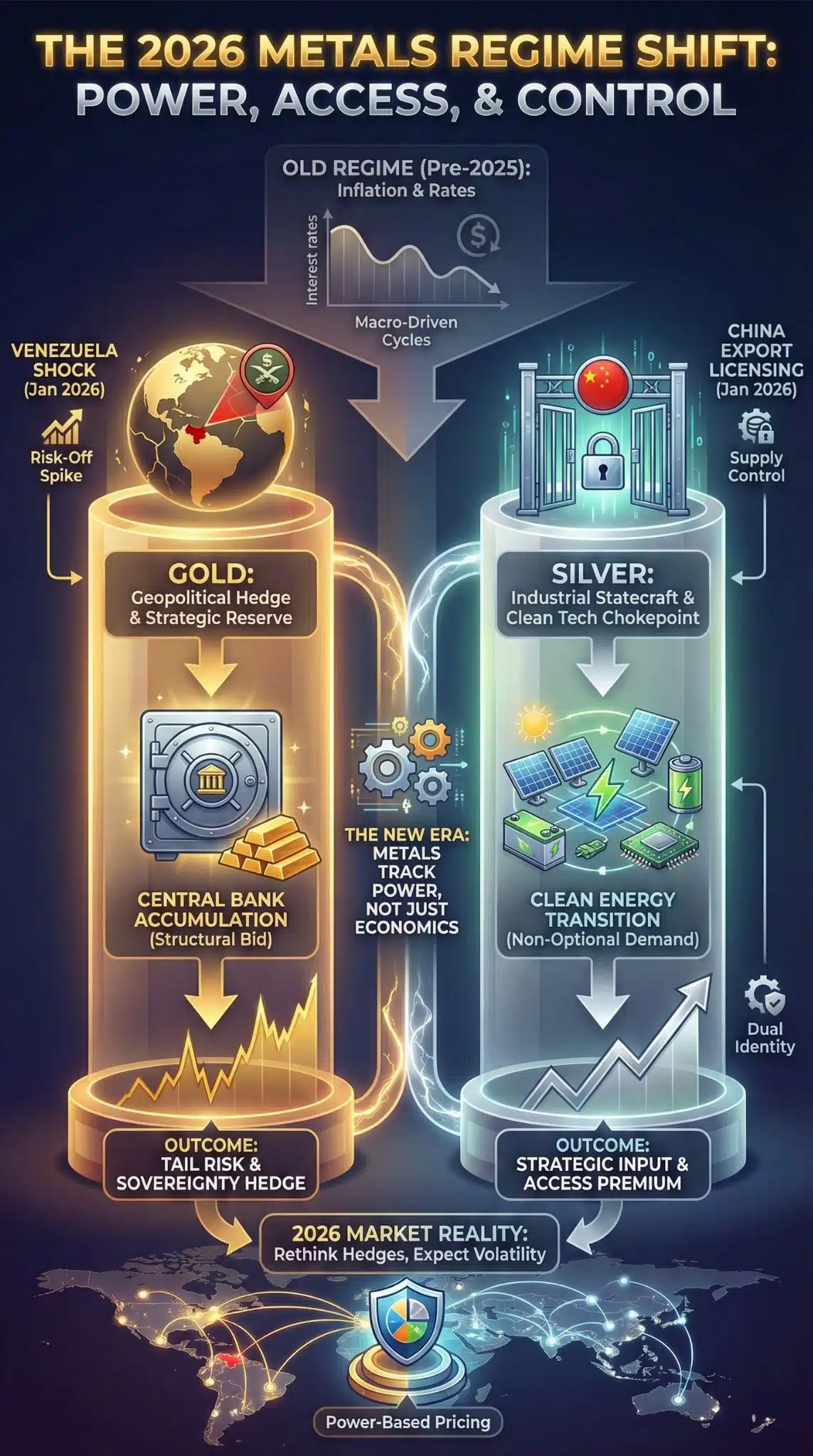

Gold And Silver Rally isn’t just a risk-off blip. China is tightening control of silver flows into clean tech, while Venezuela’s shock regime change jolts geopolitics. Together they signal a new era where metals prices track power, not just inflation or rates and investors must rethink hedges today.

The latest jump in precious metals has two distinct triggers that usually live in separate worlds. One is hard geopolitics: the U.S. military capture of Venezuela’s president Nicolás Maduro and his wife, an escalation widely compared by observers to the 1989 Panama intervention. The other is industrial statecraft: China’s move to place more of the global silver trade behind an export-licensing gate starting January 1, 2026.

Put together, they highlight a regime shift in how markets are pricing “safe havens.” Gold is still the classic geopolitical hedge, but silver is increasingly behaving like a strategic industrial input with a financial overlay. That dual identity is why silver can rise with fear and also rise with industrial optimism, sometimes in the same week. For readers, policymakers, and investors, the significance is straightforward: 2026 is shaping up as a year when metals pricing becomes less about purely economic cycles and more about power, access, and supply-chain control.

How We Got Here

Two price facts frame the story. On January 5, 2026, spot gold rose to about $4,406/oz and silver to about $75/oz in early trading, as markets moved into safe-haven mode after the Venezuela shock. These are not “normal-cycle” prices. Gold ended 2025 up roughly 64%, one of its strongest annual gains in modern history, and it had recently printed record highs above $4,500/oz. Silver’s 2025 surge was even more extreme, roughly +147% by some tallies, and it flirted with all-time highs above $80/oz in early 2026 sessions.

Those moves were not created by a single headline. They were primed by a macro backdrop that has been building for years.

First, interest-rate dynamics shifted. The Federal Reserve reduced rates again in December 2025, and its forward guidance left room for a slower, more cautious easing path. Lower expected real yields can support non-yielding assets like gold, but the deeper point is behavioral: markets that become unsure about the path of growth and inflation tend to pay a premium for assets perceived as durable stores of value.

Second, central bank behavior changed the market’s floor. Over the last several years, official-sector demand has been unusually strong, and surveys of reserve managers show many expect gold allocations to keep rising. This demand is less price-sensitive and more strategic, which matters because it can keep support under the market even when speculative sentiment fades.

Third, the energy transition pulled silver into the center of industrial demand. Solar panels and electrification trends have made silver less optional in a world scaling clean power, even as manufacturers work to use less per unit. That means silver now carries a “growth commodity” component that gold does not.

Finally, governments began treating metals and minerals as strategic assets rather than neutral commodities. In late 2025, U.S. authorities expanded the official critical minerals list to include silver. That single bureaucratic move matters because critical status can justify stockpiles, incentives, procurement preferences, and a more explicit national-security approach to supply.

Why Venezuela Matters Beyond One Country

The Venezuela operation is a high-volatility catalyst because it collapses multiple risks into one event: sovereignty norms, regional stability, sanctions enforcement, oil flows, and great-power reaction.

From a market perspective, the key is not just fear. It is uncertainty about the rules. When investors believe the geopolitical rulebook is changing, gold’s role shifts from a “hedge you buy when nervous” to something closer to a baseline allocation you hold because the world looks structurally less predictable.

Venezuela also matters because it sits at the intersection of energy, migration, and sanctions. Even if oil is not the headline driver of metals prices, energy shocks influence inflation expectations and policy responses. And sanctions enforcement creates a broader pattern: as the financial system becomes a venue for geopolitical pressure, assets perceived as politically neutral or outside the payments system gain appeal.

That is why gold often responds disproportionately to geopolitical ruptures. A single event can reprice tail risks, and gold is the asset that markets reach for when tail risk becomes the story.

Key Statistics That Signal A New Regime

- Gold traded above $4,400/oz in early January 2026 after the Venezuela shock.

- Silver traded in the mid-$70s/oz range in the same period.

- Gold posted an unusually strong 2025 annual gain (roughly mid-60% range in widely cited tallies).

- Silver posted an unusually strong 2025 annual gain (well above 100% in some tallies).

These figures do not guarantee more upside. They do, however, underline how far prices have already moved and how much of the move is tied to “regime” narratives rather than incremental economic data.

China’s Silver Gatekeeping: From Commodity To Chokepoint

If Venezuela explains the “why now” for gold, China explains the “why now” for silver’s outsized move.

China’s new export-licensing framework for silver took effect on January 1, 2026. The functional result is simple: exports become permissioned rather than automatic. Even if approvals remain relatively generous, the market learns a new lesson: supply is now politically mediated. That changes pricing psychology, because buyers and manufacturers must price not only physical scarcity but also administrative risk.

Reports described the licensing structure as covering roughly 121 million ounces of annual exports. Other coverage indicated that China maintains an official list of approved exporters for multi-year windows, reinforcing the idea that trade is being channeled rather than simply permitted. In practice, this can create a two-tier market: those with access to “approved” flows versus those scrambling in spot markets when approvals lag.

This is not simply about scarcity. It is about industrial strategy. Silver is embedded in electronics and especially solar photovoltaics. When a major player controls export volumes through licensing, downstream manufacturers in other regions face uncertainty on both price and availability. That is exactly how a commodity becomes a chokepoint.

The Energy Transition Is A Silver Story, Not Just A Climate Story

Silver’s rally is not only about fear. It is also about fundamentals.

Industrial demand for silver has reached levels that change the market’s center of gravity, with solar panels a major contributor. Renewable build-out, particularly solar, is scaling at a pace that makes “small per-unit reductions” less decisive than total deployment. Even if manufacturers steadily reduce silver loadings per panel, the total number of panels installed can still push aggregate silver demand higher.

Global renewable capacity expansion projections still point upward. Many official and industry outlooks expect massive additional solar capacity by 2030. The practical takeaway is that silver demand is increasingly tied to policy goals, grid investment, and clean-energy deployment targets. That makes it more resilient than purely cyclical consumer demand, and it makes the market more sensitive to trade and supply-chain decisions.

Before Vs. After: What China’s Licensing Changes

| Dimension | Before Licensing | After Licensing |

| Export process | More market-led, contract-driven | Permissioned flows with approval risk |

| Buyer behavior | Leaner inventories possible | Incentive to stockpile and pre-buy |

| Price formation | Spot reflects near-term balance | Spot includes administrative and geopolitical premium |

| Volatility drivers | Mostly macro and industrial cycle | Macro plus policy actions and access constraints |

Gold’s Structural Tailwind: Central Banks And Quiet Reserve Rebalancing

Gold’s rally is often described as a mix of lower rates and higher fear. That is incomplete.

Central bank accumulation is a structural bid. Surveys of reserve managers show many expect official gold reserves to keep rising in the near term. In parallel, reserve managers have signaled interest in diversification, including expectations that the U.S. dollar’s share of reserves may be lower over time. Even if the dollar remains dominant, incremental diversification into gold can meaningfully move the price because mine supply grows slowly.

China’s own gold behavior is also closely watched, both for imports and for changes in official reserves. When large economies add gold steadily, it reinforces the perception that gold is being treated as strategic collateral in a world of sanctions, trade friction, and geopolitical fragmentation.

Gold Vs. Silver: Same Rally, Different Engines

| Factor | Gold (Primary Mechanism) | Silver (Primary Mechanism) |

| Geopolitical shocks | Safe-haven allocation | Safe-haven overlay plus industrial pull |

| Monetary policy | Sensitive to real yields and rate expectations | Often correlated, but can decouple via supply policy |

| Structural demand | Central banks, long-horizon allocation | Solar and electrification compounding |

| Policy and trade control | Indirect via sanctions and reserve politics | Direct via export licensing and critical-mineral framing |

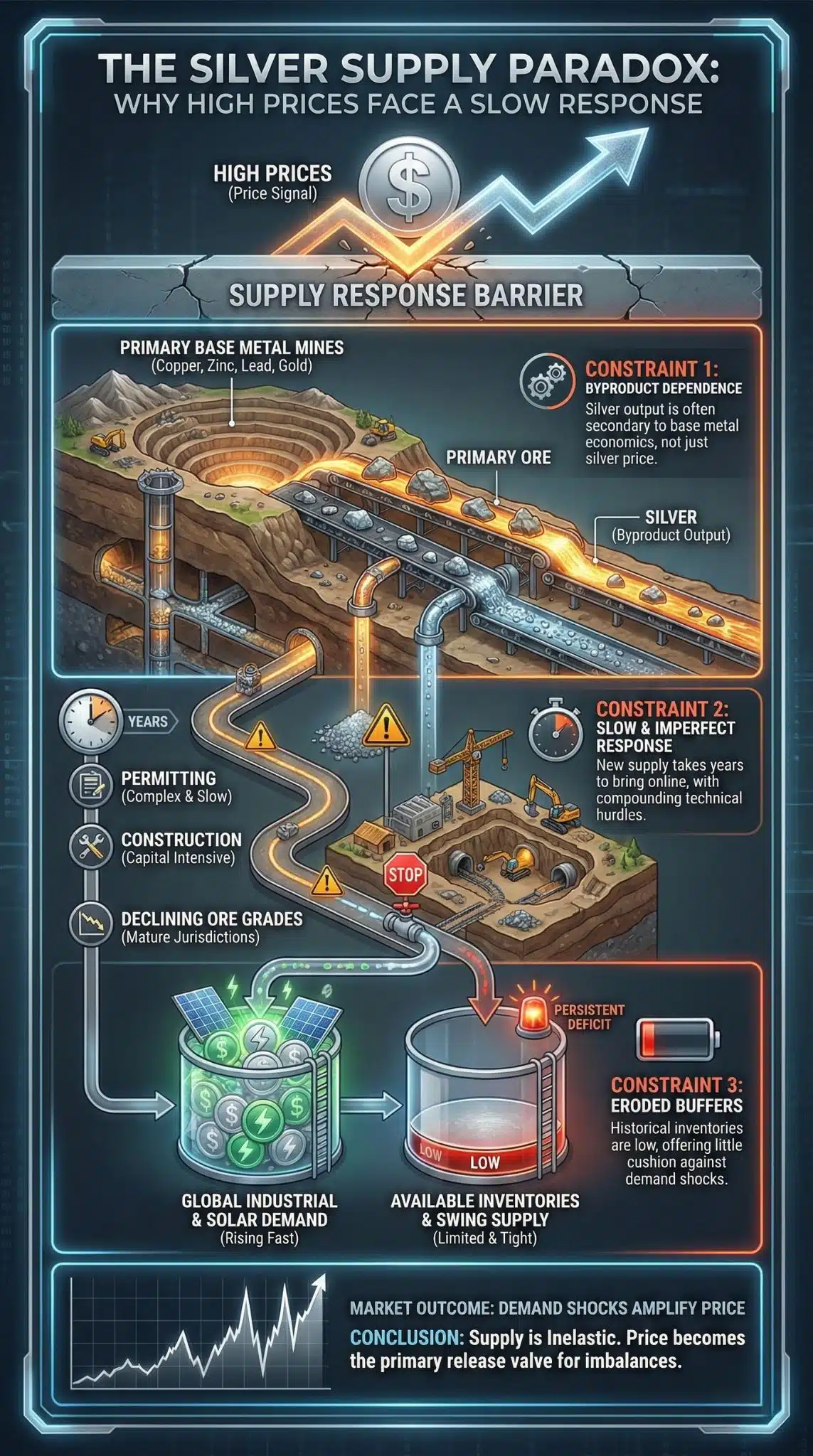

Supply Constraints: Why High Prices Don’t Quickly Fix Silver

In normal commodities, high prices trigger new supply and eventually cool prices. Silver does not behave neatly like that.

A large share of silver is produced as a byproduct of mining other metals. That means higher silver prices do not automatically cause a proportional increase in silver output. Mining decisions are often driven by copper, lead, zinc, and gold economics. As a result, the silver supply response can be slow and imperfect, even when prices are very high.

Market deficits have been persistently discussed in recent years, reflecting the tension between rising industrial use and limited flexible supply. Even if deficit estimates vary by methodology, the consistent signal is that inventories and “swing supply” are not as comfortable as they were in earlier decades.

Gold supply is also slow to respond. New mines and expansions take years, permitting is complex, and ore grades can be declining in mature jurisdictions. That means demand shocks, especially official-sector demand, can have a larger price effect than many investors expect.

Timeline That Helps Explain The Breakout

| Date/Period | Development | Market Implication |

| 2024 | Industrial silver demand remains elevated; solar demand continues rising | Silver’s industrial floor strengthens |

| 2025 | Strong gold and silver performance; gold hits repeated records | Narrative shifts from cyclical to structural |

| Nov 2025 | Silver added to U.S. critical minerals list | Policy lens shifts toward strategic supply |

| Dec 2025 | Fed cuts rates again; markets weigh softer policy path | Tailwind for non-yielding assets |

| Jan 1, 2026 | China silver export licensing takes effect | Access premium and supply uncertainty rise |

| Jan 2026 | Venezuela shock heightens geopolitical premium | Gold safe-haven bid intensifies |

Winners, Losers, And Second-Order Effects

Sharp metals rallies do not stay confined to trading desks. They spill into manufacturing costs, consumer behavior, and policy debates.

Who Gains And Who Pays If Prices Stay High

| Likely Winners | Why | Likely Losers | Why |

| Primary gold and silver miners | Higher realized prices improve cash flow | Solar and electronics manufacturers | Input cost pressure if not passed through |

| Recyclers and refiners | Higher scrap value raises recovery incentives | Jewelry-heavy retailers | Demand destruction at extreme price points |

| Countries with diversified mineral supply | Stronger negotiating position | Import-dependent economies | Higher vulnerability to trade restrictions |

| Safe-haven allocators | Benefit from diversification if volatility persists | Late-cycle speculators | More exposed if positioning unwinds |

A subtle second-order effect is political. As metals become expensive, governments face pressure to “do something,” which can translate into subsidies, tariffs, stockpiles, or accelerated permitting. Those steps can support prices further by reinforcing the idea that these are strategic inputs, not merely commodities.

Expert Perspectives And The Strongest Counterarguments

A balanced analysis must acknowledge that parabolic moves can overshoot and then correct.

The overcrowded-trade risk: When too many investors lean into the same narrative, price can detach from fundamentals in the short term. Wide forecast dispersion for 2026 gold prices reflects uncertainty and the possibility of consolidation.

The rate-path risk: If inflation stays sticky or growth re-accelerates, real yields could rise, reducing one of gold’s macro tailwinds. Monetary policy does not have to turn restrictive again for gold to stall; it merely has to become less supportive than the market expects.

The demand-destruction risk: High prices can reduce jewelry demand and shift consumer behavior. The market can lose an important stabilizing demand base if jewelry demand weakens broadly.

The substitution and thrifting risk for silver: Solar and electronics manufacturers have clear incentives to use less silver per unit. Over time, engineering can reduce intensity, and recycling can improve.

But here is the core analytic point: these counterarguments mostly apply to steady-state economics. The current rally is being reinforced by state behavior. Export controls, sanctions enforcement, critical-mineral designations, and reserve policy are political decisions. They can persist even when prices become inconvenient, because the objective is not always price efficiency. Sometimes the objective is power, resilience, or leverage.

What Comes Next In 2026: The Watch List

The next phase depends on whether this is a one-off shock or a durable new regime.

Trade And Policy Signals

- Whether China’s licensing becomes more restrictive in practice than on paper.

- Whether other countries introduce similar licensing, tariffs, or stockpile policies.

- Whether critical-mineral designations translate into funded programs or remain symbolic.

Geopolitical Trajectory

- How Venezuela’s political transition evolves and whether regional tensions rise.

- How sanctions are enforced and whether carve-outs emerge that reshape trade flows.

- Whether other flashpoints create recurring safe-haven demand.

Macro Reality Check

- Whether central banks continue to accumulate gold at elevated levels.

- Whether inflation and real yields support or challenge the gold bid.

- Whether risk assets remain volatile, sustaining demand for hedges.

Industrial Demand Reality Check

- Whether solar build-out stays on the aggressive track many forecasts expect.

- Whether silver thrifting accelerates fast enough to offset deployment scale.

- Whether recycling meaningfully increases available supply.

Final Thoughts

The most important takeaway is that the precious-metals rally is no longer explainable with a single macro variable like inflation or the dollar. Gold is pricing a world where geopolitical shocks and sanctions are persistent, and where central banks treat gold as strategic reserve ballast. Silver is pricing something even more unusual: the fusion of safe-haven psychology with industrial scarcity, amplified by government control over supply chains and a global energy transition that keeps expanding.

What comes next is less about whether metals are “overbought” and more about whether states keep treating metals as instruments of power. If they do, volatility becomes the price of admission, and hedging starts to look more like strategic allocation. If they do not, and if Venezuela stabilizes while Chinese licensing proves predictable, prices may cool. But even in that calmer scenario, the last year’s surge will have changed expectations: markets have now seen that the metal story is not just monetary. It is geopolitical and industrial too.