Many crypto fans feel lost when rules shift overnight. You may hit a wall if you own digital assets or use crypto exchanges. New know your customer checks and anti-money laundering rules can block your moves.

For example, the People’s Bank of China banned crypto trades and bitcoin mining in September 2021.

This guide on Countries With The Strictest Crypto Regulations lists ten strict nations. We explain rules on central bank digital currency and smart contracts. We cover anti-money laundering and know your customer checks.

We share Financial Action Task Force tips to guard your funds. Keep reading.

Key Takeaways

- China banned all crypto trading and mining in September 2021, launched a digital yuan pilot, and cut its bitcoin hash power share from 65% to 20%.

- India imposed a 30% capital-gains tax on crypto in 2022, enforces strict KYC/AML checks on every exchange, and uses Lukka’s Omni platform to track over 1.8 million tokens and 46,000 firms.

- Algeria, Bangladesh, Egypt, Morocco, Nepal, and Bolivia fully ban crypto use, trading, and mining under FATF-style anti-money-laundering and counter-terror rules, punishing violators with fines or jail.

- Russia bars banks from crypto dealings, limits mining to licensed sites, and uses Lukka’s Omni system to tag 1 billion addresses, 1.8 million assets, and 46,000 entities for AML enforcement.

- Vietnam bans crypto as payment under its 2018 Payment Services Act but allows mining with mandatory FATF-style AML and KYC compliance.

China

China locks the gates on most digital assets, thanks to strict action from the People’s Bank of China (PBOC). It even tracks every coin with heavy AML checks and its own block explorer.

Comprehensive ban on crypto trading and mining

The People’s Bank of China banned all crypto trading and mining in 2021. Officials flagged private digital currencies as a threat to financial stability and said bans would boost investor protection.

They warned some tokens help money laundering or fund terrorist cells. They ordered banks and payment networks to cut ties with peer platforms that list tokens or initial coin offerings.

They ramped up the digital yuan pilot, pushing central bank digital currency adoption as private coins fell.

Crypto miners scrambled across borders, slinging rigs to new hubs. It once housed over 65 percent of the global bitcoin hash power. Now it holds about 20 percent through foreign pools.

The Securities and Exchange Commission and the Commodity Futures Trading Commission took notes. Regulators in Singapore and Canada studied how swift policy changes can reshape markets in crypto-assets.

Restrictions on financial institutions dealing with crypto

Chinese banks slammed the door on crypto services. Local lenders must flag crypto assets for anti-money laundering checks. They must run strict know your customer checks. Authorities ban deposit accounts for cryptocurrency exchanges and block digital asset custody.

This move drove over $50 billion of tokens out of China in 2019. Offshore exchanges gained a flood of new clients when banks cut service. Traders used peer networks and blockchain monitoring tools to bypass bank blocks.

Regulators warn weak checks risk money laundering or terrorist financing.

India

India’s central bank bans unlicensed crypto exchanges, and it forces them to follow anti-money laundering rules. Traders feel the pinch from steep capital gains tax on digital assets.

Strict regulations on crypto exchanges and taxation policies

Lawmakers moved quickly after a surge in digital asset trading. They slapped a 30% levy on all crypto capital gains in 2022, with no deductions or exemptions. The finance ministry runs rigorous KYC reviews on every cryptocurrency exchange, chasing tax compliance and blocking money laundering.

Auditors now lean on data from Lukka’s Omni platform, tracking over 1.8 million digital tokens and 46,000 trading firms, with 98% market coverage.

Banks face penalties for aiding transfers under Reserve Bank of India rules that ban ties with crypto wallets. Authorities cite investor protection and financial stability as their top goals.

That stance also fights terrorist financing and stops AML breaches.

Algeria

Algeria bars all crypto and makes banks fight money laundering and terrorist financing under FATF rules—keep reading to learn more.

Complete ban on the use and trading of cryptocurrencies

Officials in Algeria outlawed all cryptocurrency trading and possession. They slammed the door on digital assets with a blanket ban. In 2018, authorities banned crypto mining, citing financial risks.

Regulators pointed to money laundering, terrorist financing, and other illicit activities under anti-money laundering rules.

Bankers labeled coins non-fiat and treated them like high-risk foreign exchange. Financial institutions must avoid partnering with cryptocurrency exchanges. The central bank teams up with the financial action task force to protect investors.

Anyone caught trading faces fines or jail time.

Bangladesh

Bangladesh Bank pulled the rug from under crypto traders. Its terse FIU notice, rooted in anti-money-laundering rules, packs a hidden punch you can read about next.

Prohibition of crypto trading and possession

Regulators bar all trading and holding of digital tokens. Officials cite rising money laundering and fraud risks. Financial police disable cryptocurrency exchanges and block digital wallets.

Investigators warn that illicit activities, such as terrorist financing, can hide in peer networks. Law enforcers seize mining rigs and punish violators to protect financial stability.

National bank urges citizens to use legal tender for payments. Parliament bans any blockchain transfers outside approved channels. Lawmakers pass anti-money laundering rules, strict KYC checks and consumer protection standards.

Fraud cases spurred swift action against digital assets. Courts can fine or jail offenders under new regulations.

Egypt

Egypt’s central bank outlawed e-tokens under a religious edict. It flagged illicit trading and terrorist funding, forcing all asset markets to halt digital assets.

Ban on cryptocurrency under Islamic law interpretations

A fatwa by Dar al-Ifta in January 2018 labeled Bitcoin and other digital assets as haram. It cited lack of legal tender status and potential for money laundering. Analysts at the Fatwa Department warned that cryptocurrency exchanges could fuel illicit activities.

The edict reached investors through official channels and stalled local blockchain technology and smart contract development.

The Central Bank of Egypt imposed a crypto mining ban in 2020, citing risks to financial stability, fraud, and terrorist financing. It closed local cryptocurrency trading platforms and froze icos projects under its anti-money laundering rules.

The bank coordinated with the Financial Action Task Force and the Financial Crimes Enforcement Network to spot illegal electronic payments. Observers say this move mirrors global trends in AML and digital asset oversight.

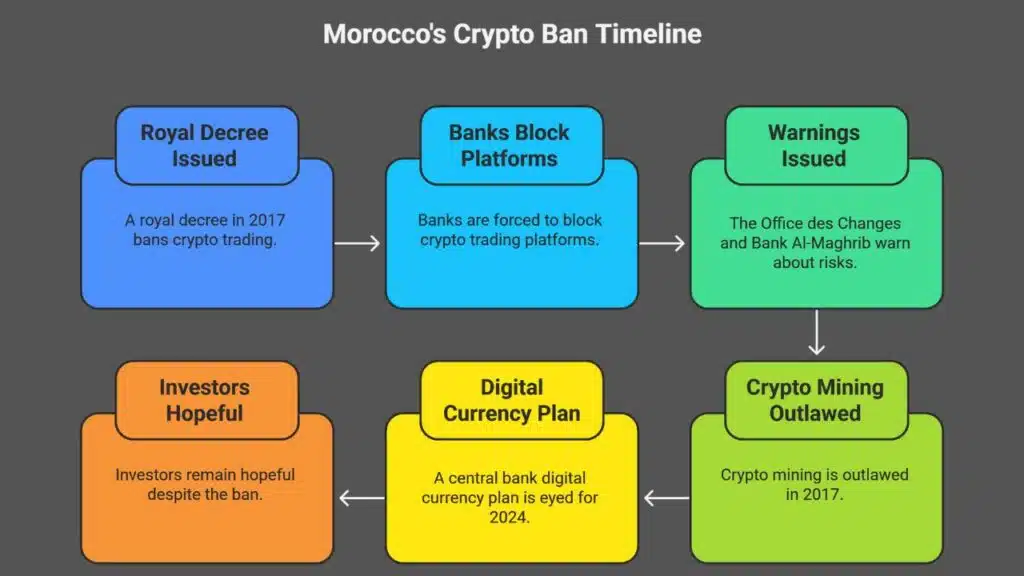

Morocco

Morocco bans crypto trades and shuts down digital asset platforms, citing anti-money laundering measures under FATF guidance—read on to learn more.

Crypto transactions and trading deemed illegal

A royal decree in 2017 forced banks to block all crypto trading platforms, banning bitcoin and altcoins as legal tender. The Office des Changes and Bank Al-Maghrib warned about money laundering and terrorist financing risks.

Traders felt like fish out of water when wallets went dark overnight.

Officials also outlawed crypto mining in that same year, chopping off power to rigs across the kingdom. The monetary authority now eyes a central bank digital currency plan for 2024 to boost investor protection.

Investors keep their fingers crossed, but for now digital assets stay off the table.

Nepal

Nepal’s central bank barred all digital asset trades, citing anti-laundering rules and fears of illicit activities. A global compliance group greets the move, but the ban leaves blockchain startups and crypto miners out in the cold.

Total ban on all cryptocurrency-related activities

The government of Nepal banned all digital assets in 2021 under the Foreign Exchange Act. It outlawed bitcoin and every mining rig for proof of work. Officials cited fraud, money laundering, and terrorist financing.

They warned of risks to financial stability and illicit activity. The law shut down local cryptocurrency exchanges. It also blocked external wallets that track crypto tokens.

Crypto investors now face fines and jail for holding digital coins. Cryptocurrency mining no longer counts as legal work. All virtual payment firms must cease operations. This zero tolerance rule hurt blockchain innovation.

It left decentralized finance projects without a home.

Bolivia

Bolivia bars every digital asset deal, it blocks trades, it forces KYC checks under the Financial Action Task Force’s glare, like a miner in a spy movie. Regulators train anti-money laundering squads to hunt token traffickers, they won’t wink at a single coin.

Prohibition on the use, trading, and possession of digital assets

The Bolivian government outlawed all digital assets in 2014. It barred use, trading, and possession of tokens, anonymous coins, and smart contracts. Regulators linked the ban to risks in money laundering, terrorist financing, and fraud.

They feared threats to financial stability and investor protection.

Banks must block transfers on any cryptocurrency exchange or initial coin offering platform. They must follow anti-money laundering (AML) rules and strong know-your-customer checks.

They will not accept any token as legal tender. They also shut down crypto mining and wallet services.

Russia

Russia, via its central bank, froze crypto payments, crushed bitcoin mining with strict anti-money laundering laws, so read on to see why.

Severe restrictions on crypto payments and mining activities

The central bank of Russia has barred local banks and payment services from handling cryptocurrency exchanges. It bars traders from using digital assets as legal tender. Law enforcers now use the Omni system by Lukka, to tag about 1 billion blockchain addresses and track over 1.8 million crypto assets and 46,000 entities.

Regulators say this helps fight money laundering and terrorist financing under strict anti-money laundering (AML) rules.

The state also limits cryptocurrency mining to licensed sites and caps power use. Authorities view this step as key to financial stability, and energy security. Miners must report output and register with the central bank digital currency (CBDC) pilot.

This clampdown has hit blockchain innovation and investor protection in the region.

Vietnam

Vietnam bans crypto as payment but lets miners dig digital gold under a Payment Services Act from its central bank. Read on for a peek at how AML checks, central bank digital currency ideas, and distributed ledger tech shape this market.

Ban on crypto as a payment method, but mining remains legal

A 2018 decree banned crypto as a payment tool due to money laundering risks. Officials cited threats to financial stability, fraud, and illicit activities as main concerns. They removed digital assets from legal tender status nationwide.

Local miners still run bitcoin mining rigs under existing crypto mining rules. They file reports under anti-money laundering and know your customer policies set by the financial action task force.

This mix fuels blockchain innovation while safeguarding investor protection and curbing illicit activities.

Takeaways

These ten nations set tight rules for crypto fans. They curb money laundering and ban most digital asset trades. India taxes each coin flip, and China ends mining runs. Regulators like the monetary authority of singapore use tough know your customer checks.

Countries such as Russia, Nepal, and Egypt hold firm lines. A market watchdog will sound alarms on new crackdowns. Stay sharp and tread safe.

FAQs

1. Which countries have the strictest anti-money laundering rules on digital assets?

Canada, Australia, the UK, and Singapore top the list. They follow FATF standards, use FinTRAC in Canada, AUSTRAC in Australia, MAS in Singapore, and the FCA in Britain. They make you show ID, track funds, and block money laundering.

2. How do these places treat crypto as legal tender or a commodity?

Most call crypto a digital asset, not legal tender. They tax gains like stocks and add value-added tax on token sales. Only El Salvador makes crypto legal tender, others limit its use to protect financial stability.

3. What rules govern token sales and cryptocurrency trading platforms?

They treat token sales like a stock sale. The SEC, CFTC, CSA, and ESMA check each launch. Registered cryptocurrency trading platforms must sign up, protect investors, file reports, and fight money laundering.

4. How do regulators curb terrorist financing and illicit acts?

They force KYC checks, scan trades for odd moves, and follow FATF and CFTF tips. They can freeze coins tied to terrorist financing or money laundering. It’s like a guard dog on your wallet.

5. What part do central banks like the PBoC, RBI, and MAS play?

They set the rules to keep banks safe, study central bank digital currency (CBDC), and ban unlicensed exchanges. They curb coin mining, warn on risk, and guard financial stability.

6. Are privacy coins allowed under strict crypto regulations?

Many strict states ban or limit privacy coins. FINMA in Switzerland and the EU call them high risk because they hide illicit funding. They push smart contracts on public chains only, and coin mining must follow local laws.