First-time drivers often pay too much for car insurance because they lack driving experience. Ontario car insurance costs more than $1,500 a year on average. This post will share 10 tips that cut insurance premiums, explain third-party liability insurance, and show how a higher deductible can lower your rates.

Read on.

Key Takeaways

- First-time drivers in Ontario pay over $1,500 a year for car insurance. You must carry at least $200,000 in third-party liability plus accident benefits and direct compensation property damage.

- Use RATESDOTCA or similar sites to compare quotes from many insurers. Raise your deductible to $1,000 to cut premiums by half or track safe driving with AMA MyRide for up to 10% savings.

- Finish a government-approved driving course to trim rates by 10–25%. AMA Driving School grads get $300 off their annual bill. Good students aged 16–24 save 10–15% with a report card.

- New electric cars cost about 15% more to insure than five-year-old sedans. A 2010 Honda Civic may cost $100 less a month than a new BMW X3. Usage-based trackers can lower your rates further.

- Millennials pay an average $2,899.30 a year for auto insurance. Keep a clean record, limit driving to under 12,000 miles, earn safe-driver certificates, bundle auto and home, and add theft deterrents to avoid rate hikes.

What types of car insurance coverage are available in Canada?

Ontario drivers must carry at least $200,000 in third-party liability insurance. This pays for injuries and damage to others in a crash you cause. Statutory accident benefits cover your medical bills, even if you did not cause the accident.

Direct compensation property damage pays your repair costs when an insured driver hits your vehicle. These three make up the legal minimum auto insurance policy in Ontario.

Collision insurance covers damage from crashes, like hitting a pole or another car. Comprehensive insurance pays for theft, fire, or hail damage. You can add extras, such as rental car reimbursement or roadside assistance.

A higher insurance deductible can lower your premiums. My cousin Alex texted, “I cut my monthly bill in half with a $1,000 deductible.” Auto insurance calculators help you compare quotes from different insurers fast.

How can I compare car insurance providers effectively?

Comparing auto insurance firms saves you money. You can use RATESDOTCA or apps to spot the best deals quickly.

- Use a site like RATESDOTCA to pull quotes from multiple coverage firms.

- Look at liability, collision, and personal injury options in each insurance policy.

- Scan for learner’s permit discounts if you hold a G2 authorization.

- Track driving habits in the AMA MyRide app to earn up to 10 percent savings on your insurance premiums.

- Read customer feedback on claim service, response time, and repair quality.

- Ask each provider about risk factor impacts to foresee rate hikes.

- Verify mileage-based coverage if you drive less than 12,000 miles a year.

- Bundle auto and home policies for extra reduction, often from a single carrier.

- Factor in your clean driving record and ticket history to spot low premiums.

- Confirm add-ons like roadside assistance or glass repair to avoid surprises.

How does my choice of car affect my insurance premiums?

Your car acts like a scorecard for insurance companies. New models from 2023 or 2024 carry expensive parts and tech, so they cost more to fix and replace. An entry-level electric car can run 15% higher in insurance premiums than a five-year-old sedan.

Insurers add risk factors for high repair bills and factor these into your insurance policy.

Cars built before 2010 lack airbags and lane assist, so insurance companies raise rates. A driver insured on a 2010 Honda Civic might pay $100 less a month than one in a new BMW X3, even with the same clean driving record.

Usage-based insurance gadgets can track miles and offer lower premiums, but your base rate still ties to your car’s age and safety kit.

Can choosing a higher deductible lower my insurance costs?

Picking a higher deductible lets insurance companies charge lower rates. A switch from $500 to $1,000 cuts auto insurance premiums. You spot the change on your insurance policy or a premium calculator.

This move keeps full coverage.

Drivers fit this plan if they have an emergency fund. Paying $1,000 after a car accident hurts less than paying bigger yearly rates. A rate comparison tool shows the best split of deductible and premium.

New drivers can log savings faster with a bigger deductible.

What discounts are available for taking a driver’s training course?

Young drivers can cut auto insurance premiums by 10 to 25 percent after a government-approved driver training course. Insurance companies review certificates from approved driving schools before they adjust insurance rates on your policy.

This price cut can trim collision coverage and liability costs, lowering your car insurance expenses.

Graduates of AMA Driving School get a $300 reduction on their annual bill from Alberta Motor Association Insurance Company. New drivers should show their course certificate when they sign up online or at the office.

Adults earning a full driver’s licence also qualify.

What are usage-based insurance programs and should I consider them?

A usage based insurance program tracks your driving with a telematics tool or a mobile device sensor. It logs speed, braking, and distance on each trip. An insurance company sets your rate on risk factors like hard stops or distracted driving.

The AMA MyRide program can deliver up to 10 percent savings on your Ontario auto insurance premiums.

First-time drivers receive instant feedback on their habits. A plan that rewards occasional drivers can slash your insurance costs if you rack few miles or stick to speed limits. Inexperienced motorists enjoy seeing safe driving scores.

You might pick this coverage if you want insurance savings and more control over your policy.

How can bundling insurance policies save me money?

You can roll your auto insurance into a larger package that includes home insurance or condo coverage. Most insurance companies give a bundling discount on premium costs. That move shrinks your insurance premiums.

Some drivers save up to 20 percent on their annual rates.

Young drivers often check an online tool in their insurer’s customer portal. That resource shows combined rates for all policies. They even use an insurance calculator to measure savings.

Getting a single policy number cuts paperwork too. Personal auto insurance joins smoothly with homeowners insurance.

Why is maintaining a clean driving record important for insurance?

A spotless driving record cuts insurance premiums. They use risk factors to set prices. Young drivers and teen drivers pay more at first. Collisions and tickets hike rates fast. First-time drivers face steep costs because they lack history, which insurers deem riskier than a traffic violation.

A tidy record shows insurers you learn from each trip. A clear file helps you shape your insurance policy.

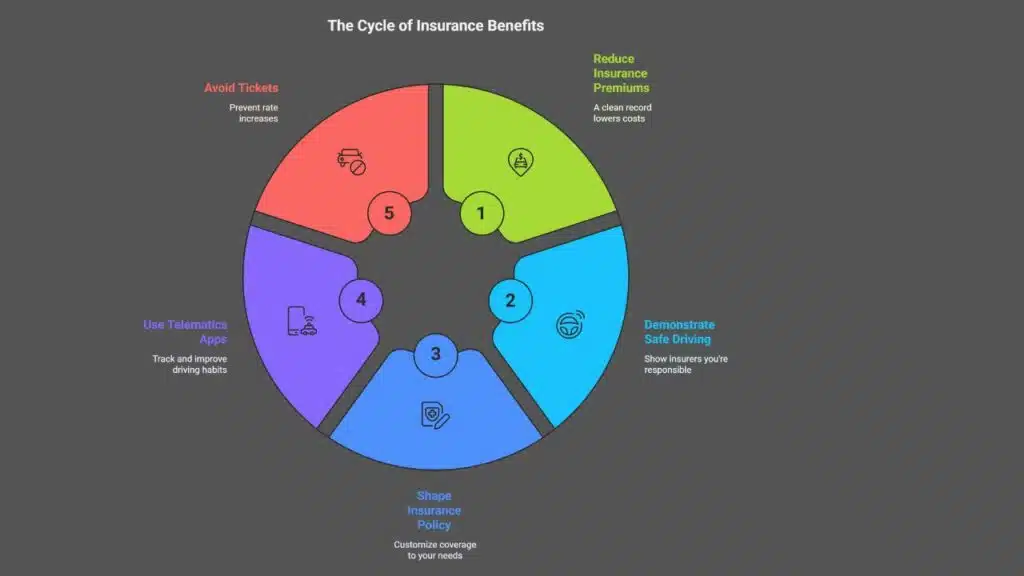

Telematics apps track speed and braking. Such tools feed data to insurers. Safe driving earns lower auto insurance rates. That phone gadget keeps your record clean. No tickets mean no extra risk charge.

Are there special discounts for students or young drivers?

Full-time students aged 16 to 24 with B averages grab 10 to 15 percent off their car insurance. Insurers offer Good Student Discounts to new drivers who submit report cards. You can pair that with lower liability coverage if you drive a compact car with parking assist tech.

Telematics apps track your safe trips, and they may cut your insurance premiums even more.

Millennials pay the highest average rate, about $2,899.30 a year. Young drivers lower insurance rates by keeping clean driving records and limiting their annual mileage. Some agents waive extra fees if your learner’s permit stays active for six months.

Check each insurance policy for teen driver savings before you sign.

How do I get added to a parent’s insurance policy correctly?

Adding a new driver to a parent’s auto insurance policy cuts cost and boosts coverage. You keep your driving record clean while living at home under a solid plan.

- Call the insurance provider, share your parent’s policy number with the agent, and give your basic info.

- Ask the agent to list you as an occasional driver on that Ontario car insurance policy.

- Provide your learner’s permit or driver’s licence info, date of birth, and any driving experience.

- Confirm collision coverage and personal injuries limits include young drivers under risk factors terms.

- Check how adding you changes insurance premiums and insurance rates for new drivers.

- Move out, then buy your own policy after you leave home, to keep your records straight.

What steps can I take to protect my car against theft?

Thieves target cars that look simple to grab. You can fight back with smart steps.

- Lock doors and roll up windows every time you leave your ride.

- Fit a club lock on the steering wheel to block hot wiring and slow thieves down.

- Install a motion-sensor alarm that sets off a siren if someone creeps near your vehicle.

- Hide a GPS tracker under the dash and monitor its signal from your smartphone app.

- Park in a garage or under a street lamp to cut risk factors and scare off crooks.

- Engage an engine immobilizer to stop hot wiring or forced entry from starting your car.

- Contact your car insurance provider to see if theft deterrent tools lower your insurance premiums.

How often should I review and update my car insurance policy?

Checking your car insurance policy often keeps your premiums low. It also guards against gaps in coverage.

- Every six months, check your policy and your insurance coverage. Use phone alerts or an inbox reminder to pay bills on time, to avoid a 15% hike at renewal.

- At each renewal date, ask your insurer for a fresh quote, compare rates, and scan new discounts.

- After any accident or traffic ticket, file an insurance claim, update your driving record, and adjust coverage if needed.

- After you earn a safe driver certificate, call your company, add the driver safety discount, and cut insurance premiums by up to 10%.

- Buy a new car, review collision coverage and liability limits, then tweak your auto insurance plan to match your ride.

- When your premiums jump more than 10%, reach out, talk risk factors, and compare quotes from at least three car insurance firms.

Takeaways

New drivers can cut costs by keeping a safe record. A handy gauge checks low tire pressure in seconds. A mobile device app logs drives, and an operating system alert flags rough stops.

Good collision coverage helps you fix dents without big bills. Holding a clean driver’s licence boosts your standing with insurers. Each tip adds up to real insurance savings.

FAQs

1. How can first-time drivers in Canada lower auto insurance premiums?

First-time drivers can shop around like they shop for shoes. They can compare quotes from many insurance companies. They should ask about discounts and keep a clean driving record. This will cut auto insurance premiums fast. They can also add a secondary driver to their car insurance policy for extra insurance savings.

2. What risk factors affect insurance rates for young drivers?

Age alone can push rates up for young drivers. Past car accidents, a record of distracted driving, and tickets can hike your insurance rates. A clean driving license, steady brake lights checks, and using turn signals help lower the risk.

3. Should new drivers in Ontario add collision coverage?

New drivers in Ontario can add collision coverage to guard their car. It pays to fix damage from a crash or a car theft. But collision coverage will raise your insurance premiums. You can skip it if your car is old or low in value.

4. How can an occasional driver keep insurance rates low?

An occasional driver drives only sometimes. Some insurance companies now insure per km with pay-per-km car insurance. You can add yourself as a secondary driver on a family policy too. Using public transit cuts miles. Less driving means lower insurance rates.

5. Do recent immigrants need a Canadian driving license to get a policy?

Most insurance companies need a valid driving license to buy a policy. They also ask recent immigrants for proof of driving experience or past auto insurance records. They will then have your policy underwritten. Without a license, you may pay more.

6. What steps can inexperienced drivers take to avoid car crashes?

Inexperienced drivers should check their tire gauge, brake lights, and turn signals before each trip. They must avoid distracted driving, like texting on phones. A tip, lock your ride tight, or you might play hide and seek with car thieves. Safe habits help avoid motor vehicle accidents, and they cut insurance rates.