Hey there, are you a dreamer with a big idea for a startup in South Africa, but struggling to find the cash to get started? It’s tough to turn a vision into reality when funds are tight, and bank loans or venture capital seem out of reach.

Here’s a cool fact: the South African government offers a bunch of grants and incentives to help small businesses grow and boost economic growth. Our blog will guide you through six amazing government funding options, like the Small Enterprise Development Agency (SEDA) and others, to kickstart your business journey.

We’ll break it down, step by step, so you can snag that business funding. Stick around!

Key Takeaways

- South Africa offers six key government grants for startups, including SEDA and the National Empowerment Fund (NEF).

- SEDA helps with business advice and mentorship; contact them at 012 441 1000 or visit www.seda.org.za.

- The Co-operative Incentive Scheme (CIS) gives cash grants to black-owned cooperatives under the Cooperatives Act of 2005; call 012 394-1425.

- Black Business Supplier Development Program (BBSDP) offers up to R100,000 for businesses with revenue under R12 million; reach out at 0861 843 384.

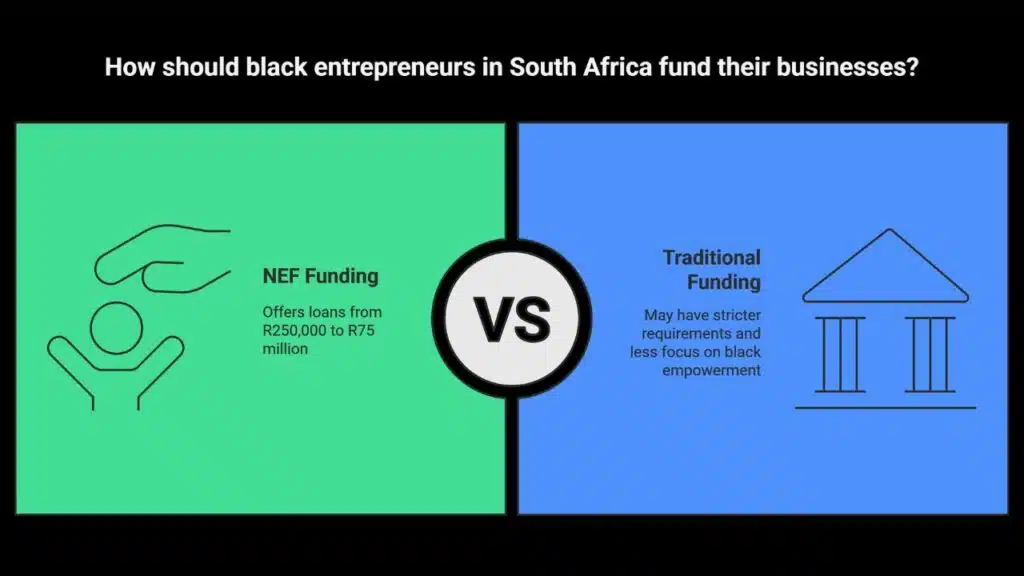

- NEF provides loans from R250,000 to R75 million for black-owned businesses; check www.nefcorp.co.za for details.

Small Enterprise Development Agency (SEDA)

Let’s chat about the Small Enterprise Development Agency, or SEDA, a real game-changer for startups in South Africa. If you’re kicking off a small business, this agency is like a trusty sidekick.

They offer hands-on help with business advice, mentorship programs, and even market access. Plus, they provide technical support to get your ideas off the ground. Got a question? Just dial 012 441 1000 or 0860 103 703 to connect with their team.

Hop over to their website at www.seda.org.za for all the details on small business development. SEDA focuses on giving you the tools for business growth, whether it’s crafting a solid business plan or finding government funding.

Think of them as a bridge to success for your startup dreams in the SME sector. Drop them a call or browse their site to see how they can boost your business venture!

Co-operative Incentive Scheme (CIS)

Hey there, readers, wanna know about a cool way to get government funding for your startup in South Africa? Check out the Co-operative Incentive Scheme, or CIS for short. This program offers straight-up cash grants to cooperatives that are mostly black-owned.

If your group is registered under the Cooperatives Act, 14 of 2005, you might just qualify. Think of it as a helping hand to boost black business supplier development and spark some real economic growth.

Got a crew ready to make waves? This could be your ticket.

Now, getting in on this deal isn’t a wild goose chase. You just need a simple business plan and some service quotations to show what you’re working on. Reach out to the Department of Trade and Industry at 012 394-1425 or 394-1608 for all the details.

Or, pop over to their site at www.thedti.gov.za to dig deeper into business funding options. Imagine turning your small idea into big business growth with a little backup from the government.

How neat is that? Stick around to see how this can fit into your dream of building something awesome with job creation in mind.

Black Business Supplier Development Program (BBSDP)

Let’s chat about a fantastic opportunity for black-owned businesses in South Africa. The Black Business Supplier Development Program, or BBSDP, offers grants up to R100,000 to help with business growth.

If your company has an annual revenue below R12 million and has been trading for at least one year, you might qualify. This support can be a game changer, like finding a hidden treasure chest for your small enterprise.

Now, getting this funding isn’t a walk in the park, but it’s worth the effort. You must have CIPRO and SARS registration to apply. Got questions or need to start the process? Just dial 0861 843 384 for assistance, or hop over to www.thedti.gov.za for more details on government grants.

Imagine using this cash to boost your operations, whether it’s for equipment or skills training. Stick with us to learn how to make your application shine!

Technology for Sustainable Livelihoods Program

Hey there, folks, let’s talk about an exciting opportunity for startups in South Africa. The Technology for Sustainable Livelihoods Program, managed by the Department of Science and Technology (DST), focuses on innovative areas like aquaculture, essential oils, and indigenous medicinal plants.

If you’ve got a talent for fish farming or creating natural products, this could be your path to business expansion. They aim to drive economic progress by supporting small business growth with smart tech solutions.

Reach out to them at 012 843-6421 or 012 843-6418 to get started.

Now, here’s the key point: you need access to suitable land to make this happen. Think of it as laying the foundation on promising soil, quite literally. This program provides government grants to assist with start-up funding for those in rural or underserved areas.

It’s like a supportive boost for black-owned businesses or women in business eager to engage in sustainable initiatives. So, prepare your business plan, ensure you have the right location, and seize this opportunity for significant business support.

Umsobomvu Youth Fund

Starting a business as a young person in South Africa can feel like climbing a steep hill, but the Umsobomvu Youth Fund is here to give you a solid push. This program, backed by the government, focuses on youth entrepreneurs who dream of turning ideas into reality.

It offers a mix of support, like loans to kickstart your venture, vouchers for specific needs, and even training to sharpen your skills. On top of that, they provide consulting services to guide you through the tricky early stages.

If you’re between 18 and 35, this could be your ticket to business growth and job creation. Got a question? Just dial 08600 YOUTH (96884) or 011 470-3111 for a quick chat.

Dig into their website at www.youthportal.org.za, and you’ll find a treasure chest of resources for small business development. Imagine having a mentor to help with your business plan or getting access to government funding without the usual headaches.

This fund isn’t just about handing out cash; it’s a full-on mentorship program for young dreamers like you. Whether you’re into tech, tourism, or waste management, they’ve got tools to help.

So, take a bold step, reach out, and see how this fund can fuel your journey with the right business funding and support.

National Empowerment Fund (NEF)

Hey there, let’s chat about a game-changer for black-owned businesses in South Africa, the National Empowerment Fund, or NEF. This government funding body is like a helping hand, offering loans from R250,000 all the way up to a whopping R75 million.

Imagine getting that kind of business funding to kickstart or grow your dream venture. It’s a real boost for economic growth, especially if you’re a black entrepreneur looking to make your mark.

Got an idea for business growth? Head over to their website at www.nefcorp.co.za to check out the details. The NEF isn’t just about handing out cash; it’s a lifeline for small business development among black industrialists.

So, if you’re ready to take your company to new heights with some solid equity funding, this might be your shot. Let’s keep the ball rolling and see how this can work for you!

Requirements for Applying for Grants

Getting a government grant in South Africa can be a game-changer for your startup. Let’s chat about what you need to have in place to apply with confidence.

- First up, grab a valid CIPC registration. This proves your business is legit and registered with the Companies and Intellectual Property Commission. Without it, you’re just spinning your wheels, so get this sorted early to show the government you mean business.

- Next, secure a SARS registration. This ties your startup to the South African Revenue Service for tax purposes. It’s a must-have to prove you’re playing by the rules, and it’s a key step for any business funding application.

- Don’t forget a tax clearance certificate. This little document shows you’ve paid your dues and owe nothing to SARS. It’s like a gold star on your report card, making your government grants application look solid.

- Make sure you comply with BBBEE guidelines. Broad-Based Black Economic Empowerment rules matter a lot in South Africa. Following them can boost your chances for programs like the Black Business Supplier Development Programme, so align your business with these standards.

- Prepare your financial statements. These papers show how your startup is doing money-wise. They’re proof of your business health, and the folks at places like the National Empowerment Fund (NEF) will want to see them before handing over any business loans or grants.

- Craft a strong business plan. This is your roadmap, laying out your goals and how you’ll reach them. It’s not just a formality; it’s your pitch to convince government funding bodies that your small business development idea is worth investing in.

- Put together a feasibility plan. This shows your project can actually work in the real world. It’s a vital piece for economic growth-focused grants, proving to schemes like the Small Enterprise Finance Agency (SEFA) that your idea isn’t just a pipe dream.

- Gather all other related documents. Things like ID copies or proof of address might seem small, but they’re the nuts and bolts of your application. Missing one could stall your shot at small business funding, so double-check every detail before submitting.

Tips to Maximize Your Grant Applications

Hey there, let’s chat about nailing those government grants for startups in South Africa. I’ve got some handy pointers to boost your chances with business funding.

- First off, submit your grant applications early. Don’t wait until the last minute, folks. Missing deadlines can tank your shot at government grants. Make sure all your paperwork, like a tax clearance certificate, is ready and complete. This shows you’re serious about snagging that small business funding.

- Dig into the eligibility rules for each grant. Every program, whether it’s the National Empowerment Fund or another, has specific criteria. Know them inside out to match your startup’s goals with theirs. This step can skyrocket your odds of getting business loans or equity funding.

- Craft a solid business plan. Lay out your project aims, expected results, and a clear budget. A sharp plan can impress folks at the Small Enterprise Finance Agency. It’s like a roadmap for your economic growth, so make it count.

- Mold your application to fit the grant’s mission. If it’s about job creation or women empowerment, highlight that in your proposal. Show how your startup aligns with their big-picture goals. This tactic can make your bid for government funding stand out.

- Focus on community impact and sustainability. Got a project that helps locals or builds long-term value? Shout it out. Grants tied to social entrepreneurship often favor ideas with heart. Paint a picture of how your work boosts South Africa’s future.

- Team up with partners or stakeholders. Joining forces can widen your project’s reach and appeal. It shows you’ve got support and resources, which can catch the eye of venture capitalists or grant reviewers. Collaboration is key to proving your startup’s strength.

- Learn from past tries to sharpen future ones. Each application teaches you something new. Use feedback or mistakes to fine-tune your strategy for small business development. Keep growing, and soon you’ll master the art of winning business grants.

Takeaways

Wow, what a journey through South Africa’s startup support landscape! These six government grants, from SEDA to the National Empowerment Fund, are like a helping hand for budding business owners.

Got a dream to start something fresh? Tap into these funds and watch your ideas grow with the right backing. Let’s cheer for your success, one grant at a time!

FAQs

1. What are some key government grants for startups in South Africa?

Hey there, if you’re launching a venture in South Africa, you’ve got options like the Black Industrialists Scheme (BIS) for black-owned businesses, or the Tourism Transformation Fund to boost economic growth in travel sectors. These business grants can be a real game-changer, giving your idea the push it needs. Just make sure you’ve got a solid business plan to snag that government funding!

2. How can the Industrial Development Corporation (IDC) help my small business?

Listen up, the Industrial Development Corporation, or IDC, is like a trusty sidekick for startups in South Africa. They offer equity funding and business loans to fuel business growth, especially in fields like new energy vehicles and automobiles.

3. What’s the deal with the Small Enterprise Finance Agency (SEFA) for SMEs?

Well, pal, the Small Enterprise Finance Agency, known as SEFA, is a lifeline for SMEs craving small business funding. They dish out credit facilities and micro-finance options, often with better interest rates than a typical line of credit. It’s like finding a shortcut through the jungle of finances!

4. Can women entrepreneurs get special support in South Africa?

Absolutely, ladies, South Africa’s got your back with programs like the Isivande Women’s Fund and the South African Women Entrepreneurs Network (SAWEN). These initiatives, tied to the Gender and Women Empowerment Unit, offer business skills training and mentorship programs to help with everything from company registration to tackling suppliers.

5. How does the National Empowerment Fund (NEF) support job creation?

The National Empowerment Fund, or NEF, is all about sparking job creation and economic growth for startups. Think of it as a sturdy bridge to cross over financial gaps, offering venture capital and support for black-owned businesses to thrive in tough markets.

6. Are there other ways to fund my startup besides government grants?

Hey, don’t put all your eggs in one basket; beyond government grants, you can tap into angel investors or venture capital firms in South Africa. Crowdfunding platforms are popping up too, acting like a friendly neighbor lending a hand. Plus, private equity investors might jump in if your business plan shines brighter than a polished diamond!