Paying taxes can feel like solving a tricky puzzle. If you’re self-employed or run a small business, figuring out how to handle quarterly tax payments might leave you scratching your head.

Missing deadlines or underpaying could land you in hot water with the IRS.

Quarterly tax payments are made four times a year to help cover what you owe. They include income tax and self-employment tax, like Social Security and Medicare. This guide will break it all down for you in five simple steps.

Ready to make sense of it? Let’s get started!

Key Takeaways

- Quarterly taxes are paid four times a year: April 15, June 15, September 15, and January 15. These payments help cover income and self-employment taxes.

- Self-employed people making $1,000+ in taxes or businesses with $500+ tax liability must pay quarterly to avoid penalties.

- To calculate payments, estimate taxable income by subtracting deductions like business costs from gross earnings using tools like Form 1040-ES.

- The Safe Harbor Rule avoids penalties if you pay either 90% of current year taxes or all the prior year’s taxes (110% for high earners).

- Use IRS EFTPS for online payments and set reminders to stay on track with due dates and avoid late fees.

What Are Quarterly Tax Payments?

Quarterly tax payments are small chunks of your yearly taxes paid in four parts. They help you avoid one big payment at the end of the year.

Definition of Quarterly Tax Payments

Quarterly tax payments are pre-scheduled income tax payments. Self-employed workers, freelancers, and business owners often make these payments to the IRS. These help spread out your tax burden throughout the year instead of paying all at once during tax season.

These taxes cover federal income tax, self-employment tax (like Social Security and Medicare), and sometimes state or local taxes. You calculate them using Form 1040-ES based on your predicted earnings for that year.

This system helps avoid big surprises or penalties later.

Who Needs to Pay Quarterly Taxes?

Self-employed people owing $1,000 or more in taxes must pay quarterly. This includes gig workers, freelancers, and sole proprietors. Corporations with over $500 tax liability also need to pay.

Those whose taxes aren’t fully covered by withholding need to make these payments too. For example, independent contractors often don’t have taxes withheld like regular employees do.

Paying in smaller chunks avoids large bills at tax return time!

Step 1: Estimate Self-Employment Tax

Start by figuring out your net income from all self-employment jobs. Then, apply the tax rate for Social Security and Medicare to get your total amount.

Identify Relevant Income Sources

Find all the ways you earn money. This includes wages, self-employment income, and side jobs. Don’t forget earnings from investments like capital gains or rental properties.

For example, Stephanie earns $90,000 in self-employment income. Add other sources like interest or dividends to get a full picture of your gross income.

Calculate Self-Employment Tax Rate

Self-employment tax stands at 15.3%. This covers Social Security and Medicare taxes. First, take your self-employment income. Then, multiply it by 92.35%. Use this amount to apply the 15.3% rate.

For example, if you earn $50,000 from self-employment, multiply $50,000 by 92.35%. That gives you $46,175 as taxable earnings for this purpose. Now apply the tax rate of 15.3%. You’ll owe $7,065 in self-employment tax for the year based on these numbers.

Step 2: Estimate Adjusted Gross Income (AGI)

Your AGI is your income minus certain adjustments. It’s the starting point for figuring out how much you owe in taxes.

Include All Income Sources

Add every dollar you earn. This includes self-employment income, wages, rents, tips, dividends, and interest. Combine both personal and business earnings. For example, if your side hustle brings $15,000 a year and your rental property adds $10,000 more—include both.

Don’t skip small amounts like hobby income or freelance work. These numbers add up fast. Using tools like tax calculators can simplify this process. Failing to include all sources could lead to underpayment penalties later on!

Account for Business-Related Adjustments

Adjust your income for business costs. Deduct expenses like supplies, mileage, or advertising. For instance, if you earned $50,000 but spent $15,000 on business expenses, only $35,000 counts as taxable income.

Lowering your adjusted gross income (AGI) reduces taxes.

Keep detailed records of all spending. Use tools like QuickBooks to track receipts and categorize costs. This helps when filling out tax forms like Schedule C or 1040-ES. Every deduction adds up and saves money!

Step 3: Subtract Deductions to Determine Taxable Income

Deductions shrink your taxable income, lowering the amount you owe. Choose the right type of deduction to save more on taxes.

Standard vs. Itemized Deductions

The standard deduction for 2023 is $14,600. This is a flat amount most taxpayers can subtract from income before calculating taxes. It’s faster and simpler than adding up individual expenses.

Itemized deductions may save more if your eligible costs are high. These include state and local tax deductions, medical bills, mortgage interest, or charity donations. For example, large expenses like high medical bills could make itemizing worth it.

Always choose the option that lowers your taxable income the most.

Consider Business Expense Deductions

Business expenses can lower your taxable income. Deduct costs like office supplies, internet, or travel for work. For example, Stephanie saved $6,358 by deducting her self-employment tax on her return.

Keep accurate records to claim these deductions. Use tools like QuickBooks or TurboTax Premium to track them year-round. This practice may reduce how much tax you owe each quarter and boost savings.

Step 4: Calculate Estimated Income Tax

Start by applying the federal tax brackets to your taxable income, based on your filing status. Don’t forget state or local taxes—they can add up quickly!

Apply Federal Tax Brackets

Federal tax brackets help figure out your income tax. Use the current year’s brackets for accuracy. Find where your taxable income falls in these brackets. For example, if you earn $50,000 and file as single, you might fall into the 22% bracket.

But not all of it gets taxed at that rate—only the part above lower thresholds.

Start with 10% for the first portion, then apply higher rates to later portions of your income. This step-by-step calculation ensures fairness based on earnings. Don’t forget business expenses or deductions—they lower taxable income!

Include State and Local Taxes (if applicable)

State and local taxes affect your total tax bill. Check the current rates for where you live and work. These vary by state, city, or county. For example, California has rates up to 13.3%, while Texas charges no state income tax.

Add these taxes to your federal estimated tax payment. If you own a business in multiple states, include taxes from each location. Always adjust based on these extra costs to avoid underpayment penalties later.

Step 5: Add Income Tax to Self-Employment Tax and Divide by Four

Combine your income tax and self-employment tax to find the total amount owed. Split this number into four payments for easier budgeting.

Divide Total Tax by Four for Quarterly Payments

Take your total tax owed for the year and split it into four. For example, if your annual tax is $19,658.49, divide by 4 to get $4,914.62 per quarter. This amount becomes your quarterly estimated tax payment.

Paying in smaller chunks every three months helps manage cash flow. Use IRS Form 1040-ES to figure payments or pay directly online through the Electronic Federal Tax Payment System (EFTPS).

Adjust for Any Seasonal Income Changes

Some businesses earn more during certain times of the year. For example, a ski shop may make most income in winter. Reassess your estimated taxes each quarter if your earnings change with the seasons.

Use the IRS’s tax withholding estimator or software like Quicken to help adjust totals.

Divide taxes based on actual income for that period. If you overpay earlier, reduce other payments later. This will avoid paying too much or facing an underpayment penalty from the IRS.

Keep track as changes happen to stay accurate.

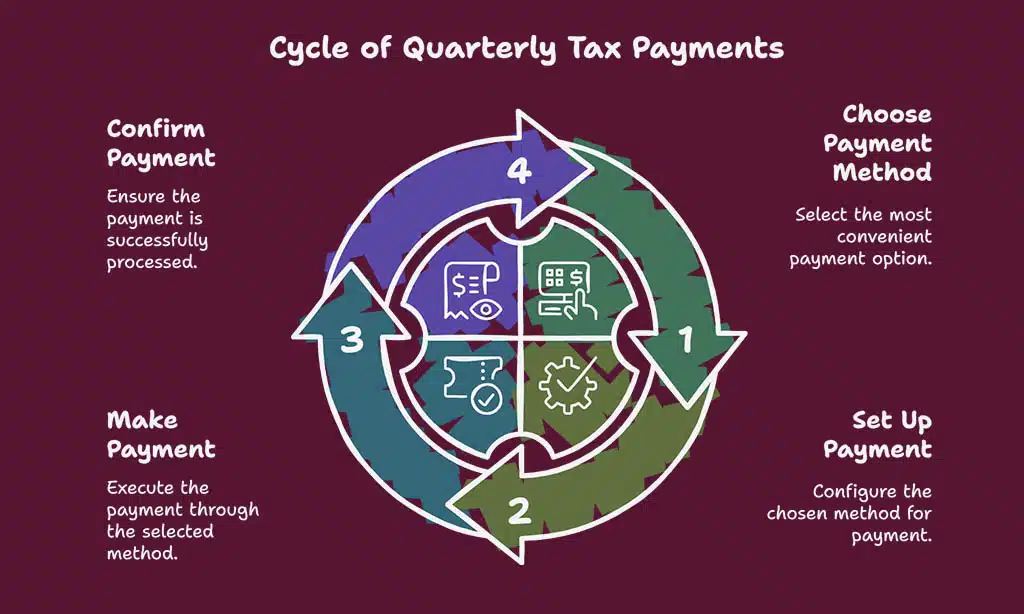

How to Make Quarterly Tax Payments

Paying quarterly taxes is simple once you know your options. Use online tools or payment methods that fit your needs, like the IRS’s secure platform.

Options for Paying Through the IRS

Use the IRS Payments Gateway online for quick payments. It accepts debit cards, credit cards, and bank transfers. You can also pay using the Electronic Federal Tax Payment System (EFTPS).

Set up an account on EFTPS.gov to schedule payments easily.

Mail Form 1040-ES with your payment if you prefer checks or money orders. Make them payable to “United States Treasury.” Include your Social Security number and tax year on the check.

Setting Up Automatic Payments

Set up automatic payments through the IRS for ease. Use the Electronic Federal Tax Payment System (EFTPS) to schedule recurring tax payments. This tool works online and helps avoid late penalties.

Link a bank account to the EFTPS for smooth processing. Payments are processed quickly, so no need to worry about missing deadlines. Stick to this system, and quarterly taxes become less stressful!

Deadlines for Quarterly Tax Payments

Missing these tax deadlines can make your wallet cry with penalties. Mark your calendar, and stay ahead of the game!

Key Due Dates for Quarterly Taxes

Quarterly tax payments are due four times a year. Mark your calendar for January 15, April 15, June 16, and September 15. These dates cover income earned in the prior quarter.

Each payment matches specific months of earnings. For example, pay by April 15 for income from January through March. Missing these deadlines can lead to IRS penalties or interest charges.

Stay ahead by setting reminders or using the Electronic Federal Tax Payment System (EFTPS) to make timely payments.

Consequences of Missing Deadlines

Missing a deadline can cost you. The IRS may charge a penalty of 5% per month. This adds up to a maximum of 25%. Even small delays can hurt your wallet fast. If you owe less than $1,000, there’s no penalty.

Interest also builds over time on unpaid taxes. It makes the amount owed grow bigger. Late payments could lead to more stress and financial strain later on. Stay ahead by paying quarterly taxes on time!

Additional Tips for Accurate Tax Calculations

Check your numbers often, especially if your income changes. Use tools like tax calculators or consult a pro to stay on track.

Reassess Estimates if Income Fluctuates

Income can change unexpectedly. If your earnings go up or down, adjust your quarterly estimated tax payments right away. This helps avoid paying too much or getting hit with an underpayment penalty later.

For seasonal work or fluctuating self-employment income, use the IRS annualized method. It calculates taxes based on what you make each quarter, not just your total year estimate. Stay accurate to cover tax liability without overpaying.

Use the Annualized Method for Seasonal Businesses

Seasonal income can cause uneven cash flow. The annualized method helps with fair tax payments. It adjusts taxes based on what you earn in each quarter, not the entire year.

For example, a summer-based shop may earn most profits from June to August. Use Form 1040-ES to calculate estimated payments using this method. This avoids overpaying when income is low during off-seasons.

Penalties for Underpayment and How to Avoid Them

Missing quarterly tax payments can lead to penalties, costing you extra money. Learn simple ways to dodge these fees and keep more cash in your pocket.

Understanding the Safe Harbor Rule

The Safe Harbor Rule helps taxpayers avoid penalties. To qualify, pay at least 90% of your current year’s tax or 100% of last year’s tax. If last year’s income was over $150,000, you must pay 110%.

For example, if you owed $10,000 last year and expect to owe more this year, paying $10,000 now covers the rule. This can protect you from IRS penalties for underpayment during the year.

Steps to Correct a Missed Payment

Missing a tax payment can feel stressful. Fix it quickly to avoid more penalties.

- Pay as soon as you can. The IRS charges interest daily on late payments, so acting fast saves money. Use the Electronic Federal Tax Payment System (EFTPS) or IRS Direct Pay to settle the amount owed.

- Calculate how much you missed. Check Form 1040-ES for estimates. Include self-employment tax and income taxes in your total.

- Contact the IRS if unsure about what to do next. They provide guidance and may help you create a plan to pay.

- Add future due dates to your calendar. Quarterly tax payments have strict deadlines: April 15, June 15, September 15, and January 15 of the following year.

- Avoid this mistake again with automatic payments through EFTPS or setting reminders on your phone.

- Check for underpayment penalties using a tax calculator or by reviewing laws like the Safe Harbor Rule, which protects taxpayers paying at least 90% of their current taxes due.

Taking action now lowers stress and prevents extra costs!

Takeaways

Paying quarterly taxes doesn’t have to be stressful. Follow the steps, calculate carefully, and stay ahead of deadlines. Use tools like Form 1040-ES or online calculators for accuracy.

Small mistakes can cost big later, so double-check your math! If stuck, a tax pro can help steer you right.

FAQs

1. What are quarterly tax payments?

Quarterly tax payments are estimated taxes paid four times a year to cover income tax, self-employment tax, Social Security tax, and Medicare tax.

2. Who needs to make estimated tax payments?

Individuals with self-employment income or businesses like S corporations must pay if they expect to owe $1,000 or more in taxes after subtracting credits and withholding.

3. How do I calculate my taxable income for quarterly taxes?

Start with your adjusted gross income (AGI), subtract allowable deductions like business expenses or student loan interest, then apply the correct rates for income and self-employment taxes.

4. Can I use a tool to figure out my estimated taxes?

Yes! Tax calculators from providers like Intuit TurboTax can help you estimate what you owe based on your earnings, deductions, and potential credits such as the child tax credit.

5. What happens if I underpay my quarterly taxes?

You might face an IRS penalty for underpayment of estimated taxes unless most of your owed amount was covered by prior refunds or withheld amounts during the year.

6. How do I pay these taxes electronically?

Use the Electronic Federal Tax Payment System (EFTPS) to send state and federal payments securely online through banking systems approved by Member FDIC institutions.