The video game business doesn’t win by box office weekends. It wins by building worlds people return to for years, then monetizing that loyalty across games, merch, media, and live-service ecosystems.

This guide ranks the highest-grossing video game franchises by estimated total revenue as of late 2025. You’ll see why some IPs dominate through merchandise, others through annual releases, and others through mobile-first spending loops.

How Did We Rank These Franchises?

Franchise revenue is messy because companies split earnings across regions, platforms, licensing, and product lines. Some IPs also earn far more outside game sales than inside them.

To keep the ranking understandable, we use widely cited franchise-level estimates and identify the main money engine for each brand in 2025.

What We Considered Most Heavily

- Total ecosystem revenue (games + in-game spending + licensing + merchandise where clearly core)

- Longevity and repeatable monetization (subscription, cosmetics, gacha, expansions, etc.)

- The franchise umbrella (spin-offs and sub-series included when they clearly share the same IP)

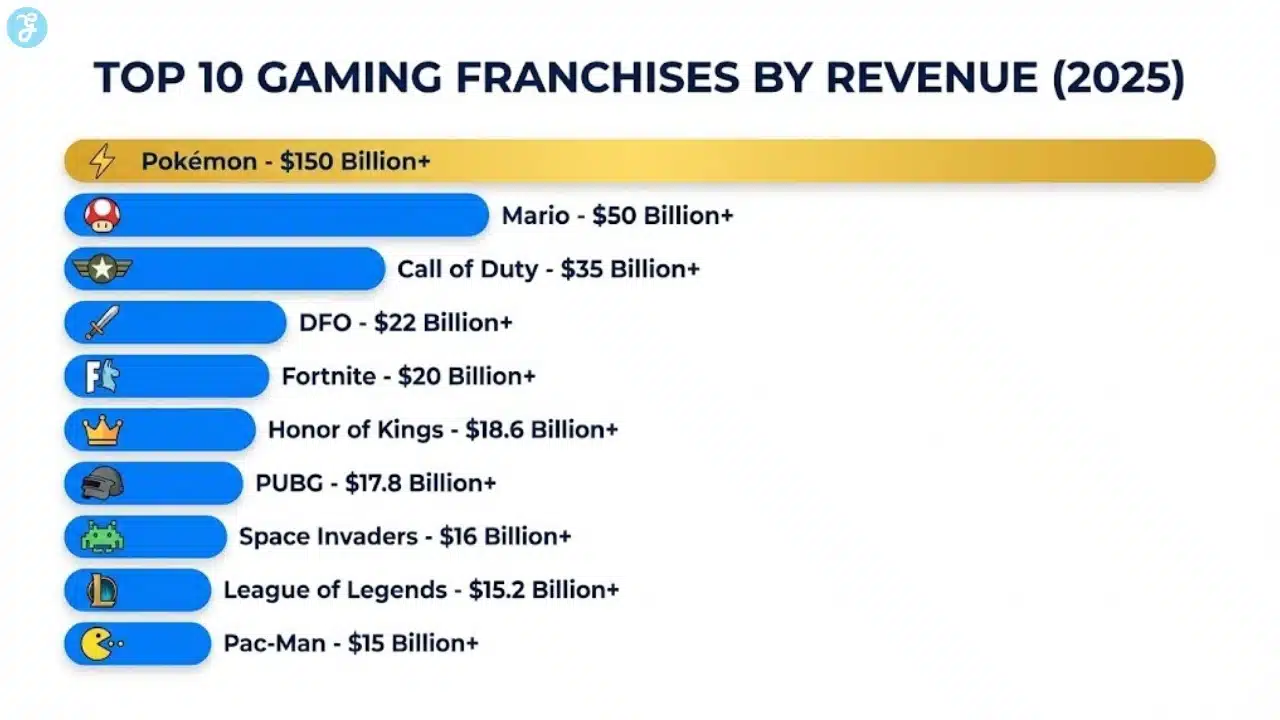

10 Highest-Grossing Video Game Franchises by Total Revenue (2025)

Here are the top 10 highest revenue-generating video game franchises ranked from highest to lowest:

1) Pokémon

| Metric | Details |

| Estimated Revenue | $150B+ |

| First Release | 1996 (Game Boy) |

| Primary Revenue Driver | Merchandise + media + licensing |

Pokémon isn’t only the biggest gaming franchise. It operates like an industry of its own, with games acting as the “engine” that powers everything else. What separates Pokémon is that the software often functions as a gateway product. The real scale comes from the merchandise machine that never stops.

Why Pokémon Prints Money:

- Games introduce new monsters and regions, refreshing demand every generation

- The Trading Card Game drives repeat spending across kids, collectors, and competitors

- Licensing keeps the brand everywhere: toys, apparel, accessories, collabs

- Pokémon GO delivers a steady live-service revenue stream years after launch

- Parents who grew up with the early titles now buy Pokémon for their kids

2) Mario

| Metric | Details |

| Estimated Revenue | $50B+ |

| First Release | 1981 (Donkey Kong) |

| Primary Revenue Driver | Console software sales |

Mario stays near the top because it sells games like a utility. Nintendo releases a Mario product, and millions buy it as if it’s a must-have part of owning the console. The “Mario umbrella” matters here. It isn’t one series. It’s multiple mega-series under one character brand.

How Mario Builds Franchise Value:

- Mainline platformers create “event” releases that move hardware and software

- Mario Kart sells like a long-term subscription without being one

- Spin-offs (Party, Sports, etc.) keep the brand active between main releases

- Theme parks (Super Nintendo World) extend Mario into real-world entertainment

- Film success expands the audience without replacing the gaming core

3) Call of Duty

| Metric | Details |

| Estimated Revenue | $35B+ |

| First Release | 2003 (PC) |

| Primary Revenue Driver | Annual releases and live service |

Call of Duty mastered a rare double win. It sells premium full-price games at blockbuster scale, then keeps earning from the same players through ongoing monetization.

The brand’s strength is consistency. Fans expect a yearly cycle, and that cycle creates predictable revenue.

Key Drivers Behind CoD’s Revenue:

- Annual launches generate massive upfront sales and attention

- Warzone brings in free-to-play players and funnels them into the ecosystem

- Cosmetics, battle passes, and bundles turn playtime into repeat spending

- Multiplayer retention keeps players active long after launch

- Mobile extends reach into phone-first gaming markets

4) Dungeon Fighter Online (DFO)

| Metric | Details |

| Estimated Revenue | $22B+ |

| First Release | 2005 (PC) |

| Primary Revenue Driver | Microtransactions in Asia |

DFO surprises many Western audiences, but it doesn’t need Western attention to earn Western-sized money. It dominates through long-term engagement and high-frequency microtransaction spending in Asia.

The franchise thrives because it behaves like a lifestyle game. People don’t “finish” it. They live in it.

Why DFO Earns So Much:

- Deep progression systems keep players chasing upgrades for years

- Long-running live-service structure turns small purchases into huge totals

- Regional dominance in China and South Korea creates massive scale

- Mobile expansion amplified earnings by increasing accessibility and daily play

- The loop encourages repeat spending without requiring sequels

5) Fortnite

| Metric | Details |

| Estimated Revenue | $20B+ |

| First Release | 2017 (Early Access) |

| Primary Revenue Driver | Cosmetics and brand collaborations |

Fortnite climbed into the top tier at record speed because it sells identity. Players spend to express who they are, what fandoms they love, and what events they experienced.

It also evolved beyond one mode. Fortnite acts like a platform where new experiences constantly rotate in.

Fortnite’s Biggest Revenue Accelerators:

- Cosmetic-only monetization keeps gameplay fair while still encouraging spending

- Constant updates prevent stagnation and keep engagement high

- Collabs turn pop culture into purchasable skins and limited-time content

- Live events create “you had to be there” moments that drive return visits

- Multiple game experiences widen the audience beyond battle royale

6) Honor of Kings

| Metric | Details |

| Estimated Revenue | $18.6B+ |

| First Release | 2015 (Mobile) |

| Primary Revenue Driver | Mobile MOBA dominance in China |

Honor of Kings proves what happens when you dominate the world’s largest gaming market with a product designed for daily habits. It isn’t a one-time purchase business. It’s a recurring spending ecosystem.

Its monetization is predictable and scalable, which makes the franchise unusually durable.

Why It Ranks So High:

- Huge daily active players create constant transaction volume

- Skins and seasonal content convert engagement into repeat spending

- Competitive culture increases loyalty and long-term retention

- Mobile-first design expands reach with low barriers

- Dominance in one region can out-earn “moderate global” popularity

7) PUBG (PlayerUnknown’s Battlegrounds)

| Metric | Details |

| Estimated Revenue | $17.8B+ |

| First Release | 2017 (PC) |

| Primary Revenue Driver | PUBG Mobile |

PUBG helped define battle royale, but the franchise’s real financial engine is mobile. PUBG Mobile brought high-stakes competitive shooting to regions where phones are the primary gaming device.

The tone also matters. PUBG’s realism appeals to players who prefer tactical play over cartoon spectacle.

PUBG’s Biggest Revenue Factors:

- Mobile reach unlocked huge markets across Asia and beyond

- Competitive squad play boosts retention through social commitment

- Cosmetics and events deliver recurring monetization without sequels

- Regional versions and partnerships kept the ecosystem resilient

- Strong brand identity helps it survive waves of competition

8) Space Invaders

| Metric | Details |

| Estimated Revenue | $16B (inflation-adjusted estimates) |

| First Release | 1978 (Arcade) |

| Primary Revenue Driver | Coin-op arcade earnings |

Space Invaders represents the earliest era of gaming wealth: the coin economy. Players paid per attempt, and the game’s difficulty and addictiveness created endless repeat spending.

It doesn’t generate modern live-service billions in 2025, but its historical earnings remain enormous when adjusted.

Why it Still Belongs in the Top 10:

- Arcade dominance created massive volume at peak cultural saturation

- Per-play monetization turned skill and competition into continuous spending

- Global recognition kept the IP alive through re-releases and licensing

- Legacy boosts long-tail revenue via compilations and collaborations

- It helped establish gaming as a mainstream commercial medium

9) League of Legends

| Metric | Details |

| Estimated Revenue | $15.2B+ |

| First Release | 2009 (PC) |

| Primary Revenue Driver | Skins and the esports ecosystem |

League of Legends became a giant by treating the game like a sport. Players invest years into skill growth, rank progression, and community identity. That long-term relationship makes cosmetic monetization extremely powerful.

Esports doesn’t just market the game. It strengthens the economy by deepening fandom.

League’s Revenue Flywheel:

- Free-to-play access keeps the funnel wide and global

- Skins and event passes monetize engagement without pay-to-win pressure

- Esports viewership increases loyalty and long-term retention

- A living meta and constant updates keep it relevant year after year

- Expanded media and spin-offs reinforce the universe and attract new players

10) Pac-Man

| Metric | Details |

| Estimated Revenue | $15B+ |

| First Release | 1980 (Arcade) |

| Primary Revenue Driver | Arcade sales + licensing |

Pac-Man became one of the first true gaming mascots. That mascot status is a business advantage because it makes licensing easy and timeless. Like Space Invaders, a lot of the money comes from the arcade golden age. The difference is how well Pac-Man maintained modern visibility.

Why Pac-Man’s Revenue Stayed Huge:

- Historic arcade earnings built an early fortune at global scale

- Brand clarity turned the character into a licensing asset for decades

- Re-releases and modern spin titles kept the IP active across generations

- Crossovers and collaborations extended relevance beyond classic cabinets

- Nostalgia stays monetizable because the iconography is universal

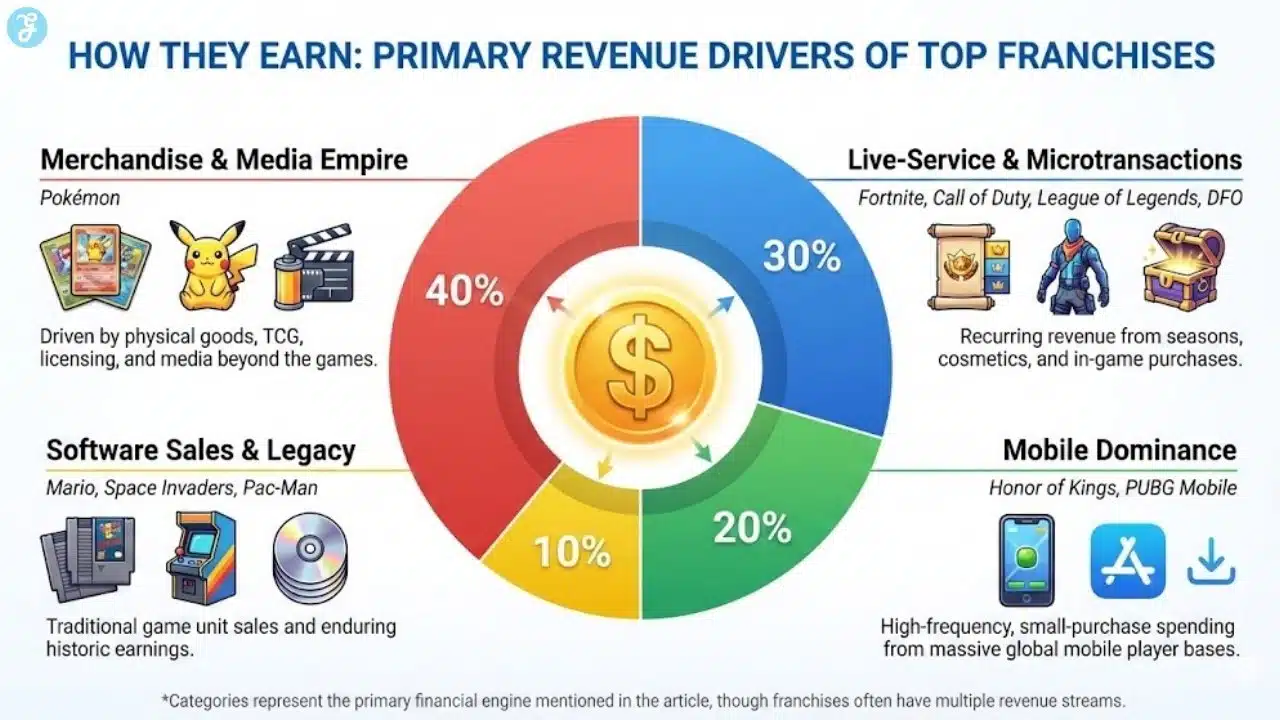

What Does “Franchise Revenue” Really Include?

When people hear “highest-grossing,” they often assume it means game sales alone. In reality, franchise revenue typically blends multiple income streams that don’t show up on “best-selling games” charts. That’s exactly why two franchises can feel equally famous yet sit far apart in total revenue.

At the simplest level, the biggest gaming IPs earn from four stacked layers. Some franchises rely on one layer almost entirely. Others win because they combine several at scale.

The four core revenue buckets behind the highest-grossing video game franchises:

- Premium game sales: full-price console/PC releases, deluxe editions, collections, and remasters

- Ongoing in-game spending: cosmetics, battle passes, gacha pulls, boosts, subscriptions, and limited-time bundles

- Licensing and merchandise: toys, apparel, trading cards, collectibles, brand partnerships

- Media and experiences: film/TV rights, esports events, concerts, theme parks, attractions, and sponsorships

This is why Pokémon is untouchable: it earns heavily from every bucket. The games are just the starting point, while the real waterfall comes from merchandise and licensing that can out-earn software year after year.

It also explains why some “legendary” series feel like they should rank higher but don’t. If an IP sells massive copies but has limited merchandising, fewer releases, or weak live-service monetization, it may end up behind a franchise that has a smaller footprint in the West but dominates a huge mobile market with daily spending habits.

Another complication is how long an IP has been collecting money. Pac-Man and Space Invaders built fortunes in the arcade era, where the business model was literally “pay per attempt.” Their modern revenue may be smaller, but their historical totals are huge when adjusted for inflation.

In short, revenue rankings measure the whole ecosystem, not just the box on the shelf. That’s why the list is a mix of old mascots, modern shooters, and mobile giants. Each represents a different era—and a different revenue strategy that actually worked.

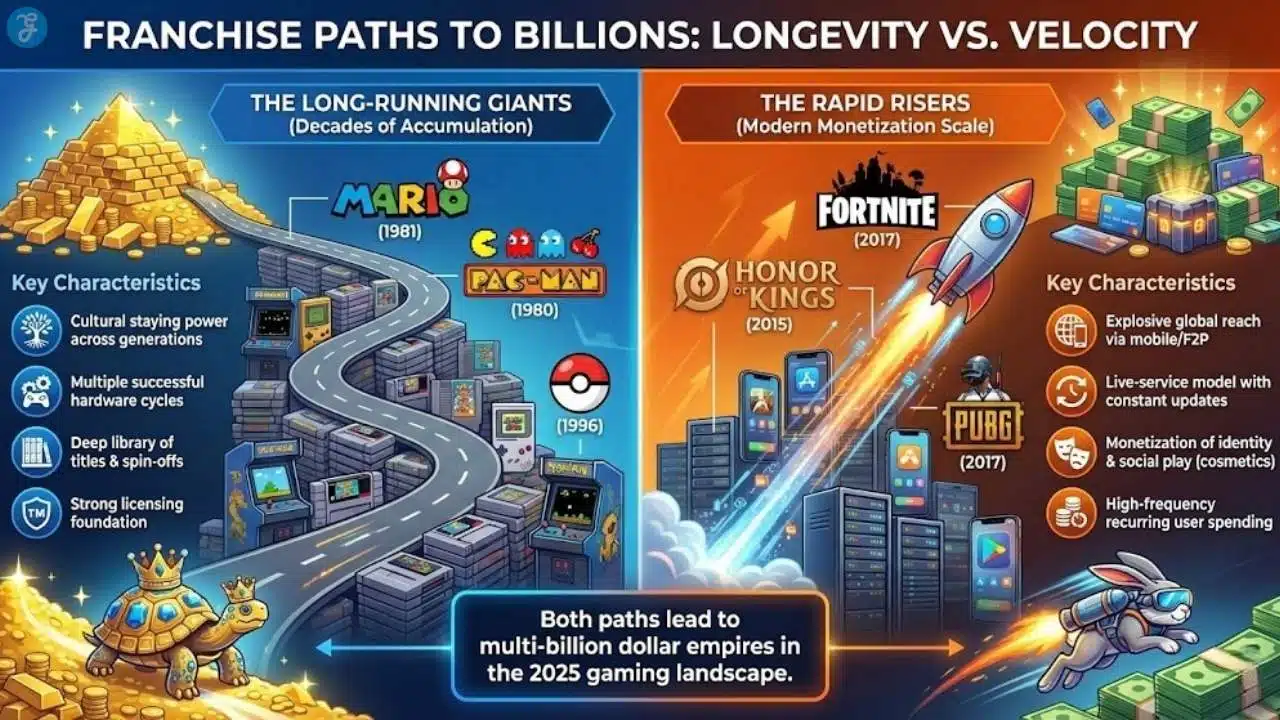

The Business Models Powering the Top 10

The common thread between these franchises isn’t genre. It’s structure. They’re designed to keep earning without needing perfect timing.

Evergreen Premium Franchises (The “Evergreen Shelf” Model)

These IPs sell for years, not weeks. They don’t depend on constant discounts or a single launch spike. They keep moving units because the experience stays relevant and family-friendly across generations.

Why evergreen works:

- Titles remain attractive long after release (evergreen “must-haves”)

- Ports, bundles, and remasters extend the revenue tail

- Spin-offs keep the brand visible between major releases

Mario is the gold standard here. One evergreen product can function like a multi-year revenue engine, and the franchise stays stable even when competition shifts.

Annualized Blockbusters

This is a rhythm-based business. The release schedule becomes tradition. Players return because it feels like a season, like sports.

Why annual cycles print money:

- Launch weeks deliver predictable premium sales at huge volume

- Seasons and stores extend spending across the entire year

- Habit makes revenue stable, even when reviews fluctuate

Call of Duty thrives here because it can sell a premium game and keep a live-service economy running in the background.

Always-on platforms

These franchises don’t want you to finish them. They want you to live inside them. Their biggest advantage is continuity.

What makes always-on ecosystems powerful:

- Content updates replace sequels as the primary growth lever

- Social play boosts retention (friends keep friends playing)

- Identity-based cosmetics turn community status into spending

Fortnite is the clearest example: it’s more than a game mode. It behaves like a platform that constantly refreshes reasons to log in.

Mobile-first Dominance

Mobile wins by scale and convenience. When a franchise becomes a daily habit on phones, revenue can stack unbelievably fast through millions of small purchases.

Why mobile totals get massive:

- Low barriers create enormous active populations

- Monetization is tuned for frequent repeat purchases

- Competitive loops and social squads reduce churn

Honor of Kings and PUBG Mobile prove that dominating one massive region can out-earn moderate popularity worldwide.

Legacy icons

Some franchises remain rich because they become symbols. When a character is instantly recognizable, licensing becomes easier, safer, and more profitable.

Why icons keep earning:

- Brand recognition creates endless partnership opportunities

- Re-releases and anniversaries generate recurring attention

- Nostalgia remains valuable across generations

That’s why Pac-Man can keep earning even when it isn’t topping modern charts.

Honorable mentions

These franchises sit just outside the top 10 but still rank among the most lucrative in gaming history.

- World of Warcraft ($13B+): Subscription longevity plus expansions built one of gaming’s most durable businesses.

- Crossfire ($13B): Regional dominance, especially in Asia, produced massive totals over time.

- Grand Theft Auto ($11B–$12B+): Fewer releases reduce franchise-wide accumulation, even though GTA V is a historic outlier.

What the Highest-Grossing Franchises Tell Us About Gaming in 2025

The money pattern is clear in 2025: franchises win when they build ecosystems, not one-off hits. Arcades did it with repeat coins. Consoles did it with long-running characters and evergreen software. Modern games do it with retention loops that turn playtime into recurring spending.

You can also see a geographic shift. Several top earners thrive because they dominate Asia’s massive markets, especially through mobile-first design. That’s why IPs like DFO, Honor of Kings, and PUBG Mobile can outrank legendary Western-facing brands.

The final takeaway is that “value” comes from repeatable engagement. The franchises that keep players emotionally invested—through collection, competition, identity, or community—stay in the money conversation for decades.

Wrap-up: Why These Franchises Are the Richest in Gaming History

Ranking the highest-grossing video game franchises is really about tracking which IPs built the strongest money loops. Pokémon dominates by turning characters into an endless licensing machine. Mario wins through Evergreen Software and generational trust. Call of Duty earns by combining annual blockbusters with live-service spending. Fortnite proves a cosmetics-driven platform can grow faster than almost anything in entertainment.

If there’s one lesson for 2025, it’s this: the biggest winners aren’t just games people buy. They’re ecosystems people join.

Frequently Asked Questions

Here are answers to some of the most common questions readers have:

Which franchise makes the most money in gaming history?

Pokémon leads the pack by a huge margin. Its total revenue combines game sales with trading cards, merchandise, media licensing, and long-running live-service income.

Are the highest-grossing video game franchises always the best games?

Not always. Revenue reflects reach, longevity, and monetization strength as much as critical acclaim. Some masterpieces remain niche compared to live-service giants.

Is Mario bigger than Pokémon?

If you focus on game software unit sales, Mario is often the benchmark. If you focus on total franchise revenue across merchandise and media, Pokémon is significantly larger.

Why isn’t Grand Theft Auto in the top five?

GTA generates massive money, but the franchise releases fewer mainline entries than brands like Mario or Call of Duty. Total franchise revenue grows faster when an IP has many releases or a continuous live-service spending loop.

What’s the highest-grossing mobile game franchise on this list?

Honor of Kings is commonly cited as one of the top mobile earners in history. PUBG Mobile is also a major revenue driver that pushes the PUBG franchise into the top 10.

How does Dungeon Fighter Online make so much money?

DFO relies on long-term engagement and microtransactions, especially in China and South Korea. Its scale and player retention turn small repeat purchases into enormous lifetime revenue.