The global toy industry is entering a new era of growth and transformation. According to a detailed market analysis by Credence Research Inc., the worldwide toy market—valued at $316.14 billion in 2024—is projected to grow steadily and reach an estimated $445.97 billion by 2032. This growth reflects a Compound Annual Growth Rate (CAGR) of 4.33%, driven by evolving consumer preferences, increased access to online retail, and technological innovation.

Major Growth Drivers Behind the Toy Market Surge

Educational and STEM-Focused Toys in High Demand

One of the key contributors to this growth is the increasing popularity of educational and STEM (Science, Technology, Engineering, Mathematics) toys. Parents today are prioritizing products that offer both fun and developmental value. These toys promote cognitive development, creativity, logical thinking, and early problem-solving skills in children.

From programmable robots to science experiment kits and math-based games, the STEM toys segment is expanding rapidly. Analysts predict that this sub-market will continue to thrive as more schools and parents emphasize hands-on, curriculum-aligned learning during early childhood years.

Rise of Smart and Tech-Integrated Toys

Another strong catalyst for growth is the integration of advanced technology in traditional toys. The inclusion of artificial intelligence (AI), augmented reality (AR), and app-based interactivity is revolutionizing how children engage with playtime.

Smart toys that respond to voice commands, adapt to individual learning curves, or interact with other devices are seeing a sharp increase in popularity. For example, interactive dolls, app-linked puzzles, and virtual reality (VR) experiences allow kids to immerse themselves in digital worlds while engaging in physical play.

This fusion of digital and physical environments is expected to shape the future of play, with a significant share of toys offering tech features by 2030.

E-Commerce Expanding Global Reach

Online retail has emerged as a game-changer in the toy industry. Digital marketplaces like Amazon, Walmart, Alibaba, and regional e-commerce platforms have made it easier than ever for consumers to access a wide variety of toys, regardless of geographic location.

The convenience of comparing products, accessing reviews, using discounts, and benefiting from fast shipping has increased consumer reliance on online shopping. This trend accelerated during the COVID-19 pandemic and has remained strong due to the seamless experience and broad selection it offers.

In fact, the share of toy sales coming from e-commerce channels is expected to grow significantly in the coming years, boosting overall market revenue.

Entertainment Licensing and Character-Based Toys Driving Sales

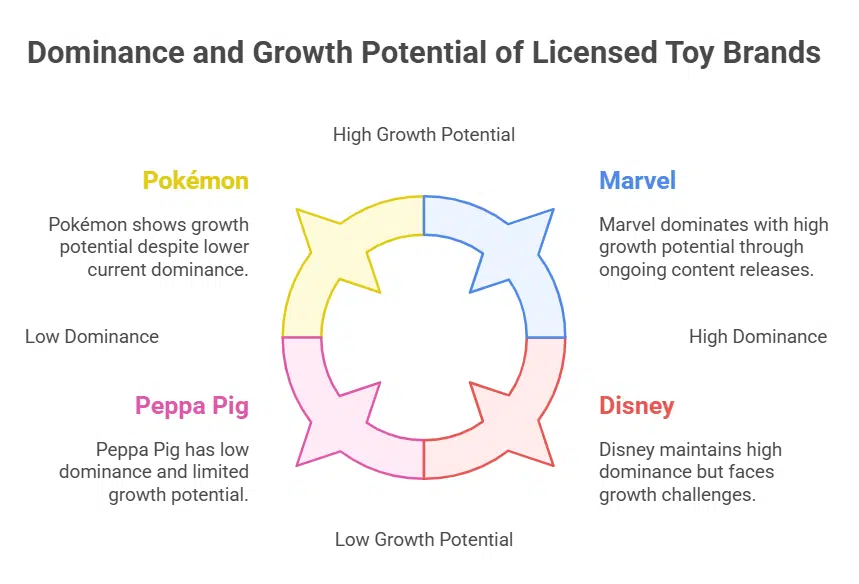

Character toys linked to popular movies, TV shows, and streaming franchises remain one of the strongest pillars of toy industry success. Brands like Marvel, Disney, Peppa Pig, Barbie, and Pokémon continue to dominate shelves through licensing deals and global fanbases.

These licensed toys benefit from built-in demand and emotional appeal, making them go-to choices for gift-givers and collectors alike. With the consistent release of content across OTT platforms and theatrical films, character toys are expected to maintain strong growth throughout the decade.

Sustainable Toys and Eco-Friendly Preferences Rising

Sustainability is becoming a major purchasing consideration for modern consumers. As awareness around environmental impact grows, many parents are consciously opting for toys made from biodegradable materials, recycled plastic, organic fabrics, and non-toxic components.

Toy manufacturers are increasingly adopting green manufacturing practices, including the use of plant-based packaging, low-emission production, and certified ethical sourcing.

Brands that prioritize sustainability not only gain market trust but also secure long-term loyalty from environmentally conscious buyers. The push for eco-friendly toys is especially prominent in markets like Europe and North America, where regulatory pressure and consumer awareness are highest.

Key Challenges Facing the Global Toy Market

Screen-Based Entertainment Reducing Physical Playtime

One of the major obstacles for the toy industry is the growing shift in children’s attention toward digital entertainment. Devices like smartphones, tablets, and gaming consoles now compete with traditional toys for screen time.

Children are increasingly spending more time on video games, YouTube videos, and social media platforms. As a result, physical toys—especially those without a tech component—struggle to maintain relevance among older children.

This growing digital preference is forcing toy makers to rethink product design and explore ways to blend physical toys with interactive digital features.

Tighter Global Safety Regulations Increasing Costs

With growing concerns about child safety, especially in smart or connected toys, regulatory bodies across different regions have implemented more stringent safety standards. These regulations include guidelines on material safety, choking hazards, data privacy for connected devices, and electromagnetic compatibility for electronic toys.

While these rules protect children from harm, they also increase compliance costs for manufacturers. Extensive testing, certification, and quality control processes add financial strain, especially for smaller toy companies entering international markets.

Non-compliance or product recalls can severely damage brand reputation, making safety regulation a top priority across the industry.

Economic Uncertainty, Tariffs, and Inflation

The toy industry is not immune to macroeconomic factors. Uncertain global economic conditions—driven by inflation, changing interest rates, and unstable currency exchange—can affect consumer spending on non-essential products like toys.

Additionally, international trade barriers and tariffs—particularly between manufacturing hubs like China and export markets like the U.S. or Europe—can raise import costs and disrupt supply chains. This puts pressure on pricing strategies, making it harder for companies to maintain profitability without compromising product quality.

Shifting Age Preferences and Shorter Attention Spans

Children’s tastes and interests evolve rapidly, often influenced by viral trends, social media, and peer behavior. What’s trending today may be forgotten tomorrow. Toy makers must constantly innovate to stay relevant.

The rise of short-form video platforms and fast-paced content has also contributed to shortening attention spans, making it more challenging to engage children through long-form or traditional play formats. To keep pace, brands are investing more in research, design thinking, and influencer marketing to adapt quickly to changing trends.

A Market at the Crossroads of Innovation and Responsibility

The global toy industry is on a strong upward trajectory, bolstered by a wave of innovation, digital transformation, and eco-conscious manufacturing. Educational toys, tech-enabled interactivity, character-driven products, and sustainable designs are reshaping the future of play.

Yet, this growth is accompanied by real challenges: screen distractions, rising production costs, tighter safety rules, and unpredictable economic shifts. To stay competitive, toy manufacturers must strike a balance between entertainment and education, innovation and safety, tradition and modernity.

The coming years will likely see the emergence of hybrid toys—those that blend physical and digital experiences, promote learning, and align with ethical and environmental standards. Companies that can adapt to these evolving demands while keeping the magic of childhood alive are poised to thrive in this expanding $446.97 billion industry.