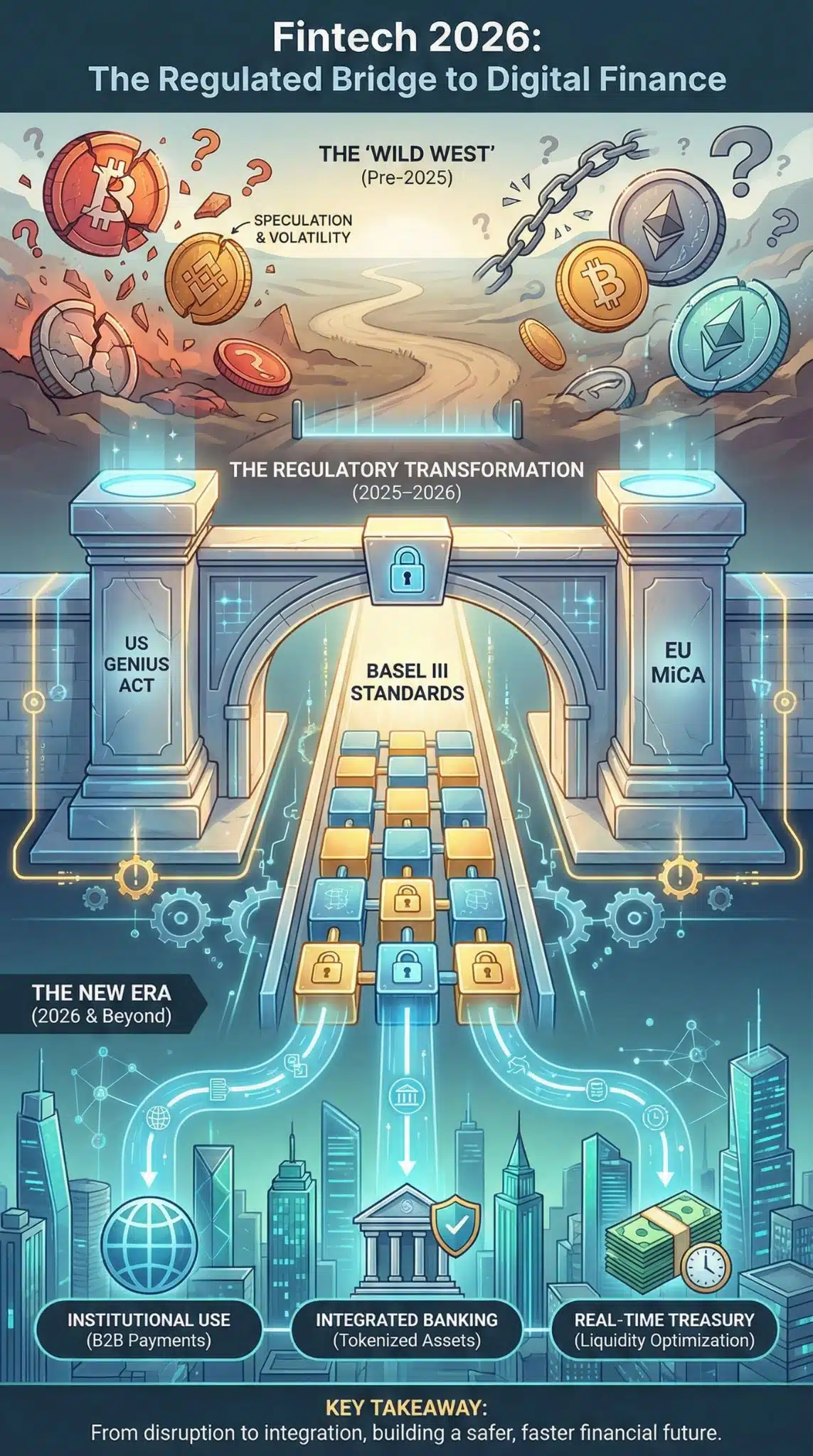

Why this matters now: 2026 marks the definitive end of the “Wild West” for digital assets. With the implementation of the Basel Committee’s crypto standards on January 1 and the full enforcement of the US GENIUS Act, stablecoins have transitioned from speculative trading tools to regulated banking infrastructure. This shift forces every major financial institution to either integrate digital asset rails or risk obsolescence in the new global payment architecture.

Key Takeaways:

- The Regulatory Moat: The “GENIUS Act” (US) and MiCA (EU) have created high barriers to entry, effectively banning unregulated algorithmic stablecoins and favoring bank-backed issuers.

- Basel III Impact: As of January 1, 2026, banks have clear capital requirement guidelines for holding crypto assets, unlocking billions in institutional liquidity.

- Shift to Utility: Volume is migrating from crypto-trading pairs to real-world treasury management, cross-border B2B payments, and “programmable money.”

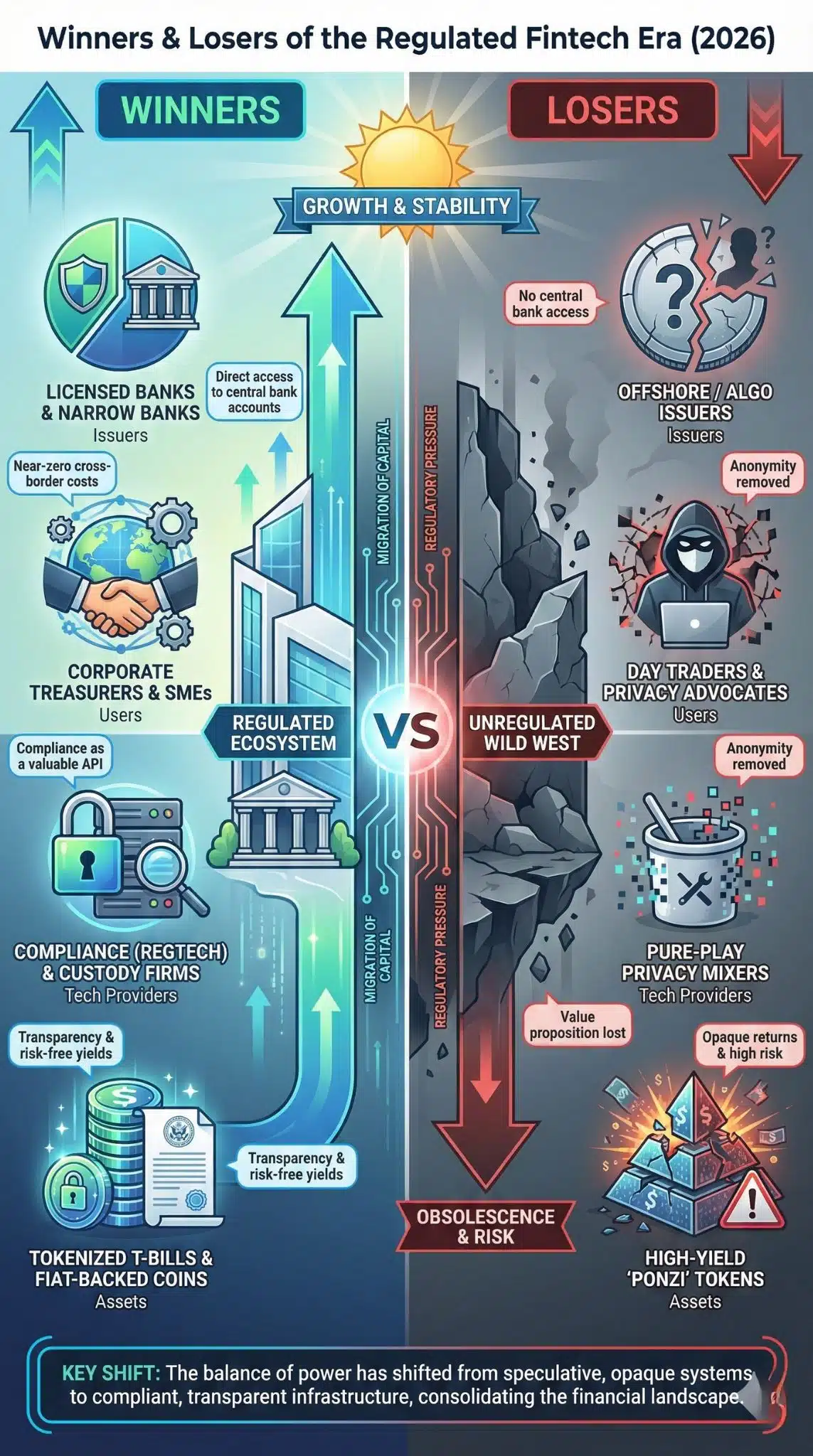

- Consolidation: The market is bifurcating into “Winners” (licensed banks, compliant fintechs) and “Losers” (offshore, opaque issuers).

How We Got Here: From Experimentation to Institutionalization

The journey to 2026 was paved by the volatility of the early 2020s. Following the collapse of high-profile algorithmic stablecoins and exchanges in 2022-2024, global regulators moved from “warning” to “legislating.”

The turning point occurred in July 2025, with the passage of the Guiding and Establishing National Innovation for U.S. Stablecoins (GENIUS) Act. This legislation, mirroring Europe’s Markets in Crypto-Assets (MiCA) regulation which became fully applicable in late 2024, mandated 100% reserve backing with high-quality liquid assets (HQLA) and federal supervision. Simultaneously, the Basel Committee on Banking Supervision (BCBS) finalized its “SCO60” standards, giving global banks a green light—albeit a strict one—to hold stablecoins and tokenized deposits starting January 2026.

We are no longer “exploring” digital assets; we are operationalizing them.

1. The Great Convergence: Banks vs. Fintechs

The defining narrative of 2026 is the blurring line between a “neobank” and a “stablecoin issuer.” With the new regulatory clarity, traditional banks are launching proprietary stablecoins or tokenized deposits to facilitate instant settlement.

- Banks Enter the Fray: Institutions are no longer content to let third-party issuers (like Circle or Tether) earn the interest on reserve floats. By issuing their own regulated tokens, banks capture the “float revenue” while offering clients 24/7 liquidity.

- Fintechs Become Banks: Conversely, major stablecoin issuers are seeking narrow bank charters or partnering deeply with G-SIBs (Global Systemically Important Banks) to meet the GENIUS Act’s rigorous custody requirements.

The “unbundling” of banking that characterized the 2015-2020 fintech wave is reversing. We are now seeing a “rebundling,” where safe custody, payment rails, and yield generation are converging back into regulated entities.

2. The Impact of the GENIUS Act & MiCA

The regulatory landscape has shifted from permissive to prescriptive. The US GENIUS Act and EU’s MiCA have effectively created a duopoly of regulatory frameworks that the rest of the world (Singapore, UK, UAE) is aligning with.

Regulatory Landscape Comparison (2026)

| Feature | US (GENIUS Act) | EU (MiCA) | Global Impact |

| Reserve Mandate | 100% Cash/Treasuries (1:1 backing) | 1:1 backing + Liquidity Buffers | Eliminates “fractional reserve” stablecoins. |

| Issuer Restrictions | Licensed Banks or Approved Non-Banks | Credit Institutions & CASPs | High barrier to entry for startups. |

| Algorithmic Coins | Effectively Banned | Banned | End of “backed by code” experiments. |

| Interest Payments | Restricted for non-banks | Banned on e-money tokens | Banks gain competitive advantage on yield. |

This alignment solves the “interoperability” crisis. A US-compliant dollar stablecoin is now largely viewed as “safe” by European regulators, facilitating smoother transatlantic digital trade.

3. The Basel III “Green Light”

Perhaps the most underreported but impactful event is the January 1, 2026 implementation of the Basel Committee’s crypto standards.

Previously, banks had to hold prohibitive amounts of capital against any crypto exposure (often 1250% risk weight). The new rules classify “Group 1b” assets (regulated stablecoins) differently.

- Group 1b Treatment: Regulated stablecoins are now treated with risk weights comparable to the underlying infrastructure, provided they pass redemption and supervision tests.

- Liquidity Unleashed: This allows banks to hold stablecoins on their balance sheets for client trading and settlement without destroying their capital efficiency ratios.

4. Infrastructure vs. Speculation: The Volume Shift

In 2024, 90% of stablecoin volume was related to crypto trading (buying Bitcoin/Ethereum). In 2026, analysts observe a “Great Decoupling.”

- B2B Cross-Border: SMEs are using stablecoins to pay overseas suppliers instantly, bypassing the 3-day wait and 4% fees of the SWIFT network.

- Treasury Management: CFOs of Fortune 500 companies are using “Corporate Stablecoins” to move liquidity between subsidiaries overnight, optimizing working capital.

- Yield on Idle Cash: With programmable money, corporate treasuries can sweep idle cash into on-chain government bond tokens (T-Bill tokens) automatically at 5:01 PM and redeem them at 8:59 AM.

5. The Privacy Paradox & Surveillance Concerns

The cost of this legitimacy is privacy. The GENIUS Act and MiCA impose strict Anti-Money Laundering (AML) and Know Your Customer (KYC) requirements.

- The “Travel Rule”: Every transaction above a minimal threshold must carry identifying information of the sender and receiver.

- Un-hosted Wallets: While not banned, interactions between regulated institutional wallets and un-hosted (private) wallets are heavily scrutinized, creating a “walled garden” of compliant DeFi.

This has birthed a bifurcated economy: a massive, regulated “White Market” for institutions and a shrinking, high-risk “Grey Market” for privacy purists.

Winners vs. Losers in the Regulated Era (2026)

The table below analyzes the shift in power dynamics resulting from the 2025-2026 regulatory wave.

| Segment | Winners | Losers | Why? |

| Issuers | Licensed Banks & “Narrow Banks” | Offshore / Algo Issuers | Regulation favors entities with direct access to central bank master accounts and deep capital buffers. |

| Users | Corporate Treasurers & SMEs | Day Traders & Privacy Advocates | Costs for cross-border payments drop near zero; anonymity is effectively removed from the system. |

| Tech Providers | Compliance (RegTech) & Custody Firms | Pure-play Privacy Mixers | “Compliance-as-a-Service” becomes the most valuable API in the stack. |

| Assets | Tokenized T-Bills & Fiat-Backed Coins | High-Yield “Ponzi” Tokens | Investors flock to transparency and “risk-free” on-chain yields over opaque returns. |

Expert Perspectives

“The era of ‘move fast and break things’ is over. 2026 is about ‘move securely and settle instantly.’ The GENIUS Act didn’t kill crypto; it professionalized it.” — Sarah Jenkins, Senior Fintech Analyst at Global Monetary Institute

“We are seeing a dangerous centralization of power. By forcing stablecoins into the banking charter model, we are recreating the ‘Too Big To Fail’ risks on the blockchain, just with faster settlement times.” — Dr. Aris Thorne, Decentralized Finance (DeFi) Researcher

Future Outlook: What Happens Next?

As we look toward the second half of 2026 and into 2027, three major trends will dominate:

- The CBDC “Crowding Out”: As Central Bank Digital Currencies (Digital Euro, Digital Pound) enter their pilot phases, they will compete directly with private stablecoins for retail use cases. Expect private issuers to pivot entirely to B2B and wholesale markets to avoid fighting the government.

- M&A Supercycle: Traditional banks will acquire crypto-native infrastructure firms. They need the tech stacks (wallets, smart contract security) that they cannot build in-house fast enough.

- Tokenized Collateral: The “Holy Grail” of 2027 will be using tokenized money market funds as collateral for real-time derivatives trading, unlocking trillions in capital efficiency.

Final Thoughts

Fintech in 2026 is less about “disruption” and more about integration. The “GENIUS Act” and MiCA have successfully tamed the volatility of the asset class, but in doing so, they have handed the keys of the kingdom to the incumbents. The revolution has been regulated, and the result is a safer, faster, but far more centralized financial system.