Gold is not supposed to behave like this. It is supposed to feel slow, deliberate, almost boring. Yet lately, it has been swinging with the kind of momentum people associate with risk assets, not the world’s oldest refuge.

That is why gold price volatility matters more than the price level itself. The whipsaws are telling us something bigger than “buyers got excited” or “sellers took profits.” They are showing how investors around the world are trying to live inside a future that refuses to settle into one clean story.

In the span of a few sessions, gold and silver can surge on fear, reverse on a policy signal, then surge again on the sense that the policy signal is itself a risk. Markets are not simply reacting to numbers. They are reacting to trust, and trust is no longer a stable input.

This is what a new era of market anxiety looks like. It is not a single crisis. It is the constant possibility of several crises, each pulling asset prices in a different direction.

When Fear Splits Into Opposing Fears

In past cycles, fear usually had a dominant flavor. Inflation fear meant one kind of positioning. Recession fear meant another. Geopolitical fear created its own playbook. The market argued, but it usually converged.

Now fear does not converge. It multiplies.

Investors can worry about inflation and deflation at the same time. They can worry about policy tightening and policy reversal at the same time. They can worry about the dollar being too strong in the short run and too politically complicated in the long run.

That collision turns gold into a battlefield asset instead of a quiet hedge. The metal becomes the place where competing anxieties negotiate in public, not behind the scenes.

Gold’s swings are not “confusing.” The world’s story has become conflicting, and gold is one of the few assets that sits at the center of the conflict.

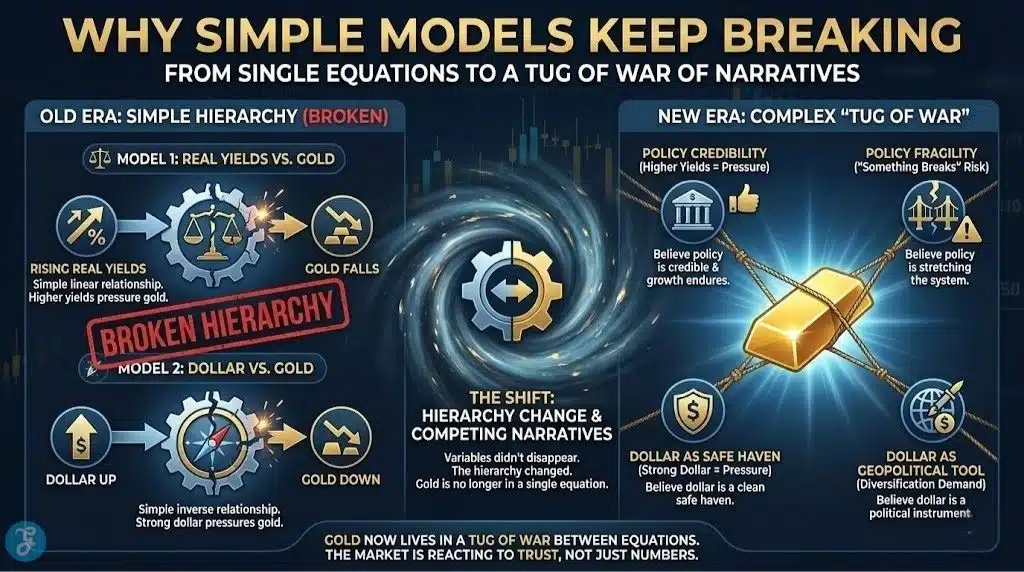

Why Simple Models Keep Breaking

A simple model says gold rises when inflation expectations rise, and gold falls when real yields rise. Another simple model says the dollar up means gold down, and the dollar down means gold up.

Those relationships still matter. They just do not get to be in charge all the time.

When investors believe policy is credible and growth can endure, higher yields can pressure gold. When investors believe policy is stretching the system, higher yields can fuel gold because the market starts pricing “something breaks” risk.

When investors believe the dollar is a clean safe haven, dollar strength can pressure gold. When investors believe the dollar is also a geopolitical instrument, the same dollar strength can increase diversification demand.

In other words, the variables did not disappear. The hierarchy changed.

Gold no longer lives in a single equation. It lives in a tug of war between equations.

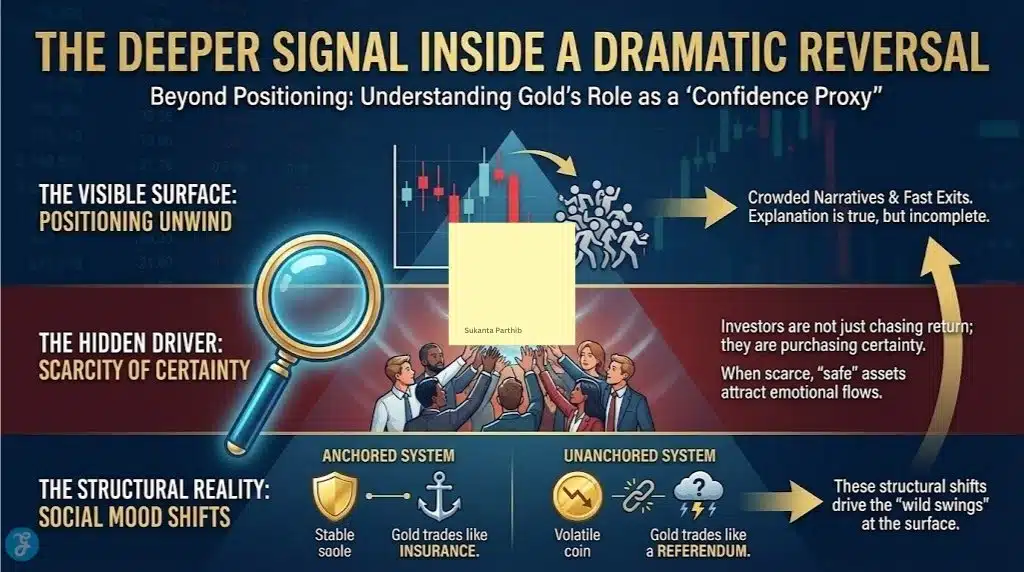

The Deeper Signal Inside A Dramatic Reversal

A sharp reversal in gold and silver over a short window is usually explained as positioning. That explanation is true, and it is incomplete.

Positioning matters because it reveals what narrative was crowded. If everyone leans the same way, the market becomes fragile. A single surprise can force fast exits, and fast exits create dramatic candles on charts.

But the reason those trades get crowded in the first place is the deeper signal. Investors are not only chasing returns. They are trying to purchase certainty. When certainty is scarce, even “safe” assets attract crowded, emotional flows.

Gold reversals increasingly resemble social mood shifts. That is not poetic language. That is structural reality.

When the system feels anchored, gold trades like insurance. When the system feels unanchored, gold trades like a referendum.

A Quick Map Of The Competing Narratives

Here is a simplified way to see why gold can whip so hard without any single data point “explaining” it.

| Dominant Narrative | What Investors Think | Typical Gold Response | What Breaks The Pattern |

|---|---|---|---|

| Inflation Threat | Prices can re-accelerate | Gold bid as hedge | Tight policy shocks growth |

| Deflation Threat | Growth cracks, credit tightens | Gold bid as safety | Inflation reappears via supply shock |

| Policy Credibility | Central bank can steer landing | Gold fades on higher yields | Market doubts political tolerance |

| Policy Fragility | Tight policy risks accidents | Gold rises even with high yields | Clear disinflation plus stable growth |

| Geopolitical Shock | Conflict and sanctions disrupt flows | Gold bid as neutral asset | Risk appetite snaps back quickly |

| Dollar Confidence | Dollar remains clean anchor | Gold pressured if USD strong | Diversification demand dominates |

None of these narratives is fake. The problem is that they can all be plausible at once.

That is why modern market anxiety does not feel like a single storm. It feels like weather that changes every hour.

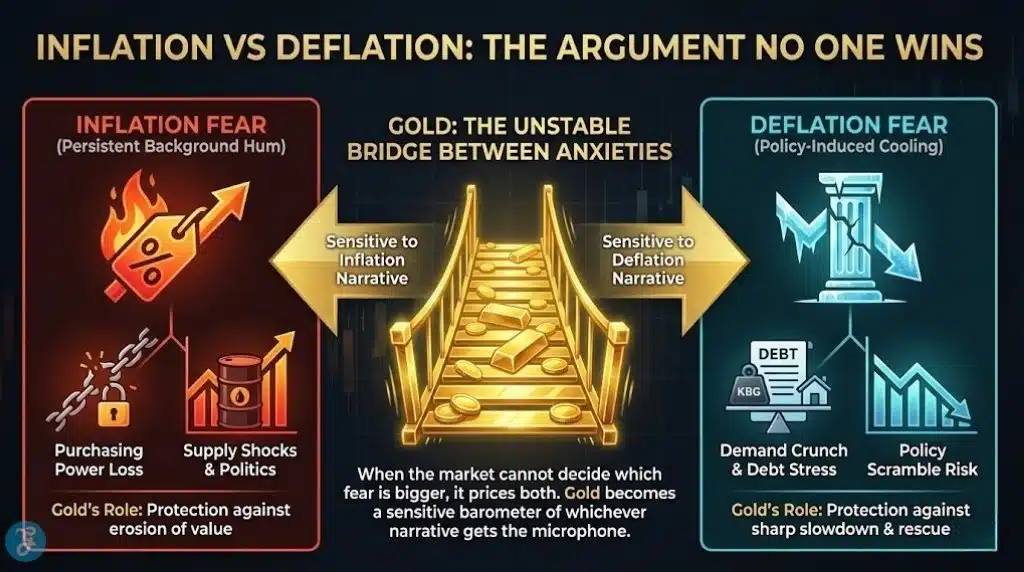

Inflation Vs Deflation: The Argument No One Wins

Inflation fear has not vanished. It has become a persistent background hum. Even when inflation cools, investors remember how quickly it can return, especially when supply chains, energy markets, and politics do not behave like textbooks.

Deflation fear has also returned because tight policy and high financing costs can cool demand faster than policymakers intend. Debt-heavy systems do not adjust gently to expensive money.

When the market cannot decide which fear is bigger, it starts pricing both. Gold becomes a bridge between two opposite anxieties.

In an inflation narrative, gold is protection against purchasing power loss. In a deflation narrative, gold is protection against the kind of policy scramble that follows sharp slowdown.

That dual role is powerful. It is also unstable. It makes gold sensitive to whichever narrative gets the microphone today.

Policy Tightening Became A Political Story

Markets used to treat central banks like engineers. Now they treat them like politicians with calculators.

The question is not only “What will rates do?” The question is “Can the system absorb what rates do?” That question includes voters, governments, debt service, housing markets, bank balance sheets, and corporate refinancing.

When investors sense that tightening is approaching a political limit, gold can rise because the market prices future policy compromise. When investors sense that tightening will persist regardless of pain, gold can also rise because the market prices financial stress.

This is why gold’s reaction function can look contradictory. Gold can rise on hawkishness and rise on dovishness, for different reasons.

In the old world, the central bank was the anchor. In the new world, the anchor itself can become a risk factor.

Geopolitics Is No Longer A Temporary Overlay

Geopolitical risk used to be treated as a temporary overlay. Markets would spike, then normalize. Investors could assume that trade routes, alliances, and rules would reset.

Now geopolitical risk behaves more like a permanent feature. Supply chains have alternative paths. Sanctions exist as policy tools. Strategic resources sit inside political negotiations. Investors can no longer assume fast reversion to a single global baseline.

Gold benefits from that shift because it is not tied to any single political promise. It is a cross-border asset that can travel between narratives.

When fear becomes structural, the premium on neutral stores of value becomes structural too.

That structural premium can still swing wildly in the short term, especially when headlines re-rank the fears. But the underlying reason does not go away.

The Dollar: Strong, Essential, And Quietly Questioned

The dollar remains dominant in global trade, finance, and crisis behavior. Investors know that. They also know that dominance does not eliminate uncertainty.

The market can simultaneously believe:

-

The dollar is the most liquid refuge in acute stress

-

The dollar can strain other economies when it runs hot

-

The dollar’s role is increasingly entangled with geopolitics

-

Diversification is rational even if dominance continues

This is not a prediction of a sudden regime collapse. It is a description of modern portfolio thinking. When the world’s politics fracture, concentration risk feels larger.

Gold becomes a tool to reduce that concentration risk. Not because gold replaces the dollar, but because gold helps investors sleep when they cannot forecast the next political turn.

That is why gold can rally without a clean dollar catalyst. The catalyst can be doubt, not data.

What Silver Adds To The Anxiety Signal

Silver is often treated as gold’s louder sibling. It is more volatile, more sensitive, and more easily pushed around by speculative flows.

But silver’s role is also conceptually important because it sits between “money metal” and “industrial metal.” It reacts to growth expectations and safe-haven demand in the same breath.

When silver reverses hard alongside gold, it can signal that the market is not simply adjusting inflation hedges. It is adjusting its worldview about growth, liquidity, and risk appetite.

Silver does not just magnify gold moves. It reveals the market’s internal argument more clearly.

If gold is the speech, silver is the tone of voice.

Why The Swings Feel Wilder Than Before

A lot of today’s market movement is amplified by structure, not emotion. The emotional part is real, but structure turns it into speed.

Several forces can add torque:

-

Systematic strategies that scale exposure based on volatility

-

Futures positioning that can shift quickly on risk limits

-

ETF flows that respond to headlines and momentum

-

Options hedging that forces buying or selling into moves

-

Cross-asset de-risking that bundles gold with broader positioning

When these mechanisms combine, price action can look like the market is “overreacting.” Often, it is reacting mechanically, not morally.

That does not make the move meaningless. It makes it more meaningful because structure is part of the new era.

If the plumbing produces whiplash, then whiplash becomes part of the signal.

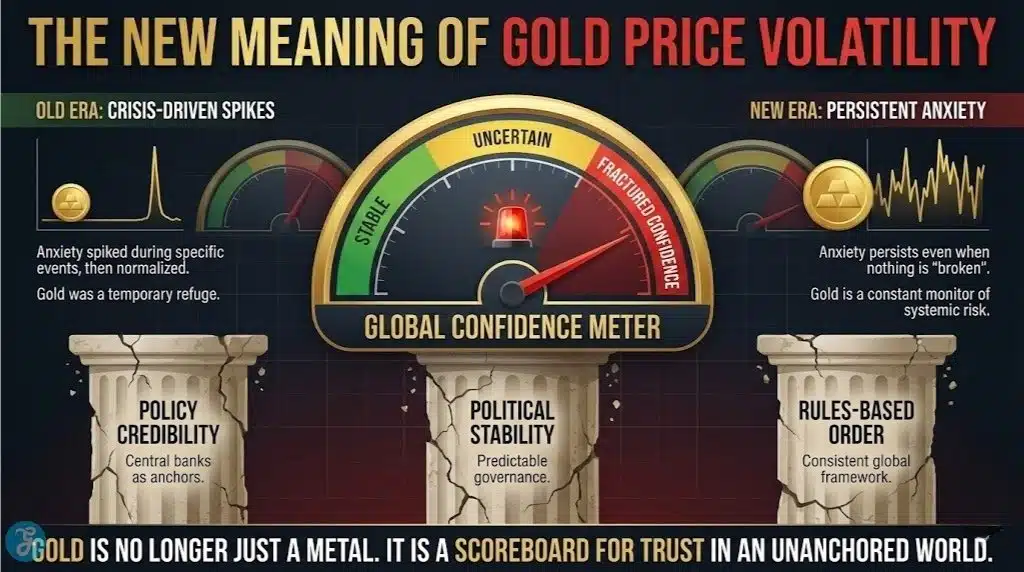

The New Meaning Of Gold Price Volatility

Here is the uncomfortable truth. Gold price volatility is no longer only a story about gold.

It is a story about how global investors price confidence when confidence is fractured. It is a story about whether policy is credible, whether politics is stable, whether currencies can carry both domestic goals and global responsibilities, and whether rules-based behavior will persist under stress.

In older eras, market anxiety spiked during crises. In this era, market anxiety can persist even when nothing has “broken” yet.

That persistence changes the behavior of hedges. It changes how investors build portfolios. It changes what “safe” means.

Gold is not becoming riskier in its essence. The environment is becoming riskier in its assumptions.

Pros And Cons For Investors Using Gold As A Signal

Pros

-

Gold can flag confidence stress earlier than many risk assets.

-

Gold offers a neutral store of value when politics drives financial outcomes.

-

Gold can hedge multiple fear scenarios when narratives compete.

-

Gold can diversify portfolio concentration in currency exposure.

Cons

-

Whipsaws can punish investors who treat gold like a slow-moving hedge.

-

Crowded trades can turn “safe haven” into short-term instability.

-

Headlines can dominate fundamentals for longer than expected.

-

Silver can amplify mistakes if investors assume it behaves like gold.

Gold is still useful. The way people need to use it has changed.

The era of passive “buy and forget” gold exposure is giving way to a more active understanding of what gold represents at any given moment.

How Investors Are Really Pricing Risk Now

The old world framed risk as a neat spectrum. Growth assets on one side, safety assets on the other. Correlations behaved more predictably, and policy felt like a stabilizer.

The new world prices risk as a network of conflicts:

-

inflation vs slowdown

-

policy credibility vs policy constraint

-

currency strength vs currency weaponization

-

liquidity now vs solvency later

Gold sits in the middle of that network. That is why it can feel like it is reacting to everything.

It is reacting to the network, not a single node.

When investors treat risk like a network, they also treat hedges like dynamic tools. That makes flows faster, and it makes reversals sharper.

What To Watch If You Want The Signal, Not The Noise

You cannot control the day-to-day headlines. You can control whether you interpret the market in a way that fits the era.

If you want to read gold as a signal of market anxiety, watch the intersections:

-

When yields rise and gold rises, the market is often pricing policy stress, not inflation.

-

When the dollar strengthens and gold holds firm, the market is often pricing diversification, not just FX mechanics.

-

When silver collapses while gold stays resilient, the market is often pricing growth fear more than monetary fear.

-

When both gold and silver reverse sharply, the market is often repricing narrative dominance.

You do not need perfect data to see this. You need narrative discipline.

The key is to stop asking, “What one thing caused this?” and start asking, “Which fear just moved to the top of the stack?”

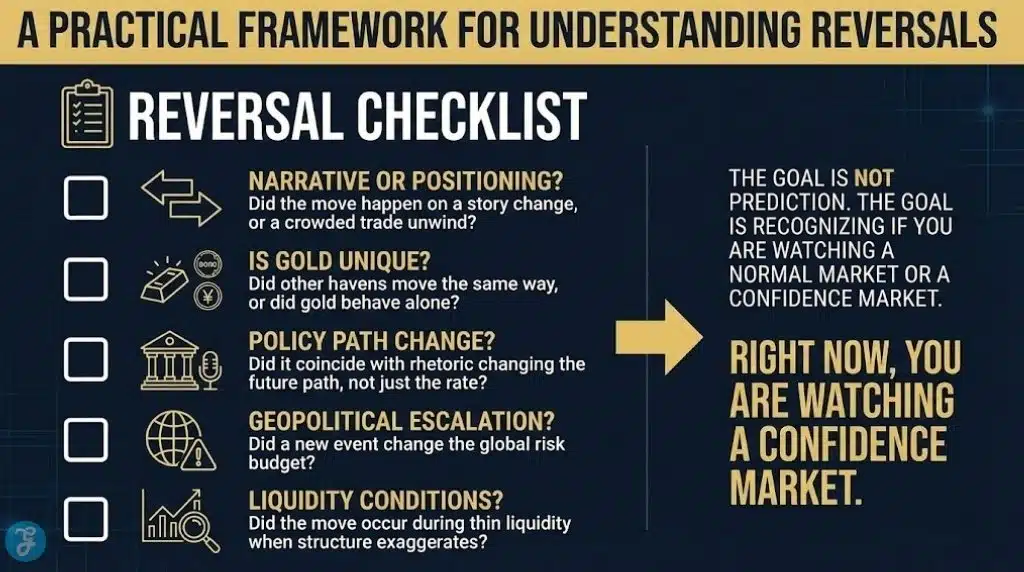

A Practical Framework For Understanding Reversals

A reversal is not always the end of a trend. Sometimes it is the market changing the story it believes.

Use this checklist when you see a violent swing:

-

Did the move happen on a narrative change or on a positioning unwind?

-

Did other havens move the same way, or did gold behave uniquely?

-

Did the move coincide with policy rhetoric that changes the path, not just the rate?

-

Did the move coincide with a geopolitical escalation that changes risk budgeting?

-

Did the move occur during thin liquidity when structure can exaggerate?

This is not about predicting the next tick. It is about recognizing whether you are watching a normal market or a confident market. Right now, you are watching the latter.

What Comes Next For Gold And For Anxiety?

The question is not whether gold will be volatile again. The question is whether the world will offer a stable anchor that reduces the need for gold’s role as a confidence proxy.

As long as investors face a future where:

-

Inflation can return without warning

-

Growth can break under tight policy

-

Geopolitics can reshape trade and prices

-

Politics can constrain central banks

-

Currency dominance can carry strategic tension

Then gold will continue to behave like more than a metal. It will behave like a scoreboard for trust.

The wild swings are not a glitch. They are the market admitting, in the most honest language it has, that certainty is expensive.

And that is why gold price volatility is not just a feature of the precious metals market. It is a signature of our moment.