Debt can be overwhelming, but taking proactive steps to manage it is key to financial freedom. Understanding how to negotiate with creditors can help you reduce your debt, lower interest rates, and regain control over your finances.

In this guide, we’ll walk you through 7 actionable tips to negotiate effectively with creditors and achieve financial peace of mind.

Learning how to negotiate with creditors is not just about reducing debt—it’s about taking control of your financial future.

Understanding Debt Negotiation

What Is Debt Negotiation?

Debt negotiation involves communicating with creditors to modify the terms of your debt repayment. The goal is to reach a mutually beneficial agreement that allows you to reduce your financial burden while ensuring creditors recover some of the owed amount. Common outcomes include:

- Lowering the total debt amount.

- Reducing interest rates.

- Establishing affordable payment plans.

Debt negotiation empowers individuals to avoid default, collections, or bankruptcy while working toward financial stability. For example, a borrower owing $10,000 in credit card debt might negotiate a lump-sum settlement of $6,000, saving $4,000. Knowing how to negotiate with creditors can make the difference between financial recovery and prolonged hardship.

When Should You Negotiate With Creditors?

Timing is critical in debt negotiation. Consider initiating discussions when:

- You’ve missed payments or anticipate missing future ones.

- Interest and penalties are increasing your debt rapidly.

- Creditors are threatening legal action or sending accounts to collections.

Addressing these issues early can improve the chances of a favorable outcome. For instance, if your income has decreased significantly, notifying creditors early demonstrates responsibility and transparency.

| Indicator | Action |

| Missed multiple payments | Contact creditors immediately |

| Rising interest charges | Request lower interest rates |

| Threats of legal action | Propose a payment plan or settlement |

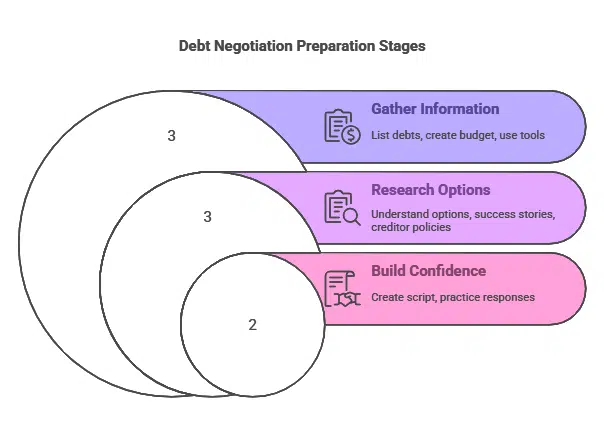

Preparing for Negotiations

Gather Financial Information

Preparation is the cornerstone of successful debt negotiation. Before contacting creditors:

- List all your debts, including balances, interest rates, and payment due dates.

- Create a realistic budget to determine how much you can afford to pay.

- Use financial tools or apps to organize your data and ensure accuracy.

Knowing how to negotiate with creditors requires a clear understanding of your financial standing.

| Step | Details |

| Create a debt inventory | Include balances, due dates, and interest rates |

| Build a budget | Account for necessary expenses and disposable income |

| Use financial tools | Apps like Mint or YNAB can simplify tracking |

Research Your Options

Understanding your creditor’s policies and possible negotiation options will give you an advantage.Common options include:

- Settlement Offers: Proposing a lump-sum payment that’s less than the total balance.

- Payment Plans: Setting up structured monthly payments.

- Interest Rate Reductions: Requesting lower interest rates to reduce long-term costs.

Research success stories online to understand what has worked for others. For example, a borrower might discover that a creditor typically accepts settlements of 40-60% of the debt. The more you know about how to negotiate with creditors, the better your chances of success.

Build Confidence With a Script

Having a script can make conversations with creditors less intimidating. Here’s an example:

“Hello, my name is [Your Name], and I’m calling to discuss my account. Due to [specific hardship], I’m unable to make the current payments. I’d like to explore options to reduce my balance or set up a manageable payment plan. Can we work together on a solution?”

Practice staying calm and assertive to build trust and cooperation. Role-playing with a friend can help you prepare for possible responses.

7 Tips for Reducing Your Debt

Tip #1: Know Your Rights

Understanding your rights is essential when negotiating with creditors. The Fair Debt Collection Practices Act (FDCPA) protects consumers from abusive collection tactics.

Key rights include:

- Creditors cannot harass or threaten you.

- You have the right to request written verification of your debt.

- Collectors must follow specific rules regarding communication times and methods.

Knowing how to negotiate with creditors becomes much easier when you understand your legal protections.

| Protection | Description |

| Harassment ban | No repeated or abusive calls |

| Written verification | Ensures debt details are accurate |

| Limited communication times | Calls allowed only during reasonable hours |

Tip #2: Offer a Lump-Sum Payment

If you have access to savings or a windfall, a lump-sum payment can be an effective negotiation tool.

Steps to take:

- Calculate an amount you can afford to offer.

- Start with a lower offer, such as 30-50% of the total balance, and negotiate upward if needed.

- Ensure any settlement agreement is provided in writing before making a payment.

For example, a $5,000 debt might be settled for $3,000 with a lump-sum offer. This approach is one of the most effective methods for those learning how to negotiate with creditors.

| Debt Amount | Offer Range |

| $5,000 | $2,500-$3,500 |

| $10,000 | $5,000-$6,500 |

Tip #3: Request Lower Interest Rates

High-interest rates can make it nearly impossible to pay off debt.

To negotiate lower rates:

- Highlight your commitment to repaying the debt.

- Mention any long-standing relationship with the creditor.

- Use specific phrases like, “Can we reduce the interest rate to make my payments more manageable?”

Even a small reduction in interest can lead to significant savings over time. For example, reducing a 20% APR to 10% on a $10,000 debt can save over $1,000 annually. Knowing how to negotiate with creditors for lower interest rates is a valuable skill.

| Debt | Original APR | Negotiated APR | Savings |

| $10,000 | 20% | 10% | $1,000/year |

Tip #4: Set Up a Payment Plan

A structured payment plan can make debt more manageable.

When proposing a plan:

- Provide a clear outline of what you can afford each month.

- Ask creditors to waive late fees or penalties as part of the agreement.

- Document all terms and confirm them in writing.

Learning how to negotiate with creditors for a payment plan involves clear communication and mutual agreement.

| Plan Component | Details |

| Monthly payment | Amount you can afford |

| Waivers | Request removal of late fees |

| Documentation | Ensure written confirmation |

Tip #5: Leverage Financial Hardship

Explaining genuine financial hardship can encourage creditors to cooperate.

Be honest and provide:

- Documentation, such as medical bills or unemployment records.

- A clear plan showing how you intend to meet the new terms.

Creditors are often willing to accommodate if they see a good-faith effort to resolve the debt. For instance, someone impacted by a medical emergency may secure reduced payments or deferred terms. Understanding how to negotiate with creditors includes presenting your situation transparently.

Tip #6: Seek Professional Help

If negotiating directly feels overwhelming, consider working with a professional.

Options include:

- Credit Counseling Agencies: Nonprofit organizations that negotiate on your behalf.

- Debt Settlement Companies: Firms that aim to reduce your total debt (be cautious of scams).

- Financial Advisors: Professionals who can offer personalized strategies.

| Professional Service | Description |

| Credit Counseling | Helps create payment plans |

| Debt Settlement | Negotiates reductions (may affect credit) |

| Financial Advisors | Offers long-term financial strategies |

Tip #7: Get Everything in Writing

Always insist on written agreements when negotiating with creditors. This protects you from future disputes and ensures both parties understand the terms.

A confirmation letter should include:

- The agreed-upon settlement or payment plan.

- Terms of the new agreement.

- Any conditions for future payments.

| Document Component | Purpose |

| Settlement amount | Confirms negotiated reduction |

| Payment terms | Details due dates and amounts |

| Conditions | Outlines future obligations |

Additional Strategies for Managing Debt

Consider Debt Consolidation

Consolidating debts into a single loan can simplify repayment and potentially lower interest rates. Steps to take:

- Research options such as personal loans, balance transfer credit cards, or home equity loans.

- Compare terms, fees, and rates before committing.

| Option | Benefit |

| Personal loan | Fixed rates and terms |

| Balance transfer | 0% introductory APR |

| Home equity loan | Low rates, but secured by your home |

Monitor Your Credit Score

Debt negotiation can impact your credit score, but rebuilding is possible:

- Make timely payments on all accounts.

- Use credit monitoring tools to track progress.

- Gradually reduce credit utilization for long-term improvements.

| Action | Impact |

| On-time payments | Improves credit history |

| Reduced credit utilization | Boosts credit score |

| Regular monitoring | Identifies errors or improvement areas |

Takeaways

Knowing how to negotiate with creditors is a powerful tool for reducing debt and achieving financial stability.

By applying these 7 tips, you can lower your debt burden, improve your financial situation, and move closer to a debt-free life. Take control today—your journey to financial freedom begins with a single step.