pros:

- Instant Finality: No 7-day waiting period. Once the proof is verified on L1, the funds are secure.

- Higher Security: Relies on math, not game theory (validators watching validators).

- Cons:

- Complexity: Building a “zkEVM” (a ZK rollup compatible with Ethereum code) was historically incredibly difficult.

- Computational Cost: Generating proofs is computationally expensive.

Sidechains and Hybrid Solutions

- Leaders: Polygon PoS.

- Role: While technically a sidechain with its own validators, Polygon PoS played a crucial role in onboarding users due to extremely low fees. It is currently transitioning toward a “Validium” (a ZK-hybrid) to align closer with Ethereum security.

Head-to-Head Comparison of Layer 2 Solutions

| Feature | Optimistic Rollups (Arbitrum, Optimism) | ZK Rollups (zkSync, Starknet) | Sidechains (Polygon PoS) |

| Security | High (Relies on 1 honest watcher) | Very High (Cryptographic guarantee) | Medium (Relies on own validators) |

| EVM Compatibility | Equivalent (Easy for devs) | High (Now mostly equivalent) | High |

| Withdrawal Time | ~7 Days (Challenge period) | Minutes/Hours (Proof generation) | Minutes |

| Transaction Cost | Low | Low (becoming lower with scale) | Lowest |

| Throughput | High | Very High | High |

| Primary Use Case | DeFi, General Purpose | Payments, High-Volume Trading | Gaming, NFTs, Micro-transactions |

Adoption Metrics: Who Is Winning Right Now?

To declare a winner, we must look at the data.

Total Value Locked (TVL)

In the battle for capital, Optimistic Rollups are the clear winners.

Arbitrum consistently holds the largest share of TVL (often 40-50% of the entire L2 market), acting as the premier hub for DeFi. Optimism and Base follow closely. The ease of porting existing dApps (like Uniswap and Aave) gave them an unassailable head start.

Active Users and Transactions

Here, the lines blur.

- Base (Coinbase): Has dominated in daily active users and transaction count, driven by consumer apps like Friend. Tech and the seamless onboarding of Coinbase users.

- zkSync: Has seen massive spikes in transaction volume, though historically driven partly by airdrop farming.

Ecosystem and App Support

Optimistic rollups have the deepest “lego stacks”—money markets built on top of DEXs built on top of stablecoins. However, ZK rollups are attracting high-performance applications, such as on-chain order book exchanges, which require the specific benefits of validity proofs.

So, Which Layer 2 Solution Finally Won?

The answer is a split verdict based on timeline.

The Short-Term Winner: Optimistic Rollups

Arbitrum and Optimism won the battle. They solved the immediate problem (high gas fees) when the market needed it most. Their EVM equivalence allowed them to inherit Ethereum’s network effects instantly. If you are using DeFi today, you are likely using an Optimistic Rollup.

The Long-Term Likely Winner: ZK Rollups

ZK Rollups are poised to win the war. Vitalik Buterin himself has stated that in the long term, ZK rollups will likely beat Optimistic rollups for all use cases. The mathematics of validity proofs offers a level of security and speed (instant withdrawals) that Optimistic models cannot match. As the technology matures and “proving costs” drop, the industry expects a gradual migration toward ZK tech.

Why There May Never Be a Single “Winner”

The “Winner Takes All” narrative is dead. We are moving toward a Multi-Rollup Future or “Layer 3” world.

- App-Chains: Large applications (like a global exchange or a game) will launch their own L2 or L3 (built on top of an L2) to customize fees and speed.

- The Superchain: Optimism is building a “Superchain” where many different L2s share a communication layer.

The Future of Ethereum After the Layer 2 Wars

With the “wars” cooling down, the focus shifts from competition to interoperability.

- Shared Sequencers: To preventing fragmentation, L2s are exploring shared sequencing to allow atomic transactions across different rollups.

- Data Availability (DA): Upgrades like EIP-4844 (Proto-Danksharding) dramatically reduced the cost for L2s to post data, acting as a massive subsidy for the entire sector.

- Account Abstraction: The complexity of L2s (bridging, switching networks) will soon be hidden from users. Wallets will handle the “which chain am I on?” question automatically.

What This Means for Developers, Users, and Investors

For Developers

You no longer need to choose a “side” based on ideology. Choose based on tooling. The OP Stack and ZK Stack allow you to spin up your own chain easily. The barrier to entry has never been lower.

For Everyday Users

The “Wars” have been a massive net benefit. You can now transact on Ethereum-secured networks for pennies. The future user experience will feel like using a standard fintech app—fast, cheap, and without the need to worry about gas wars.

For the Ethereum Ecosystem

Ethereum has successfully transitioned from a monolithic computer to a modular settlement layer. It didn’t lose the wars to “Ethereum Killers” (Alt-L1s); it absorbed the innovation. By outsourcing execution to Layer 2s, Ethereum secured its place as the foundation of the decentralized web.

Final Thoughts: The War is Over, but the Evolution Has Just Begun

If we look back at the “Layer 2 Wars,” it is tempting to view them as a zero-sum game where one token had to moon while others crashed. However, the reality of 2026 paints a different picture.

The true victory wasn’t Arbitrum defeating Optimism or ZK-Rollups crushing Optimistic ones. The real victory was the validation of the Modular Blockchain Thesis.

For years, critics argued that Ethereum was too slow and expensive to survive. They claimed that monolithic “Ethereum Killers” (like Solana or the early iterations of BSC) would render it obsolete. The Layer 2 Wars proved them wrong. By successfully offloading traffic to Layer 2s, Ethereum proved that a blockchain can be secure, decentralized, and scalable—just not all on the same layer.