Your credit report is more than just a list of your credit cards, loans, and payment history—it’s a detailed financial snapshot that lenders use to evaluate your creditworthiness. However, many consumers are unaware that their credit reports often contain hidden items in your credit report that can quietly and negatively impact their credit scores. These hidden factors might include outdated information, unexpected public records, or even errors that you didn’t know existed.

Understanding these hidden items is crucial because they can affect your ability to qualify for loans, credit cards, or even rental agreements. Sometimes, these entries are buried deep in your report and overlooked during routine checks, yet they have the power to lower your credit score significantly. Whether it’s a forgotten collection account, a tax lien, or multiple hard inquiries, these hidden elements can create obstacles to your financial goals.

In this article, we reveal 10 lesser-known factors that might be hurting your credit and show you how to spot and address them before they impact your borrowing power.

Unpaid Municipal Debts

Municipal debts like utility fees or city fines can pop on your credit report. Unpaid fees can stay for seven years and drag down your credit score. They hit your credit history hard.

You might settle a bill, but credit bureaus may still list it as unpaid.

A low score can hike interest rates on a loan or a credit card. It can feel like a ghost debt haunting your file. You can pull a free report at annualcreditreport.com. Expired municipal agreements can still show on your report.

Then you can dispute errors or pay off old balances. Credit monitoring sends alerts when a municipal debt pops up again.

Debt Collections and Charge-Offs

A charge-off hits your credit score when a lender marks a debt uncollectible. That mark appears on your credit report as a collection. A defaulted student loan can scare FICO scores even if you do not know about it.

A collections agency may list unpaid utility bills or late loan payments. Credit scoring systems flag those entries for up to seven years. These hits weaken your credit mix and boost interest rates on new credit.

Debt collectors buy those charge-offs and call you for repayment. You can sort that with a debt consolidation loan or personal loan. A $10,000 credit card balance transfer may save about $3,000 in interest.

Found 48.7% of LendingTree users did that in Q1 2025. Pull a free credit report at annualcreditreport.com to spot new collection accounts. Set up credit monitoring to watch credit utilization ratio and missed payments.

Dispute errors under the Fair Credit Reporting Act to protect your credit mix and score.

Errors in Personal Information

Wrong spellings and mismatched SSN digits can tank your credit report. Inaccurate dates for late payments can cut your credit score by dozens of points. A mismatched address confuses a credit bureau.

The report shows your payment history and home equity line of credit. A false employer name raises flags for identity theft. Those mistakes can make interest rates jump. They can lock you out of cheap loans.

Each odd entry acts like a wrench in your financial gears.

Grab your free copy at annualcreditreport.com and scan every line. Check your name spelling and all account balances. Spot missing or extra charges on credit cards or student loan debt.

Flag any odd entry and send a dispute letter to each credit reporting agency. Attach proof like a utility bill or your Social Security card copy. That step can clear false marks and mend your credit history fast.

Use credit monitoring tools to watch for new errors each month.

Accounts You Didn’t Open (Fraudulent Accounts)

Scammers slip in fake credit cards under your name. These sneaky accounts can push your credit utilization ratio sky high. Think of a bad apple spoiling all your credit history. You spot these frauds with a free credit report on annualcreditreport.com or through a credit bureau alert.

Lock down your file with a freeze, call a credit monitoring service, or ring your credit card company. File a fraud alert under the Fair Credit Reporting Act. Send dispute letters to Equifax, Experian, and TransUnion.

This fight pulls the bogus account off your report, and it helps your FICO score heal.

Closed Credit Card Accounts with Balances

A closed credit card account with a balance still hikes your credit utilization ratio. That extra debt weighs on your FICO score, like a rock in your shoe. For example, closing a card with $500 left on a $1,000 limit leaves a 50% use rate.

Credit bureaus flag high ratios as a risk. Log into a credit monitoring tool or request a free credit report from annualcreditreport.com to spot that debt.

Contact the card issuer to clear the balance. Pay the debt in full or set up a plan. A zero balance on a closed card can improve your payment history. That change might boost your credit score and shrink your interest rates.

Active accounts with low balances help more than closed cards with debt.

High Credit Utilization Rates

Credit utilization ratio shows how much of your available credit you use. Credit-reporting agencies list this number on your credit report. FICO rating models treat this factor as 30% of your credit score.

They hike interest rates when you max out card balances. That dents your personal finance options.

Account monitoring helps you spot surges in usage. You can set alerts on annualcreditreport.com or via a credit monitoring app. Small payments can drop your ratio under 30%. That move lifts your credit scores and improves credit mix.

Many people slash balances fast and see better FICO rating in weeks.

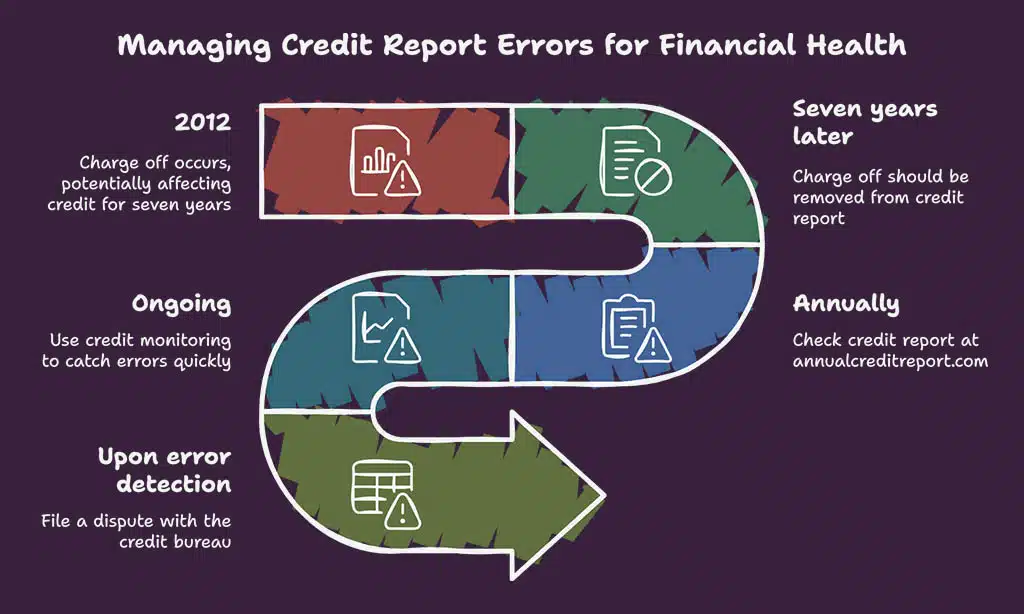

Old Negative Marks Not Removed on Time

Past due accounts can stay on your report beyond the allowed time. A 2012 charge off may lurk for up to seven years. Those negative marks drag down your credit score and FICO score.

Expired credit agreements like final municipal debts may still show up. Each bureau must remove them by law once they hit seven years.

Get your free credit report from annualcreditreport.com each year. Use credit monitoring to catch old marks fast. Spot expired entries and errors. You can file a dispute with the named bureau.

Mail your letter to Experian or TransUnion. A cleared error can boost your FICO score.

Co-Signed Loans with Missed Payments

Co-signed loans sit on both borrowers’ payment history. A missed payment by your co-signer can damage your credit score. Credit bureaus record each slip. You share the fault, even if you did not touch your own loan.

Late loan payments can drop a FICO score by tens of points.

Check your credit report at annualcreditreport.com each year. Use credit monitoring to spot errors. Talk to your financial institution or a mortgage broker fast. They can set up a payment plan.

This step saves your credit mix and credit history.

Multiple Hard Inquiries in a Short Period

Lenders log each hard inquiry in your credit report, those entries stick around for two years. A single application can shave off two to five points from your FICO score, and five requests in thirty days can lower it by about ten points.

TransUnion and Experian record every check, new credit risk shows instantly. Multiple scans can raise interest rates on personal loans and mortgages, underwriter sees the pattern.

Check your Experian file on AnnualCreditReport.com to spot extra scans. Sign up for Experian CreditWorks to get alerts when someone pulls your report. You can call the mortgage broker or loan officer if you see an odd inquiry.

Cutting back on new credit grabs helps protect your credit utilization ratio and payment history.

Takeaways

Hidden hits like old municipal debts or closed card totals can trap you. Grab your free report at annualcreditreport.com and scan for errors or strange accounts. Limit your credit utilization ratio to under 30 percent of your total limit.

Spot any identity theft quick, dispute wrong info with each bureau. Tap a credit monitoring solution or call a financial pro, then watch your FICO score rise.

FAQs on Hidden Items in Your Credit Report

1. What hidden items in my credit report can hurt my credit score?

You might find a high credit utilization ratio, old defaults, missed payments, too many inquiries, or large credit card balances. Each one can pull down your FICO score.

2. How can unused credit cards affect my credit history?

Unused cards can cut your length of credit history, shrink your credit mix, and nudge your credit score down. It is like leaving a tool on the shelf and never using it.

3. Can small debts, like utility bills, show up on my credit report?

Yes, unpaid utility bills sent to a collection agency can appear as debts, and they can hit your report hard. Think of them like little pebbles in your shoe, they slow you down.

4. Why do old collection accounts still matter?

Collection accounts stay on your report for up to seven years. Even after you pay, they can raise your annual percentage rate or push up mortgage rates, so they stick around like ghosts.

5. How do multiple credit checks affect me?

Each inquiry can shave points off your score for months. Spread out your loan applications, or use credit monitoring, to keep the hits to a minimum.