Do you worry about picking a crypto exchange that meets German rules and shields your coins? German law treats crypto assets as financial instruments and makes BaFin licenses a must.

This guide lists seven BaFin-approved platforms, each with strong security, AML checks, cold storage, and simple bank transfer support. Find your perfect match.

Key Takeaways

- All seven platforms (Coinbase, Bitcoin.de, Bitpanda, Kraken, Bitvavo, Bison, eToro) hold BaFin licenses. They follow German law, keep most coins in cold storage, and run AML and KYC checks.

- Bitcoin.de became Germany’s first BaFin-licensed exchange in 2020 and stores 98% of funds offline. Coinbase lets users pay with Apple Pay and Google Pay and meets MiFID II rules. Bitpanda offers over 300 coins, ETFs, and stocks at 1.49% per trade.

- Kraken supports over 350 coins. It offers high liquidity, margin trading, staking, and a public API under EU rules. Bitvavo lists over 150 coins and shows clear maker and taker fees.

- Bison links to Börse Stuttgart for direct euro trades and uses a built-in spread fee model. eToro holds a BaFin license, lets you copy-trade on 85 coins, and supports both spot trading and CFDs.

Coinbase

Coinbase holds a BaFin license and puts most crypto assets in cold storage. It integrates with Coinbase Wallet and adds Apple Pay for instant funding.

Licensed by BaFin with advanced security measures

It holds a BaFin license. Regulators check every service offering spot trading and futures trading. The exchange meets AML and KYC rules for each account. Users fund accounts via bank transfer, credit cards or Google Pay.

Operations follow EU law and MiFID II for markets in crypto-assets. That oversight helps with capital gains tax and income tax reporting.

SSL encryption plus 2FA safeguard accounts. Cold storage at vaults holds most coins offline. The platform flags odd transfers to fight money laundering. Detailed fee tables list costs for Apple Pay, debit cards and credit cards.

Traders link to crypto wallets to track staking rewards and blockchain data. It supports digital assets from bitcoin to alternative coins.

User-friendly interface for beginners

Newcomers see crisp icons and clear charts in a simple menu. They open the app, link their bank account or use card and PayPal. Users track their crypto portfolio in real time. The interface lays out spot trading options, cold storage wallets, and fiat balances in plain view.

The site guides each step, from bank transfers to hardware wallet setup. It shows tutorials on cryptocurrency trading and security measures. Labels sit under icons for Buy, Sell, Deposit.

Investors feel calm. They click, trade, grow confidence fast.

Bitcoin. de

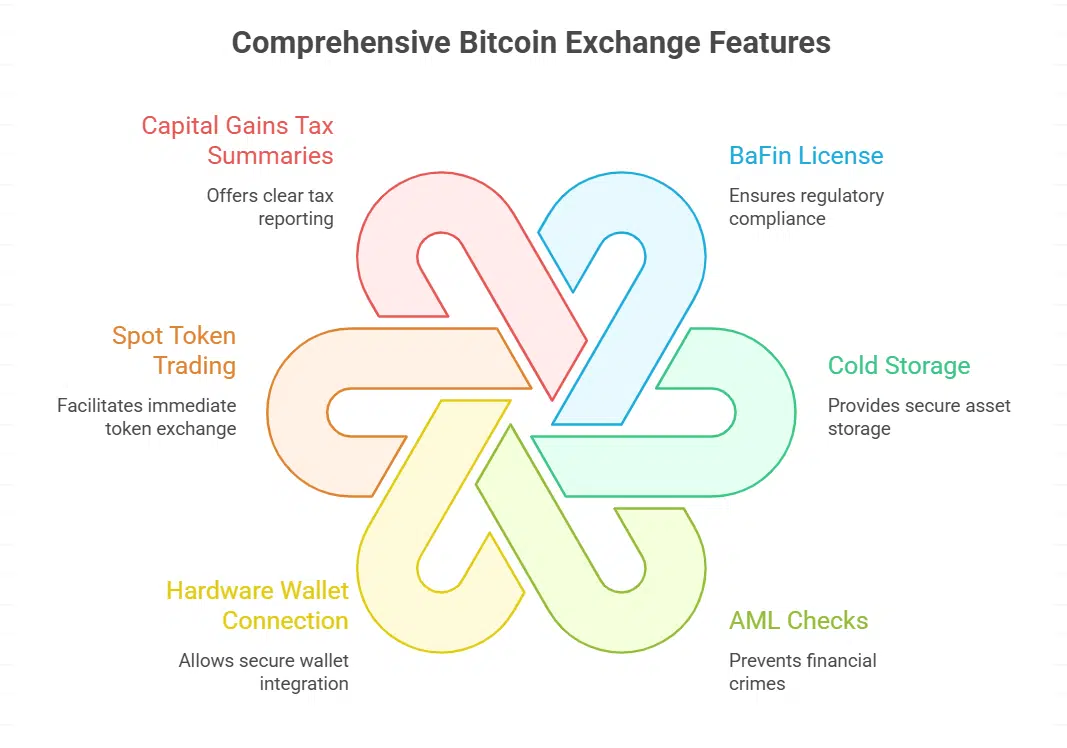

Bitcoin.de stands as Germany’s first exchange that BaFin licenses, its cold storage and AML checks guard your digital assets. You can connect a hardware wallet, trade spot tokens, and view clear capital gains tax summaries, all under one roof.

Germany’s first regulated crypto platform

This platform, Bitcoin.de, began regulated trading under BaFin in 2020. It holds a BaFin license and meets top regulatory compliance, with strict anti-money laundering rules for markets in crypto assets.

The service locks most funds in cold storage and offers built-in cryptocurrency wallets to manage a crypto portfolio. German law treats every trade as a taxable event, so traders can track capital gains tax on euro spot trading.

Strong focus on compliance with German laws

German law demands strict checks on cryptocurrency exchanges. Our platform meets AML regulations and KYC rules set by BaFin, showing strong regulatory compliance.

They scan IDs and trace every transfer to curb terrorist financing and fraud. We store 98% of funds in cold storage, using offline vaults for top security.

Bitpanda

Bitpanda lets you mix in ETFs and token bundles in one wallet. It locks private keys in hardware wallets and follows tough AML rules under EU regulations.

Offers a wide range of assets beyond crypto

Investors can buy over 300 cryptocurrencies. Users can also invest in stocks and precious metals. This mix builds a robust crypto portfolio. Traders can add ETF shares to digital assets.

The platform supports spot trading in euros and dollars. It meets AML and KYC regulations in Germany. You can hold funds in hardware wallets or cold storage. Live feeds show market price moves in real time.

Fully compliant with AML and KYC regulations

BaFin, Germany’s federal financial watchdog, vets every user in strict KYC and AML checks. The exchange holds most digital assets in offline vaults, a cold storage method that stops online thieves.

Fees sit at 1.49% per transaction, a modest price for top-level security and regulatory compliance.

This crypto platform supports spot trading, margin trading, and initial coin offerings from vetted projects. You can use a bitcoin wallet or link Apple Pay to fund your fiat accounts.

Traders can add BNB tokens or build a diversified crypto portfolio with confidence. It issues trade reports that align with Germany’s capital gains tax and deductible expense rules.

Kraken

Kraken holds a BaFin license, keeps most digital assets in cold storage, and fuels high liquidity for spot trading. You can tackle margin trading, earn staking rewards, or tap into the Kraken API to build your crypto portfolio.

Globally recognized with BaFin licensing

This exchange holds a BaFin license. Germany’s top financial watchdog grants that seal. You spot it and feel like your cryptos wear a digital helmet. Regulators check each trade, driving real regulatory compliance.

Users tap cold storage, hot wallets, and multi-signature key setups. These tools guard your cryptos and blockchains.

High liquidity lets traders move big orders fast. Spot trading and margin trading run without hiccups. The site logs every trade under EU regulations, covering tax laws on capital gains and value added taxes.

You can build a strong crypto portfolio of digital assets and tokens. It acts under the Markets in Financial Instruments Directive.

High liquidity and robust security features

Kraken offers high liquidity for over 350 cryptocurrencies. Traders enjoy fast spot trading with low fees. Deep markets let you fill big orders without delay.

Kraken stores most digital assets in cold storage. It uses two factor authentication and secure socket layer encryption to boost security measures. These tools guard your crypto portfolio around the clock.

Bitvavo

Bitvavo locks down your assets like Fort Knox with most funds in cold storage, cutting off hackers at the gate. Its clear fee chart and handy API let novices and pros tweak their portfolios or test copy trading with ease.

Transparent fee structure and regulatory compliance

Users see every fee on a neat grid, like a lunch menu without surprises. The layout shows spot trading fees and withdrawal costs in cents. Makers and takers pay clear percentages, no buried extras.

This open style cuts guesswork, letting you manage your crypto portfolio cost.

The platform holds a BaFin license under German law. It follows AML and KYC rules step by step. Most tokens rest in offline cold storage vaults. You trade with legal tender or crypto tokens, all under strict regulatory compliance.

Supports a wide variety of cryptocurrencies

Bitvavo lists over 150 digital assets, from a major coin to a stablecoin, plus smart contract tokens. The menu feels like a candy store, only for crypto lovers. Traders can pick coins for spot trading to round out a diverse crypto portfolio.

They can stake tokens for rewards or tap into crypto lending. Much of your balance resides offline in cold storage, secured by bank-grade security measures, and supervised under baFin rules.

Bison

Bison locks in a link to Börse Stuttgart, giving traders direct access to euro markets, tucking coins in cold storage like a squirrel hoarding nuts. It serves instant trades, offers simple spot trading, guides you through income tax laws, all in a sleek mobile app.

Backed by Börse Stuttgart for added trustworthiness

Backing from Börse Stuttgart adds a strong seal of trust to this crypto exchange. The site carries a BaFin (federal financial supervisory authority) license, so it follows deep regulatory compliance rules.

Most digital assets stay in cold storage, and top security measures lock down your crypto portfolio.

Spot trading covers bitcoin, ethereum and other tokens under strict German oversight. The platform feels like a bank branch, with clear fees and simple moves. Tax in Germany links to built-in reports, so you face fewer surprises.

Simple platform ideal for new crypto investors

Bison makes each trade feel simple and fast. It links to your euro wallet, so there is no bank transfer hassle. You see balances and crypto holdings in one screen. The platform shows no explicit fees, it earns through a built-in spread.

Beginners can grow a crypto portfolio with clear costs.

Backed by Börse Stuttgart, Bison offers full regulatory compliance under BaFin. The app stores coins in offline vaults and uses strong safeguards. You control your private keys via the app’s cold storage option.

This spot trading tool keeps your digital assets safe. It also helps with taxed gains by offering trade records.

eToro

On eToro, you ride shotgun with top traders via copy trading, so you can follow their every move. You can also hop into spot trading or open CFD positions in seconds.

Licensed for cryptocurrency trading in Germany

eToro holds a BaFin license for cryptocurrency trading in Germany. It meets EU regulations and German capital gains tax rules. It follows strict anti-money laundering and KYC standards.

Regulators at the Federal Financial Supervisory Authority approve its operations.

You can fund your spot trading account by bank transfer, credit card or PayPal. Most digital assets go into cold storage to lock them up tight. Social trading fans enjoy copy trading functions and it feels like peeking over the shoulder of a pro.

The site keeps fee data clear so you can track expenses and build your crypto portfolio.

Includes social trading features for collaborative learning

Social trading features let you tag along with peers and mirror their moves. Copy trades on spot markets, or use cfd brokers for contracts for difference. The system supports 85 cryptocurrencies in global financial markets, from bitcoin to altcoins.

It feels like a live classroom in your wallet.

Readers follow top traders, view their risk scores, and post questions in chat. They test margin trading tips, watch spot trading demos, or join copy trading groups. BaFin vets every move and the interface links to the German tax system.

You learn from real orders and grow your crypto portfolio.

Takeaways

Say goodbye to feeling like a fish out of water, these platforms follow BaFin rules.

They guard your crypto.

They use cold storage, KYC checks, and spot trading to keep assets safe.

You can trade with Coinbase Wallet, earn staking rewards, or try copy trading.

Pick a site, build your crypto portfolio, and watch digital assets grow.

FAQs on Crypto Platforms Compliant with German Regulations

1. What crypto exchanges meet German regulatory compliance and EU regulations?

Bitcoin.de and Boerse Stuttgart stand out, they register with BaFin as the federal financial supervisory authority, they work with the central bank and the federal ministry of finance, and they use cold storage plus strong security measures to guard your digital assets and keep financial stability.

2. What advanced trading features can I use under German law?

You can use spot trading, margin trading, or futures trading, you can try derivative trading or CFD trading, many platforms let you do copy trading, you trade in fiat currencies or foreign currency pairs, and you can even pay with ApplePay for quick deposits.

3. How do I manage my crypto portfolio and assets?

You link a Coinbase Wallet or your own secure wallet, you earn staking rewards, or you try crypto lending, and you keep most funds in cold storage so you can build your crypto portfolio with peace of mind.

4. What about tax for bitcoin trading and other gains?

Platforms share reports with taxpayers, they track your capital gains tax, income taxes, and they spell out possible deductions for tax relief, they even note income from cryptocurrency mining or from decentralised autonomous organisations tokens.

5. How safe are these platforms from scams?

You might worry about hacks, right? These sites fight cryptocurrency scams with monthly hack drills, they guard your keys with cold storage like a Fort Knox vault, and they follow EU regulations and BaFin rules to keep you safe.

6. Who watches over these platforms for financial stability?

BaFin, the federal financial supervisory authority, checks every move, the central bank and the federal ministry of finance set the rules, and a regulated broker like ActivTrades joins the list, so you can trade with clear oversight.