Have you ever felt let down by a bank? Maybe your money transfers took too long, or the fees on your checking account made no sense. Many people worry about hidden charges and lack of control over their digital assets in traditional finance.

Folks are looking for better ways to manage their money, especially as more daily life happens online.

Here is one thing to know: decentralized finance (DeFi) uses blockchain technology to offer faster, cheaper financial services without banks acting as middlemen. You will see how DeFi platforms give users more control with smart contracts and cryptocurrencies, making old-school banking look slow and pricey.

This guide shows why trust in traditional banks is falling while DeFi’s trust grows. Ready for a peek behind the curtain? Keep reading!

Key Takeaways

- DeFi uses blockchain and smart contracts to let people control their own money. There are no banks or middlemen. This makes sending money faster and cheaper than with banks like Goldman Sachs.

- Anyone with a smartphone can use DeFi, even if they do not have a bank account. People in poor countries can now borrow, lend, or earn interest using just the internet.

- Banks often charge high fees and use slow manual steps for things like wire transfers or loans. DeFi has lower fees and lets users move digital assets—like crypto—in minutes instead of days.

- Security is still an issue with DeFi because hackers target these systems. There are no strong consumer protections yet, so some people lose their funds during hacks.

- Laws for DeFi are unclear right now, making it risky for many users. New rules could change how smart contracts and lending work at any time. This uncertainty stops some from trusting DeFi fully today.

Key Differences Between DeFi and Traditional Banking

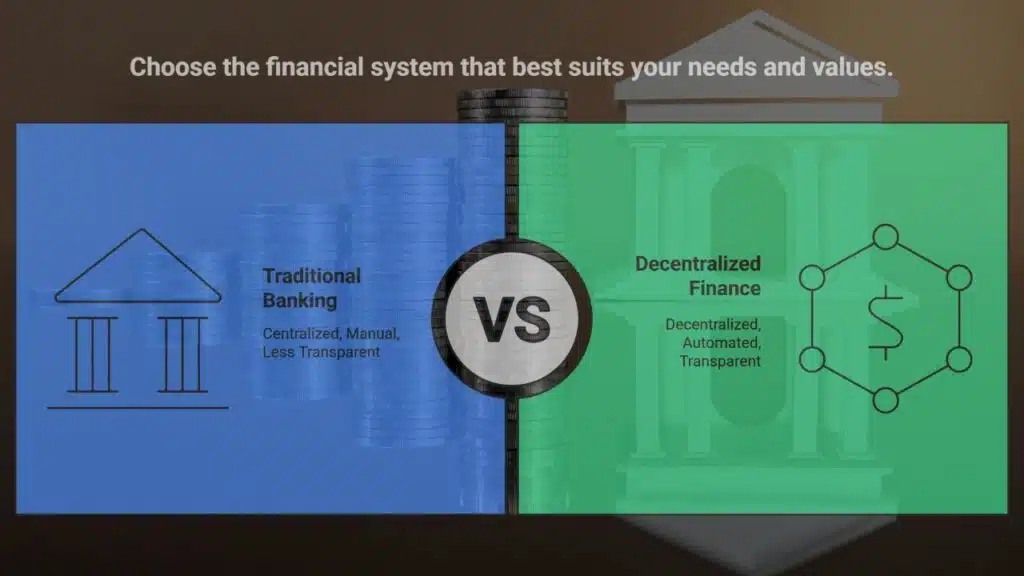

DeFi and traditional banking work in very different ways. DeFi uses smart contracts on blockchain networks, while banks rely on manual methods and central control.

Centralization vs Decentralization

Banks use centralization. This means a few groups, like central banks and other financial intermediaries, control things. The Federal Reserve or big names like Goldman Sachs say what goes and who gets what.

People need to trust these groups with their money in checking accounts and savings accounts. If there is a mistake or data breach, customers have to wait for help.

Decentralized finance flips the script by letting blockchain networks power everything on public blockchains such as the Ethereum blockchain. No single company controls digital assets or payment processing using smart contracts on decentralized platforms.

Users can handle crypto assets themselves with hardware wallets and multisignature wallets—no waiting for wire transfers or dealing with fees from debit cards or ATMs. Anyone with an internet connection can join peer-to-peer lending, liquidity mining through automated market maker systems, or even yield farming without asking permission from insurers or credit unions first.

Transparency and Accessibility

Public blockchains like Ethereum let you see every transaction. Anyone can check the records at any time. This open-book style builds more trust than old-school banks, which often keep their ledgers hidden behind closed doors.

The Federal Trade Commission has linked bank secrecy to many data breaches in recent years.

Decentralized finance apps break down many walls that traditional banks put up, such as strict credit checks or location limits. You do not need a bank account to join peer-to-peer lending or decentralized exchanges like Coinbase and Binance.

People from emerging countries use digital assets and smart contracts for money-transfer or yield farming without jumping through hoops. DeFi lets someone with just a phone skip past red tape and high interest rates while joining the global financial system instantly—no suit-and-tie meeting required!

Smart Contracts vs Manual Processes

Smart contracts run on blockchain technology and cut out financial intermediaries like banks or insurance companies. These digital agreements do not need a banker, a stamp, or mountain of paperwork.

Code runs the whole thing, so payments happen in seconds instead of days. No branch visits needed, just your phone or computer.

Manual processes in traditional finance drag their feet. Bank transfers can take up to three business days because humans must check documents, follow rules, and enter data by hand.

That means more fees for simple things like peer-to-peer lending or sending digital currencies across borders. Smart contracts use proof-of-stake systems to move money faster with fewer mistakes—just ask anyone who’s tried yield farming or using decentralized applications for personal loans.

Even Goldman Sachs keeps an eye on this shift; they know smart contracts could shake up capital markets soon enough!

Core Advantages of DeFi Over Banks

Decentralized finance, or DeFi, offers quick transactions that beat traditional banks. Users pay lower fees and keep better control over their digital assets. This means more freedom for people managing investments like mutual funds or stocks.

With smart contracts running on blockchain technology, everything feels seamless. No queues, no waiting! You get to decide how you use your money without extra hands in the mix. It’s a refreshing change from old banking methods.

Faster Transactions

Transactions happen fast in DeFi. Users can send and receive money quickly, without waiting days. Banks often take too long to process payments due to their manual steps. In contrast, DeFi uses smart contracts.

These are like digital agreements that run on blockchain technology.

With smart contracts, transactions can occur in minutes or even seconds. This speed cuts out lots of red tape found in traditional finance. People enjoy lower fees because there are fewer intermediaries involved.

Decentralized finance also allows for 24/7 access to funds anywhere worldwide. That means no more banking hours holding you back!

Lower Fees

Decentralized Finance (DeFi) offers lower fees compared to traditional banks. Banks often charge high fees for services like transfers and loans. DeFi cuts out middlemen, which makes transactions cheaper.

This benefits users by saving them money.

Smart contracts handle operations automatically in DeFi, reducing costs further. There are no hidden charges or surprise fees, unlike many bank services. People around the world can access financial services without breaking the bank.

For those who have struggled with expensive banking options, DeFi opens new doors for savings and opportunities in managing digital assets.

Greater Control Over Assets

In decentralized finance, users have more control over their assets. They can manage their digital currency directly without a bank’s help. This freedom allows people to do what they want with their money, like investing or lending it through platforms that use smart contracts.

Unlike traditional banks, DeFi does not hold your assets for you. You are in charge. This means no one can freeze your funds or limit how you use them. For those who have been left out of the banking system, DeFi offers new possibilities to access financial services and grow wealth on their own terms.

DeFi’s Role in Financial Inclusion

DeFi helps people without bank accounts access financial services. This means folks in developing areas can now take part in the digital economy. They can borrow, lend, or invest with just a smartphone and internet access.

No need for credit scores or long lines at banks. It opens doors to many who felt left out of traditional finance. Want to know how this works? Keep reading!

Empowering the Unbanked

Many people lack access to banks. They miss out on basic financial services that many take for granted. DeFi lending protocols change this. They let anyone borrow or lend money without needing a bank account.

This new system creates opportunity, especially in emerging markets. People can now earn from digital assets and participate in the digital economy. It opens doors to peer-to-peer lending and yield farming, allowing more folks to grow their wealth.

With lower fees and faster transactions, DeFi is building a bridge for the unbanked to join the financial world.

Global Accessibility

DeFi opens doors for many who don’t have a bank account. This is good news for the unbanked. They can now access financial services without barriers. DeFi lending lets people borrow and lend money directly through technology, like smart contracts.

These contracts run on blockchain technology, ensuring trust and transparency.

People from anywhere in the world can participate in this new digital economy. It doesn’t matter if they live in a big city or a small town; everyone has equal chance to join in DeFi activities, like yield farming or peer-to-peer lending.

Global accessibility means more opportunities for everyone, not just those with traditional banks backing them up.

Challenges and Risks of DeFi

DeFi comes with its share of risks. Security issues can arise, leading to hacks and theft of digital assets. Users also face uncertainty in regulations, which can change quickly. Plus, without traditional protections, some may feel uneasy about their investments.

Want to know more about these challenges? Keep reading!

Security Concerns and Hacks

Security is a big worry in decentralized finance. The lack of central oversight makes DeFi systems easy targets for hackers and scammers. High-profile hacks have shown that these platforms can be vulnerable to attacks, leading to theft of digital assets.

Important security measures like two-factor authentication must be used, yet many still fall short.

Many users are unaware of the risks involved. If vulnerabilities go unchecked, they could harm financial stability as DeFi grows. Investment management without proper protections may lead to identity theft or loss of funds for innocent users.

Without strong consumer protections, trust becomes hard to build in this new system.

Regulatory Uncertainty

Many face significant concerns with decentralized finance, or DeFi. Numerous individuals question how laws will change for these new financial tools. This hesitation slows down progress in the DeFi space.

Without clear rules, bad actors may take advantage of vulnerabilities. Scammers and hackers already target this area due to its lack of protection.

Unclear regulations create risk for users as they explore digital assets like cryptocurrencies. New laws could alter how smart contracts function or even restrict access to peer-to-peer lending platforms.

If any future changes occur suddenly, it may undermine confidence in the whole system. People seek safety while exploring new tech, but uncertainty can prevent them from fully engaging with DeFi.

Takeaways

Decentralized finance is shaking things up in the money world. It offers speed, lower costs, and clear options. People without banks can now join in too. While risks exist, many trust DeFi more than old banks.

The future of finance looks bright and different with these changes!

FAQs

1. What is decentralized finance, and how does it differ from traditional banks?

Decentralized finance uses blockchain technology to let people make financial transactions without a bank or other financial intermediaries. It relies on smart contracts instead of paperwork or bankers.

2. Why are more people trusting digital assets over credit cards and online banking?

Digital assets give users direct control of their money, unlike credit card companies that sometimes freeze accounts. Blockchain records every move; you see what happens with your funds.

3. How does peer-to-peer lending in decentralized finance offer better annual returns than stock exchanges or cooperatives?

Peer-to-peer lending cuts out middlemen, so lenders and borrowers often get better rates compared to old-school banks or crowded markets like stock exchanges.

4. Are there risks like market volatility or security vulnerabilities in decentralized finance?

Yes, market volatility can hit hard when prices swing fast, and some platforms face security vulnerabilities since hackers love new financial technologies.

5. Can decentralized finance help with financial inclusion where banks fall short?

Absolutely; many folks left out by traditional finance find access through crowdfunded projects and yield farming tools built on permissioned blockchains.

6. What about regulatory challenges and consumer protections for these new services?

Regulatory challenges remain tough because laws lag behind tech changes; groups like the Centre for the Fourth Industrial Revolution push for clearer rules while trying not to kill innovation but still demand basic guarantees for everyone’s safety.