Are you breaking out in a cold sweat just thinking about your taxes? You’re not alone. Dealing with the IRS can feel like navigating a minefield, especially when issues pop up. But don’t panic! Whether you’re facing an audit, struggling with back taxes, or just confused about deductions, there’s hope. We’ve tapped into the expertise of certified accountants in Phoenix to bring you the inside scoop on tackling common IRS headaches. So grab a cup of coffee (or something stronger—we won’t judge), and let’s dive into some expert tips that’ll help you resolve those pesky tax problems and get back to enjoying the Arizona sunshine.

How Certified Accountants in Phoenix Can Help Resolve IRS Tax Problems

Delinquent Tax Returns

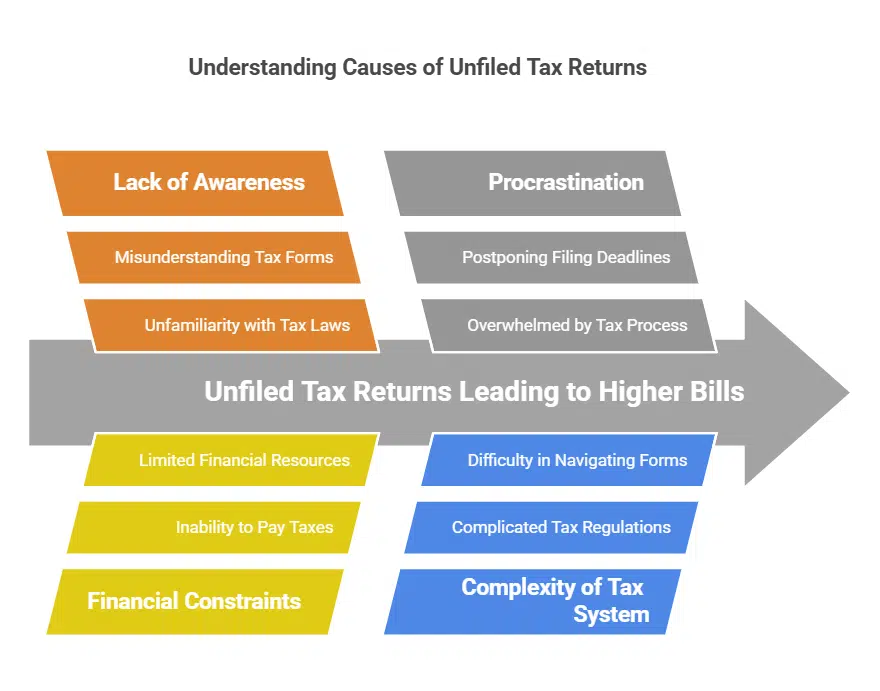

Many Phoenix residents find themselves in hot water with the IRS due to unfiled tax returns. Whether it’s due to procrastination or confusion about the filing process, failing to submit your returns can lead to hefty penalties and interest. Don’t let this snowball into a bigger problem – catch up on your filings ASAP!

Unpaid Tax Debts

Another frequent headache for Phoenicians is outstanding tax debts. If you’re struggling to pay what you owe, don’t ignore those IRS notices. The tax man cometh, and ignoring him only makes things worse. Consider setting up a payment plan or exploring other options to tackle your tax debt head-on.

Audit Anxiety

Getting that dreaded audit notice can send anyone into a panic. While audits aren’t as common as you might think, they do happen. The key is to stay calm, gather your documentation, and consider seeking professional help to navigate the process.

Payroll Tax Problems

For small business owners in Phoenix, payroll tax issues can be a major stumbling block. Failing to withhold or remit employee taxes properly can result in serious consequences. Stay on top of your payroll obligations to avoid this common pitfall.

Incorrect Tax Filings

Even with the best intentions, mistakes happen. Incorrect information on your tax returns can trigger red flags with the IRS. Double-check your math, verify your deductions, and consider using tax preparation software or a professional to minimize errors.

Understanding Audits and Examinations by the IRS

Unfiled Tax Returns

The IRS may file a substitute return on your behalf, often resulting in a higher tax bill than if you’d filed yourself. Don’t let this happen to you – it’s crucial to file your returns on time, even if you can’t pay right away.

Outstanding Tax Debts

The IRS can impose penalties and interest, making your debt grow faster than a saguaro cactus. If you’re struggling to pay, don’t ignore the problem. The IRS offers various payment plans and options for those facing financial difficulties.

Payroll Tax Discrepancies

The IRS takes these matters seriously, as they involve funds belonging to employees. If you’re facing payroll tax problems, it’s crucial to address them promptly and consider working with a tax professional to get back on track.

Identity Theft and Tax Fraud

In our digital age, identity theft and tax fraud have become increasingly common issues for Phoenix residents. Scammers may file false returns using stolen information, causing major headaches for legitimate taxpayers. If you suspect you’ve been a victim of tax-related identity theft, contact the IRS immediately and consider placing a fraud alert on your credit reports.

Expert Strategies for Negotiating with the IRS

Living in the Valley of the Sun doesn’t exempt you from tax troubles. Here are the most common IRS headaches Phoenix folks encounter and how to tackle them head-on.

Late Filing and Payment Penalties

Missed the April 15 deadline? You’re not alone. Many Phoenicians find themselves scrambling to file or pay taxes on time. Remember, even if you can’t pay in full, always file on time to avoid hefty penalties. If you’re in a bind, consider requesting an extension or setting up a payment plan with the IRS.

Dealing with Audit Anxiety

Getting that dreaded audit letter can make you sweat more than a July afternoon in Phoenix. Don’t panic! Most audits are conducted by mail, and being organized is your best defense. Keep thorough records, respond promptly, and consider seeking professional help if you’re feeling overwhelmed.

Incorrect Reporting of Income

With the gig economy booming in Phoenix, it’s easy to overlook some income sources. Whether it’s a side hustle or rental income from your Scottsdale vacation home, report all earnings to avoid unwanted IRS attention.

Misunderstanding Deductions and Credits

Arizona’s unique tax landscape can make deductions tricky. From solar energy credits to charitable contributions, ensure you’re claiming all eligible deductions without overstepping. When in doubt, consult a local tax pro who knows the ins and outs of Phoenix-specific tax rules.

Addressing Tax Fraud

Unfortunately, tax-related identity theft is on the rise, even in our desert oasis. Protect yourself by filing early, using secure methods, and being wary of phishing scams. If you suspect you’re a victim, act fast and contact the IRS immediately.

Resolve Tax Issues the Easy Way

Make sure to reach out to a certified account Phoenix specialist. This way, you’ll save yourself from the stress of dealing with these tax issues! Take note of the tips mentioned above and spend more time on what you truly want to do.