Iran Protests 2026 are significant now because a collapsing currency, entrenched inflation, and tighter external pressure are colliding with a hardened security state and a frustrated public. This wave is testing whether Tehran can restore economic stability without reopening deeper legitimacy cracks.

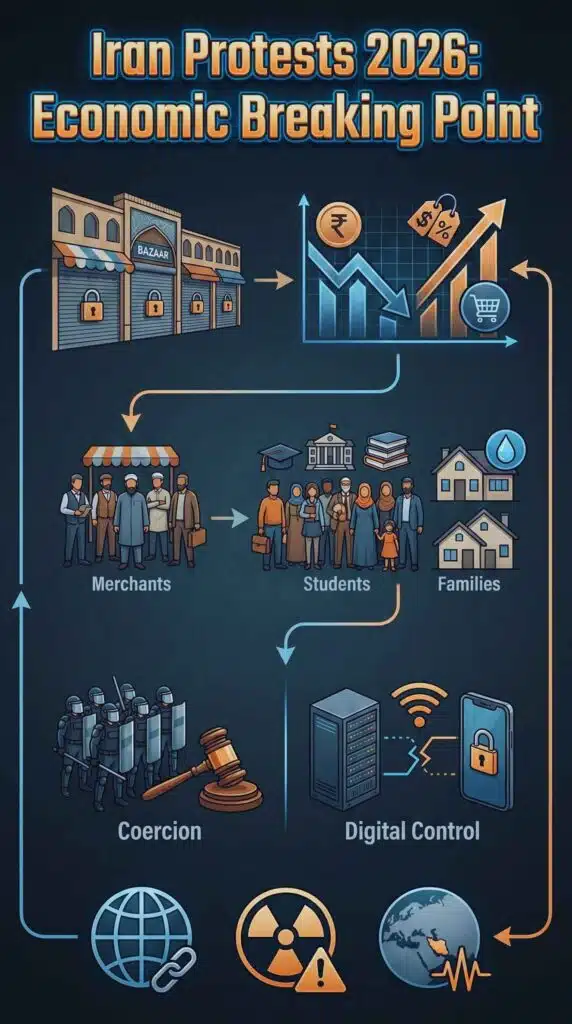

Iran’s latest protests did not start with a single viral moment. They started with a signal the Islamic Republic has always taken seriously: the bazaar. When merchants close their shops, it is not only commerce that stops. It is the regime’s everyday proof that the system can keep life predictable. This is why the opening act matters. Bazaar strikes over the currency collapse quickly expanded beyond Tehran’s commercial heart into student circles and provincial cities. That pattern is not accidental. It reflects how economic pain in Iran travels. It begins with prices and supply chains, then moves into households, then becomes political.

Several credible monitors and international news organizations described the unrest spreading across dozens of cities and many provinces as it moved into a second week after beginning around late December 2025. Reported casualty and arrest figures vary by source, but the consistent theme is escalation: deaths have been reported in multiple provinces, hundreds of arrests have been recorded by rights groups, and officials have acknowledged a tougher security response. Meanwhile, Iran’s leadership has sent mixed signals, with calls for restraint and “responsible” handling from parts of the elected government, and sharper warnings from the system’s top authority that the state will not yield.

What makes this moment more consequential than “another protest wave” is the convergence of three pressures that usually arrive separately: a stagflation-like squeeze inside the country, a geopolitical environment that narrows Iran’s room to maneuver, and a sanctions trajectory that can further strain foreign exchange, trade, and investment. The result is a feedback loop. Economic stress fuels protest. Protest scares markets and capital. Capital flight and uncertainty weaken the currency. A weaker currency raises prices again. Breaking that loop is difficult even for governments with high legitimacy. For Tehran, it is harder.

How We Got Here?

Iran’s protest cycles rarely come out of nowhere. They build on unresolved grievances, unaddressed shocks, and lessons learned by both society and the state. Over the last two decades, three large waves shaped the political psychology of the country.

The 2009 Green Movement challenged political legitimacy after disputed elections. It taught the system that mass mobilization can form quickly in Tehran and major cities, and it taught citizens that political dissent carries long-term consequences. The 2017–2018 protests shifted the center of gravity toward economic anger and discontent in a wider range of cities. Then, the November 2019 protests after fuel price hikes exposed a brutal reality about escalation dynamics: when economic triggers spread nationwide, the state often responds with decisive coercion. Human rights organizations later documented large death tolls and extensive arrests during that period, leaving a deep memory of fear as well as rage.

The 2022 “Woman, Life, Freedom” protests marked a further shift. They fused questions of social freedom, dignity, and rights with systemic critique, and they broadened the protest vocabulary. Even when street demonstrations eased, the movement left behind more resilient networks, stronger symbolic language, and an expanded sense of what public dissent could demand. International investigators and human rights bodies later described severe violations during the crackdown, a finding that matters because it shapes how both sides interpret risk. Protesters know the cost. Officials know the world is watching.

Now layer on the economic trajectory heading into late 2025. Iran entered this period with chronic inflation, sanctions fatigue, and structural constraints such as water scarcity and energy shortages. When the rial’s open-market value slid to extreme lows, it was not merely a financial headline. It was a daily-life event. Imports, medicine, food inputs, and industrial components all become more expensive. Domestic producers with imported materials raise prices. Families shift from planning to survival mode. Merchants face an impossible choice: sell goods today and fail to restock tomorrow, or close shops and wait for clarity.

That is the runway that produced Iran Protests 2026. Not a single incident, but a long sequence of pressures that finally made the bazaar conclude that “business as usual” was no longer rational.

A Timeline That Explains The Escalation

| Approx. Date | What Shifted | Why It Mattered |

| Late Dec 2025 | Bazaar closures and strikes appear as currency anxiety spikes | The bazaar signals economy-wide loss of confidence and spreads disruption quickly |

| Late Dec 2025 to early Jan 2026 | Students and broader crowds join across multiple cities | The protest base expands beyond merchants, increasing political risk |

| Early Jan 2026 | Authorities increase arrests, including alleged online organizers | The state prioritizes decapitation tactics to prevent coordination |

| Early Jan 2026 | Senior leaders issue contrasting messages, from restraint to punishment | Mixed signals reflect tension between de-escalation and deterrence |

| Second week after start | Protest endurance becomes the story, not only protest size | Sustained unrest raises the cost of containment and the risk of miscalculation |

The key analytical point is that duration changes everything. A one-day strike is a message. A multi-day unrest pattern becomes a governance challenge.

The Economic Engine Of Unrest

Iran Protests 2026 are rooted in economics, but not in a simplistic way. “Inflation” is not a single problem in Iran. It is a system of pressures that shape trust, expectations, and behavior.

A collapsing currency acts like an immediate price amplifier. In economies with stable institutions, households may tolerate moderate inflation if wages and predictability keep pace. In Iran, predictability has been the scarce commodity for years. When citizens believe prices will rise again tomorrow, they do not behave calmly today. They stock up, they buy dollars or gold if they can, and they reduce discretionary spending. That behavior itself pushes volatility higher.

Merchants sit at the center of this mechanism. They must price goods under uncertainty, restock with changing costs, and manage informal credit relationships. When merchants close shops, they are not only protesting. They are also reducing exposure to price risk. That is why the bazaar strike is both political and financially rational.

International institutions have described Iran’s macro trajectory in stark terms. Forecasts published in the last year pointed to contracting growth in the coming fiscal years, rising inflation pressures returning toward very high levels, and poverty rates increasing under upper-middle-income poverty definitions. Forecasts are not certainties, but in Iran they matter because people act as if the downside scenario is plausible.

At the same time, Iran faces a second economic vulnerability that is no longer “future risk.” It is present disruption: energy and water constraints. Electricity shortages, outages, and rationing do not just inconvenience households. They reduce productivity, harm small businesses, and undermine the state’s claim to competence. Water stress and land subsidence fears carry deeper implications, including the long-run viability of certain agricultural and urban regions.

Key Economic Indicators Shaping Public Anger

| Indicator | What It Signals | Why It Feeds Protest Risk |

| Sharp rial depreciation | Loss of confidence, rising import and input costs | Prices surge quickly and unpredictably, expanding grievance beyond politics |

| High inflation and inflation expectations | Households shift into survival behavior | People stop believing official reassurances and begin acting defensively |

| Growth slowdown or contraction forecasts | Fewer jobs and less upward mobility | Youth frustration grows as opportunity narrows |

| Energy shortages and outages | State capacity strain | Outages make hardship visible and personal |

| Water stress and rationing | Structural fragility | Citizens interpret scarcity as mismanagement and injustice |

Economic pain alone does not automatically produce mass protest. The trigger is often the sense of unfairness. People tolerate hardship longer when they believe it is shared and temporary. They protest when they believe hardship is imposed, avoidable, or distributed in favor of elites.

That is why slogans tend to evolve quickly. Early chants focus on prices and wages. Later chants focus on systemic accountability. This evolution matters because it changes the state’s playbook. A government can negotiate over prices. It cannot easily negotiate over legitimacy without opening deeper questions.

Who Feels The Shock First And Why That Matters?

| Group | Primary Exposure | Likely Political Behavior |

| Bazaar merchants and small business | Inventory risk, supply chain cost spikes | Strike and shutdown leverage, rapid signaling behavior |

| Wage earners and lower-income households | Food and essential inflation | Street protests more likely when daily necessities become unstable |

| Students and young adults | Unemployment and lost mobility | Higher appetite for political slogans and sustained activism |

| Provincial cities | Local shortages and uneven enforcement | Faster spread when grievances are already high and networks are tight |

| Middle class savers | Currency loss and capital controls | Quiet capital flight, plus political frustration when life plans collapse |

This distribution matters because it shapes coalition formation. If unrest stays confined to one group, the state isolates it. If it spans merchants, youth, and provincial households at the same time, containment becomes harder.

Politics, Security, And The State’s Options

Every protest wave forces Tehran to choose between concession and coercion. Iran’s system has repeatedly preferred coercion when it fears contagion, but it also uses selective concessions to divide coalitions. This wave is showing that familiar dual strategy again.

Public messaging reveals the internal logic. Parts of the elected government have framed the protests as a response to hardship and urged a calmer, more responsible approach. That language aims to reduce escalation and keep grievances inside an “economic box.” But system-level leadership and security institutions often speak in deterrence terms. They frame unrest as disorder, foreign instigation, or a threat to national stability. That framing justifies arrests, surveillance, and stronger crackdowns.

The state’s security approach has also evolved. In earlier eras, the regime tried to control streets primarily through physical presence and mass arrests. Now it targets coordination nodes, including online organizers, administrators of messaging channels, and people accused of spreading false information. This is not only about stopping protests today. It is about preventing protests from becoming self-sustaining movements tomorrow.

The challenge for Tehran is that repression carries costs, and those costs have risen. Crackdowns can deter participation, but they also generate new grievances and international scrutiny. They can reduce protest size, but they can increase protest intensity among the most committed. They can also push dissent into forms that are harder to police, such as sporadic strikes, flash gatherings, and decentralized sabotage against symbols of authority.

Containment Tools Tehran Is Likely Using And Their Tradeoffs

| Tool | What It Achieves | What It Risks |

| Targeted arrests of alleged organizers | Disrupts coordination and reduces momentum | Can radicalize networks and intensify anger |

| Heavy police and paramilitary presence | Deters crowds and protects buildings | Raises chance of lethal incidents and backlash |

| Limited economic relief or policy gestures | Offers face-saving exit for moderates | May be seen as too little, too late |

| Narrative control and media pressure | Reduces visibility and limits contagion | Weakens credibility further when reality contradicts messaging |

| Internet throttling or shutdown capability | Breaks coordination and slows spread | Harms commerce, increases anger among non-protesters |

The most important political question is not whether the state can suppress protests. It almost certainly can in the short run. The question is what suppression does to the system’s medium-term stability.

A state that relies on deterrence must keep increasing the price of dissent. But increasing that price also raises the stakes for those who still protest. Over time, that dynamic can produce a smaller but more determined opposition. It can also increase the probability of unpredictable triggers, including localized uprisings, ethnic-region unrest, or sectoral strikes that emerge without warning.

Another political dimension is elite cohesion. When different parts of the state send different messages, analysts look for signs of internal disagreement. Iran’s system has historically managed internal rivalries without fracture. Still, economic crisis can intensify competition over blame and resources. Central bank leadership changes, public disputes over policy, and competing narratives about whether the problem is “sanctions” or “mismanagement” all matter because they signal how unified the leadership remains.

The External Arena: Nuclear Pressure, Regional Risk, And Markets

Iran Protests 2026 cannot be analyzed as purely domestic. The external environment shapes both the economy and the regime’s strategic behavior.

Sanctions pressure influences foreign exchange, trade routes, and the cost of doing business. Even when oil sales continue through discounted channels, tighter enforcement or new legal mechanisms can reduce revenues or increase transaction costs. That creates direct consequences for the rial and for inflation. In Iran, external financial pressure tends to show up not as a neat “GDP decline” headline, but as an everyday squeeze: higher food prices, medicine shortages, and new barriers to ordinary commerce.

The nuclear file increases the stakes further. When Iran faces heightened scrutiny or potential sanctions escalation linked to its nuclear program, uncertainty rises across the entire economy. Businesses and households interpret nuclear tension as a forecast of more isolation, fewer dollars, and harsher trade conditions. That interpretation becomes a self-fulfilling pressure on the currency and on sentiment.

Regional dynamics also matter. Iran’s deterrence narrative relies on projecting strength through allied networks and strategic leverage across the region. When that network appears weakened, or when conflict episodes expose vulnerability, domestic confidence can suffer. Citizens who feel their daily lives are worsening may become less willing to accept foreign policy costs, especially when leaders frame external posture as necessary sacrifice.

There is also a market channel beyond Iran. Whenever Iran’s internal stability looks uncertain, markets and governments reprice regional risk. That includes energy markets, shipping insurance, and risk premiums tied to the Persian Gulf and surrounding trade routes. Even if Iran’s oil exports continue, the perception of instability can push volatility higher. The market impact is often less about actual barrels removed and more about the probability of disruption.

How Domestic Unrest Can Spill Into Regional And Market Risk?

| Transmission Channel | What Changes | Why It Matters Outside Iran |

| Currency collapse and capital flight | Higher volatility and reduced import capacity | Raises humanitarian risk and adds pressure on migration and regional stability |

| Sanctions escalation linked to nuclear tensions | Greater trade isolation and revenue strain | Increases risk premium for regional commerce and energy |

| Security overreaction | International condemnation and diplomatic hardening | Shrinks space for negotiations and crisis management |

| External rhetoric and threats | Faster escalation cycles | Increases chance of miscalculation that affects shipping and markets |

| Internet shutdowns and narrative warfare | Uncertainty about real conditions | Investors and governments act on worst-case assumptions |

A critical counterargument deserves attention. Some analysts argue that external pressure often strengthens the regime’s internal control because it allows officials to frame unrest as foreign interference. That argument has evidence behind it in many authoritarian contexts. The counterpoint is that external pressure also reduces the state’s ability to stabilize daily life. In Iran, both can be true at the same time. External threat narratives can justify crackdowns, but economic scarcity can also undermine legitimacy faster.

This is why the external arena is not a sideshow. It is part of the same system. The nuclear trajectory, sanctions enforcement, and regional tension all influence whether Iran’s leadership thinks it can “wait out” the protests or whether it feels compelled to escalate.

What Comes Next: Scenarios, Signposts, And Milestones To Watch In 2026

Predictions must be labeled carefully. No one can responsibly claim certainty about whether unrest will expand or fade. Still, analysts can map plausible scenarios based on incentives and past patterns.

Three Plausible Paths For Iran Protests 2026

| Scenario | What It Looks Like | Early Signposts |

| Containment With Partial Stabilization | Arrests reduce coordination, protests fade unevenly, currency steadies | Government swaps economic officials, expands controlled relief, avoids nationwide shutdowns |

| Rolling Unrest With Strike Recurrence | Protest flare-ups continue for months, strikes reappear, repression intensifies | Periodic bazaar closures, student mobilization cycles, rising arrest numbers |

| Escalation Through Externalization | Leaders intensify foreign threat narrative and harden security posture | Wider internet disruptions, harsher rhetoric, new sanctions triggers and diplomatic breakdowns |

The most likely near-term outcome is some form of containment, because the state has strong coercive capabilities and deep experience in protest management. But containment does not equal resolution. If economic fundamentals keep deteriorating, unrest becomes a recurring feature rather than a single episode. In that sense, the “next wave” may not be a discrete future event. It may be the same wave returning repeatedly in different cities and forms.

The most dangerous risk is miscalculation. In prolonged unrest, one local incident can become a national symbol. A single lethal clash, a widely shared funeral gathering, or a policy shock like a subsidy cut can accelerate anger faster than the state can manage it. Conversely, if the state perceives existential threat, it may choose harsher repression sooner, raising the probability of wider backlash.

What Decision Points Matter More Than Daily Protest Counts?

| Decision Point | Why It Matters | What To Watch |

| Currency stabilization measures | The rial’s direction shapes prices and confidence immediately | Open-market volatility, policy coherence, messaging credibility |

| Inflation and household essentials | Food and essentials drive street-level anger | Price shocks, shortages, rationing patterns |

| Sanctions and nuclear diplomacy milestones | External pressure can tighten economic constraints quickly | New enforcement actions, negotiation signals, legal mechanisms |

| Internet control strategy | Digital visibility shapes coordination and international attention | Targeted throttling vs broader disruptions |

| Strike participation beyond bazaars | Broader labor disruption changes leverage | Transport stoppages, industrial slowdowns, energy-sector signals |

A core analytical insight is that protests are often less decisive than the economic story behind them. If the rial stabilizes and inflation moderates, the state can likely reduce protest momentum without large concessions. If the currency keeps sliding and essentials keep rising, protests become more rational for more people, and fatigue becomes less effective as a strategy.

Another insight is coalition durability. The bazaar can ignite unrest, but it cannot always sustain it alone. Students can sustain moral energy, but they often lack economic leverage. The most impactful coalition is one that connects public anger, economic disruption, and broad geographic spread. Whether that coalition forms depends on events and on the state’s ability to prevent coordination.

Finally, the external environment can accelerate or slow everything. If diplomacy lowers sanctions pressure and reduces risk premiums, Tehran may gain breathing room. If pressure rises and uncertainty grows, the domestic loop tightens again.

Iran Protests 2026 matter because they are not only a snapshot of anger. They are a stress test of whether Iran’s governing model can restore predictability under simultaneous economic strain and geopolitical pressure. The bazaar’s role signals elite and commercial loss of confidence. Student participation signals political evolution. Provincial spread signals that this is not a single-city phenomenon.

In 2026, the most important question is not whether the streets quiet down for a week. It is whether the underlying loop breaks: currency instability, inflation, shortages, and trust collapse. If that loop remains intact, Iran’s leadership will face recurring waves of unrest, each one shaped by a society that adapts and a state that responds with increasingly costly tools.