Financial inclusion is the ability of individuals and businesses to access affordable and useful financial services. This includes savings, payments, credit, and insurance. In many parts of the world, especially in developing countries, people still lack access to basic banking services. According to the World Bank, about 1.4 billion adults globally remain unbanked as of 2021.

Cryptocurrency and blockchain technology are changing this scenario. With decentralized finance (DeFi), digital wallets, and mobile-first solutions, new crypto projects are helping to close the financial gap. These crypto projects aimed at financial inclusion are not just buzzwords; they offer real solutions that bring banking to those who need it the most. In this article, we’ll explore seven crypto initiatives that are breaking barriers and building bridges to financial access.

Why Financial Inclusion Matters in 2025

Financial inclusion is more than just access to banking; it’s about enabling economic participation and empowerment for all. In 2025, as the digital economy expands, those left behind face deeper marginalization. Inclusive finance is a stepping stone toward reducing poverty, increasing education, and fostering entrepreneurship. By ensuring everyone has access to affordable financial services, we can drive long-term social and economic growth across nations.

The Global Financial Divide

Despite global advancements in technology and banking, billions still live without access to secure financial tools. Many face challenges like:

- No access to local banks

- High transaction fees

- Limited identification documentation

- Currency instability

These challenges are more prominent in developing countries in Africa, Latin America, and South Asia.

Crypto as a Financial Equalizer

Cryptocurrency offers an alternative to traditional banking. It’s borderless, low-cost, and accessible with just a smartphone. It doesn’t require a formal ID or credit history. This makes it ideal for:

- Migrant workers sending remittances

- Small businesses in rural areas

- Individuals without access to banks

Criteria for Selection

We selected these seven crypto projects based on the following:

- Innovation in using blockchain to solve financial inclusion issues

- Global impact in unbanked or underbanked communities

- Transparency and open-source operations

- Accessibility, such as mobile support and low fees

7 Promising Crypto Projects Aimed at Financial Inclusion

These crypto projects were selected for their real-world impact, usability in underserved regions, and ability to scale. Each one is tackling a unique aspect of financial exclusion—from remittances to microloans and identity verification. These blockchain initiatives offer practical tools to people in remote and financially neglected communities, improving their ability to earn, save, invest, and grow.

1. Stellar (XLM)

Stellar is a blockchain network designed to connect financial systems. It facilitates fast, low-cost international transactions.

Key Information at a Glance:

| Feature | Details |

| Founded | 2014 by Jed McCaleb |

| Purpose | Cross-border payments and financial infrastructure |

| Notable Partners | IBM, MoneyGram, Circle |

| Fee | 0.00001 XLM per transaction |

| Regions Impacted | Africa, Southeast Asia |

Stellar’s network helps people and institutions send money across borders with minimal fees. In countries with high remittance costs, this brings significant relief. It also partners with banks and NGOs to develop localized financial services.

2. Celo

Celo is a mobile-first blockchain platform focused on financial inclusion. Users can send and receive crypto using their phone numbers.

Key Information at a Glance:

| Feature | Details |

| Founded | 2017 |

| Unique Feature | Phone number as wallet address |

| Transaction Fees | Under $0.01 |

| Supported Devices | Android, iOS |

| Regions Impacted | Latin America, Sub-Saharan Africa |

Celo enables users to store and transfer digital currencies without the need for a traditional bank account. It supports local stablecoins like cUSD, cEUR, and cREAL, allowing financial activities in native currencies.

3. Algorand

Algorand is a scalable blockchain that emphasizes speed, security, and sustainability. It’s working with governments and organizations to power inclusive finance.

Key Information at a Glance:

| Feature | Details |

| Founded | 2017 by Silvio Micali |

| Speed | Up to 6,000 transactions per second |

| Energy Efficiency | Carbon-negative |

| Use Case | National digital currencies, microfinance |

| Regions Impacted | South America, India |

Algorand has partnered with El Salvador to explore blockchain-based financial solutions. Its fast transaction times and low energy use make it suitable for public infrastructure in developing countries.

4. BanQu

BanQu is not a cryptocurrency but a blockchain-based identity platform. It empowers people without formal IDs to participate in the global economy.

Key Information at a Glance:

| Feature | Details |

| Founded | 2015 |

| Use Case | Identity and transaction history for the unbanked |

| Partners | Coca-Cola, AB InBev |

| Tech Type | Permissioned blockchain |

| Regions Impacted | Africa, Asia, South America |

BanQu creates a digital identity for small farmers, refugees, and factory workers. This helps them access credit and build a track record without a bank account. The platform ensures transparency in supply chains, benefiting both producers and consumers.

5. Moeda (MDA)

Moeda uses blockchain to fund sustainable projects and promote microfinancing. It focuses on underrepresented entrepreneurs, especially women.

Key Information at a Glance:

| Feature | Details |

| Founded | 2017 |

| Use Case | Microloans and project funding |

| Currency | MDA Token |

| Focus Area | Sustainable development goals (SDGs) |

| Regions Impacted | Brazil and Latin America |

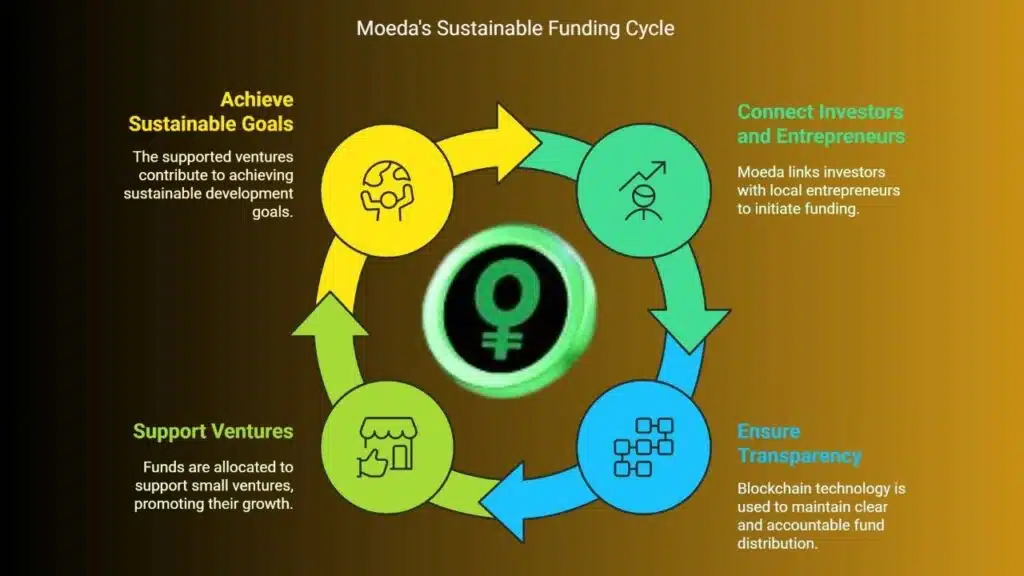

Moeda’s platform connects investors with local entrepreneurs. By using the blockchain, it ensures transparency and accountability in fund distribution. The project has already supported over 40 small ventures.

6. Akoin

Akoin is a crypto ecosystem founded by artist and entrepreneur Akon. It aims to stimulate youth entrepreneurship and digital economies in Africa.

Key Information at a Glance:

| Feature | Details |

| Founded | By Akon in 2018 |

| Unique Feature | Multi-currency crypto wallet |

| Partnerships | MWALI (Comoros Islands), BitMinutes |

| Pilot Region | Akon City in Senegal |

| Target Audience | African youth and entrepreneurs |

Akoin provides tools for people to manage finances, access services, and build businesses. Its pilot city in Senegal is designed as a futuristic, blockchain-powered smart city.

7. Paxful

Paxful is a peer-to-peer Bitcoin marketplace that allows users to buy and sell crypto using various payment methods.

Key Information at a Glance:

| Feature | Details |

| Founded | 2015 |

| Users | Over 10 million globally |

| Payment Methods | 300+ (including mobile money, gift cards, bank transfers) |

| Fees | 1% (sellers only) |

| Regions Impacted | Nigeria, Kenya, India |

Paxful is popular in areas where access to banking is low. It lets users convert mobile money into crypto and vice versa. The flexibility of payment options makes it a powerful tool for everyday transactions in developing markets.

Real-World Stories and Testimonials

Real-life stories show how these crypto projects are making a real difference in people’s lives. From rural farmers to young entrepreneurs, blockchain is breaking financial barriers. These testimonials highlight the human impact behind the technology.

Africa: Empowering Rural Communities

Celo’s partnership with NGOs in Uganda allowed over 2,000 rural farmers to receive payments via mobile wallets. Many were previously paid in cash, which was unsafe and unreliable.

Latin America: Microloans for Small Shops

Moeda funded a female entrepreneur in Brazil to open a local grocery shop. With a small microloan, she expanded her business and now employs two workers from her village.

India: Digital ID for Workers

BanQu provided digital transaction histories for day laborers in India. This helped them access small loans and savings plans through local cooperatives.

Challenges and Road Ahead

Barriers to Adoption

Despite their promise, crypto projects still face hurdles:

- Internet connectivity issues in remote areas

- Regulatory uncertainty in many countries

- Lack of digital literacy

- Security and scams in P2P platforms

Building Sustainable Solutions

To scale effectively, these crypto projects need to:

- Collaborate with local governments

- Offer user education and onboarding tools

- Build intuitive and accessible apps

- Ensure environmental sustainability

Takeaways

Crypto projects aimed at financial inclusion are transforming lives around the world. From helping small farmers in Africa to empowering women in Latin America, these initiatives are making finance more accessible and inclusive. The seven projects highlighted in this article show how blockchain is being used not just for trading but to solve real human problems.

By promoting decentralized access to money and financial tools, these crypto platforms are giving millions a chance to save, invest, and build better futures. The path to full financial inclusion is long, but with innovation and collaboration, the future looks promising.