Microinsurance plays a crucial role in providing financial security to low-income groups in India. As of 2025, with rising economic uncertainties, microinsurance has become a vital tool to protect individuals and families from unforeseen financial crises.

The growing demand for microinsurance is driven by increasing awareness, government initiatives, and the rise of digital financial services. However, many still lack clarity on its working, benefits, and claim processes.

This comprehensive guide answers the 10 most important FAQs About Microinsurance Schemes in India, helping you understand its benefits, eligibility, claim process, and more.

1. What is Microinsurance and How Does It Work?

Microinsurance has emerged as a game-changer in India’s financial landscape, offering protection to economically vulnerable sections of society. With its affordable premiums and simplified claim process, microinsurance is bridging the gap between traditional insurance and the underserved population.

In recent years, government-backed initiatives and digital innovations have further enhanced accessibility, making it easier for individuals to secure coverage for their lives, health, and businesses.?

Understanding Microinsurance

Microinsurance is a type of insurance designed specifically for low-income individuals who may not have access to traditional insurance policies. It provides coverage at lower premiums while offering essential protection against risks such as health emergencies, accidents, death, crop failures, and loss of livelihood.

These policies are structured to meet the unique needs of individuals with limited financial resources, ensuring they can access crucial coverage without financial strain.

How Microinsurance Works in India

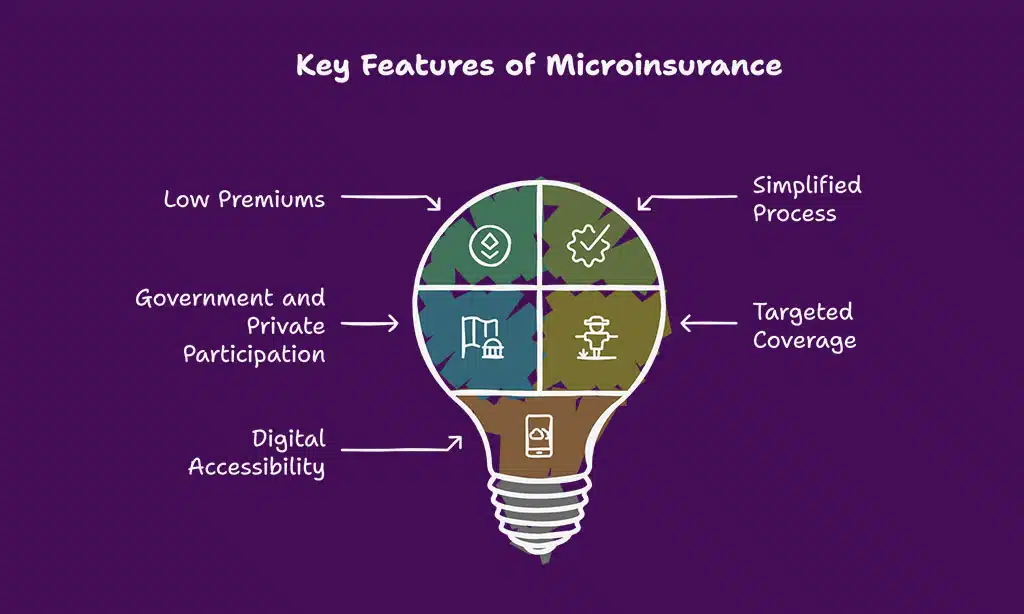

- Low Premiums: Policies are affordable, making them accessible to lower-income groups.

- Simplified Process: Easy enrollment, minimal documentation, and quick claim settlements.

- Government and Private Participation: Offered by both government-backed schemes and private insurers.

- Targeted Coverage: Designed for rural workers, farmers, small-scale traders, and daily wage earners.

- Digital Accessibility: Increasing number of microinsurance policies are now available through mobile apps and online platforms.

| Feature | Details |

| Policyholders | Low-income individuals, rural workers, small business owners |

| Coverage | Life, health, crop, and business insurance |

| Premiums | Affordable, often government-subsidized |

| Claim Process | Simplified with minimal documentation |

2. Who is Eligible for Microinsurance in India?

Microinsurance schemes in India are specifically designed to cater to economically vulnerable populations, ensuring they have access to financial security. With a focus on affordability and accessibility, these policies help individuals and families safeguard themselves against unforeseen risks. Understanding eligibility criteria is crucial to maximizing the benefits of microinsurance and choosing the right plan.

Eligibility Criteria

Eligibility varies depending on the scheme, but common requirements include:

- Individuals from low-income households.

- Farmers, daily wage workers, and self-employed individuals.

- Small business owners with limited financial resources.

- Women and marginalized communities in rural areas.

- Beneficiaries of government financial inclusion programs.

Government and Private Microinsurance Offerings

| Provider | Eligibility | Coverage |

| Government Schemes | Low-income groups, rural workers, farmers | Basic life, health, and accident insurance |

| Private Insurers | Low and middle-income groups | Comprehensive plans with broader coverage |

3. What Are the Key Benefits of Microinsurance?

Microinsurance is designed to provide crucial financial security to economically vulnerable communities. With affordable premiums and tailored coverage, it ensures that individuals can access essential insurance protection against health emergencies, accidents, and livelihood disruptions.

This form of insurance plays a significant role in fostering financial resilience, enabling policyholders to recover quickly from unforeseen adversities.

Financial Security for Low-Income Groups

Microinsurance helps vulnerable groups manage financial risks effectively, preventing them from falling deeper into poverty after unforeseen emergencies. In times of crisis, such as medical emergencies or sudden income loss, having microinsurance can prevent financial ruin.

Accessibility and Affordability

- Lower Premiums: Policies are designed to be cost-effective.

- Flexible Payment Options: Monthly, quarterly, or yearly premiums.

- Easy Claim Settlements: Minimal paperwork and faster payouts.

- Digital Enrollment: Many policies are now available online, allowing faster access and fewer hurdles for policyholders.

Government Support and Subsidies

The Indian government offers various subsidies and incentives to make microinsurance more accessible, particularly in rural areas. For example, under PMJJBY (Pradhan Mantri Jeevan Jyoti Bima Yojana), the annual premium is kept as low as INR 330 to encourage mass adoption.

| Benefit | Description |

| Low Premiums | Affordable for lower-income groups |

| Financial Protection | Covers unexpected health and life risks |

| Government Support | Subsidies and incentives for rural populations |

4. What Types of Microinsurance Policies Are Available?

Microinsurance policies in India are categorized based on coverage type and target beneficiaries. These policies aim to provide financial stability to vulnerable groups, ensuring they receive protection against various risks. With the growing awareness and digital accessibility, different types of microinsurance policies are being tailored to cater to specific needs, including life, health, and livelihood protection.

Life and Health Microinsurance

- Life Insurance: Covers accidental and natural death, ensuring financial support for the family.

- Health Insurance: Covers medical treatments, hospitalization, and critical illnesses. For instance, the Rashtriya Swasthya Bima Yojana (RSBY) provides low-cost hospitalization coverage.

Agriculture and Livelihood Protection

- Crop Insurance: Provides compensation for crop loss due to natural disasters.

- Livelihood Protection: Covers small business owners and self-employed individuals against income loss.

| Type of Policy | Coverage Details |

| Life Insurance | Death benefits to family members |

| Health Insurance | Hospitalization, treatment, and medical expenses |

| Crop Insurance | Protection against climate risks |

5. How Can One Apply for a Microinsurance Policy?

Applying for microinsurance in India has become simpler with digital advancements and government initiatives aimed at financial inclusion. Many microinsurance providers now offer streamlined application processes with minimal paperwork, making it easier for low-income groups to secure coverage.

Understanding the application steps and required documents can help individuals make informed choices and ensure a smooth enrollment process.

Application Process

- Choose a Policy: Compare government and private microinsurance schemes.

- Provide Necessary Documents: Aadhar card, income proof, and address verification.

- Pay the Premium: Opt for digital or cash payment modes.

- Receive Policy Details: A policy document is issued with coverage details.

Tips for Choosing the Right Microinsurance Policy

- Compare benefits, premiums, and claim processes.

- Check for government-backed schemes with subsidies.

- Choose a reputed insurer with a reliable claim settlement record.

- Verify the claim process to ensure hassle-free settlements.

| Factor | Consideration |

| Affordability | Low premium costs |

| Claim Process | Quick and hassle-free |

| Coverage | Comprehensive protection for risks |

10. What Is the Future of Microinsurance in India?

The microinsurance sector in India is evolving rapidly, driven by technological advancements, policy reforms, and growing awareness. As more people recognize the importance of financial security, microinsurance schemes are expected to expand their reach and improve accessibility.

The increasing integration of digital platforms and fintech solutions will play a crucial role in transforming the industry, ensuring seamless policy issuance, premium payments, and claim settlements.

Emerging Trends in 2025

- AI-Driven Underwriting: Faster policy approvals using AI analytics.

- Blockchain for Claims Processing: Enhancing transparency and reducing fraud.

- Expansion into Rural Areas: Government and private initiatives increasing reach.

- Partnerships with Fintech Firms: Digital platforms making insurance more accessible.

Expected Policy Reforms and Government Initiatives

- Strengthening digital microinsurance platforms.

- More subsidy programs for farmers and rural workers.

- Collaboration between fintech companies and insurers for better accessibility.

- Introduction of AI-powered chatbots to assist policyholders with queries.

Takeaways

Microinsurance is an essential tool for financial protection among India’s low-income population. With various government-backed and private schemes available, individuals can choose policies that best fit their needs.

By understanding these FAQs About Microinsurance Schemes in India, you can make informed decisions to safeguard your future.

Whether you’re a farmer, self-employed individual, or daily wage worker, microinsurance can offer crucial financial security. Stay informed, compare policies, and invest in a plan that ensures peace of mind for you and your family.