Apple has long been known for its ability to manage global challenges while keeping its products attractive to consumers. Over the past year, the company has faced a new obstacle: tariffs introduced by the Trump administration as part of its trade war policies.

While Apple CEO Tim Cook has skillfully maneuvered to shield the company from the harshest effects, there are signs that the hidden costs of these tariffs may eventually land on everyday iPhone buyers. With the iPhone 17 series expected this month, analysts believe customers may see price hikes—even after Cook’s extensive efforts to soften the tariff impact.

Cook’s Relationship with the White House

Tim Cook has been at the center of Apple’s strategy to mitigate tariff threats. In a carefully choreographed moment last month, Cook presented President Trump with a gold-and-glass plaque. The gift symbolized more than a gesture of goodwill—it underscored Apple’s announcement that it would invest an additional $100 billion in U.S. operations, bringing its total planned U.S. spending to $600 billion over the next five years.

This move drew praise from Wall Street, which credited Cook with building a strong enough relationship with Trump to secure Apple exemptions from the most damaging tariffs. For example, forthcoming tariffs on semiconductors that could have doubled their prices were waived for Apple. Trump himself declared that Apple was playing a vital role in “American jobs and innovation,” further cementing Apple’s image as a key U.S. corporate ally.

How Apple Has Managed Tariffs So Far

At the beginning of the tariff announcements in February, it looked as if Apple would be in serious trouble. Most of its iPhones, iPads, and Macs are manufactured in China, and tariffs targeting China’s exports had the potential to double Apple’s production costs. Trump’s “reciprocal” tariffs also threatened Apple’s new manufacturing hubs in India and Vietnam, where the company had diversified part of its supply chain.

Yet, seven months later, Apple had fared better than expected. The U.S. paused some of the harshest tariffs, smartphones and laptops won specific exemptions, and Apple shifted part of its supply chain to India to reduce costs. By May, Cook told investors that Apple was successfully importing iPhones from India to the U.S., where tariffs were lighter.

Perhaps more importantly, Cook’s ability to build political capital with Trump paid off. Apple avoided certain chip tariffs, and when courts ruled in August that Trump’s use of the IEEPA tariffs was illegal—although they still remained in effect—Apple continued to benefit from partial relief.

The Hidden Costs: Apple’s Billions in Tariff Expenses

Even with exemptions, Apple hasn’t been able to completely avoid tariff costs. Cook disclosed that the company spent $800 million on tariffs during the June quarter alone. While that figure was less than 4% of the company’s profits, it was still a significant financial hit. Apple also warned investors that it expected to spend $1.1 billion in the following quarter on tariffs—suggesting that costs were mounting.

In total, Apple could be paying nearly $2 billion in tariff expenses in just two quarters. For months, Apple absorbed these costs instead of passing them on to customers. But analysts now believe that this strategy may be unsustainable. With the iPhone 17 launch looming, Apple might be preparing to adjust prices to recoup some of its losses.

A History of Apple’s Cautious Pricing Strategy

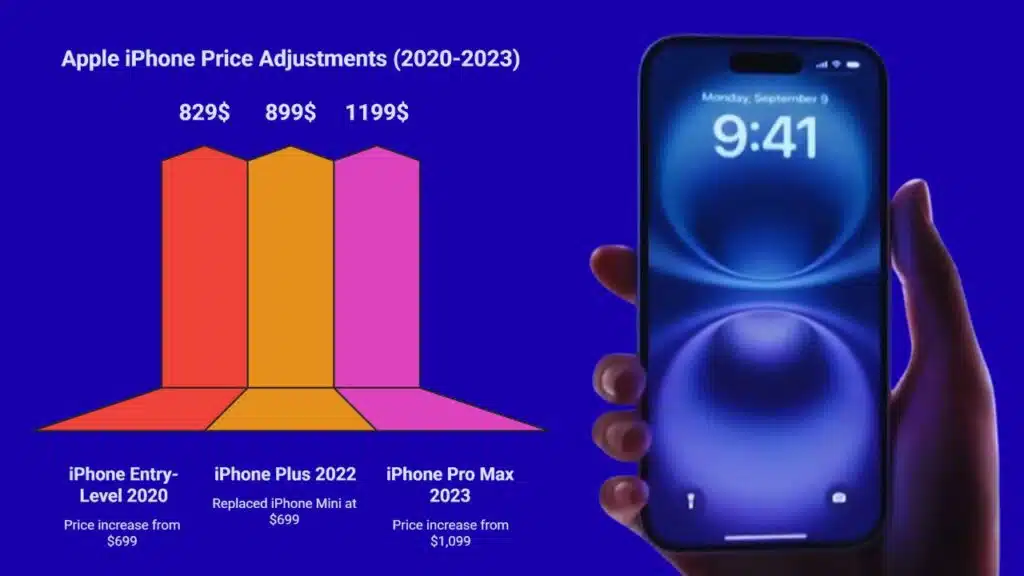

Apple has a long track record of carefully managing U.S. prices. The smaller Pro model has remained at $999 since its 2017 debut, avoiding price increases despite rising component costs. However, the company has introduced subtle adjustments over time.

- In 2020, the entry-level iPhone rose from $699 to $829.

- In 2022, Apple discontinued the smaller iPhone Mini at $699 and replaced it with the larger iPhone Plus at $899.

- In 2023, the Pro Max increased from $1,099 to $1,199.

These examples show how Apple often raises prices indirectly—by eliminating cheaper models or raising the cost of premium devices—while avoiding sweeping hikes across the lineup. If Apple raises prices again, the company is unlikely to blame tariffs directly. Instead, it will emphasize improvements in features, performance, and storage.

The iPhone 17 Lineup: What to Expect

This year, analysts expect Apple to unveil four new iPhone 17 models. As with the iPhone 16 lineup, there will be a base model, a Pro, and a Pro Max. However, one major change could be the elimination of the iPhone Plus, which lagged in sales compared to other models. In its place, Apple is rumored to introduce a slimmer, lighter device that sacrifices some features like camera modules or battery size in exchange for portability.

Goldman Sachs analysts suggest this new model could cost around $899—similar to the iPhone 16 Plus—but warn that Apple could still raise the price slightly. If so, the new device would still be cheaper than Samsung’s Galaxy Edge, which launched earlier this year at $1,099.

In addition, some analysts believe Apple may quietly increase the effective cost of the iPhone Pro by eliminating its entry-level storage option. By forcing customers to start at a higher storage tier, Apple could raise the base Pro price from $999 to $1,099 without formally calling it a “price increase.” This is the same strategy the company used with the Pro Max in 2023.

What Analysts Are Saying

- CounterPoint Research: The main question is whether the iPhone will rise in price, and consumer attention is now fixed on Apple’s September launch event.

- Jefferies (Edison Lee): Predicts at least a $50 increase in average selling price across the iPhone 17 lineup.

- Goldman Sachs: Believes Apple’s mix of phones already leans toward higher-priced models, making overall selling prices rise naturally.

- JPMorgan (Samik Chatterjee): Expects limited price changes due to Apple’s large U.S. investments, but forecasts the removal of the Pro’s entry-level version as a price-raising tactic.

Component Costs and Market Trends

Another factor driving potential increases is the rising cost of smartphone components. Camera modules, memory chips, and processors have all become more expensive in recent years. According to IDC, global smartphone average selling prices are rising industry-wide, not just at Apple.

Other consumer goods categories hit by tariffs—such as apparel, footwear, and coffee—have already seen sharp price increases. In the electronics sector, Sony, Microsoft, and Nintendo raised U.S. console prices earlier this year. If Apple follows suit, it would not be an outlier but part of a larger market trend.

Apple’s Future: Price Hikes Wrapped in Innovation

If prices do rise with the iPhone 17 series, Apple will likely frame the change around innovation. Larger screens, faster processors optimized for AI, and increased memory are all expected this year. Instead of linking higher costs to tariffs, Apple will spotlight these features as justifications for new pricing.

One subtle way Apple could implement hikes is by raising storage baselines. For example, by eliminating the 128GB Pro and starting at 256GB, Apple can advertise “more storage” while effectively charging $100 more. This approach avoids negative headlines about tariffs or cost pressures while still increasing revenue per device.

Tariffs May Not Break Apple, But Consumers Could Pay

Tim Cook has successfully protected Apple from the harshest outcomes of Trump’s tariff war by combining diplomacy, supply chain shifts, and massive U.S. investment pledges. But protection has a price, and Apple has already spent billions absorbing tariffs.

As the iPhone 17 series launches, the company may finally pass some of these costs onto consumers—though in Apple’s signature style: quietly, subtly, and framed as innovation rather than trade policy fallout. Whether through higher entry-level storage, slimmer models with premium positioning, or outright price bumps, Apple’s customers may soon feel the tariff impact in their wallets, even if the company never admits it.

The information is collected from CNBC and CNN.