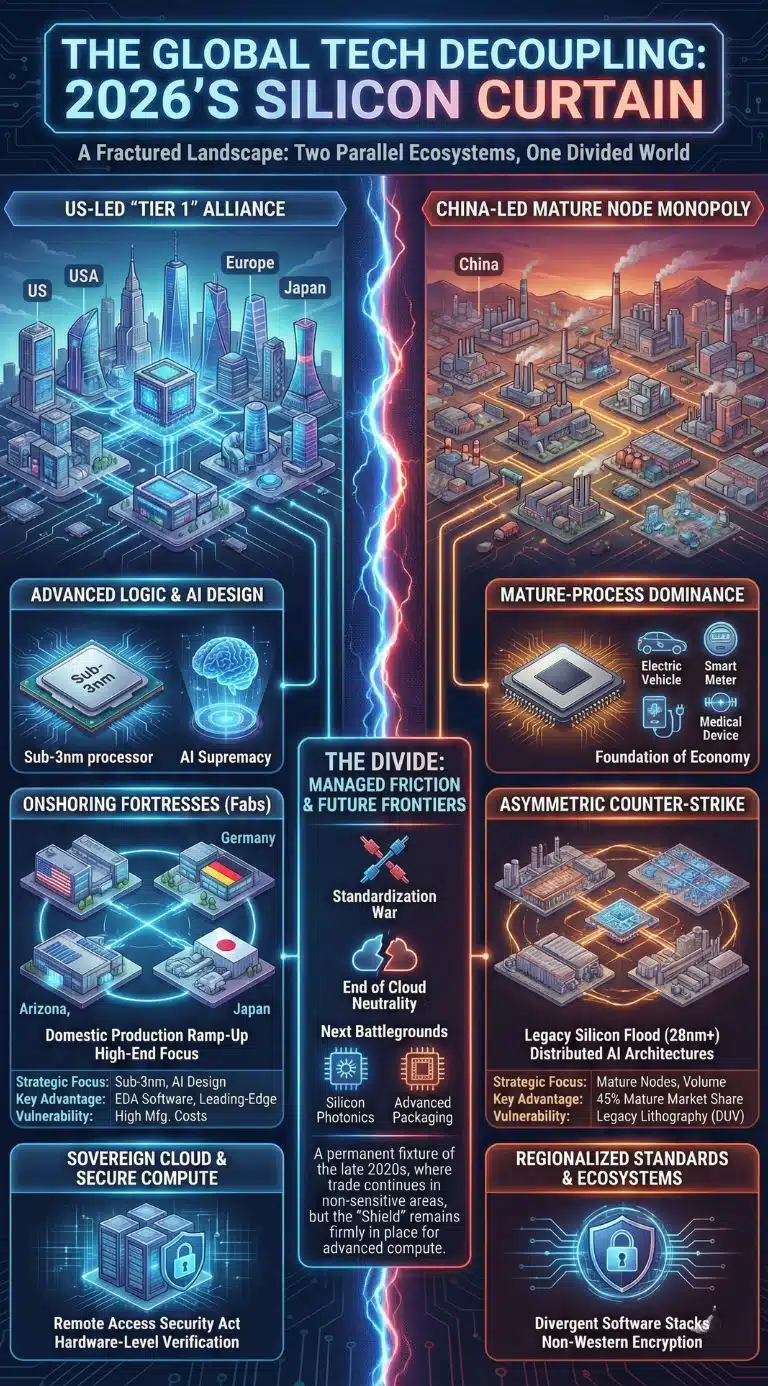

The global semiconductor landscape in 2026 has officially fractured into a “Silicon Curtain,” as the United States and China finalize their transition from trade partners to siloed technological rivals. This shift represents the most significant restructuring of the global economy since the Cold War, prioritizing national security over market efficiency and ending the era of universal tech standards.

Key Takeaways

- Bifurcation of Standards: The world is moving toward two distinct hardware and software ecosystems, ending the era of “universal” tech standards.

- Supply Chain Sovereignty: Nations are willing to accept 20–30% higher production costs in exchange for “friend-shoring” and geographic certainty.

- China’s Mature Node Dominance: While restricted from high-end AI chips, China is aggressively monopolizing the legacy chip market (28nm and above), creating a new form of “asymmetric dependency.”

- Market Growth Amidst Friction: Despite decoupling, the global semiconductor market is approaching $1 trillion in 2026, driven by an insatiable demand for Edge AI and HBM (High-Bandwidth Memory).

The path to the 2026 “Silicon Curtain” was paved by a decade of increasing friction, but the definitive rupture occurred between 2022 and 2025. Following the initial U.S. export controls on advanced compute, the industry entered a “tit-for-tat” cycle of resource nationalism. By the time the first major domestic fabs funded by the U.S. CHIPS Act began operations in early 2026, the global supply chain—once a marvel of just-in-time efficiency—had been fundamentally rewired. What was once a globally integrated network is now a series of regionalized fortresses.

This fragmentation was not merely a reaction to trade wars but a response to the “Compute-Security Paradox”: as AI becomes the core engine of national defense and economic productivity, no sovereign state can afford to rely on a rival for its silicon. The 2026 landscape is defined by “The Semiconductor Shield,” a strategic doctrine where technology is treated as a guarded national asset rather than a tradable commodity.

The Bifurcated Global Ecosystem: Two Parallel Universes

By 2026, the industry has settled into two distinct technological spheres. The “Tier 1 Alliance”—comprising the U.S., Taiwan, Japan, South Korea, and the Netherlands—has consolidated control over sub-3nm nodes and advanced lithography. Conversely, China has shifted its focus to “Asymmetric Decoupling,” achieving nearly 60% self-sufficiency in mature-process chips while pioneering distributed AI architectures that require less advanced hardware.

Regional Semiconductor Strategic Positioning (2026)

| Region | Strategic Focus | Primary Advantage | Major Vulnerability |

| United States | Onshoring & AI Design | EDA Software dominance | High manufacturing & labor costs |

| China | Mature Node Monopoly | 45% of global 28nm+ capacity | Reliance on legacy DUV lithography |

| Taiwan | “Silicon Shield” Maintenance | Leading-edge 2nm mass production | High geopolitical risk concentration |

| European Union | Industrial & Automotive Logic | Research & Development (IMEC) | Fragmented funding across members |

| Japan | Material Science | Critical chemical supply (Photoresists) | Aging technical workforce |

This bifurcation has led to a “Standardization War.” In 2026, a consumer in the West might use a device optimized for NVIDIA’s Rubin architecture, while an Eastern equivalent utilizes Huawei’s Ascend series. For the first time, software developers are forced to choose an ecosystem early in the development cycle, as the underlying hardware stacks have diverged so significantly that cross-compatibility is no longer a given.

Onshoring and the “CHIPS” Fortress: 2026 Fab Openings

The year 2026 marks the “Great Opening” for Western domestic manufacturing. After years of construction and billions in subsidies, several flagship facilities have reached high-volume production. This has shifted the narrative from “subsidies and promises” to “output and yields.” However, the high cost of operating these facilities has led to a permanent price premium for “onshored” silicon.

Major 2026 Semiconductor Facility Milestones

| Company | Facility Location | 2026 Status | Projected Impact |

| Samsung | Taylor, Texas | Fully Operational | 4nm logic for domestic AI startups |

| Micron | Clay, New York | High-Volume Production | 40% of DRAM supply secured in U.S. |

| TSMC | Phoenix, Arizona | Phase 2 Expansion | 3nm capability for Apple and NVIDIA |

| Texas Instruments | Lehi, Utah | New 300mm Fab Open | Reliable supply for U.S. automotive |

| Intel | Magdeburg, Germany | Production Ramp-up | Foundation of EU tech sovereignty |

The U.S. government’s August 2025 purchase of a 10% stake in Intel has further blurred the lines between private industry and national infrastructure. By 2026, “Secured Fabs” are treated similarly to energy grids or defense contractors, with strict “Know Your Compute” (KYC) protocols ensuring that domestic chips do not find their way into restricted foreign defense systems via third-party shell companies.

China’s Mature Node Monopoly: The Asymmetric Counter-Strike

While Western nations have successfully blocked China’s access to the “bleeding edge,” China has effectively captured the “foundation” of the global economy. In 2026, China controls over 45% of the global market for mature-process chips (28nm to 90nm). These are not used for high-end AI, but they are essential for electric vehicles (EVs), medical devices, and smart appliances.

Global Market Share of Mature-Node Capacity (28nm and above)

| Year | China Market Share | Rest of World | Primary Driver |

| 2022 | 18% | 82% | Globalization |

| 2024 | 29% | 71% | Initial Self-Reliance Push |

| 2026 (Est) | 42% | 58% | Mature-Node Subsidy Blitz |

| 2028 (Proj) | 51% | 49% | Asymmetric Dependency |

This represents a form of “weaponized legacy silicon.” By flooding the market with low-cost, high-quality chips for the automotive and industrial sectors, China has made it difficult for Western competitors to justify the cost of building their own mature-process fabs. In a crisis, China could theoretically “turn off” the supply of these workhorse chips, grinding global EV production to a halt—even if the West has all the high-end AI chips it needs.

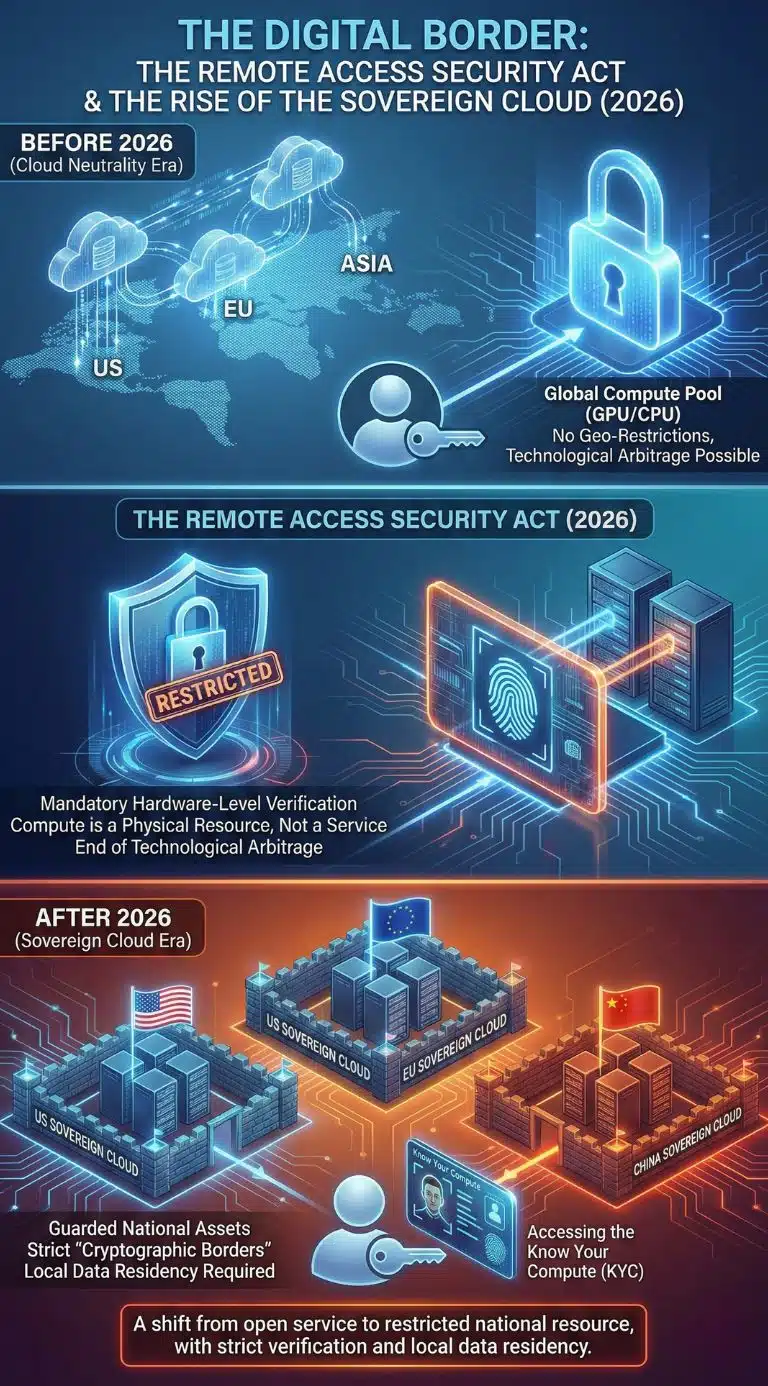

The End of Cloud Neutrality: The Remote Access Security Act

A major turning point in early 2026 was the implementation of the Remote Access Security Act. For years, restricted entities used cloud computing to bypass hardware export bans, renting GPU power through data centers in neutral regions. This legislation effectively ended “technological arbitrage.”

Cloud providers like AWS, Azure, and Google Cloud are now required to implement hardware-level verification of all remote users. Compute power is no longer viewed as an abstract service; it is a physical resource tied to national origin. This has led to the rise of the “Sovereign Cloud,” where nations build their own secure data centers that are entirely disconnected from the global internet to prevent unauthorized AI model training.

“In 2026, compute is the new oil. You cannot just refine it in one country and burn it in another without a license. The ‘Know Your Compute’ era has arrived.” — Market Analyst Report, January 2026.

Data & Visualization: The Economics of the Divide

The cost of this decoupling is immense. While the semiconductor market is projected to reach $1.6 trillion by 2030, the “efficiency loss” in 2026 is becoming a drag on global GDP. Redundant supply chains, duplicated R&D, and higher labor costs in Western fabs have added an estimated $150 billion in annual operational costs to the tech sector.

The Decoupling Impact: Winners vs. Losers (2026)

| Category | Winners | Losers | Reason for Shift |

| Supply Chain | Multi-fab contractors & Logistics | Single-source manufacturers | Need for redundancy over cost |

| Design | Specialized AI hardware firms | Generic smartphone chipmakers | Fragmented standards require custom silicon |

| National Economy | Vietnam, India, Mexico | Traditional “Grey Market” hubs | Shift to “Friend-Shoring” partners |

| Consumers | High-security users | Value-conscious shoppers | 18% average price increase for electronics |

Expert Perspectives: A Divided Consensus

The 2026 semiconductor landscape has drawn sharp criticism and praise from different quarters. To maintain a nuanced analysis, we must examine the differing viewpoints on whether this decoupling is a necessary security measure or a self-inflicted economic wound.

- The Security Pragmatists: Argue that the “Silicon Curtain” is the only way to prevent advanced AI from being used for cyberwarfare and autonomous weapons systems. They view the higher costs as a “security tax” that is worth paying for long-term sovereignty.

- The Economic Realists: Point out that the $150 billion in added costs is fueling inflation and slowing down the global transition to green energy, as EVs become more expensive due to higher chip costs. They fear that a “bifurcated world” will lead to slower innovation as the global talent pool is split.

- The Neutral Arbiters: Countries like India and Brazil are attempting to play both sides, positioning themselves as “neutral hubs” that can assemble devices using components from both blocs. However, both the U.S. and China are putting increasing pressure on these nations to “pick a side.”

Future Outlook: What Happens Next?

As we move toward 2027, the focus of the “Semiconductor Shield” will shift from fabrication to Advanced Packaging and Silicon Photonics. Making the chip is no longer enough; how those chips are stacked and how they communicate is the next bottleneck.

- Packaging as the New Frontier: With transistor scaling reaching physical limits, 3D stacking (heterogeneous integration) will become the primary way to gain performance. Expect intense competition for control over “CoWoS” (Chip on Wafer on Substrate) capacity.

- The Rise of Edge AI: As data sovereignty laws become stricter, more AI processing will happen on the device rather than in the cloud. This will drive a massive surge in demand for specialized “Edge AI” chips in 2026 and 2027.

- Cryptographic Borders: We expect to see the emergence of hardware that is fundamentally incompatible with foreign encryption standards, creating a “security silo” where hardware from one bloc cannot communicate with the other.

The “Managed Friction” Era

The “Silicon Curtain” is likely a permanent fixture of the late 2020s. The challenge for 2026 and beyond is not how to reunite the supply chain, but how to manage the friction. We are entering an era of “Managed Decoupling,” where trade continues in non-sensitive areas, but the “Shield” remains firmly in place for anything related to advanced compute and national security.