Do you feel lost by all the talk of blockchain technology and decentralized finance in Japan’s digital currency scene? In fact, the FTX crash in 2022 shook cryptocurrency exchanges, but by 2023, the APAC region saw a rise in cryptocurrency adoption.

We’ll map six trends, from new digital wallets and altcoins to updated government regulation and savvy corporate moves. Read on to stay ahead.

Key Takeaways

- One in five Japanese adults now hold digital assets. After a 22% drop in Q3 2022, APAC crypto use rose by 2023 with 36% of owners aged 25–34.

- Female share in APAC rose from 30% to 36% in two years. Developers at CryptoHub and CoinTrade add features based on women’s feedback and stablecoin demand.

- Japan’s FSA plans new rules. It will ban insider trading on exchanges by 2027, treat tokens as financial products, and join a 54-country monitoring network.

- SBI Group put $50 million into Circle on June 7, 2025, and BlackRock’s token fund reached $2.5 billion on April 28, 2025. After the $320 million DMM Bitcoin fraud on Dec 2, 2024, firms beef up security.

- Sumitomo Mitsui works on a bank-backed stablecoin, and sports fan tokens link with AC Milan. Bitcoin hit $100,000 on Dec 5, 2024, and fiat-pegged tokens for Southeast Asia aim for a Dec 2024 launch.

Increased Cryptocurrency Adoption and Ownership

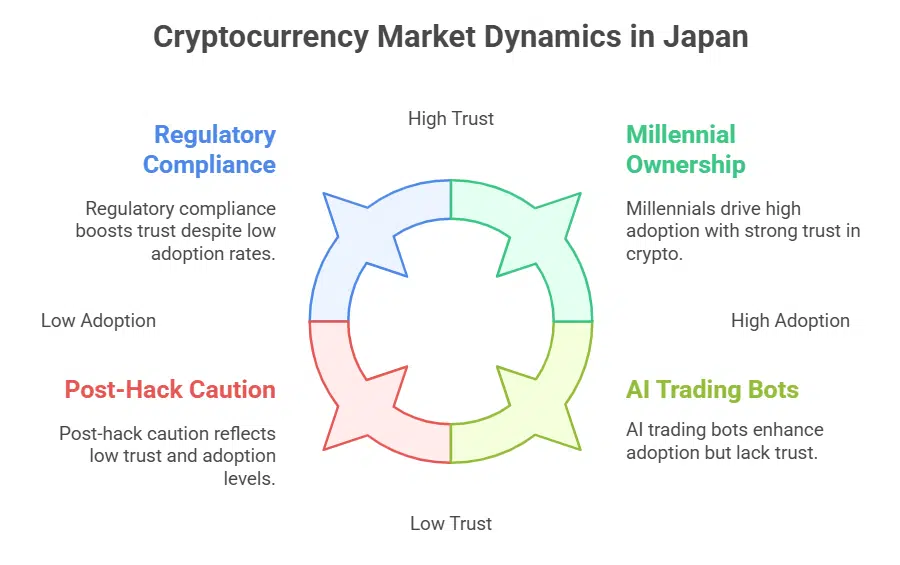

One in five adults in Japan hold digital assets. Q3 2022 saw a 22% drop in cryptocurrency adoption. Millennials, ages 25 to 34, now make up 36% of APAC owners. Consumers tap mobile wallets, connect IoT devices to blockchain technology.

Many use AI-driven bots for trading tips.

A 2018 hack stole over 58 billion Yen, or roughly $500 million, from a Tokyo exchange. That breach shook trust and drove tougher crypto regulations on cryptocurrency exchanges. Investors vet platforms for compliance, check digital currency safeguards.

A cautious vibe still drives crypto market growth, spurs new crypto investments, and fuels decentralized finance apps.

Growing Female Participation in Crypto Markets

Miyu, a 29-year-old app developer in Tokyo, uses blockchain technology to send digital currency home. She logs into CryptoHub, a major cryptocurrency exchange, and moves some digital assets.

Today, 36 percent of crypto owners in APAC are women. That share rose from 30 percent just two years ago. This growth shows a clear shift in consumer preferences. Women now shape the cryptocurrency market, and they craft new DeFi services.

Their feedback on CoinTrade sparks fresh features in decentralized applications.

Across APAC, 89 percent of women used at least one online payment service last month. Many then try digital currencies. They sign up for CryptoHub and CoinTrade accounts after a few clicks.

A software engineer friend texted, “Stablecoins feel safe.” She swapped yen for a token and stored it in her digital wallet. That spike follows a rise in DeFi tools and mobile apps that mesh with IoT devices.

Female investors now shape decentralized finance and altcoin markets in Japan.

The Rise of Security Token Offerings (STOs)

Security token offerings pack a punch for investors and issuers alike. They link digital assets to real world shares. Japan’s Financial Services Agency proposed legal revisions to tag cryptocurrencies as financial products.

Lawmakers aim to regulate stablecoins, NFTs and DAOs. STOs rest on blockchain technology and smart contracts. They work like a digital handshake, giving clear rights on a public ledger.

A bank group such as Sumitomo Mitsui Financial Group even talks with U.S. firms to craft a stablecoin. This move blends digital currency with bank level trust. It taps into decentralized finance and the cryptocurrency market.

Security token offerings demand strict crypto regulations on cryptocurrency exchanges and digital wallets. They help firms raise capital, grant retail buyers more access, boost financial inclusion and drive cryptocurrency adoption.

Regulatory Developments and Enhanced Legal Frameworks

Japan’s Financial Services Agency proposed a ban on insider trading on cryptocurrency exchanges, clearing a path for fair digital asset trades. It will join a global crypto monitoring network of 54 countries by 2027 and tighten government rules around blockchain technology.

Thai banks now use stablecoins to cut fees and speed remittance services for migrant workers, a move that ties digital currency with real life. This shift taps DeFi networks, smart contracts, and IoT apps to drive financial inclusion across borders.

Corporate Investment and Public Companies Embracing Crypto

Many big names join the crypto scene. SBI Group invested $50 million in Circle on June 7, 2025. That move shows public firms back stablecoin innovation. BlackRock’s tokenized fund reached $2.5 billion in net value by April 28, 2025.

Corporations now chase digital assets and decentralized finance yields.

DMM Bitcoin announced liquidation after a $320 million fraud on December 2, 2024. This scandal shook the cryptocurrency exchange market. Regulators then pushed for stronger crypto regulations and tighter blockchain technology oversight.

Investors watch compliance and network security more closely.

The Emergence of Game-Changing Altcoins in Japan

Japan spots fresh digital assets shaking up markets. Fan tokens join a sports blockchain platform, teaming with AC Milan to woo local traders. A crypto exchange giant will launch fiat-pegged tokens tied to Southeast Asian currency by December 2024.

Bitcoin soared past $100,000 on December 5, 2024, and traders ride the wave into altcoin bets.

Developers crunch blockchain technology and decentralized finance networks to build new coin projects. They tap Internet of Things devices and smart contracts to power digital currency experiments.

Local cryptocurrency exchanges list these tokens fast, feeding a surge in digital assets trading.

Takeaway: What’s Next for Japan’s Crypto Future

Bold shifts mark Japan’s digital currency scene. Blockchain interoperability moves to center stage. Security token offerings and Defi tools draw corporate interest on local exchanges.

AI teams up with IoT in smart trading apps. Female traders boost market demand and innovation. Regulators update rules to protect small investors.

FAQs on Cryptocurrency Trends in Japan

1. What is driving cryptocurrency adoption in Japan?

A flood of people now use digital currency, even in small shops and online stores. This surge in e cash helps with financial inclusion and makes banking easier for everyone.

2. How will blockchain technology change the cryptocurrency market in Japan?

Think of a giant ledger that never stops. Blockchains and blockchain interoperability keep records safe. They help the cryptocurrency market flow smoothly across borders, like passing a baton in a relay.

3. Are new rules affecting cryptocurrency exchanges in Japan?

Yes. The government regulation team has set fresh crypto regulations. These rules cut negligence and tort claims, lower damages, and guide safe cryptocurrency trading on exchanges.

4. How do artificial intelligence (ai) and the internet of things (iot) boost crypto investments?

Imagine ai as a smart helper that can analyze data and give forecasts. The internet of things links your phone or watch to your wallet. Together, they spot trends in digital assets fast.

5. What makes decentralized finance (defi) a big trend in Japan?

DeFi cuts out the middle bank. You can lend, borrow, or swap coins right on your phone. This drives financial inclusion and sparks market expansion without a bank teller in sight.

6. How do targeted advertising and cookies reach crypto fans?

Ads follow you like a shadow on the internet. They use targeting cookies, market research, and market segmentation to match adverts to your taste. It all ties back to consumer behavior and your online moves.