To say that capital is the lifeblood of any successful company would be an understatement. Funding is essential, whether it involves launching a brand-new venture, expanding on an existing one, or maneuvering through financial turbulence. Basically, entrepreneurs walked into banks and credit unions, applying for business loans in Canada and elsewhere. Even though these traditional paths still carry weight, it is becoming apparent that the present business environment demands the funding sources to be varied and flexible. Such source diversification is now a must for the actualization of an enterprise’s vision and sustainable growth. Ways to do this include crowdfunding, venture capital, strategic alliances, and government grants.

Then again, Canada is so obviously vast, even with its many unique regional economies, that it actually presents either opportunities or threats to businesses searching for funding. For instance, business funding in Yukon may conjure different images from what one may think of in cities such as Toronto or Vancouver. It is the resource-based economy and the extreme remoteness of the Yukon that necessitate specialized knowledge of local funding programs and networks for investments. Government grants, tailored exclusively for northern territory businesses, also prove very significant in this area. These avenues meanwhile take into consideration building relationships with regional development corporations and understanding some specific needs of the local markets something for success-probably creating a well-rounded picture of what each funding strategy should entail according to geographical elaboration and economic peculiarities.

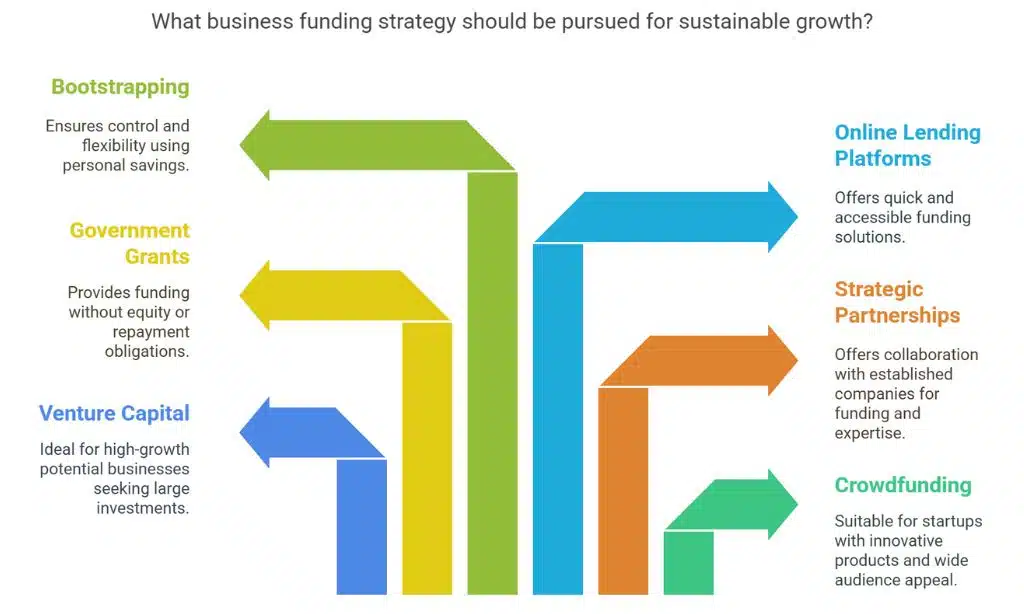

Apart from bank loans, other alternative sources of funding grow. One of them is crowdfunding, which allows businesses to raise money from multitudes of individuals, often in return for a reward or some share. This is one of the preferred financing methods for start-ups whose innovative products or services resonate with a wide audience. On the other hand, venture capitalists invest in a business with a promise of huge investment for equity, normally, for high-growth potential businesses.

Strategic partnerships may also serve as a beneficial means of capital acquisition. It opens avenues for collaboration with developed companies or industry leaders where their assets and expertise are also available together with the funding. Such a scenario is perfect for businesses looking at expanding into new markets or developing trends.

An avenue worth checking out is government grants and subsidies. A lot of countries run programs that aim to farm subsidies to small businesses, innovation, and regional development. Such programs are big money into which one would get benefits without worrying about equity or repayments.

Today money comes online, as more online lending platforms are proving to be funding alternatives. These online funding sources also provide a more accessible and speedy application process compared with the traditional banks. Many of these are available to businesses with shorter operating histories or those with slightly more impaired records.

However, many entrepreneurs still consider bootstrapping-the sitting out of a business with their own savings or revenue-as quite an avenue. Bootstrapped start-ups cannot grow as much in the early stages, but they have a much higher degree of control and flexibility.

Whatever maneuver one is going to adopt, well written business plans are prerequisites. It should explain what the business seeks to achieve; its market, financial projection, and what financing would make it work too well. All under one roof, it makes everything round about as a guide for attracting funders to put their bean into it.

Thus, business funding will always be changing: New and innovative ways will be a necessary armor for businesses striving to burn their vision into reality while creating a sustainable growth track. By mixing up and varying funding options from crowdfunding, venture capital, institutional to strategic partnerships, and government grants, entrepreneurs can turn the wheels of success in seizing capital. Specific designs matching the regional needs are critical for success, such as what businesses seeking funding will face in Yukon.