Are you puzzled by the wild west of cryptocurrency regulations? It can feel like a maze, right, with every country setting different rules for digital assets, leaving you scratching your head about what’s safe or legal.

Guess what, Germany is stepping up big time in this game. They’ve built a solid set of laws for crypto assets, blending them right into their financial system, and it’s catching eyes across the European Union.

Wondering how they’re doing it with blockchain technology and markets in crypto-assets? Stick around, because we’ve got the scoop on seven cool ways Germany’s crypto laws are paving the path for others.

Keep reading!

Key Takeaways

- Germany’s crypto laws, led by BaFin, require strict licensing for providers like exchanges since 2020.

- Tough AML and KYC rules ensure safe crypto transactions with clear customer checks.

- Crypto held over 12 months is tax-free for individuals; under €600 short-term gains are also exempt.

- Germany aligns with the EU’s MiCA framework, set for December 2024, for unified crypto rules.

- BaFin and the Ministry of Finance enforce compliance, protecting financial stability with the digital euro talks by April 2025.

Comprehensive Licensing and Registration Requirements

Got a minute to chat about Germany’s crypto rules? They’ve set a high bar with tough licensing needs through BaFin, the Federal Financial Supervisory Authority. Since 2020, all crypto service providers, like exchanges, custodians, token issuers, and wallet providers, must get a license.

No shortcut here, folks, it’s the law! This step keeps the playing field fair for everyone in the digital assets game.

Now, mess up on this, and you’re in hot water. Non-compliance can slap you with fines, shut down your business, or even land you in criminal trouble. BaFin isn’t playing around when they oversee cryptocurrency regulations and crypto custody services.

It’s like a strict teacher watching over a rowdy class, making sure everyone follows the rules. Stick to these standards, and you’re on the safe side of blockchain technology in Germany.

Strict AML and KYC Regulations

Hey there, folks, let’s chat about how Germany is cracking down on shady dealings in the crypto world with tough anti-money laundering rules, or AML for short. These laws hit hard on cryptocurrency transactions, making sure no funny business slips through the cracks.

Every crypto platform must follow strict guidelines, like checking who their customers are through solid Know Your Customer steps, often called KYC. It’s like a bouncer at a club, making sure only the right people get in.

BaFin, Germany’s financial watchdog, keeps a close eye on all this, enforcing AML compliance with an iron grip. They demand businesses report any suspicious activities, no matter how small, to stop money laundering in its tracks.

Now, imagine trying to sneak cash through a border without anyone noticing, tough, right? That’s why Germany sticks to the EU Transfer of Funds Regulation, tying crypto transfers to clear customer due diligence.

This means every deal gets traced, keeping digital assets clean and safe on blockchain networks. It’s all about stopping financial crimes before they even start. So, whether you’re trading bitcoins or dabbling in decentralized finance, these rules keep the system honest.

Let’s move on and see how clear taxation policies shape the crypto game next.

Clear Taxation Policies for Crypto Transactions

Got a stash of digital currency? Germany’s got your back with clear rules on taxing crypto transactions. If you hold your cryptocurrency for at least 12 months, you’re in the clear, no tax for individuals.

That’s a sweet deal if you’re playing the long game with digital assets.

Now, hang on to your crypto for less than a year, and it’s a different story. You’ll face income tax on those gains. But here’s a neat trick, if your sales are under €600, roughly $692, within that short time, no tax applies.

Plus, swapping cryptocurrencies won’t hit you with VAT. Germany’s tax system for blockchain technology is like a roadmap, easy to follow for tax compliance!

Regulation of ICOs and STOs

Moving from taxation rules, let’s discuss how Germany manages Initial Coin Offerings (ICOs) and Security Token Offerings (STOs) with clear guidelines. These digital assets often fall under strict laws, and Germany takes regulatory compliance seriously.

If an ICO is classified as a security under the Securities Prospectus Act, you must adhere to stringent rules. It’s akin to overcoming challenges, but it ensures the market remains secure for all.

On the other hand, STOs require prospectuses and approval from BaFin, the major financial authority. This process ensures investors are fully informed about the risks associated with financial instruments like crypto tokens.

Germany’s stance on blockchain technology demonstrates their commitment to balancing innovation with security. Stay with us, folks, as we explore more ways they’re influencing the crypto landscape!

Integration of the Crypto Asset Transfer Regulation (KryptoWTransferV)

Shifting from the tight rules on ICOs and STOs, let’s chat about how Germany is stepping up with the Crypto Asset Transfer Regulation, known as KryptoWTransferV. This piece of the puzzle focuses on making sure digital assets move safely across the board.

It’s like putting a GPS tracker on every crypto transaction to keep things clean and clear.

Now, imagine sending money to a pal, but with cryptocurrency. Germany’s got rules in place to follow the travel rule, making sure every transfer of digital currencies is traceable.

This ties into tough AML, or anti-money laundering steps, and KYC, which means knowing your customer. It’s all about stopping shady deals and keeping financial crimes at bay. So, whether you’re dabbling in blockchain technology or holding crypto custody services, these guidelines help keep the playground safe for everyone.

Emphasis on Financial Market Integrity and Consumer Protection

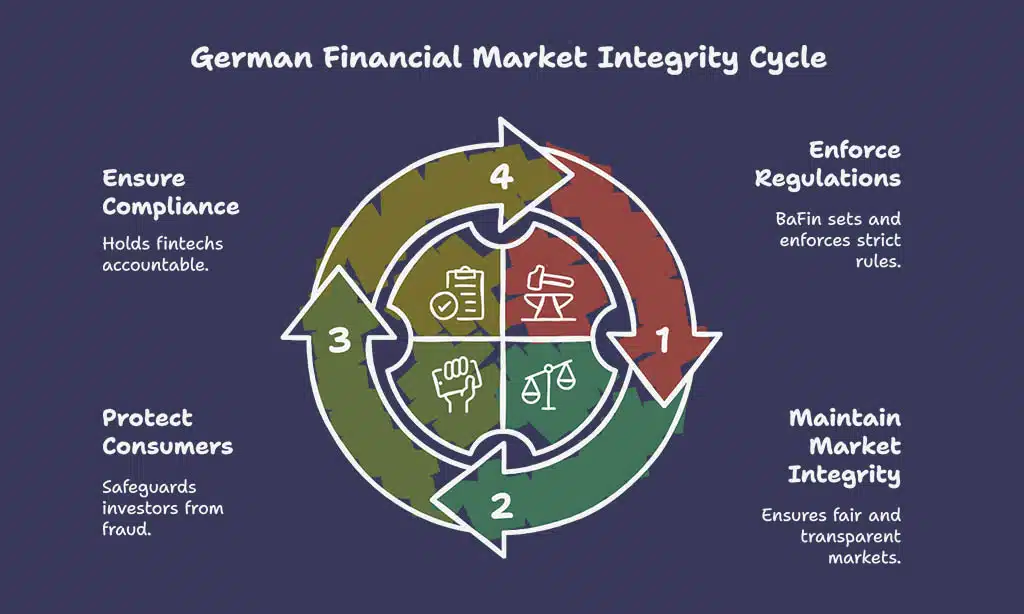

Moving from the strict rules of the Crypto Asset Transfer Regulation, let’s talk about how Germany focuses on keeping financial markets safe and protecting folks like you. Think of it as a sturdy shield guarding your hard-earned cash in the wild world of digital assets.

Germany, through BaFin, works hard to maintain financial market integrity, making sure shady dealings don’t mess things up for honest investors in blockchain technology.

Now, consumer protection is a big deal here, and it’s like having a trusty friend watching your back. BaFin sets tough security and transparency measures for cryptocurrency regulations, so scams and tricks have no place to hide.

Mess up these rules, and you might face criminal charges, no kidding! This focus keeps fintechs and crypto custody services in check, ensuring your trust in financial instruments isn’t broken.

Stick around to see how this shapes a safer crypto space!

Support for Blockchain and Crypto Innovation through Legal Clarity

Hey there, folks, let’s talk about how Germany is leading the charge in blockchain technology with clear regulations. Their approach, shaped by the Germany Blockchain Strategy 2019, makes it simple for companies to engage with digital assets.

No uncertainty here; the laws clearly define what’s allowed and what isn’t. This transparency fuels innovation in fields like logistics, energy, and finance. It’s like handing builders a reliable plan to construct something incredible.

Surprise! Germany’s got your support with programs like the FinTech Innovation Hub, driving crypto adoption ahead. The team at BaFin, the financial overseer, maintains a balance between regulation and a welcoming environment for innovation.

Imagine it as a secure space for blockchain tech to flourish. From smart contracts to decentralized finance, Germany is creating an environment where fresh business models can prosper across sectors.

Stay with us, and let’s see how this influences the future!

Alignment with EU’s Markets in Crypto-Assets (MiCA) Framework

Germany is stepping up to match the EU’s big plan for digital assets with the Markets in Crypto-Assets framework, known as MiCA. Set to kick in by December 2024, this rulebook will create a single standard for cryptocurrency regulations across all EU countries.

Think of it like a shared playbook, making sure everyone plays fair with blockchain technology. Germany, already a leader in this space, is aligning its laws to fit this new system, balancing innovation with solid risk management.

Isn’t it neat how this ties the whole EU together? With MiCA, Germany faces the task of blending its national rules with these broader guidelines during the transition. It’s like fitting puzzle pieces into a larger picture, focusing on financial stability and retail investor protection.

This move also boosts crypto adoption by setting clear paths for decentralized finance and other tech. Now, let’s explore how supervisory practices keep everything in check in the next section.

Supervisory Practices to Ensure Compliance

Moving from Germany’s alignment with the EU’s Markets in Crypto-Assets framework, let’s chat about how the country keeps a tight watch on crypto rules. Supervisory practices here are no joke, folks, and they’re handled by big players like BaFin and the Ministry of Finance.

These groups work hard to make sure every business dealing with digital assets sticks to the strict cryptocurrency regulations. Mess up, and you might face hefty fines or even a shutdown of your operations.

It’s a bit like a strict teacher keeping an eye on the class, making sure no one skips the rules.

Now, imagine trying to sneak past these watchful eyes, it’s tough. BaFin doesn’t just sit back; they actively check on crypto custody services and other financial technology setups for regulatory compliance.

With Bundesbank also in the mix, focusing on monetary policy and the digital euro, there’s a solid team guarding against financial crimes. Their goal? Keep the market safe and sound for everyone involved in blockchain technology.

Stick around, and you’ll see how this vigilance ties into bigger risks next.

Addressing Risks to Financial Stability

Hey there, folks, let’s chat about how Germany tackles risks to financial stability in the crypto world. It’s a big deal, and they’re not messing around. With digital assets growing fast, there’s a real chance of systemic risk shaking up the economy.

Germany knows this, so they’ve set tough rules to keep things steady. Non-compliance with these laws? Oh boy, that can lead to criminal charges, no joke. This hard line helps protect the whole financial system from wild crypto swings.

Speaking of staying safe, Germany also joins hands with the European Central Bank on the digital euro project. They’re deep in talks as of April 2025, aiming to balance innovation with risk control.

Think of it like walking a tightrope, keeping blockchain technology thriving while dodging cyber attacks. Their goal is clear: guard financial stability and keep your euros safe in this digital age.

Takeaways

Well, folks, Germany’s crypto laws are paving a golden path for the EU. They’re setting a high bar with clear rules on digital assets and blockchain technology. Think of it as a sturdy bridge, connecting innovation with safety.

Got thoughts on this trailblazing approach? Drop a comment, and let’s chat about it!

FAQs

1. How are Germany’s crypto laws shaping rules for digital assets in the EU?

Well, folks, Germany is leading the charge with tight cryptocurrency regulations that focus on digital assets and blockchain technologies. Their approach, like a sturdy ship steering through rough seas, sets a benchmark for EU law by prioritizing retail investor protection acts and clear guidelines. It’s no small feat, and it’s got other countries taking notes on how to handle this wild west of finance.

2. What’s the deal with Germany’s take on AML and KYC for crypto?

Germany ain’t messing around with AML, that’s anti-money laundering, and KYC, know your customer, rules. Their laws demand strict checks to stop financial crimes, tying into the Financial Action Task Force standards like a well-knotted rope.

3. How does Germany handle taxes on crypto, like capital gains?

Let me tell you, Germany’s got a sharp eye on income taxes and capital gains tax for crypto trades. They’ve laid out clear paths through the Federal Ministry of Finance for tax compliance, so whether it’s corporate income taxes or personal capital gains, you’re not left guessing. It’s like having a map in a maze, guiding every retail investor through the tax base jungle.

4. Why is blockchain technology a big focus in Germany’s laws?

Germany’s all in on blockchain strategy, seeing it as the backbone of Industrie 4.0 and the internet of things. They’re weaving smart contracts and decentralized applications into their legal framework with a nod to cybersecurity. Think of it as building a fortress around new tech, keeping financial stability board concerns at bay.

5. Are Germany’s crypto custody services setting a trend?

You bet they are. Germany’s rules on crypto custody services demand top-notch IT security and regulatory compliance, paving the way for safer decentralized finance across the EU.

6. How do Germany’s laws tackle non-fungible tokens and decentralized autonomous organizations?

Hey, let’s chat about this hot topic; Germany’s diving deep into non-fungible tokens and decentralized autonomous organizations with fresh policies. They’re linking these to traceability and data management, making sure there’s no funny business under the travel rule. It’s like putting a leash on a wild pup, keeping everything from stock market plays to energy transition projects in check.